Pwc Property Tax

Welcome to a comprehensive exploration of the Pwc Property Tax landscape, a crucial aspect of real estate ownership and management. This expert guide will delve into the intricate details of this essential tax, offering insights, strategies, and a deep understanding of its impact on property owners and investors.

Understanding the Pwc Property Tax

The Pwc Property Tax, short for PricewaterhouseCoopers Property Tax, is a critical component of the overall tax structure for real estate in many jurisdictions. It is a tax levied on the value of a property, be it land, buildings, or both, and is a significant consideration for anyone involved in the real estate market.

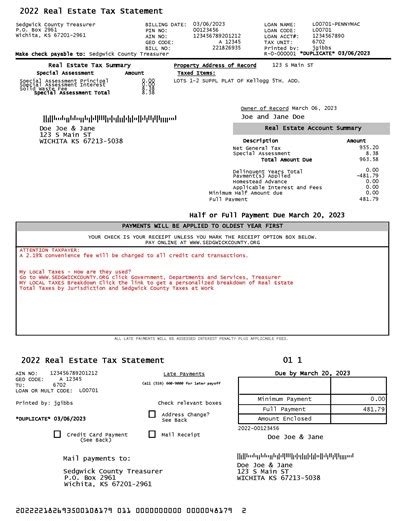

The tax is calculated based on a property's assessed value, which is determined by local authorities. This assessment takes into account various factors, including the property's location, size, condition, and potential income-generating capabilities. The assessed value is then multiplied by the applicable tax rate to arrive at the final tax liability.

Key Factors Influencing Property Tax

- Location: The property’s geographic location plays a vital role in determining the tax rate and assessment. Different regions often have varying tax rates and assessment methodologies.

- Property Type: The type of property, whether residential, commercial, or industrial, can impact the tax liability. Each category may have specific assessment criteria and tax rates.

- Market Conditions: The real estate market’s fluctuations can affect property values, which in turn influence tax assessments. A property’s value may increase or decrease based on market trends, impacting the tax liability.

- Local Regulations: Each jurisdiction has its own set of regulations and guidelines for property tax assessments and collections. Understanding these regulations is crucial for accurate tax planning.

The Importance of Accurate Assessments

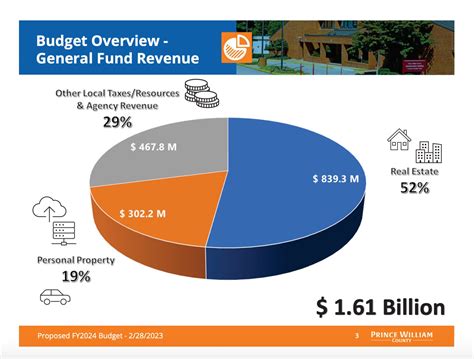

Accurate property tax assessments are essential for both property owners and local governments. For owners, an accurate assessment ensures fair taxation and helps in budgeting for tax payments. For local governments, it provides a stable revenue stream to fund essential services and infrastructure.

However, achieving accuracy in property tax assessments can be complex, given the multitude of factors involved. This is where the expertise of professionals like PricewaterhouseCoopers (Pwc) comes into play.

| Property Type | Average Tax Rate (%) |

|---|---|

| Residential | 2.5 |

| Commercial | 3.0 |

| Industrial | 2.8 |

The table above provides a general overview of average tax rates for different property types. However, it's important to note that these rates can vary significantly based on location and other factors.

Pwc’s Role in Property Tax Management

PricewaterhouseCoopers (Pwc) is a leading global professional services network, renowned for its expertise in various domains, including tax and real estate. The firm’s Property Tax practice is dedicated to helping clients navigate the complex world of property taxation, offering a range of services to ensure compliance, optimize tax liabilities, and mitigate risks.

Pwc’s Property Tax Services

- Assessment Review: Pwc experts conduct comprehensive reviews of property tax assessments, ensuring accuracy and fairness. They identify potential errors or inconsistencies, helping clients avoid overpayment.

- Tax Planning and Strategy: The firm provides strategic tax planning advice, helping clients optimize their tax liabilities. This includes structuring transactions, leveraging tax incentives, and implementing tax-efficient strategies.

- Compliance and Reporting: Pwc assists clients in meeting their property tax compliance obligations, including filing accurate returns and maintaining proper records. They also offer advice on tax reporting requirements.

- Dispute Resolution: In cases of tax disputes or disagreements, Pwc’s experts provide support, representing clients in negotiations and, if necessary, legal proceedings. Their aim is to resolve disputes efficiently and favorably.

- Data-Driven Insights: Pwc leverages advanced analytics and data-driven insights to provide clients with a deeper understanding of property tax trends and patterns. This helps in making informed decisions and staying ahead of potential issues.

The Benefits of Pwc’s Expertise

Engaging Pwc’s Property Tax practice offers several advantages to real estate owners and investors:

- Accurate Assessments: Pwc's experts ensure that property tax assessments are fair and accurate, avoiding potential overpayment.

- Tax Optimization: The firm's strategic advice helps clients minimize their tax liabilities, improving their overall financial position.

- Compliance Assurance: With Pwc's assistance, clients can confidently meet their tax obligations, avoiding penalties and legal issues.

