Understand and Calculate Ohio Auto Sales Tax to Save Money

In the labyrinthine world of Ohio's automotive commerce, where the roar of engines meets the whisper of tax codes, understanding and calculating auto sales tax isn't just a mundane task—it's a clandestine art form. For the savvy shopper armed with a calculator, a spreadsheet, and perhaps a dash of sarcasm, unraveling the complexities of Ohio's sales tax on vehicles offers a gateway to significant savings—and a few laughs along the way. Buckle up as we cruise through the intricacies of Ohio auto sales tax, blending rigorous analysis with wit sharper than a freshly tuned exhaust pipe, all designed to turn you from tax neophyte into road-ready economist.

Decoding Ohio Auto Sales Tax: The Roadmap to Savings

If the very thought of calculating sales taxes conjures images of confusion and legalese, rest assured, Ohio’s system, though layered, is navigable—once you understand its geometry. Ohio imposes a sales tax rate that varies not only by the location of the purchase but also by the vehicle type and the buyer’s intent. Primarily, the combined state and local sales tax rate hovers around 5.75%, but this is just the start of the adventure. For car buyers, especially those looking to avoid paying more than their fair share, the key lies in understanding the variables that influence the final bill—sales tax base, exemptions, and applicable local rates.

The Mechanics of Ohio Auto Sales Tax Calculation

At its core, Ohio calculates sales tax on the manufacturer’s suggested retail price (MSRP) or the actual purchase price, whichever is higher. But this is where the plot thickens: often, dealerships employ tactics—ranging from offering discounts to adding miscellaneous fees—that can skew the taxable amount. Consequently, a buyer might think they’re getting a sweet deal until the tax man arrives, clutching his ledger like a ticket collector on a ride to fiscal responsibility.

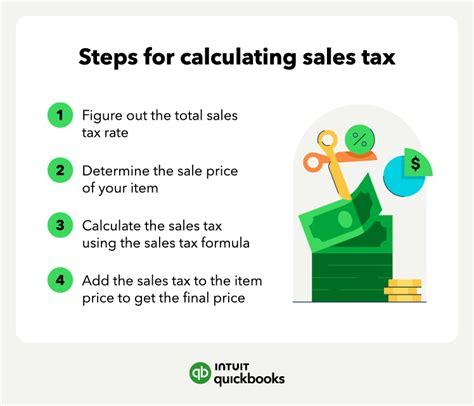

To accurately determine how much tax you'll pay, start with the basic formula:

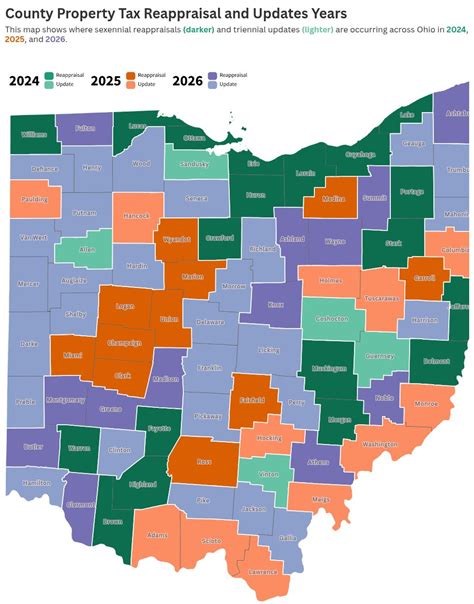

Tax = Purchase Price × Applicable RateHowever, the applicable rate isn't a monolithic number. Instead, it's a dynamic blend of state, county, and municipal rates, which can differ significantly across Ohio. For example, while the state rate is 5.75%, county and city levies can add an additional 1-2%. Tools like Ohio’s Tax Rate Lookup or industry-specific calculators can help demystify your local rate, ensuring you’re not overpaying—or underpaying, which is a different kind of trouble.

