Nyc Tax Bill

Welcome to an in-depth exploration of the New York City tax bill, a crucial aspect of financial planning for both residents and businesses in the Big Apple. Understanding the intricacies of the NYC tax system is essential for navigating the city's complex financial landscape. In this comprehensive guide, we will delve into the various components of the tax bill, providing a detailed breakdown of what it entails and how it impacts individuals and entities operating within the city limits. From property taxes to income taxes and everything in between, we aim to offer a clear and concise understanding of this essential financial obligation.

Understanding the NYC Tax Bill

The New York City tax bill is a comprehensive document that outlines the various taxes owed by individuals and businesses operating within the city. It serves as a record of the taxpayer’s financial obligations and is an essential tool for managing one’s financial responsibilities. The tax bill is a complex document, encompassing a range of taxes and fees, each with its own set of rules and regulations.

The primary purpose of the NYC tax bill is to generate revenue for the city's budget, which funds essential services such as education, infrastructure, and public safety. It is a critical component of the city's financial system, ensuring that the government has the resources necessary to provide for its residents. The tax bill is also a means of redistributing wealth, as higher-income earners and businesses contribute a larger portion of their earnings to support the community.

Key Components of the NYC Tax Bill

The NYC tax bill consists of several key components, each playing a vital role in the city’s financial structure. Here is a breakdown of the main elements:

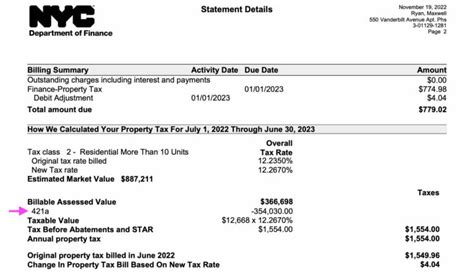

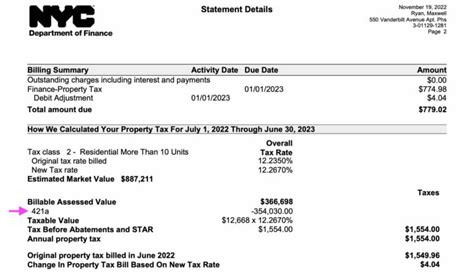

- Property Taxes: Property taxes are a significant portion of the tax bill, especially for homeowners and commercial property owners. These taxes are based on the assessed value of the property and are used to fund local services and infrastructure. The tax rate varies depending on the borough and the type of property.

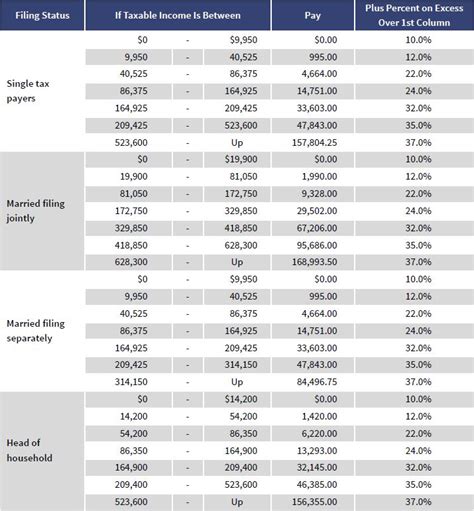

- Income Taxes: NYC residents and businesses are subject to both state and city income taxes. The city income tax is an additional tax on top of the federal and state income taxes, and it is used to support the city's budget. The income tax rate varies based on income brackets and filing status.

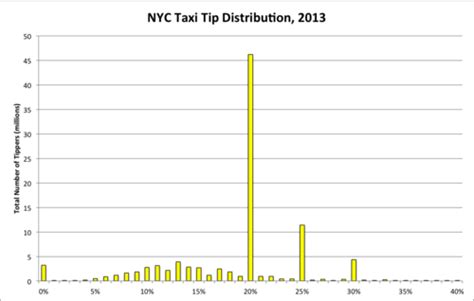

- Sales and Use Taxes: Sales taxes are applied to most retail transactions within the city, while use taxes are levied on goods purchased outside the city but used within NYC. These taxes contribute to the city's revenue and are often used to promote economic development.

