La County Tax Rate

The County Tax Rate is a crucial aspect of understanding the financial landscape for individuals and businesses operating within Los Angeles County, often referred to as LA County. This comprehensive guide aims to delve into the intricacies of the LA County Tax Rate, providing an in-depth analysis of the various taxes applicable, their rates, and their impact on the local economy. By exploring the different tax categories, we can gain a clearer understanding of the financial obligations and opportunities within this vibrant county.

Unraveling the LA County Tax Landscape

Los Angeles County, with its diverse population and thriving industries, presents a complex tax structure. This section provides an overview of the key taxes levied by the county, setting the foundation for our exploration.

Property Taxes: A Cornerstone of County Revenue

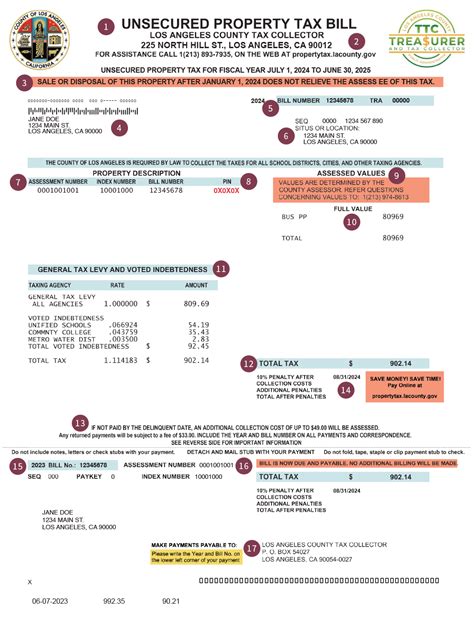

Property taxes form a significant portion of the county’s revenue stream. The LA County Assessor’s Office plays a pivotal role in assessing property values, which directly influence the tax rates applied. Here’s a breakdown of the property tax landscape:

- Assessment Base: Properties are typically assessed at their market value, which serves as the basis for tax calculations. However, Proposition 13, a landmark initiative, caps the annual increase in assessed value at 2% or the inflation rate, whichever is lower.

- Tax Rate: The current tax rate for LA County stands at 1.0132%, which includes both the county’s base rate and additional assessments for various services and special districts.

- Exemptions and Benefits: The county offers certain exemptions, such as the Homeowner’s Exemption, which reduces the assessed value of a primary residence by up to $7,000. Additionally, veterans and disabled individuals may be eligible for further tax reductions.

| Tax Category | Rate |

|---|---|

| County Base Tax Rate | 0.755% |

| Voter-Approved Bonds | 0.1576% |

| Special Assessments | 0.1006% |

Sales and Use Taxes: Impacting Consumer Behavior

Sales and use taxes are a critical component of the county’s tax revenue, particularly given the robust consumer market in LA County. These taxes are levied on the sale of goods and services and are often a point of consideration for businesses and shoppers alike.

- Sales Tax: The sales tax rate in LA County currently stands at 9.5%, which includes both state and local components. This rate can vary slightly within the county due to city-specific add-ons.

- Use Tax: Use tax is applicable when goods are purchased from out-of-state vendors and used within the county. This ensures that consumers pay the equivalent of sales tax, promoting fairness in the market.

- Tax Exemptions: Certain items, such as groceries, are exempt from sales tax, providing a financial relief to consumers. Additionally, businesses may qualify for exemptions on specific purchases, reducing their tax burden.

Income Taxes: A Snapshot of Earnings

Income taxes are an essential tool for the county to measure and tax earnings within its borders. LA County, being home to a diverse range of industries, experiences a wide variation in income levels, making income taxes a critical revenue source.

- Personal Income Tax: The county’s personal income tax rate is progressive, ranging from 1% to 12.3%, depending on income levels. This structure ensures that higher earners contribute a larger share to the county’s finances.

