Florida Corporate Tax Rate

The corporate tax landscape in Florida presents a unique and advantageous environment for businesses. Unlike many other states in the United States, Florida stands out for its relatively low and straightforward corporate tax structure, making it an attractive destination for corporations seeking to minimize their tax liabilities.

Understanding Florida's Corporate Tax Rate

Florida imposes a corporate income tax on businesses operating within its borders. The state's corporate tax rate is currently set at 5.5%, which is significantly lower compared to the national average and many other states. This flat rate applies to all corporations, regardless of their size or industry, providing a consistent and predictable tax environment.

The corporate tax rate in Florida has remained stable over the years, offering businesses a sense of certainty in their financial planning. Additionally, Florida does not impose a franchise tax, which is a significant advantage for corporations, as it eliminates an additional layer of taxation that is common in many other states.

Taxable Income and Exemptions

Florida's corporate tax is calculated based on the taxable income of the corporation. Taxable income is determined by subtracting allowable deductions and exemptions from the corporation's gross income. The state offers a range of deductions and exemptions that can further reduce the tax liability of businesses.

One notable exemption is the Research and Development (R&D) Tax Credit, which encourages innovation and technological advancements. Corporations engaged in qualifying research activities can benefit from a tax credit, effectively reducing their tax burden. This incentive aims to promote economic growth and competitiveness in Florida's business landscape.

| Tax Credit | Rate |

|---|---|

| Research and Development | Up to 20% |

Furthermore, Florida provides tax incentives for specific industries, such as the Film and Entertainment Industry, offering rebates and tax credits to productions that meet certain criteria. These incentives aim to attract businesses and stimulate economic development in the state.

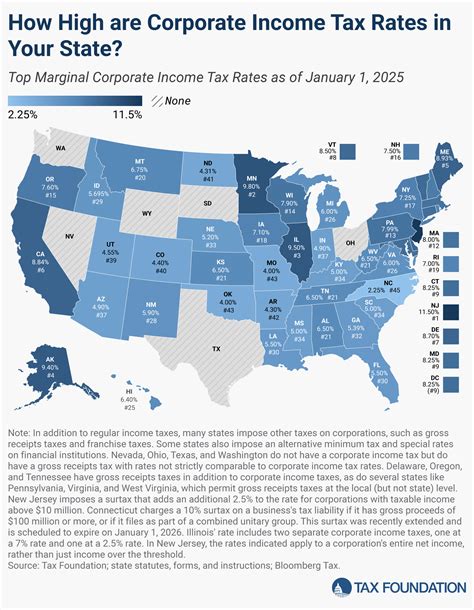

Comparison with Other States

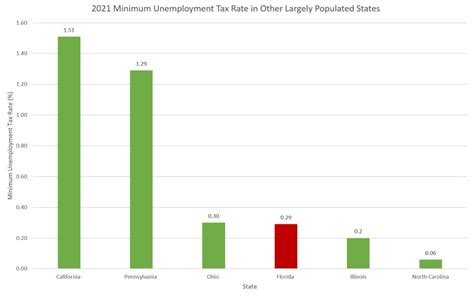

When comparing Florida's corporate tax rate to other states, the contrast becomes evident. Many states impose higher corporate tax rates, often with additional taxes and fees, making Florida's business tax environment more competitive.

For instance, states like California and New York have corporate tax rates exceeding 8%, and they often impose additional taxes on corporations, such as the Unitary Tax or Combined Reporting requirements. These additional taxes can significantly increase the overall tax burden for businesses.

| State | Corporate Tax Rate |

|---|---|

| Florida | 5.5% |

| California | 8.84% |

| New York | 6.5% |

| Texas | 0% (No corporate income tax) |

Additionally, some states, like Texas, have no corporate income tax, relying instead on other revenue streams. While this may seem advantageous, it's important to consider the overall tax structure and other business costs when comparing states.

Benefits for Businesses

Florida's low corporate tax rate offers several advantages to businesses:

- Cost Savings: Businesses can potentially reduce their tax liabilities, leading to increased profitability and financial flexibility.

- Competitive Advantage: Lower tax rates can make Florida an attractive location for business expansion and investment, giving companies an edge over competitors in other states.

- Stability: A consistent and predictable tax environment allows businesses to plan and forecast their financial strategies more effectively.

Florida's Business-Friendly Environment

Beyond the corporate tax rate, Florida boasts a range of business-friendly policies and initiatives. The state offers a pro-business regulatory environment, with streamlined processes for business registration and minimal bureaucratic hurdles.

Florida's strategic location, with access to major markets and international trade routes, further enhances its appeal. The state's infrastructure, including efficient transportation networks and modern ports, supports the needs of businesses operating in various industries.

Economic Development and Incentives

Florida actively promotes economic development and growth through various incentive programs. These initiatives aim to attract and retain businesses, stimulate job creation, and drive innovation.

One notable program is the Enterprise Zone Program, which offers tax incentives and grants to businesses operating within designated areas. These zones are typically in economically disadvantaged regions, providing an opportunity for businesses to contribute to community development while benefiting from tax breaks.

| Incentive Program | Benefits |

|---|---|

| Enterprise Zone Program | Tax incentives, grants, and reduced business taxes for qualifying businesses. |

| Quick Response Training Program | Customized training programs for businesses, funded by the state, to enhance workforce skills. |

Additionally, Florida provides Workforce Development Programs, offering customized training and skill development initiatives for businesses. These programs ensure a skilled workforce, meeting the specific needs of different industries.

Conclusion

Florida's corporate tax rate of 5.5% positions the state as a competitive and attractive destination for businesses. The low tax rate, coupled with various exemptions and incentives, provides an opportunity for corporations to optimize their tax strategies and contribute to the state's vibrant economy.

As Florida continues to prioritize business-friendly policies, it remains a preferred choice for companies seeking a stable and supportive environment for their operations. The state's commitment to economic growth and development ensures a bright future for businesses and the communities they serve.

Frequently Asked Questions

How does Florida's corporate tax rate compare to other states in the US?

+Florida's corporate tax rate of 5.5% is significantly lower than the national average and many other states. While some states have no corporate income tax, others impose rates exceeding 8%. Florida's flat tax rate provides a competitive advantage and simplicity in tax planning.

<div class="faq-item">

<div class="faq-question">

<h3>What are the tax exemptions and incentives available for businesses in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Florida offers a range of tax exemptions and incentives, including the Research and Development Tax Credit and incentives for the Film and Entertainment Industry. Additionally, the Enterprise Zone Program provides tax breaks and grants for businesses operating in designated areas.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any additional taxes or fees for corporations in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Florida does not impose additional taxes, such as a franchise tax, on corporations. However, there may be other fees and charges related to specific business activities or industry regulations. It's important to consult with tax professionals to understand any potential additional costs.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How does Florida's business-friendly environment impact economic growth?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Florida's business-friendly environment, including its low corporate tax rate and streamlined regulations, attracts businesses and fosters economic growth. The state's strategic location, infrastructure, and incentive programs further enhance its appeal, leading to increased investment, job creation, and innovation.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can you provide examples of successful businesses that have benefited from Florida's corporate tax structure?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Certainly! Florida has been a preferred location for various industries. For instance, the entertainment industry, including film and TV production, has thrived in Florida due to the state's incentives and tax advantages. Additionally, tech startups and innovation hubs have found success in Florida, benefiting from the Research and Development Tax Credit.</p>

</div>

</div>

</div>