What Is A Non Refundable Tax Credit

A non-refundable tax credit is a tax benefit that can reduce the amount of tax owed by an individual or entity, but it has specific conditions and limitations that make it different from a regular tax deduction or a refundable tax credit. Unlike a deduction, which directly reduces taxable income, a tax credit provides a dollar-for-dollar reduction in the tax liability. In this comprehensive guide, we will explore the concept of non-refundable tax credits, their mechanics, eligibility criteria, and their impact on taxpayers.

Understanding Non-Refundable Tax Credits

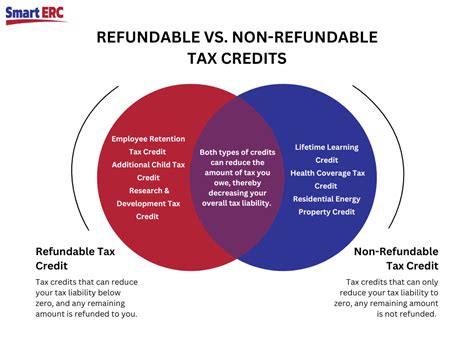

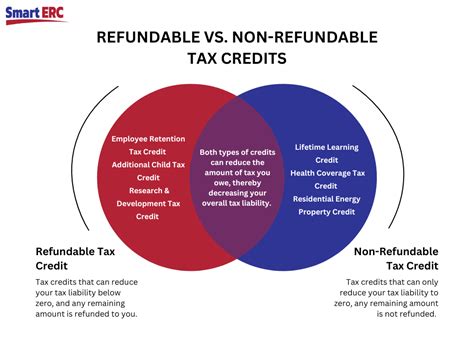

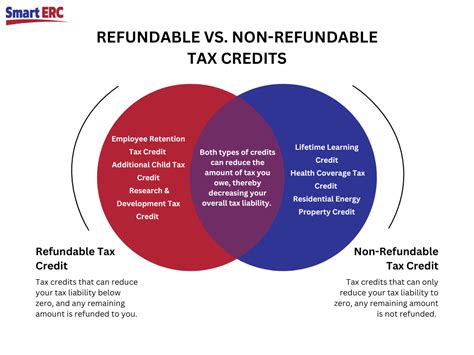

Non-refundable tax credits are tax incentives offered by governments to encourage specific behaviors or support certain industries or causes. These credits can be claimed by taxpayers who meet the necessary qualifications and can be used to offset their tax liability. However, the key distinction lies in the term “non-refundable.” This means that if the tax credit exceeds the taxpayer’s tax liability, the excess amount is not refunded to the taxpayer.

For instance, imagine a scenario where an individual has a tax liability of $5,000 and claims a non-refundable tax credit of $3,000. In this case, the credit reduces their tax liability to $2,000. However, if the tax credit amount is $6,000, the credit will only offset the entire $5,000 liability, leaving no refund for the excess $1,000.

Eligibility and Qualifications

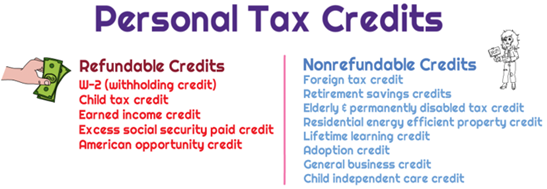

Non-refundable tax credits are typically tied to specific activities or circumstances. These may include credits for:

- Energy-efficient home improvements.

- Adoption expenses.

- Education-related expenses.

- Child and dependent care costs.

- Foreign tax payments.

- Research and development activities.

- Retirement savings contributions.

Each tax credit has its own set of eligibility criteria and documentation requirements. For example, to claim the credit for energy-efficient home improvements, taxpayers might need to provide receipts and certifications demonstrating the improvements' energy efficiency.

Calculating and Claiming Non-Refundable Tax Credits

To claim a non-refundable tax credit, taxpayers must first calculate their total tax liability for the year. This involves considering their income, deductions, and other tax adjustments. Once the liability is determined, eligible taxpayers can apply the appropriate non-refundable tax credits to reduce this liability.