- Business Taxes: Businesses operating in NYC are subject to a range of taxes, including corporation taxes, unincorporated business taxes, and commercial rent taxes. These taxes vary depending on the type of business and its revenue.

- Excise Taxes: NYC imposes excise taxes on certain goods and services, such as tobacco products, gasoline, and certain entertainment activities. These taxes are often used to deter specific behaviors or generate revenue for specific purposes.

- Fees and Assessments: In addition to taxes, the tax bill may also include various fees and assessments. These can include water and sewer charges, garbage collection fees, and special assessments for specific improvements or services.

| Tax Type | Description | Rate (as of 2023) |

|---|---|---|

| Property Tax | Based on property value | Varies by borough and property type |

| Income Tax | State and city income tax | City: 2.475% - 3.876% State: 4% - 8.82% |

| Sales Tax | Applied to retail transactions | 8.875% (combined state and city rate) |

| Business Taxes | Varies by business type and revenue | Corporation: 8.85% Unincorporated: 4% |

| Excise Taxes | Tobacco, gasoline, entertainment, etc. | Varies by product and service |

Calculating and Paying Your NYC Tax Bill

Calculating your NYC tax bill involves a meticulous process that takes into account various factors, including your income, property value, and the specific taxes applicable to your situation. Here’s a step-by-step guide to help you understand the process:

Step 1: Determine Your Taxable Income

Your taxable income is the starting point for calculating your NYC tax bill. This includes all sources of income, such as wages, salaries, investments, and business profits. It’s crucial to accurately report all income to avoid penalties and ensure compliance with tax laws.

Step 2: Calculate Property Taxes

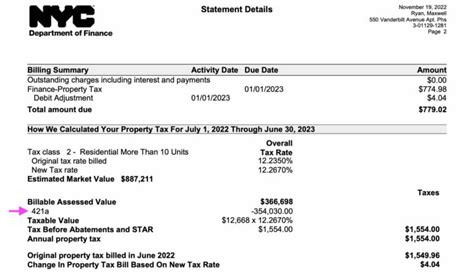

If you own property in NYC, you’ll need to calculate your property taxes. This involves determining the assessed value of your property and applying the appropriate tax rate for your borough and property type. The Department of Finance provides tools and resources to help you calculate your property taxes accurately.

Step 3: Compute Income Taxes

NYC residents are subject to both state and city income taxes. You’ll need to calculate your taxable income and apply the relevant tax rates for each. The tax rates vary based on your filing status and income bracket. The Department of Taxation and Finance offers tax calculators and guides to assist with this process.

Step 4: Include Sales and Use Taxes

Sales and use taxes are an essential part of your NYC tax bill. If you own a business, you’ll need to collect and remit these taxes to the city. For individuals, these taxes are typically included in the prices of goods and services. It’s essential to understand the applicable sales tax rates to ensure accurate reporting.

Step 5: Add Business Taxes

Businesses operating in NYC are subject to various business taxes, including corporation taxes and unincorporated business taxes. The tax rates and requirements vary depending on the type of business and its revenue. The Department of Finance provides detailed guidelines and resources for business tax calculations.

Step 6: Consider Excise Taxes

Excise taxes are applied to specific goods and services, such as tobacco, gasoline, and entertainment activities. These taxes are often included in the prices of these items, but it’s important to understand the rates and regulations to ensure compliance.

Step 7: Include Fees and Assessments

In addition to taxes, your NYC tax bill may include various fees and assessments. These can include water and sewer charges, garbage collection fees, and special assessments for specific improvements or services. It’s crucial to review your tax bill carefully to ensure all applicable fees are included.

