Does Montana Have Sales Tax

Nestled in the heart of the United States, Montana is a state known for its vast wilderness, stunning landscapes, and vibrant communities. When it comes to taxes, particularly sales tax, Montana has a unique approach that differs from many other states. In this comprehensive exploration, we delve into the world of sales tax in Montana, uncovering the ins and outs of this tax system and its impact on residents and businesses alike.

The Montana Sales Tax Landscape

Montana, the Treasure State, stands out in the realm of taxation with its distinctive sales tax policies. Unlike some neighboring states, Montana does indeed have a sales tax, but it operates under a set of rules and regulations that make it quite distinct.

The sales tax in Montana is governed by the Montana Department of Revenue, which plays a pivotal role in collecting and managing this revenue stream. The tax is imposed on the retail sale of tangible personal property and certain services within the state.

Sales Tax Rates

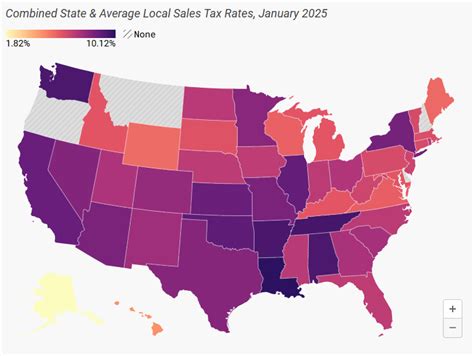

Montana’s sales tax rates can vary depending on the location and the nature of the transaction. The state has a base sales tax rate of 4%, which is applicable to most goods and services. However, there are additional local option taxes that can be levied by counties and cities, resulting in a combined sales tax rate that may be higher than the base rate.

| Sales Tax Category | Tax Rate |

|---|---|

| Base Sales Tax | 4% |

| Local Option Taxes | Varies by Location |

| Average Combined Rate | Approximately 5% |

For instance, in the city of Missoula, the combined sales tax rate is 5%, while in Great Falls, it is 6%, showcasing the variability across the state.

Exemptions and Special Cases

Montana’s sales tax system also includes a range of exemptions and special cases. Certain items, such as food for home consumption, prescription drugs, and most agricultural equipment, are exempt from sales tax. Additionally, there are provisions for resale certificates, which allow businesses to purchase goods without paying sales tax, provided they will be resold to customers.

Moreover, Montana offers sales tax holidays on specific items during certain periods. These tax-free events are designed to boost consumer spending and provide temporary relief from sales tax obligations.

Registration and Compliance

For businesses operating in Montana, understanding and complying with sales tax regulations is crucial. The Montana Department of Revenue provides resources and guidelines to help businesses navigate the sales tax landscape. This includes registering for a sales tax permit, collecting and remitting sales tax on taxable transactions, and maintaining proper records.

Impact on Residents and Businesses

The presence of sales tax in Montana has a significant impact on both residents and businesses. For consumers, it adds an additional cost to their purchases, which can influence buying decisions and overall spending habits.

Businesses, on the other hand, must carefully manage their sales tax obligations to avoid legal issues and maintain a positive relationship with the state. Proper sales tax management can also enhance a business's reputation and ensure a smooth operational environment.

Comparative Analysis

When compared to other states, Montana’s sales tax system stands out for its variability and the presence of local option taxes. While some states have higher base rates, the combined rates in Montana can be relatively moderate, making it an attractive destination for businesses and consumers alike.

Furthermore, the exemptions and special provisions in Montana's sales tax laws provide opportunities for certain industries and consumers to benefit from reduced tax burdens.

Future Implications

The future of sales tax in Montana is subject to ongoing discussions and potential legislative changes. As economic conditions evolve and technology advances, the state may consider updates to its sales tax policies to ensure fairness and efficiency.

One potential area of focus could be the expansion of sales tax to online transactions, which has become a significant revenue stream for many states. Additionally, the state may explore ways to simplify the tax system and provide clearer guidelines for businesses and consumers.

Conclusion

In conclusion, Montana’s sales tax system is a crucial aspect of the state’s fiscal landscape. With its unique features, varying rates, and exemptions, it plays a significant role in shaping the economic environment for residents and businesses. Understanding and navigating this system is essential for all parties involved, ensuring compliance and contributing to the state’s economic vitality.

What is the primary purpose of Montana’s sales tax?

+Montana’s sales tax is primarily a revenue-generating measure for the state. It helps fund various government services and infrastructure projects, contributing to the overall economic development of the state.

Are there any plans to eliminate sales tax in Montana?

+As of my last update in January 2023, there are no immediate plans to eliminate sales tax in Montana. However, tax policies are subject to change, and future legislative decisions could bring about alterations to the sales tax system.

How can businesses stay updated on sales tax changes in Montana?

+Businesses can stay informed by regularly checking the Montana Department of Revenue’s website, which provides the latest updates and resources related to sales tax. Additionally, subscribing to their newsletters or following their social media accounts can ensure timely access to tax-related information.