Here's a simplified calculation to illustrate the process:

| Tax Liability | Non-Refundable Tax Credit | Net Tax Liability |

|---|---|---|

| $5,000 | $3,000 | $2,000 |

In this example, the taxpayer's original tax liability of $5,000 is reduced by the $3,000 non-refundable tax credit, resulting in a net tax liability of $2,000.

Real-World Examples and Impact

Energy-Efficient Home Improvement Credit

The Energy-Efficient Home Improvement Credit encourages homeowners to make environmentally conscious upgrades to their properties. Eligible expenses might include the installation of solar panels, energy-efficient windows, or certain types of insulation. By claiming this credit, homeowners can offset a portion of their tax liability, making eco-friendly renovations more financially feasible.

Adoption Credit

The Adoption Credit is designed to assist families with the costs associated with adopting a child. This credit can help offset expenses such as adoption fees, court costs, and travel expenses related to the adoption process. It aims to reduce the financial burden on prospective adoptive parents, making adoption more accessible.

Impact on Taxpayers

Non-refundable tax credits can have a significant impact on taxpayers’ financial situations. For individuals and businesses that qualify, these credits can provide substantial savings, making certain activities or investments more attractive. For instance, the energy-efficient home improvement credit can incentivize homeowners to adopt greener practices, while the adoption credit can make the adoption process more affordable.

Comparative Analysis: Non-Refundable vs. Refundable Tax Credits

While non-refundable tax credits have their advantages, they differ significantly from refundable tax credits. Refundable tax credits can result in a refund even if the credit amount exceeds the taxpayer’s liability. This makes refundable credits more beneficial for low-income taxpayers who may have little or no tax liability.

For example, consider the Earned Income Tax Credit (EITC), a refundable credit aimed at assisting low-income workers. If a taxpayer qualifies for the EITC but has no tax liability, they can still receive a refund equal to the credit amount. This feature makes refundable credits a powerful tool for reducing tax burdens on lower-income individuals and families.

Future Implications and Policy Considerations

Non-refundable tax credits are an essential component of tax policy, offering incentives to promote specific behaviors or support particular industries. As governments continually refine their tax systems, the design and scope of non-refundable tax credits can evolve to address emerging societal needs and priorities.

For instance, in response to the global push for sustainability, we might see an expansion of credits for eco-friendly practices. Similarly, credits aimed at encouraging small businesses or promoting research and development could be enhanced to stimulate economic growth and innovation.

FAQs

Can I carry forward a non-refundable tax credit if I don’t use it all in one year?

+In some cases, non-refundable tax credits can be carried forward to future tax years if they exceed the current year’s liability. However, the rules and limitations vary depending on the specific credit and jurisdiction. It’s essential to consult tax guidelines or seek professional advice to understand the carryover provisions.

Are there any income restrictions for claiming non-refundable tax credits?

+Income restrictions can apply to certain non-refundable tax credits. For example, the earned income tax credit (EITC) has income limits to ensure it benefits lower-income individuals and families. Other credits may have different income thresholds or no income restrictions at all. It’s crucial to review the specific guidelines for each credit to determine eligibility based on income.

How do non-refundable tax credits impact tax refunds?

+Non-refundable tax credits reduce the amount of tax owed but do not typically result in a refund if the credit amount exceeds the tax liability. However, if the credit reduces the liability to zero, the taxpayer may still receive a refund for any overpayments made during the year or for other refundable credits claimed.

Are non-refundable tax credits available to all taxpayers?

+Non-refundable tax credits are available to eligible taxpayers who meet the specific criteria set by the government. Eligibility can vary based on factors such as income, family status, or participation in certain activities. It’s important to review the qualifications for each credit to determine eligibility.

Can non-refundable tax credits be combined with other tax benefits?

+In many cases, non-refundable tax credits can be combined with other tax benefits, such as deductions or other credits, to maximize tax savings. However, there may be restrictions or limitations on combining specific credits. It’s advisable to consult tax professionals or refer to official guidelines to ensure compliance and optimize tax strategies.