Latino Taxes Denver Colorado

In the vibrant city of Denver, Colorado, where diverse cultures thrive, understanding the intricacies of tax obligations for the Latino community is essential. This comprehensive guide aims to shed light on the specific tax considerations for Latinos in Denver, ensuring clarity and compliance. Let's delve into the world of Latino Taxes in Denver, Colorado, navigating the complexities together.

Navigating the Tax Landscape for Latinos in Denver

Denver, known for its dynamic Latino population, presents a unique tax environment. As an expert in the field, I aim to provide a detailed analysis, offering insights and strategies to simplify the tax process for Latinos residing in this beautiful city.

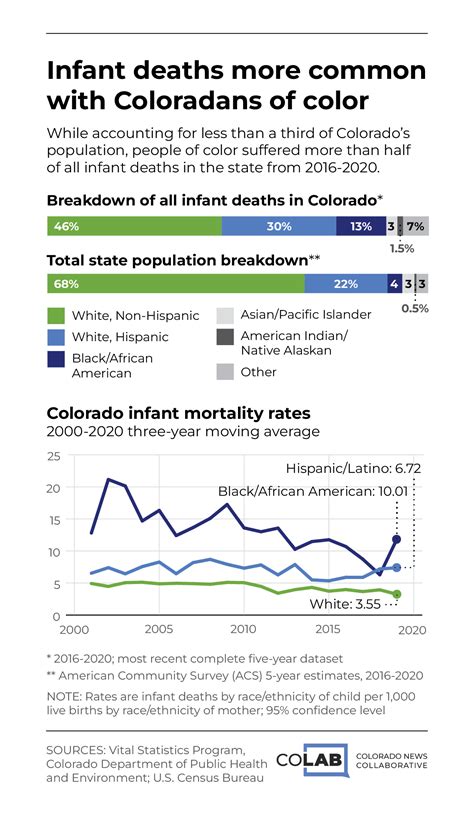

The tax system in Denver, like any other, can be complex, especially for those new to the country or unfamiliar with the local regulations. Latinos, with their rich cultural heritage and diverse backgrounds, may face unique challenges when it comes to tax compliance. This guide aims to bridge that gap, offering a comprehensive understanding of the tax landscape tailored to the needs of the Latino community.

Understanding Tax Obligations: A Latino Perspective

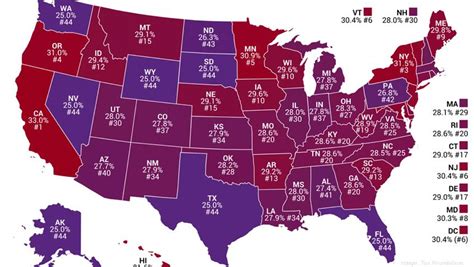

For Latinos in Denver, tax obligations extend beyond federal and state regulations. It’s essential to consider local tax laws, which can vary significantly across different cities and states. Denver, with its progressive tax policies, offers a unique set of rules and regulations that impact the tax filings of its residents.

One key aspect is the Denver Earned Income Tax Credit (EITC), a program designed to provide tax relief for low- and moderate-income earners. This credit can significantly reduce the tax burden for eligible individuals and families, making it a crucial consideration for Latinos with varying income levels.

| Tax Category | Relevant Information |

|---|---|

| Federal Income Tax | Latinos, like all U.S. residents, are subject to federal income tax. The Internal Revenue Service (IRS) provides guidelines and resources to ensure compliance. |

| State Income Tax | Colorado imposes a state income tax, and Latinos must file accordingly. The Colorado Department of Revenue offers resources to assist with state tax filings. |