Step 8: Pay Your Tax Bill

Once you’ve calculated your NYC tax bill, it’s time to make your payment. The Department of Finance offers various payment options, including online payments, direct debit, and payment by mail. It’s essential to pay your taxes on time to avoid penalties and interest charges.

Tax Relief and Incentives in NYC

New York City recognizes the financial burden that taxes can place on its residents and businesses, and as such, it offers a range of tax relief programs and incentives to help ease the burden. These programs are designed to support specific groups, such as low-income individuals, seniors, and certain businesses, by providing reductions or exemptions from certain taxes.

Property Tax Relief

Property taxes can be a significant expense for homeowners and businesses in NYC. To provide relief, the city offers several programs, including the Senior Citizen Rent and Property Tax Relief Program, the Veterans’ Property Tax Exemption, and the Homeowner Assistance Program. These programs offer reduced property taxes or exemptions based on income, age, and military service.

Income Tax Credits and Deductions

NYC also provides income tax credits and deductions to help offset the cost of living and doing business in the city. These include the Earned Income Tax Credit, which provides a tax credit for low- and moderate-income workers, and the Small Business Jobs Survival Act, which offers a tax credit for eligible small businesses.

Sales Tax Exemptions

Certain purchases are exempt from sales tax in NYC, providing relief for consumers and businesses. These exemptions include purchases of food for home consumption, clothing and footwear under a certain price threshold, and certain medical devices. Understanding these exemptions can help reduce your tax burden.

Business Incentives

NYC offers a range of incentives to attract and support businesses, especially those that contribute to the city’s economic growth and job creation. These incentives include tax credits for hiring veterans or residents of specific neighborhoods, tax abatements for businesses that locate in certain areas, and tax breaks for businesses that invest in renewable energy.

Tax Assistance Programs

For individuals and businesses struggling to meet their tax obligations, NYC provides tax assistance programs. These programs offer guidance, resources, and in some cases, relief from penalties and interest. The Department of Finance and the Department of Taxation and Finance offer tax clinics, workshops, and online resources to help taxpayers understand their rights and responsibilities.

The Impact of NYC Tax Bill on the City’s Economy

The NYC tax bill plays a crucial role in shaping the city’s economic landscape. The taxes collected contribute to the city’s budget, funding essential services and infrastructure projects. The tax system also encourages economic growth by providing incentives for businesses and promoting investment in certain sectors. Here’s a deeper look at the impact of the NYC tax bill on the city’s economy:

Funding Essential Services

The revenue generated from NYC taxes is vital for funding the city’s operations. It supports critical services such as education, healthcare, public safety, and transportation. Without these taxes, the city would struggle to provide the level of services its residents expect and deserve.

Economic Development and Growth

The tax system in NYC is designed to encourage economic growth and development. Tax incentives and abatements are offered to businesses that invest in the city, create jobs, and contribute to its economic vitality. These incentives attract new businesses and encourage existing businesses to expand, fostering a thriving business environment.

Equitable Distribution of Wealth

The NYC tax system aims to redistribute wealth to support the city’s most vulnerable residents. Higher-income earners and businesses contribute a larger portion of their income to taxes, which helps fund programs and services for low-income individuals, seniors, and other vulnerable groups. This equitable distribution of wealth promotes social and economic justice.

Encouraging Sustainable Practices

NYC has implemented various taxes and incentives to encourage sustainable practices and reduce environmental impact. For example, the congestion pricing plan aims to reduce traffic congestion and air pollution by charging a fee for vehicles entering certain areas of the city. Similarly, taxes on single-use plastics and incentives for renewable energy promote environmentally friendly practices.

Promoting Fairness and Compliance

The NYC tax system is designed to ensure fairness and compliance. The city has implemented measures to combat tax evasion and ensure that all taxpayers contribute their fair share. This includes rigorous enforcement of tax laws, audits, and penalties for non-compliance. By promoting fairness, the city ensures that its tax system remains effective and sustainable.