- Corporate Income Tax: Businesses operating within LA County are subject to a corporate income tax, with rates varying based on the type of entity and income bracket. This tax is an essential contributor to the county’s overall financial health.

- Tax Incentives: The county offers various tax incentives to attract and retain businesses. These incentives, such as tax credits and deductions, can significantly reduce a company’s tax liability, making LA County an attractive business destination.

Navigating the Complex Web of County Taxes

The tax landscape of LA County is intricate, with a myriad of taxes and rates applicable to different scenarios. This section aims to provide a practical guide to navigating these complexities, offering insights into tax planning and compliance.

Tax Planning Strategies for Individuals

For individuals residing or working in LA County, effective tax planning can lead to significant savings. Here are some strategies to consider:

- Maximize Deductions: Understand the deductions available, such as mortgage interest, medical expenses, and charitable contributions. These deductions can reduce your taxable income, lowering your overall tax liability.

- Optimize Withholdings: Review your W-4 form to ensure the correct number of allowances are claimed. This can help avoid underpayment penalties while ensuring you receive the right amount of tax refund.

- Explore Tax Credits: LA County offers various tax credits, such as the Earned Income Tax Credit and the Child and Dependent Care Credit. These credits can provide substantial relief, especially for low- and middle-income earners.

Compliance and Reporting for Businesses

Businesses operating in LA County must adhere to a range of tax obligations. Here’s a guide to ensure compliance:

- Register for Tax Accounts: Businesses must register with the California Franchise Tax Board and obtain necessary tax accounts for sales tax, income tax, and payroll taxes.

- Sales Tax Compliance: Ensure accurate reporting of sales and use taxes. Failure to comply can result in penalties and interest charges.

- Income Tax Reporting: Timely filing of income tax returns is crucial. Consider utilizing tax professionals to ensure accurate reporting and potential tax savings.

The Economic Impact and Future Outlook

The tax structure of LA County has a profound impact on its economic landscape, influencing investment, consumer spending, and overall growth. This section explores the current economic climate and provides insights into the potential future directions of the county’s tax policy.

Economic Analysis: Current Trends

The county’s tax revenue has seen a steady increase over the past decade, driven by a thriving economy and robust consumer spending. However, certain sectors, such as tourism and entertainment, have experienced fluctuations due to external factors.

- Residential Real Estate: The property tax base has expanded due to rising home values, providing a stable revenue stream for the county.

- Consumer Spending: High sales tax revenue indicates strong consumer confidence, which is vital for the county’s economic health.

- Business Climate: The county’s competitive tax rates and incentives have attracted businesses, leading to job creation and economic growth.

Future Projections and Policy Considerations

Looking ahead, the county’s tax policy may face several challenges and opportunities. Here are some key considerations:

- Technological Advancements: The rise of e-commerce and remote work may impact sales and income tax collections, requiring adaptive tax policies.

- Population Growth: As LA County continues to attract new residents, the demand for services and infrastructure will increase, potentially leading to adjustments in tax rates.

- Sustainable Development: The county may explore tax incentives to promote environmentally friendly practices, aligning with global sustainability goals.

FAQs

How often do property tax rates change in LA County?

+

Property tax rates in LA County are typically reviewed annually. However, significant changes are relatively rare due to Proposition 13, which limits annual increases.

Are there any tax incentives for renewable energy installations in LA County?

+

Yes, LA County offers tax incentives for renewable energy systems, including solar panels. These incentives can reduce the assessed value of your property, leading to lower property taxes.

How can I estimate my sales tax liability as a business owner in LA County?

+

You can use the Sales and Use Tax Rate Calculator provided by the California Department of Tax and Fee Administration. This tool considers your business location and specific products to provide an accurate estimate.

Understanding the intricacies of the LA County tax rate is essential for both residents and businesses. By staying informed about the various taxes and their rates, individuals and businesses can effectively plan their finances, optimize their tax strategies, and contribute to the vibrant economic landscape of Los Angeles County.