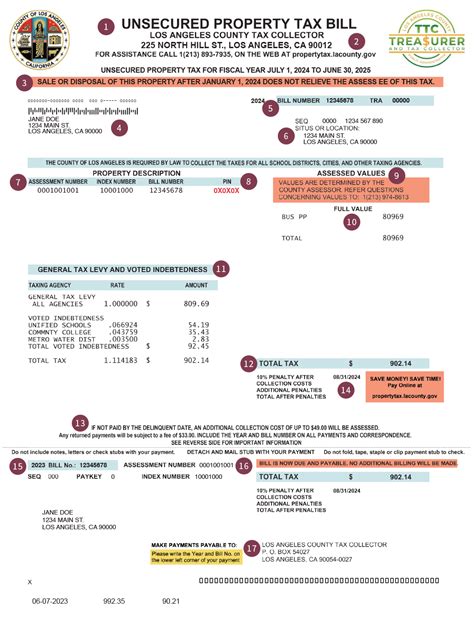

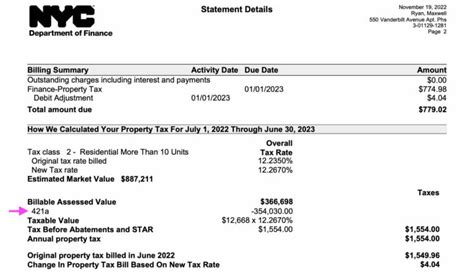

| Local Taxes | Denver has its own set of local taxes, including property taxes and sales taxes. Understanding these is crucial for accurate tax planning. |

Tax Strategies for the Latino Community in Denver

Navigating the tax landscape can be challenging, but with the right strategies, Latinos in Denver can optimize their tax positions and ensure compliance. Here are some key strategies tailored to the needs of the Latino community:

Maximizing Deductions and Credits

Latinos, like all taxpayers, can benefit from various deductions and credits offered by the IRS and the state of Colorado. Some of these include:

- Child Tax Credit: Eligible taxpayers can claim a credit for each qualifying child, providing a significant reduction in tax liability.

- Education Credits: The American Opportunity Tax Credit and the Lifetime Learning Credit can offset the cost of higher education for Latino students and their families.

- EITC: As mentioned earlier, the Denver EITC is a valuable tool for low- and moderate-income earners. It's essential to understand the eligibility criteria and how to claim this credit.

Effective Tax Planning

Tax planning is a crucial aspect of financial management. Latinos in Denver can benefit from the following strategies:

- Retirement Savings: Contributing to tax-advantaged retirement accounts like IRAs or 401(k)s can reduce taxable income and provide long-term financial security.

- Health Savings Accounts (HSAs): HSAs offer a triple tax benefit: pretax contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. This strategy can significantly reduce taxable income for Latinos with health-related expenses.

- Charitable Contributions: Donating to qualified charities can provide tax deductions, allowing Latinos to support causes close to their hearts while also reducing their tax liability.

Navigating Complex Scenarios

For Latinos with more complex tax situations, such as self-employment or business ownership, additional considerations come into play:

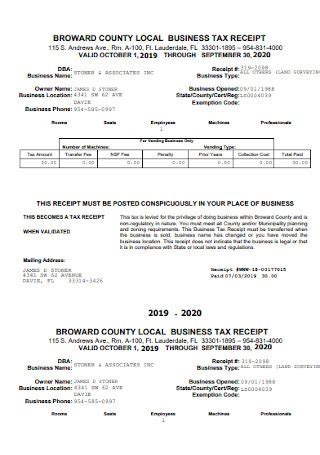

- Self-Employment Taxes: Latinos running their own businesses or working as independent contractors need to understand and plan for self-employment taxes, including Social Security and Medicare taxes.

- Business Deductions: From office supplies to business travel, Latinos in business can take advantage of various deductions to reduce their taxable income. It's essential to keep accurate records and consult with tax professionals.

The Role of Tax Professionals

Navigating the tax landscape can be complex, and for Latinos in Denver, it’s crucial to have access to reliable tax professionals who understand their unique needs. Tax professionals play a vital role in ensuring accurate filings, maximizing deductions, and providing peace of mind.

Benefits of Working with a Tax Professional

Engaging the services of a tax professional offers several advantages:

- Expertise: Tax professionals have extensive knowledge of tax laws and regulations, ensuring that Latinos receive accurate and up-to-date advice.

- Compliance: Tax professionals ensure that tax filings are compliant with federal, state, and local regulations, reducing the risk of penalties and audits.

