Florida State Car Sales Tax

Welcome to a comprehensive guide exploring the intricacies of Florida's car sales tax! As one of the most popular states for vehicle purchases, Florida's unique tax structure can often leave buyers with questions. In this expert-level journal article, we'll delve into the specifics of Florida's car sales tax, providing clarity and insight for anyone considering a vehicle purchase in the Sunshine State.

Understanding Florida’s Sales Tax: A Unique Approach

Florida’s sales tax landscape is distinct from many other states, particularly when it comes to vehicle purchases. While some states apply a flat sales tax rate to car sales, Florida operates on a percentage-based system, with tax rates varying depending on the county where the vehicle is purchased and registered.

This unique approach is designed to distribute tax revenue equitably across Florida's 67 counties, each with its own specific tax rate. This can make understanding the exact tax implications of a vehicle purchase in Florida a bit more complex than in other states.

Let's take a closer look at how Florida's car sales tax works, exploring the key factors that influence the amount of tax you'll pay on your vehicle purchase.

The Role of County-Level Taxes

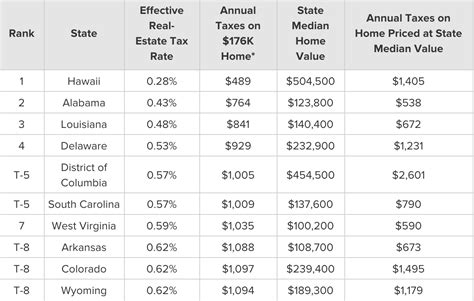

In Florida, the county in which you purchase and register your vehicle is a crucial determinant of the sales tax rate you’ll pay. Each county sets its own discretionary sales surtax, which is added to the state’s base sales tax rate of 6%. This means that the total sales tax rate on a vehicle purchase can vary significantly from one county to another.

For instance, Alachua County has a discretionary sales surtax of 0.5%, bringing the total sales tax rate to 6.5%. On the other hand, Miami-Dade County has a higher surtax of 1.5%, resulting in a total sales tax rate of 7.5% for vehicle purchases.

Here's a table showcasing the sales tax rates for some of Florida's most populous counties:

| County | Discretionary Surtax | Total Sales Tax Rate |

|---|---|---|

| Miami-Dade | 1.5% | 7.5% |

| Broward | 1.5% | 7.5% |

| Hillsborough | 1.0% | 7.0% |

| Orange | 1.25% | 7.25% |

| Palm Beach | 1.5% | 7.5% |

Factors Influencing Your Sales Tax

While the county-level sales tax rate is a significant factor, it’s not the only consideration when calculating your sales tax on a vehicle purchase in Florida.

Vehicle Price and Fees

The purchase price of your vehicle, including any additional fees and add-ons, is the primary basis for calculating the sales tax. This means that a more expensive vehicle will generally incur higher sales tax.

For example, if you're purchasing a vehicle in Miami-Dade County with a total purchase price of $30,000, including all fees and add-ons, the sales tax would be calculated as follows:

- Base sales tax: 6% of $30,000 = $1,800

- Discretionary surtax: 1.5% of $30,000 = $450

- Total sales tax: $1,800 + $450 = $2,250

So, in this scenario, you would pay a total of $2,250 in sales tax on your vehicle purchase.

Trade-In Value and Incentives

If you’re trading in your old vehicle as part of the purchase, the trade-in value can impact your sales tax calculation. Generally, the trade-in value is subtracted from the purchase price of the new vehicle before applying the sales tax rate.

Additionally, any manufacturer incentives or dealer discounts can also affect the final sales tax amount. These incentives are often deducted from the purchase price, reducing the taxable value of the vehicle.

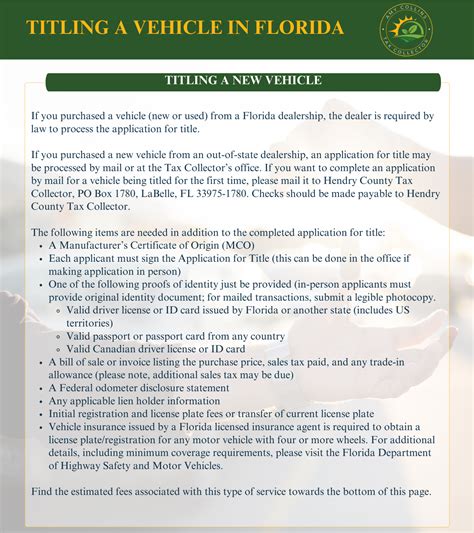

Registration and Title Fees

In addition to sales tax, you’ll also need to consider registration and title fees when purchasing a vehicle in Florida. These fees vary depending on the county and the type of vehicle, and they are typically paid separately from the sales tax.

Comparing Florida’s Sales Tax to Other States

Florida’s sales tax system for vehicle purchases differs significantly from many other states. While some states have a flat sales tax rate for all vehicle purchases, Florida’s county-level approach provides a more nuanced and complex tax structure.

For instance, Texas has a state sales tax of 6.25%, with some cities and counties adding additional taxes. In California, the sales tax varies by county, but the state also imposes a vehicle license fee of 1.15% of the vehicle's value, which can add up to a significant amount for more expensive vehicles.

