941 Tax Deposit Due Dates

Every business and self-employed individual operating in the United States must fulfill their tax obligations, and one crucial aspect of this is making timely tax deposits. The Internal Revenue Service (IRS) has established specific due dates for tax deposits, ensuring a systematic approach to tax compliance. Among these, the 941 tax deposit due dates hold significant importance for employers and businesses.

Understanding the 941 Tax Form and Its Significance

The Form 941, also known as the “Employer’s Quarterly Federal Tax Return,” is a vital document for employers. It is used to report income taxes, Social Security taxes, and Medicare taxes withheld from employees’ paychecks, as well as the employer’s share of Social Security and Medicare taxes. The information reported on this form is crucial for the IRS to calculate the correct tax liabilities and ensure compliance.

The 941 tax deposit due dates are tied to the quarterly filing schedule for this form. These due dates are critical as they help employers manage their tax obligations and avoid potential penalties for late deposits.

The 941 Tax Deposit Due Dates in 2023

For the current year, 2023, the 941 tax deposit due dates are as follows:

- First Quarter: Deposit due date is April 30, 2023, for the period ending March 31.

- Second Quarter: Deposit due date is July 31, 2023, for the period ending June 30.

- Third Quarter: Deposit due date is October 31, 2023, for the period ending September 30.

- Fourth Quarter: Deposit due date is January 31, 2024, for the period ending December 31, 2023.

These due dates are based on the quarterly filing schedule, and it's important to note that they are specific to the deposit of taxes, not the filing of the 941 form itself. The filing due dates for the 941 form are typically one month after the end of each quarter.

Methods of Making 941 Tax Deposits

The IRS offers several methods for making tax deposits, providing flexibility to businesses and employers. The choice of method often depends on factors such as the amount of taxes owed, the frequency of deposits, and personal preferences.

Electronic Federal Tax Payment System (EFTPS)

The EFTPS is a secure system offered by the IRS that allows users to make tax payments and view payment history online. It’s a convenient method, especially for those who prefer digital transactions. To use EFTPS, businesses and individuals must first enroll, which can be done easily through the IRS website.

Direct Deposit or Wire Transfer

Direct deposit and wire transfers are efficient ways to make tax payments, especially for larger amounts. These methods often provide real-time confirmation, ensuring timely deposits. The IRS provides specific routing and account numbers for these transfers, which can be found on their official website.

Paying by Check or Money Order

For those who prefer traditional methods, paying by check or money order is an option. The IRS provides specific instructions on how to write and send these payments, including the necessary details to be included on the payment instrument.

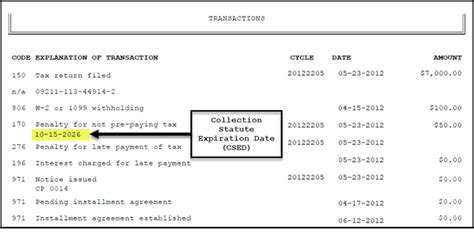

Penalties for Late 941 Tax Deposits

While the IRS understands that mistakes can happen, late tax deposits often result in penalties. These penalties can be substantial, impacting a business’s financial health. Therefore, it’s crucial to understand the potential consequences and take steps to avoid them.

The IRS calculates penalties for late deposits based on the amount of the deposit and the duration of the delay. Generally, the penalty is 2% of the unpaid tax deposit for each month or part of a month that the deposit is late, with a maximum penalty of 10% of the unpaid deposit.

Additionally, if the late deposit is part of a pattern of late payments, the IRS may impose a penalty of 10% for each occurrence, with a maximum penalty of 50% of the unpaid deposit.

Strategies to Avoid Late 941 Tax Deposits

To avoid the potential pitfalls of late tax deposits, businesses and employers can implement several strategies:

- Set Reminders: Use calendar reminders or accounting software that can alert you to upcoming due dates. This simple step can help ensure you don't miss critical deadlines.

- Automate Payments: If possible, set up automatic payments through EFTPS or your banking institution. This can help ensure timely deposits without the need for manual intervention.

- Review Payroll Processes: Regularly review your payroll processes to ensure accurate tax withholding and timely deposit calculations. This can help identify potential issues before they become problems.

- Seek Professional Help: Consider engaging the services of a tax professional or accountant who can guide you through the tax deposit process and ensure compliance.

Conclusion: Staying Compliant with 941 Tax Deposits

The 941 tax deposit due dates are an essential aspect of tax compliance for employers and businesses. By understanding these due dates and the various methods of making deposits, individuals can ensure they meet their tax obligations efficiently and effectively. While late deposits can result in significant penalties, implementing simple strategies can help avoid these pitfalls and maintain a positive relationship with the IRS.

Staying informed and proactive is key to navigating the complex world of tax compliance. With the right strategies and a commitment to timely deposits, businesses can focus on their core operations while ensuring they meet their tax responsibilities.

How can I determine the amount I need to deposit for my 941 taxes?

+The amount you need to deposit for your 941 taxes depends on the total taxes withheld from your employees’ paychecks and your share of Social Security and Medicare taxes. You can use the IRS’ tax deposit estimator tool or consult a tax professional to determine the precise amount.

Are there any exceptions or special considerations for 941 tax deposit due dates?

+Yes, there are certain situations where exceptions or special considerations may apply. For example, if you’re a new employer or have recently acquired a business, you may have different due dates or deposit requirements. It’s essential to consult the IRS guidelines or seek professional advice to understand your specific situation.

What happens if I miss a 941 tax deposit due date?

+Missing a 941 tax deposit due date can result in penalties, as mentioned earlier. The IRS may impose a penalty of 2% for each month or part of a month that the deposit is late, up to a maximum of 10%. Additionally, there may be interest charges on the unpaid amount. It’s crucial to address missed deposits promptly to mitigate potential penalties.