- Deduction Maximization: Tax professionals can identify and maximize available deductions and credits, potentially reducing tax liabilities.

- Peace of Mind: With a tax professional on their side, Latinos can focus on their lives and businesses, knowing that their tax obligations are being handled efficiently and effectively.

Finding the Right Tax Professional

When seeking a tax professional, Latinos in Denver should consider the following:

- Experience: Look for professionals with experience serving the Latino community and an understanding of their unique tax needs.

- Credentials: Ensure the tax professional is licensed and has the necessary qualifications, such as a CPA or EA (Enrolled Agent) designation.

- Communication: Choose a tax professional who communicates effectively and is willing to explain complex tax concepts in a clear and concise manner.

- Accessibility: Opt for a tax professional who is easily accessible, offering convenient appointment times and multiple methods of communication.

Future Implications and Resources

As the Latino community in Denver continues to grow and thrive, it’s essential to stay informed about tax obligations and changes in the tax landscape. Here are some key considerations and resources for the future:

Tax Law Updates

Tax laws are subject to change, and it’s crucial to stay updated. The IRS and the Colorado Department of Revenue provide resources and updates on their websites. Additionally, subscribing to reputable tax newsletters or following tax-focused blogs can keep Latinos informed about the latest developments.

Community Resources

The Latino community in Denver is fortunate to have several organizations and resources dedicated to supporting their financial well-being. These include:

- Latino Community Foundation: A nonprofit organization dedicated to empowering Latino communities through financial literacy and education.

- Hispanic Chamber of Commerce of Metro Denver: Provides resources and support for Latino-owned businesses, including tax-related guidance.

- Local Community Centers: Many community centers in Denver offer financial literacy programs and tax assistance, particularly during tax season.

Long-Term Financial Planning

Beyond annual tax filings, Latinos in Denver can benefit from long-term financial planning. This includes investing for the future, estate planning, and retirement savings. Engaging the services of a financial planner who understands the unique needs of the Latino community can provide valuable guidance and peace of mind.

Conclusion

Navigating the world of taxes as a Latino in Denver can be challenging, but with the right knowledge and resources, it becomes a manageable and even empowering process. This guide aims to provide a comprehensive understanding of the tax landscape, offering strategies and insights to ensure compliance and financial well-being. Remember, staying informed and seeking professional advice when needed is key to a successful financial journey.

FAQ

What is the Denver Earned Income Tax Credit (EITC), and how can it benefit Latinos in Denver?

+

The Denver EITC is a tax credit available to low- and moderate-income earners in Denver. It can significantly reduce tax liabilities, providing much-needed financial relief. Latinos in Denver can benefit from this credit by ensuring they meet the eligibility criteria and claim it on their tax returns.

Are there any tax benefits specifically for Latino-owned businesses in Denver?

+

Yes, Denver offers various tax incentives and programs to support small businesses, including those owned by Latinos. These can include tax credits for hiring and retaining employees, as well as incentives for investing in the local community. It’s beneficial for Latino business owners to stay informed about these opportunities.

How can I find a tax professional who specializes in serving the Latino community in Denver?

+

You can start by asking for recommendations from trusted sources within the Latino community. Local community centers, chambers of commerce, and financial institutions often have networks of tax professionals who specialize in serving Latinos. Online directories and reviews can also provide valuable insights.

What resources are available for Latinos in Denver to learn more about tax planning and financial management?

+

The Latino Community Foundation in Denver offers financial literacy programs and workshops specifically tailored to the needs of the Latino community. Additionally, the Hispanic Chamber of Commerce provides resources and guidance for Latino business owners. Online resources, such as tax blogs and financial websites, can also be valuable sources of information.

Are there any tax credits or deductions available for Latinos with dependents or children in Denver?

+

Yes, Latinos with dependents or children may be eligible for various tax credits and deductions. These include the Child Tax Credit, the Earned Income Tax Credit, and the Child and Dependent Care Credit. It’s essential to consult with a tax professional to understand which credits and deductions apply to your specific situation.