Capital Gains Tax Over 65

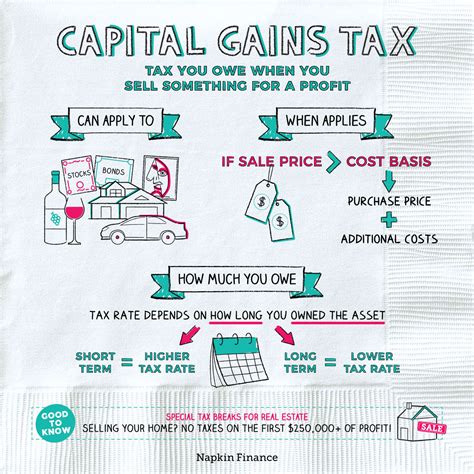

The topic of capital gains tax for individuals over the age of 65 is an important one to explore, as it can have significant financial implications for retirees and those approaching retirement. Capital gains tax, in general, is a tax levied on the profit made from the sale of an asset, such as a property, investment, or business. However, the tax treatment for individuals in different age brackets can vary, and understanding these nuances is crucial for effective financial planning.

Understanding Capital Gains Tax for Over-65s

In many jurisdictions, capital gains tax is a common mechanism used by governments to generate revenue and ensure fairness in the distribution of wealth. For individuals aged 65 and above, the tax treatment can be slightly different due to various factors, including retirement savings, pension plans, and social security benefits.

When it comes to capital gains tax, individuals over 65 may benefit from certain allowances and exemptions that can reduce their overall tax liability. These provisions are designed to support retirement planning and encourage long-term investments. However, it's essential to note that the specific rules and regulations can vary significantly depending on the country or region in question.

Exemptions and Allowances for Capital Gains

One of the key advantages for individuals over 65 is the potential for a higher annual exemption threshold for capital gains. This means that a certain amount of capital gains made during the tax year can be exempt from taxation. For instance, in the United Kingdom, the annual exempt amount for capital gains tax is currently set at £12,300 for the 2023⁄24 tax year. However, individuals aged 65 and over may have a higher threshold, providing them with more flexibility when it comes to disposing of assets without incurring tax liabilities.

| Tax Year | Annual Exempt Amount (Standard) | Annual Exempt Amount (Over-65s) |

|---|---|---|

| 2023/24 | £12,300 | £13,300 |

| 2022/23 | £12,300 | £13,100 |

| 2021/22 | £12,300 | £12,300 |

The table above illustrates the annual exempt amounts for capital gains tax in the UK for the last three tax years, with a specific focus on the higher thresholds applicable to individuals aged 65 and over. It's important to note that these amounts are subject to change each year, and individuals should refer to the latest guidelines to ensure accuracy.

Capital Gains Tax Rates for Over-65s

In addition to the higher annual exempt amounts, individuals aged 65 and over may also benefit from reduced capital gains tax rates. In the UK, for example, the standard capital gains tax rate is set at 20% for higher-rate taxpayers. However, for individuals who are basic-rate taxpayers and over the age of 65, the capital gains tax rate is reduced to 10%. This can result in substantial tax savings, especially for those with substantial capital gains from investments or property sales.

Furthermore, certain types of assets may be eligible for even more favorable tax treatment. For instance, gains from the sale of a primary residence are often exempt from capital gains tax entirely, provided certain conditions are met. This can be a significant advantage for retirees looking to unlock equity from their homes to fund their retirement.

Planning Strategies for Over-65s

Understanding the tax implications and potential advantages for individuals over 65 is just the first step. Effective financial planning requires a strategic approach to make the most of these provisions.

Maximizing Exemptions and Allowances

One of the key strategies for individuals over 65 is to ensure they take full advantage of the higher annual exempt amounts and reduced tax rates. This can be achieved by carefully timing the disposal of assets and spreading gains across multiple tax years. By doing so, they can ensure that their capital gains remain within the exempt threshold, minimizing their tax liability.

For instance, if an individual has multiple assets they wish to sell, they can consider staggering the sales over several tax years. This strategy, known as "bed and breakfasting," allows them to make use of the annual exempt amount in each tax year, thereby reducing the overall tax burden. However, it's important to note that this strategy may not be suitable for all assets and should be discussed with a financial advisor to ensure compliance with tax regulations.

Utilizing Retirement Accounts

Another strategic approach for individuals over 65 is to utilize retirement accounts, such as pension plans or Individual Retirement Accounts (IRAs), to shelter their investments from capital gains tax. These accounts offer tax-efficient growth potential, as gains are generally not taxed until withdrawal, and even then, they may be subject to favorable tax rates.