Another layer involves exemptions. For instance, vehicles purchased for resale, donations, or by certain government agencies may be exempt from sales tax. A keen buyer who qualifies for such exemptions can save hundreds—or even thousands—on a big purchase. Understanding these nuances is essential, as ignorance here can cost more than a dodged speeding ticket.

| Relevant Category | Substantive Data |

|---|---|

| Average Combined Tax Rate in Ohio | Approximately 7.0% to 7.25% in most urban counties |

| Standard Vehicle Purchase Price | $30,000 (typical mid-size sedan) |

| Typical Tax Paid | $2,100 to $2,175 at average rates |

Strategies for Minimizing Ohio Auto Sales Tax

An intelligent approach to Ohio’s auto sales tax involves more than just math; it’s a strategic game akin to chess, where each move can save or cost you a significant sum. Here are some tactics that seasoned car shoppers and industry insiders swear by:

Buy Resale Vehicles or Utilize Trade-Ins

Trade-ins effectively reduce the (taxable) purchase price. If you’re trading your old clunker, Ohio often credits the trade-in value against the new vehicle’s price, shrinking the tax base. Think of it as giving the tax collector a bs-slap—one that leaves your wallet a little thicker.

Time Your Purchase to Local Tax Rates

Since local tax rates fluctuate based on municipal budgets, shopping at the end of the fiscal quarter might just come with a tiny discount—if dealerships are feeling generous. Some counties adjust rates seasonally or respond to political shifts, making timing a tactical consideration.

Leverage Exemptions and Special Programs

Vehicles bought for certain purposes—like those for disabled persons or nonprofit entities—can be exempt from sales tax. Additionally, some dealerships participate in promotional programs that include tax waivers or reductions, transforming the purchase into a financial escape room with a freer exit route.

Errors and Pitfalls: Navigating the Minefield

Auto sales tax calculations aren’t just a straightforward multiplication; you’re also navigating a minefield full of misdirection, clerical errors, and bureaucratic red tape. For instance, misclassification of the vehicle—calling a lease an outright purchase—or failing to account for local tax rates can turn savings into liabilities. Furthermore, some dealerships might tout “tax-inclusive” pricing, but hidden fees and surcharges often mean that the real tax bill exceeds initial estimates.

The Importance of Due Diligence and Documentation

Keeping meticulous records—receipts, dealer statements, and any correspondence—is critical. Should an audit arise (and, let’s be honest, it’s more a matter of “if” than “when”), well-organized documentation ensures you’re not done in by a bureaucratic snafu or a slick sales pitch gone wrong.

| Common Mistakes | Implication |

|---|---|

| Underestimating Local Tax Rates | Overpaying on the purchase |

| Failing to Claim Exemptions | More tax paid than necessary |

| Not Timing Purchases | Missing out on rate reductions or promotional periods |

Future Trends: Will Ohio Turn the Tax Tackle?

Ohio’s tax policies are as predictable as a V8 engine’s fuel consumption—sometimes volatile, often subject to political whims. Recent proposals insinuate possible increases in local levies to bolster infrastructure, which could nudge the average combined tax rate upward by 0.25% to 0.5%. Conversely, some legislative sessions aim to offer relief for first-time buyers or low-income households, hinting at a future where the barrier of auto sales tax might shrink—if only temporarily.

Moreover, advancing technology—like digital tax collection platforms—promises to streamline the process, but may also open new avenues for audit and compliance complexities. Staying ahead of these shifts requires a keen eye on policy changes, industry trends, and the economic tides that shape Ohio's fiscal landscape.

Conclusion: Turning the Tax Maze into Your Personal Autobahn

Understanding and accurately calculating Ohio auto sales tax isn’t simply a chore—it’s an enterprise that combines savvy, strategic planning, and a pinch of humor about the system’s labyrinthine nature. Whether you’re purchasing a sleek new ride or bidding farewell to an old faithful, orchestrating your purchase to minimize tax impact turns a mundane transaction into a victory lap of financial finesse. Embrace the nuances, check your local rates, and remember that the best driver in this game is the one who leaves the tax collector in their exhaust fumes.

How does Ohio determine the sales tax on a vehicle?

+Ohio calculates sales tax based on the higher of the purchase price or MSRP, including local rates which vary by county and municipality. The combined rate usually ranges from 7.0% to 7.25%. Special exemptions and timing can influence the final tax.

Can I reduce my Ohio auto sales tax liability legally?

+Yes, through trade-ins, claiming applicable exemptions (such as for disabled persons or resellers), and timing your purchase when local rates are lower, you can legally minimize your tax burden while staying within legal boundaries.

What are common mistakes when calculating Ohio auto sales tax?

+Common errors include misjudging local tax rates, overlooking exemptions, and failing to keep proper documentation. These mistakes can lead to overpayment or legal issues during audits.