In contrast, Oregon has no sales tax on vehicle purchases, but it does have a use tax of 1.5% that applies when a vehicle is registered in the state. This use tax is based on the purchase price, similar to a sales tax, but it's collected when the vehicle is registered rather than at the time of purchase.

Strategies for Minimizing Your Sales Tax

While you can’t avoid paying sales tax on your vehicle purchase in Florida, there are a few strategies you can consider to potentially minimize the amount you pay.

Shopping Across Counties

If you’re flexible about where you purchase your vehicle, you may want to consider shopping in counties with lower sales tax rates. While this strategy can save you money, it’s important to weigh the savings against the potential inconvenience and additional costs of traveling to a different county for your purchase.

Timing Your Purchase

In some cases, timing your vehicle purchase can make a difference in the sales tax you pay. Certain counties in Florida offer tax-free holidays for specific types of purchases, including vehicles. During these tax-free periods, you can save a significant amount on sales tax.

For example, Leon County in Florida offers a tax-free holiday for vehicle purchases during the month of September. This means that if you purchase a vehicle during this period, you won't pay the county's discretionary surtax, potentially saving you hundreds of dollars.

Researching Dealer Incentives

Dealers often offer incentives and discounts to attract customers. These incentives can reduce the taxable value of your vehicle purchase, potentially lowering your sales tax liability. It’s worth researching and comparing offers from different dealers to find the best deal.

The Impact of Sales Tax on Vehicle Affordability

Sales tax on vehicle purchases can significantly impact the overall cost of ownership. In Florida, with its county-level tax system, the sales tax can add a substantial amount to the purchase price, especially for higher-end vehicles.

For instance, consider a scenario where you're purchasing a luxury vehicle priced at $80,000 in Miami-Dade County. The sales tax on this purchase would be calculated as follows:

- Base sales tax: 6% of $80,000 = $4,800

- Discretionary surtax: 1.5% of $80,000 = $1,200

- Total sales tax: $4,800 + $1,200 = $6,000

So, in this case, the sales tax alone would amount to $6,000, adding a significant cost to the vehicle's purchase price.

Future Implications and Potential Changes

Florida’s sales tax landscape is subject to change, both at the state and county levels. While the current system provides a certain level of predictability, future legislative changes or county-level decisions could alter the tax rates and structures.

For instance, there have been proposals in the past to simplify Florida's sales tax system by implementing a uniform sales tax rate across the state. While such a change would make the tax system more straightforward, it could also result in higher taxes for some counties and lower taxes for others, depending on the proposed rate.

It's important for vehicle buyers in Florida to stay informed about any potential changes to the sales tax system, as these changes can significantly impact the cost of vehicle ownership.

How often do Florida's county-level sales tax rates change?

+County-level sales tax rates in Florida can change periodically, typically as part of county budget decisions or in response to changing economic conditions. While some counties may adjust their rates annually, others may keep the same rate for several years. It's always a good idea to verify the current tax rates with the county tax office or an authorized dealer before finalizing your vehicle purchase.

Are there any exemptions or reductions in sales tax for certain types of vehicles in Florida?

+Yes, Florida does offer certain exemptions and reductions in sales tax for specific types of vehicles. For example, there is a reduced sales tax rate of 3% for the purchase of a new alternative fuel vehicle, including electric, hybrid, and natural gas vehicles. Additionally, there are exemptions for certain types of vehicles used for agricultural or governmental purposes, as well as for vehicles purchased by qualifying disabled individuals.

Can I negotiate the sales tax on my vehicle purchase in Florida?

+The sales tax on a vehicle purchase in Florida is set by law and cannot be negotiated directly with the dealer. However, you may be able to negotiate the overall purchase price of the vehicle, which can indirectly impact the sales tax amount. Additionally, as mentioned earlier, you can explore strategies like shopping across counties or timing your purchase to potentially minimize the sales tax you pay.

Are there any online resources to help me calculate my sales tax for a vehicle purchase in Florida?

+Yes, there are several online calculators and resources available to help estimate your sales tax for a vehicle purchase in Florida. These tools typically require you to input the purchase price, county of purchase, and any applicable discounts or incentives. Some popular resources include the Florida Department of Revenue's Sales Tax Calculator and various online vehicle purchase calculators offered by automotive websites and dealerships.

How does Florida's sales tax on vehicle purchases compare to other states in terms of overall cost of ownership?

+Florida's sales tax system for vehicle purchases can make the overall cost of ownership higher compared to some other states, especially for higher-priced vehicles. While the base sales tax rate of 6% is similar to many other states, the additional county-level surtaxes can significantly increase the total sales tax. This can make Florida less competitive in terms of vehicle affordability, particularly when compared to states with lower or no sales tax on vehicle purchases.

In conclusion, Florida’s car sales tax system is a complex yet intriguing aspect of vehicle ownership in the state. With its county-level approach, the sales tax rate can vary significantly, influencing the affordability of vehicle purchases. By understanding the factors that impact the sales tax and exploring strategies to minimize it, buyers can make more informed decisions when purchasing a vehicle in Florida.