Colorado 529 Tax Deduction

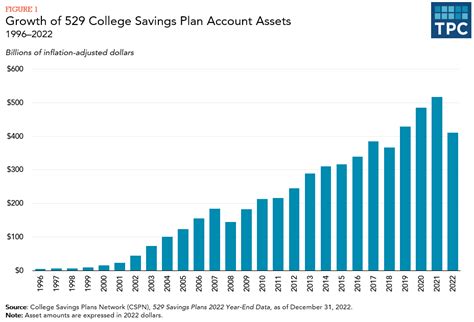

The Colorado 529 Tax Deduction is a powerful financial tool that offers significant benefits to residents of the Centennial State who are planning for their children's or their own education. This comprehensive guide will delve into the intricacies of this deduction, exploring its potential to reduce your tax burden while simultaneously investing in your future education. With the right strategies, you can maximize your savings and ensure a brighter financial future.

Understanding the Colorado 529 Plan

The Colorado 529 College Savings Plan, officially known as the CollegeInvest program, is a state-sponsored savings plan designed to help families and individuals save for qualified education expenses. It is managed by the Colorado Department of Higher Education and offers a range of investment options to cater to different financial goals and risk tolerances.

The plan is named after Section 529 of the Internal Revenue Code, which provides a framework for tax-advantaged education savings plans. These plans, often referred to as "529 plans," allow individuals to set aside funds for education expenses while benefiting from various tax incentives.

Colorado's 529 plan offers two primary savings options: the Direct Portfolio, which allows investors to choose from a range of professionally managed portfolios, and the Advisor-Sold Portfolio, which is designed for those who prefer personalized advice and guidance from a financial professional.

| Portfolio Type | Key Features |

|---|---|

| Direct Portfolio |

|

| Advisor-Sold Portfolio |

|

Both options offer tax benefits to Colorado residents, but it's the tax deduction aspect that can make a significant difference in an investor's overall savings.

Exploring the Tax Deduction

The Colorado 529 Tax Deduction is a state-level incentive that allows residents to deduct a portion of their contributions to the CollegeInvest plan from their state taxable income. This deduction can lead to substantial savings, especially for those in higher tax brackets.

Eligibility and Contribution Limits

To be eligible for the tax deduction, individuals must be Colorado residents and contribute to the CollegeInvest plan. The contribution limits are set annually and can vary, but for the 2023 tax year, the deduction is allowed on contributions up to 6,450</strong> for individuals and <strong>12,900 for married couples filing jointly.

| Tax Year | Individual Contribution Limit | Joint Contribution Limit |

|---|---|---|

| 2023 | $6,450 | $12,900 |

| 2022 | $6,400 | $12,800 |

| 2021 | $6,350 | $12,700 |

It's important to note that the contribution limits are per taxpayer, so if both spouses contribute to a 529 plan, they can each claim the full deduction.

Calculating Your Tax Savings

The amount of tax savings you can expect depends on your state tax bracket. Colorado has a flat income tax rate of 4.55%, so for every dollar you contribute up to the limit, you can save $0.0455 in state taxes.

For example, if you're a single taxpayer contributing the maximum of $6,450 in 2023, you could save up to $294.38 on your state taxes. For married couples filing jointly, contributing the maximum of $12,900, the potential tax savings could be as high as $585.15.

Key Advantages

- Immediate Tax Benefit: Unlike some other tax-advantaged plans, the Colorado 529 Tax Deduction provides an immediate reduction in your taxable income, potentially lowering your tax liability for the current year.

- Flexibility: You can choose from a variety of investment options within the CollegeInvest plan, allowing you to tailor your savings strategy to your financial goals and risk tolerance.

- Transferability: Funds in a 529 plan can be used for qualified education expenses at any accredited college or university nationwide, offering flexibility in choosing educational institutions.

Maximizing Your Deduction

To make the most of the Colorado 529 Tax Deduction, consider the following strategies:

Regular Contributions

Contributing consistently, especially early on, can help maximize your savings potential. By making regular contributions, you benefit from the power of compounding, where your earnings generate additional earnings over time.

Strategic Investment Choices

Choose investment options that align with your financial goals and risk appetite. The CollegeInvest plan offers a range of portfolios, from conservative to aggressive, allowing you to balance potential returns with risk.

Family Contributions

Encourage other family members, such as grandparents or relatives, to contribute to the 529 plan. Each contributor can claim the tax deduction, effectively multiplying the savings potential.

Plan for Long-Term Goals

The 529 plan is designed for long-term savings. Consider the potential future costs of education and aim to save accordingly. The plan allows for flexibility in choosing educational institutions and can be used for various qualified expenses.

Conclusion: A Wise Investment in Your Future

The Colorado 529 Tax Deduction offers a compelling opportunity for residents to invest in their future education while reducing their tax burden. By understanding the mechanics of the plan and employing strategic savings strategies, you can make the most of this valuable financial tool. Whether you’re saving for your own education or that of a loved one, the Colorado 529 College Savings Plan can be a powerful catalyst for achieving your educational goals.

Can I use the Colorado 529 plan for K-12 expenses?

+While the primary focus of 529 plans is on higher education, Colorado’s plan allows for the use of funds for K-12 expenses up to $10,000 per year. This can include private school tuition, online courses, and certain educational materials.

Are there any penalties for withdrawing funds early?

+Withdrawing funds for non-qualified expenses may result in a 10% federal penalty tax, as well as income taxes on the earnings portion of the distribution. Additionally, Colorado may impose a 2.5% state penalty on earnings.

Can I transfer my 529 plan to another state’s plan?

+Yes, you can roll over your 529 plan to another state’s plan without tax consequences. However, you should consider the features and benefits of the new plan to ensure it aligns with your goals.