Sales Tax Auto California

In the state of California, the sales tax is an essential aspect of the economic landscape, impacting businesses and consumers alike. This article aims to provide an in-depth exploration of the intricacies of sales tax in California, shedding light on its implications, variations, and the strategies employed by businesses to navigate this complex tax landscape. With a focus on the automotive industry, we will delve into the specific considerations and challenges faced by car dealerships and buyers when it comes to sales tax obligations.

Understanding Sales Tax in California

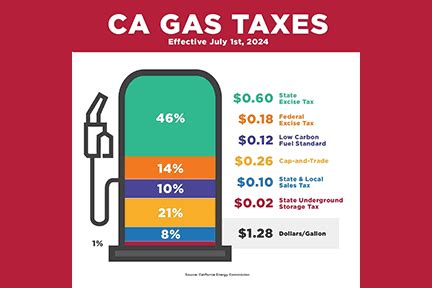

California’s sales tax system is a critical component of the state’s revenue generation, contributing significantly to its overall fiscal health. The state sales tax is imposed on the sale or lease of tangible personal property and certain services, and it plays a vital role in funding various public services and infrastructure projects.

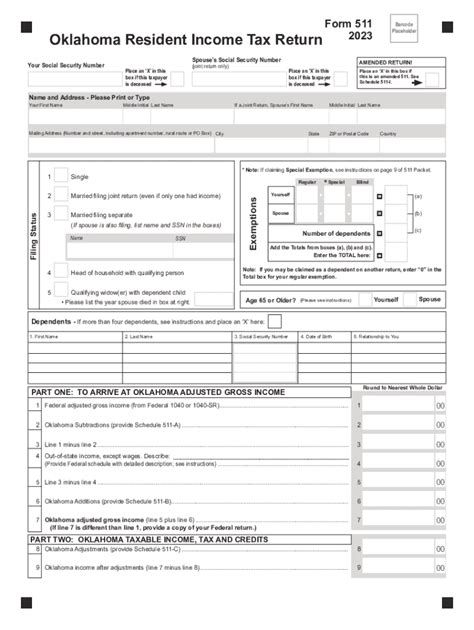

The sales tax in California is administered by the California Department of Tax and Fee Administration (CDTFA), which ensures compliance and oversees the collection and distribution of tax revenues. The state's sales tax rate is subject to periodic adjustments, with the latest rate effective as of January 1, 2023, standing at 7.25%.

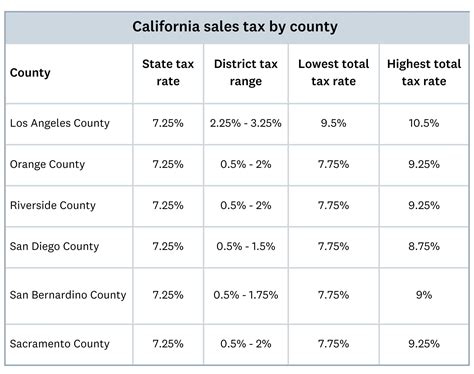

However, it's important to note that the sales tax rate is not uniform across the state. California employs a state-local sales tax system, where the base state sales tax rate is combined with local sales tax rates determined by individual counties and cities. This means that the total sales tax rate can vary significantly depending on the location of the transaction.

| Sales Tax Type | Rate |

|---|---|

| State Sales Tax | 7.25% |

| Average Local Sales Tax | Varies (approximately 1.25% - 2.25%) |

| Total Average Sales Tax | Approximately 8.50% - 9.50% |

For instance, in the city of Los Angeles, the total sales tax rate as of 2023 is 10.25%, comprising the state sales tax rate of 7.25% and a local sales tax rate of 3%. In contrast, the city of San Francisco has a lower local sales tax rate, resulting in a total sales tax of 9.50%.

