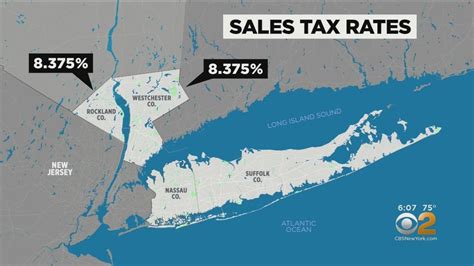

Suffolk County Sales Tax

Suffolk County, located in the U.S. state of New York, has a unique sales tax system that is worth exploring. The county's sales tax rate is determined by a combination of state and local taxes, which can vary depending on the specific municipality within Suffolk County. This article aims to provide an in-depth analysis of the Suffolk County sales tax, its rates, how it affects businesses and consumers, and its implications for the local economy.

Understanding the Suffolk County Sales Tax

Suffolk County’s sales tax structure is comprised of a state tax and a local tax, with the state tax rate currently set at 4%. However, the local tax rate can vary significantly, as each municipality within the county has the authority to set its own local sales tax rate. This local tax rate is added to the state tax, resulting in a combined sales tax rate that can differ across the county.

For instance, the city of Hauppauge, a popular business hub, imposes an additional 3% local sales tax, bringing the total sales tax rate to 7%. On the other hand, in Riverhead, a thriving agricultural and tourism center, the local sales tax is 4%, resulting in a combined rate of 8%. These variations in local tax rates can have a significant impact on businesses and consumers, influencing purchasing decisions and business strategies.

| Municipality | Local Sales Tax Rate | Combined Sales Tax Rate |

|---|---|---|

| Hauppauge | 3% | 7% |

| Riverhead | 4% | 8% |

| Brentwood | 3.75% | 7.75% |

| Islip | 4.5% | 8.5% |

Exemptions and Special Considerations

It’s important to note that certain items are exempt from sales tax in Suffolk County. These include most food items for home consumption, clothing, footwear, and prescription drugs. Additionally, Suffolk County offers tax incentives and exemptions for certain businesses, particularly those involved in economic development and job creation initiatives. These exemptions can significantly impact a business’s operational costs and profitability.

For instance, businesses that meet specific criteria for job creation and investment may qualify for a 5-year sales tax exemption on new machinery and equipment. This incentive aims to attract and support businesses that contribute to the county's economic growth and development.

Impact on Businesses and Consumers

The varying sales tax rates across Suffolk County can influence consumer behavior and business strategies. For consumers, the higher sales tax rates in certain areas may encourage them to shop in municipalities with lower rates, especially for big-ticket items. This can lead to a redistribution of consumer spending and potentially impact the local economy.

Businesses, on the other hand, may need to adjust their pricing strategies and marketing approaches to account for the varying tax rates. For example, a business operating in multiple Suffolk County municipalities may need to implement different pricing structures or offer targeted promotions to maintain competitiveness. Additionally, businesses may need to educate their customers about the sales tax rates to manage expectations and ensure a positive shopping experience.

Strategies for Businesses

To navigate the complex sales tax landscape in Suffolk County, businesses can employ several strategies. One approach is to analyze the sales tax rates of competing businesses and adjust pricing accordingly to remain competitive. Another strategy is to leverage technology, such as point-of-sale systems that automatically calculate and display the correct tax rate based on the customer’s location.

Additionally, businesses can utilize marketing campaigns that highlight their commitment to providing transparent pricing, ensuring customers are aware of the sales tax rates and feel confident in their purchasing decisions. By adopting these strategies, businesses can effectively manage the impact of varying sales tax rates and maintain a competitive edge in the Suffolk County market.

Future Implications and Economic Impact

The sales tax system in Suffolk County has significant implications for the local economy. Higher sales tax rates can potentially discourage consumer spending, especially for discretionary items, leading to a decrease in revenue for businesses and the local government. On the other hand, targeted tax incentives and exemptions can stimulate economic growth by attracting new businesses and encouraging investment.

Furthermore, the varying sales tax rates can impact the county's competitiveness in attracting new businesses and investors. While higher tax rates may deter some, the strategic use of tax incentives can make Suffolk County an attractive destination for businesses seeking a supportive economic environment. The county's economic development agencies play a crucial role in promoting these incentives and supporting businesses throughout their growth journey.

A Balancing Act

Suffolk County’s sales tax system represents a delicate balance between generating revenue for local governments and supporting economic growth. The county’s approach to sales taxation, with its combination of state and local taxes and targeted exemptions, reflects a thoughtful strategy to manage this balance.

As the county continues to evolve and adapt to economic changes, the sales tax system will likely remain a key tool in shaping the local economy. By carefully considering the impacts on businesses and consumers, Suffolk County can ensure its sales tax structure remains fair, effective, and supportive of long-term economic prosperity.

How often are sales tax rates updated in Suffolk County?

+

Sales tax rates in Suffolk County are typically updated annually to align with state and local budgetary requirements. These updates are usually announced in advance to allow businesses and consumers to prepare.

Are there any plans to standardize sales tax rates across Suffolk County?

+

There have been discussions about standardizing sales tax rates, but no concrete plans have been implemented yet. The current system, with its varying local tax rates, is seen as a way to provide flexibility and support for specific municipalities.

How can businesses stay updated on sales tax changes in Suffolk County?

+

Businesses can subscribe to alerts from the Suffolk County Department of Finance, which typically announces any changes in sales tax rates. Additionally, staying connected with local business associations and economic development agencies can provide valuable insights and updates.