Cherokee County Tax

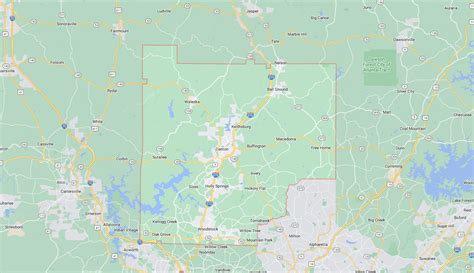

Welcome to an in-depth exploration of the Cherokee County Tax system, a critical component of the local government's revenue stream and an essential aspect of the region's economic landscape. In this comprehensive guide, we will delve into the intricacies of Cherokee County's tax structure, its impact on residents and businesses, and the unique features that set it apart. With a focus on providing an expert analysis, we aim to offer a clear understanding of this important topic for both residents and those interested in the region's financial dynamics.

Understanding the Cherokee County Tax System

The tax system in Cherokee County, located in the heart of Georgia, is a complex yet well-structured mechanism designed to support the county’s operations and development. It serves as a vital source of revenue, enabling the county to provide essential services, maintain infrastructure, and invest in the community’s future. From property taxes to sales taxes and specialized levies, the Cherokee County Tax system is a comprehensive framework tailored to the region’s needs.

Property Taxes: The Backbone of Revenue

Property taxes are a significant contributor to Cherokee County’s tax revenue. The county assesses property values annually, taking into account factors such as location, improvements, and market trends. This assessment forms the basis for calculating property tax liabilities. Homeowners, business owners, and landowners are responsible for paying these taxes, which help fund local schools, emergency services, and other vital public services.

The county employs a millage rate, a measure of tax liability per $1,000 of assessed property value, to determine the tax rate. This rate is subject to change annually, influenced by factors like the county’s budget needs and economic conditions. Property owners can access detailed information on their tax assessments and payment schedules through the Cherokee County Tax Assessor’s office.

| Property Type | Assessment Rate |

|---|---|

| Residential | 40% |

| Commercial | 40% |

| Agricultural | 30% |

Sales and Use Taxes: Supporting Local Businesses

Sales and use taxes are another crucial component of the Cherokee County Tax system. These taxes are levied on the sale of goods and services within the county, as well as on the use or storage of certain tangible personal property. The revenue generated from these taxes contributes to the county’s general fund, supporting a range of public services and infrastructure projects.

Cherokee County’s sales tax rate is competitive, aiming to attract businesses and promote economic growth. The county also offers incentives and exemptions for certain types of businesses, such as manufacturers and agricultural producers, to encourage investment and job creation.

Special Taxes and Fees

In addition to property and sales taxes, Cherokee County utilizes a range of special taxes and fees to fund specific initiatives and services. These include:

- Hotel/Motel Tax: A tax levied on the rental of hotel and motel rooms, generating revenue for tourism promotion and infrastructure improvements.

- Vehicle Registration Fee: A fee collected when registering a vehicle, contributing to road maintenance and transportation projects.

- Special Purpose Local Option Sales Tax (SPLOST): A temporary sales tax approved by voters to fund specific projects like school construction or transportation improvements.

Tax Benefits and Incentives

Cherokee County recognizes the importance of fostering a business-friendly environment, and as such, offers a range of tax benefits and incentives to attract and support businesses. These incentives aim to encourage economic growth, job creation, and investment in the community.

Industrial Revenue Bonds (IRBs)

IRBs are a powerful tool used by Cherokee County to support industrial development. These bonds are issued by the county to finance the construction or expansion of industrial facilities. They offer significant tax advantages, as interest earned on the bonds is exempt from federal income tax, making them an attractive financing option for businesses.

Cherokee County works closely with local businesses to structure IRBs that meet their specific needs, providing a flexible and cost-effective financing solution.

Tax Abatement Programs

The county offers tax abatement programs to incentivize businesses to locate or expand within Cherokee County. These programs reduce or eliminate certain taxes for a specified period, helping businesses offset initial costs and promote long-term investment.

Eligible businesses can benefit from reduced property taxes, sales taxes, or both, depending on the nature of their operations and the impact they have on the local economy.

Enterprise Zones

Cherokee County has designated specific areas as Enterprise Zones, offering enhanced tax incentives to businesses that operate within these zones. These zones are targeted at areas with high unemployment rates or those in need of economic development.

Businesses located in Enterprise Zones may be eligible for reduced property taxes, sales tax exemptions, and other incentives to encourage job creation and investment.

Taxpayer Services and Support

Cherokee County is committed to providing excellent service to its taxpayers. The county offers a range of resources and support to ensure that residents and businesses understand their tax obligations and can navigate the tax system effectively.

Online Services

The Cherokee County Tax Commissioner’s office provides a user-friendly online platform for taxpayers. This platform allows residents to:

- View and pay property taxes online.

- Access tax assessment information and records.

- Apply for tax exemptions and benefits.

- Track the status of their tax payments and refunds.

The online system is designed to be secure and efficient, offering a convenient way for taxpayers to manage their obligations.

Assistance and Outreach

The county understands that tax matters can be complex, and offers dedicated assistance to taxpayers. This includes:

- Taxpayer assistance centers: Physical locations where residents can receive personalized help with tax-related queries.

- Outreach programs: The county actively engages with the community through workshops and information sessions, providing education on tax topics and answering questions.

- Taxpayer advocates: Dedicated staff members who assist taxpayers with resolving issues or disputes related to their tax obligations.

Conclusion: Cherokee County’s Tax Landscape

The Cherokee County Tax system is a well-structured and dynamic framework that supports the county’s growth and development. From property taxes to sales taxes and specialized levies, the county’s tax structure is tailored to meet the needs of its residents and businesses. With a focus on providing excellent taxpayer services and offering a range of incentives, Cherokee County demonstrates its commitment to fostering a thriving and prosperous community.

As the county continues to evolve and adapt to economic changes, its tax system remains a critical component of its financial health and a key driver of its success.

How are property taxes calculated in Cherokee County?

+

Property taxes in Cherokee County are calculated based on the assessed value of the property and the applicable millage rate. The assessed value is determined by the Tax Assessor’s office, and the millage rate is set annually by the county government.

What are the tax benefits for businesses in Cherokee County?

+

Cherokee County offers a range of tax benefits to businesses, including Industrial Revenue Bonds (IRBs), tax abatement programs, and Enterprise Zones. These incentives aim to attract and support businesses, fostering economic growth and job creation.

How can residents access their tax information and payment options online?

+

Residents can access their tax information and payment options through the Cherokee County Tax Commissioner’s online platform. This platform provides a secure and convenient way to manage property taxes, view assessment records, and stay updated on tax-related matters.