Impact on Automotive Sales

The automotive industry is particularly sensitive to sales tax fluctuations, as the purchase of vehicles often involves significant financial transactions. Buyers are responsible for paying the applicable sales tax on their vehicle purchases, which can significantly impact the overall cost of the vehicle.

For example, consider the purchase of a new car priced at $30,000 in Los Angeles, where the total sales tax rate is 10.25%. The sales tax liability on this purchase would amount to $3,075, bringing the total cost of the vehicle to $33,075. This additional cost can significantly affect a buyer's decision-making process and their overall budget for vehicle ownership.

Sales Tax Obligations for Automotive Businesses

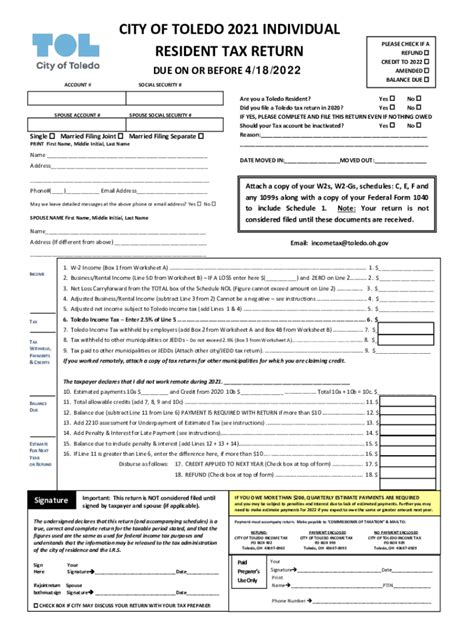

Automotive businesses, including car dealerships, face unique challenges when it comes to sales tax compliance. They must ensure that they collect and remit the appropriate sales tax amounts to the state and local authorities, while also providing accurate information to their customers.

Registration and Compliance

To operate legally and comply with sales tax regulations, automotive businesses must register with the CDTFA. This registration process involves obtaining a Seller’s Permit, which authorizes the business to collect and remit sales tax on behalf of the state.

The CDTFA provides detailed guidelines and resources to help businesses understand their sales tax obligations. These resources cover various aspects, including tax rate determination, record-keeping, filing requirements, and payment deadlines. Automotive businesses must stay informed about these regulations to avoid penalties and ensure smooth operations.

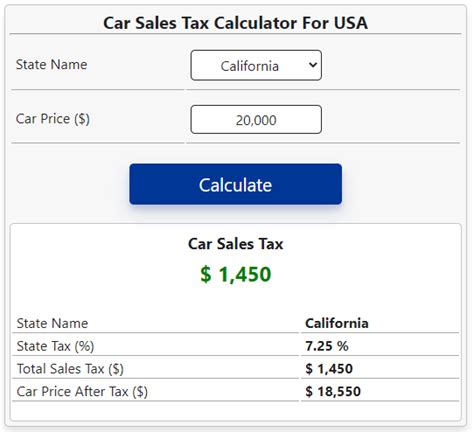

Calculating Sales Tax for Automotive Sales

Calculating sales tax for automotive sales involves a few key considerations. First, the sales tax rate applicable to the transaction must be determined based on the location of the buyer or the delivery of the vehicle. This rate includes both the state and local sales tax components.

Next, the sales tax is calculated as a percentage of the total sale price of the vehicle, including any additional fees, options, and accessories. It's important to note that sales tax is typically not applied to the value of trade-ins or down payments, as these are considered separate transactions.

For example, if a car dealership sells a vehicle priced at $40,000 to a buyer in a location with a 9.50% total sales tax rate, the sales tax liability would be $3,800, bringing the total cost of the vehicle to $43,800.

Record-Keeping and Reporting

Automotive businesses must maintain accurate records of all sales tax transactions. This includes documenting the sale price, the applicable sales tax rate, and the total sales tax collected. These records are crucial for audit purposes and for ensuring compliance with reporting requirements.