The Future of NYC Tax Bill: Trends and Predictions

As NYC continues to evolve and adapt to changing economic conditions, the tax bill is also subject to ongoing revisions and adjustments. Here are some trends and predictions for the future of the NYC tax bill:

Increasing Reliance on Property Taxes

With the city’s growing population and increasing demand for services, NYC is likely to rely more heavily on property taxes in the future. This shift could lead to higher property tax rates or the implementation of new property-related taxes to fund infrastructure projects and essential services.

Expansion of Sales and Use Taxes

To generate additional revenue, NYC may explore expanding the sales and use tax base. This could involve increasing the tax rates, applying sales tax to new categories of goods and services, or implementing online sales taxes to capture revenue from e-commerce transactions.

Focus on Equitable Taxation

As the city strives for greater social and economic equity, the tax system is likely to continue evolving to support this goal. This may involve further enhancements to tax relief programs for low-income individuals and families, as well as increased efforts to ensure that higher-income earners and businesses pay their fair share.

Digitalization of Tax Processes

The future of the NYC tax bill is likely to be characterized by increased digitalization and automation. The city may further develop its online tax filing and payment systems, making it more convenient and efficient for taxpayers to meet their obligations. This could also reduce the administrative burden on the city’s tax agencies.

Tax Incentives for Green Initiatives

In an effort to promote sustainability and combat climate change, NYC is likely to continue offering tax incentives for green initiatives. This could include tax breaks for businesses that adopt renewable energy sources, implement energy-efficient practices, or reduce their carbon footprint.

Enhanced Tax Enforcement

To ensure compliance and fair taxation, the city may invest in enhanced tax enforcement measures. This could involve increased audits, stricter penalties for tax evasion, and the use of data analytics to identify non-compliance. A more robust tax enforcement system would help maintain the integrity of the city’s tax system.

Conclusion

The NYC tax bill is a complex and multifaceted aspect of life in the city, impacting individuals, businesses, and the city’s economy as a whole. Understanding the various components of the tax bill and how it is calculated is essential for financial planning and compliance. The tax system plays a critical role in funding essential services, promoting economic growth, and redistributing wealth to support the city’s most vulnerable residents.

As NYC continues to evolve, the tax bill will also undergo changes to adapt to new economic realities and emerging trends. By staying informed about these changes and taking advantage of available tax relief programs and incentives, individuals and businesses can navigate the city's tax landscape with confidence and contribute to the vibrant economic and social fabric of the Big Apple.

How often do I need to pay my NYC tax bill?

+

Taxpayers typically receive a quarterly tax bill, and payments are due by the 20th of each quarter (January, April, July, and October). However, the specific due dates may vary depending on the type of tax and your payment method.

Are there any tax breaks or deductions for homeowners in NYC?

+

Yes, NYC offers various tax breaks and deductions for homeowners, including the School Tax Relief (STAR) exemption, the Enhanced STAR exemption for seniors, and the Veteran’s Exemption. These programs provide reductions in property taxes based on income and service eligibility.

What happens if I don’t pay my NYC tax bill on time?

+

Late payments of NYC taxes may result in penalties and interest charges. It’s important to pay your taxes on time to avoid additional fees and potential enforcement actions. The Department of Finance provides payment plans and options for taxpayers facing financial difficulties.

Can I appeal my NYC tax bill if I believe it is incorrect?

+

Yes, if you believe your NYC tax bill is incorrect, you have the right to file an appeal. The Department of Finance has a comprehensive appeals process in place, allowing taxpayers to challenge their assessments and seek adjustments. It’s important to review your bill carefully and act promptly if you wish to appeal.

How can I stay updated on changes to NYC tax laws and regulations?

+

To stay informed about changes to NYC tax laws and regulations, it’s recommended to regularly visit the official websites of the Department of Finance and the