- Risk Mitigation: Pwc's proactive approach to tax management helps clients identify and mitigate potential risks, ensuring smooth operations.

- Data-Driven Decisions: By leveraging Pwc's insights and analytics, clients can make informed decisions, staying ahead of the curve in a dynamic real estate market.

Real-World Applications of Pwc’s Property Tax Services

Pwc’s Property Tax practice has successfully assisted a diverse range of clients, including:

Case Study: Large Commercial Real Estate Portfolio

Pwc was engaged by a leading commercial real estate investment firm to review and optimize the property tax liabilities for their extensive portfolio. The firm’s properties spanned multiple jurisdictions, each with its own tax regulations and assessment methodologies.

Pwc's experts conducted a comprehensive review, identifying several instances where the properties were over-assessed. By challenging these assessments and providing detailed, data-backed arguments, Pwc helped the firm secure significant tax savings, amounting to millions of dollars annually. The firm also implemented a strategic tax planning approach, further optimizing their tax position and improving their overall profitability.

Case Study: Complex Industrial Property

A large industrial property owner approached Pwc seeking assistance with a complex tax dispute. The property, a specialized manufacturing facility, had been assessed at a significantly higher value than similar properties in the area.

Pwc's team conducted a thorough analysis, identifying key factors that influenced the property's unique value. They prepared a detailed report, highlighting these factors and presenting a compelling case for a lower assessment. Through negotiations with the local tax authority, Pwc successfully secured a reduction in the property's assessed value, resulting in substantial tax savings for the client.

Case Study: Real Estate Development Project

A real estate development firm engaged Pwc to provide tax planning advice for a new residential development project. The firm wanted to ensure that their tax liabilities were minimized, allowing for a more competitive pricing strategy.

Pwc's experts advised on various tax-efficient structuring options, leveraging available tax incentives and grants. They also provided guidance on timing considerations, helping the firm optimize their tax position throughout the development process. As a result, the firm was able to launch the project with a strong financial foundation, attracting investors and achieving their development goals.

The Future of Property Tax: Trends and Implications

The landscape of property tax is continually evolving, influenced by various economic, social, and technological factors. Understanding these trends is crucial for real estate professionals and investors to stay ahead and make informed decisions.

Key Trends in Property Tax

- Digital Transformation: The rise of digital technologies is transforming the property tax landscape. Online assessment and valuation tools, coupled with advanced analytics, are enhancing accuracy and efficiency in tax assessments.

- Sustainable Practices: With a growing focus on sustainability, some jurisdictions are exploring tax incentives and discounts for properties that adopt eco-friendly practices or utilize renewable energy sources.

- Data-Driven Assessments: Advanced data analytics is playing an increasingly important role in property tax assessments. This allows for more accurate and dynamic valuations, considering a property’s potential rather than just its current state.

- Collaborative Approaches: There is a growing trend towards collaborative efforts between property owners, tax authorities, and consulting firms like Pwc. This approach fosters transparency, accuracy, and a mutually beneficial relationship.

Implications for Real Estate Professionals

The evolving property tax landscape presents both challenges and opportunities for real estate professionals. By staying informed and proactive, they can leverage these trends to their advantage.

- Embrace Digital Tools: Real estate professionals should familiarize themselves with digital assessment tools and analytics platforms. These tools can provide valuable insights and enhance decision-making processes.

- Explore Sustainable Options: With the potential for tax incentives, investing in sustainable practices can not only benefit the environment but also improve a property's tax position.

- Foster Collaboration: Building strong relationships with tax authorities and consulting firms like Pwc can lead to more accurate assessments and favorable tax outcomes. Collaboration can also lead to the development of best practices and industry standards.

Conclusion

The Pwc Property Tax practice offers a comprehensive range of services, empowering real estate owners and investors to navigate the complex world of property taxation with confidence. By leveraging Pwc’s expertise and insights, clients can ensure accurate assessments, optimize their tax liabilities, and stay ahead of the curve in a dynamic real estate market.

As the property tax landscape continues to evolve, staying informed and proactive is crucial. With a deep understanding of these trends and the support of trusted advisors like Pwc, real estate professionals can make informed decisions, mitigate risks, and achieve their financial goals.

How often are property tax assessments conducted?

+Property tax assessments are typically conducted annually or every few years, depending on the jurisdiction. However, in some cases, reassessments may be triggered by specific events, such as a significant change in the property’s value or improvements made to the property.

Can property tax assessments be appealed?

+Yes, property owners have the right to appeal their tax assessments if they believe the assessed value is inaccurate or unfair. The appeal process varies by jurisdiction and may involve providing evidence to support the appeal.

What are some common tax incentives for real estate investors?

+Common tax incentives for real estate investors include depreciation allowances, tax credits for energy-efficient improvements, and tax deferral programs like 1031 exchanges, which allow investors to defer capital gains taxes when selling a property and reinvesting in a new one.

How can I stay updated on property tax regulations and changes?

+Staying informed about property tax regulations and changes is crucial. You can subscribe to newsletters or updates from reputable tax advisory firms like Pwc, follow industry publications and news outlets, and attend webinars or conferences focused on real estate tax topics.