The CDTFA requires businesses to file sales tax returns periodically, typically on a quarterly basis. These returns must include the total sales tax collected during the reporting period, along with any applicable fees or penalties. Late or inaccurate filings can result in penalties and interest charges.

Strategies for Automotive Businesses

Navigating the complexities of sales tax in California requires automotive businesses to adopt strategic approaches to ensure compliance and optimize their operations.

Implementing Sales Tax Automation

One effective strategy is the implementation of sales tax automation software. These tools can automate the calculation, collection, and reporting of sales tax, reducing the risk of errors and simplifying the compliance process. By integrating such software into their systems, automotive businesses can save time and resources while ensuring accuracy in their sales tax obligations.

Sales tax automation software can dynamically calculate the applicable sales tax rate based on the customer's location, ensuring that the correct rate is applied to each transaction. It can also automate the filing of sales tax returns, reducing the administrative burden on the business.

Optimizing Pricing Strategies

Automotive businesses can also explore strategies to optimize their pricing models while considering the impact of sales tax. By analyzing market trends, competitor pricing, and customer behavior, dealerships can develop pricing strategies that account for sales tax obligations while remaining competitive.

For instance, dealerships can offer pre-tax pricing or all-inclusive pricing packages, where the sales tax is included in the advertised price. This approach can provide transparency to customers and simplify the purchasing process, as buyers are aware of the total cost upfront.

Building Customer Awareness

Educating customers about sales tax obligations is crucial for automotive businesses. By providing clear and transparent information about sales tax rates and their impact on the total cost of the vehicle, dealerships can build trust and ensure that customers are well-informed throughout the purchasing process.

Dealerships can utilize various channels, such as their websites, brochures, and sales staff, to communicate sales tax information effectively. By fostering transparency, businesses can alleviate potential concerns or misunderstandings related to sales tax liabilities.

Future Implications and Considerations

As the landscape of sales tax continues to evolve, automotive businesses must stay abreast of potential changes and their implications. The following considerations highlight some key aspects that may impact the industry in the future.

Potential Sales Tax Rate Adjustments

The sales tax rate in California is subject to periodic adjustments, and automotive businesses must be prepared for potential rate changes. While the current state sales tax rate of 7.25% is stable, local sales tax rates can fluctuate based on local government decisions. Monitoring these changes is essential to ensure accurate sales tax calculations and compliance.

Emerging Technologies and E-Commerce

The rise of e-commerce and digital platforms in the automotive industry presents both opportunities and challenges when it comes to sales tax compliance. Automotive businesses that operate online must navigate the complexities of sales tax obligations across multiple jurisdictions, ensuring that they collect and remit sales tax accurately for online transactions.

Regulatory Updates and Compliance

Staying informed about regulatory updates and changes in sales tax laws is crucial for automotive businesses. The CDTFA and other regulatory bodies may introduce new guidelines, filing requirements, or reporting formats that businesses must adhere to. By staying up-to-date with these changes, dealerships can ensure continued compliance and avoid potential penalties.

How often are sales tax rates adjusted in California?

+Sales tax rates in California are typically adjusted on an annual basis, often effective from January 1st of each year. However, local jurisdictions may adjust their sales tax rates at different times, so it’s important to stay informed about local rate changes as well.

Are there any sales tax exemptions for automotive purchases in California?

+Yes, there are certain sales tax exemptions for specific purchases in California. For example, the purchase of a vehicle for business use may be eligible for a partial or full sales tax exemption. However, the eligibility criteria and application process can be complex, so it’s advisable to consult with tax professionals or the CDTFA for specific guidance.

What happens if an automotive business fails to comply with sales tax obligations in California?

+Non-compliance with sales tax obligations can result in significant penalties and interest charges. The CDTFA has the authority to impose fines, suspend permits, or take legal action against non-compliant businesses. It’s crucial for automotive businesses to prioritize compliance and seek professional guidance if needed.