For example, in the US, traditional IRAs allow individuals to contribute pre-tax dollars, which grow tax-free until retirement. When funds are withdrawn, they are taxed as ordinary income. However, for individuals over 65, these withdrawals may be subject to lower tax rates due to reduced income levels and potentially lower tax brackets.

Long-Term Investment Strategies

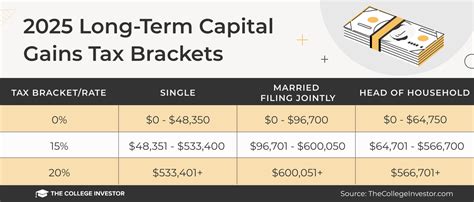

Long-term investment strategies can also be beneficial for individuals over 65, particularly when it comes to capital gains tax. Holding onto investments for extended periods can lead to substantial growth, and the potential for favorable tax treatment. Many jurisdictions offer reduced capital gains tax rates for long-term investments, which can be especially advantageous for retirees.

For instance, in the US, the capital gains tax rate is generally lower for assets held for more than one year. This long-term capital gains tax rate can be as low as 0% for certain income brackets, providing a significant incentive for retirees to maintain a long-term investment strategy.

Case Study: John’s Retirement Planning

To illustrate the practical application of these strategies, let’s consider the case of John, a 67-year-old retiree in the UK.

John has decided to downsize his property portfolio and sell off two of his rental properties. He has held these properties for over 10 years, and as a basic-rate taxpayer, he is eligible for the reduced capital gains tax rate of 10% on any gains. Additionally, with the higher annual exempt amount for over-65s, he can ensure that a significant portion of his gains are tax-free.

By carefully timing the sales and spreading them across two tax years, John can make use of the annual exempt amounts in each year. This strategy allows him to minimize his tax liability, ensuring that a larger portion of the proceeds can be utilized for his retirement needs.

Furthermore, John has also taken advantage of pension planning. He has contributed regularly to his personal pension plan throughout his working life, and upon retirement, he began drawing a taxable income from it. By carefully managing his pension withdrawals and considering his other income sources, John can ensure that he remains in a lower tax bracket, thereby reducing the tax implications on his pension income.

John's case highlights the importance of understanding the specific tax provisions for individuals over 65 and the potential advantages they offer. By implementing strategic planning and taking advantage of these provisions, retirees like John can ensure a more comfortable and financially secure retirement.

Conclusion: Navigating Capital Gains Tax Over 65

Capital gains tax can be a complex topic, especially for individuals over 65 who may have unique financial circumstances and goals. However, by understanding the specific provisions and strategies available, retirees can navigate this landscape with confidence. From higher annual exempt amounts to reduced tax rates, the tax system offers a range of advantages to support retirement planning.

It's crucial for individuals to seek professional advice and stay informed about the latest tax regulations. By doing so, they can make informed decisions and ensure that their financial plans are optimized to take full advantage of the available tax benefits. With careful planning and a strategic approach, individuals over 65 can effectively manage their capital gains tax liabilities and secure a more prosperous retirement.

How often do capital gains tax rates change, and where can I find the latest information?

+Capital gains tax rates can change annually or even more frequently, depending on the jurisdiction. It’s essential to stay updated with the latest tax guidelines. You can find the most recent information on official government websites or through reputable financial news sources. Additionally, financial advisors and tax professionals can provide up-to-date advice tailored to your specific circumstances.

Are there any age-related exemptions or allowances for capital gains tax in the US?

+In the US, there are no specific age-related exemptions or allowances for capital gains tax. However, retirees may benefit from lower tax rates on long-term capital gains and qualified dividends, as these are generally taxed at more favorable rates than ordinary income. Additionally, retirement accounts, such as IRAs and 401(k)s, offer tax-efficient growth potential.

Can individuals over 65 defer capital gains tax through retirement accounts in the UK?

+Yes, in the UK, individuals can utilize pension plans and other retirement accounts to defer capital gains tax. Contributions to pension plans are generally made with pre-tax income, and any growth within the plan is tax-free until withdrawal. Upon retirement, individuals can draw a taxable income from their pension, which may be subject to reduced tax rates due to lower income levels.

Are there any potential pitfalls or limitations to consider when planning around capital gains tax for over-65s?

+While there are many advantages to the tax provisions for individuals over 65, it’s important to consider potential limitations. For instance, the higher annual exempt amount may only apply to a limited number of disposals per year. Additionally, certain strategies, such as bed and breakfasting, may be subject to specific rules and regulations to avoid tax avoidance. It’s crucial to seek professional advice to ensure compliance and maximize the benefits.