Dallas County Property Tax Lookup

Welcome to this comprehensive guide on the Dallas County Property Tax Lookup system. Property taxes are an essential component of local government funding, and understanding how they work and how to navigate the tax lookup process is crucial for homeowners and property owners alike. This article aims to provide an in-depth analysis of the Dallas County Property Tax Lookup system, covering its functionality, features, and the steps involved in searching for property tax information.

Understanding the Dallas County Property Tax System

Dallas County, located in the heart of Texas, is home to a diverse range of properties, from residential homes to commercial buildings and land. The property tax system in Dallas County is a vital revenue source for the county, contributing to the funding of various public services, including schools, roads, and emergency services.

The property tax system in Dallas County operates under the guidance of the Dallas Central Appraisal District (DCAD). DCAD is responsible for appraising all taxable property within the county, ensuring fair and accurate assessments. This process involves evaluating the value of properties based on factors such as location, size, improvements, and market conditions.

Once the appraisal process is complete, the DCAD sends out notices of appraised value to property owners. These notices provide detailed information about the assessed value of the property and the basis for the appraisal. Property owners have the right to review their appraisal and, if necessary, file a protest against the assessed value.

The Role of Property Taxes in Dallas County

Property taxes in Dallas County are calculated based on the appraised value of the property and the tax rates set by various taxing entities, such as the county government, school districts, and municipalities. These tax rates are established annually and can vary depending on the specific location of the property.

The property tax revenue generated in Dallas County is distributed among these taxing entities based on predefined formulas. A significant portion of the revenue goes towards funding public education, with school districts receiving a substantial share. Other essential services, such as fire protection, emergency medical services, and infrastructure development, are also supported by property tax revenue.

For property owners, understanding the property tax system is crucial for budgeting and financial planning. Property taxes are typically paid annually or in installments, and failure to pay can result in penalties, interest, or even tax liens on the property.

Navigating the Dallas County Property Tax Lookup

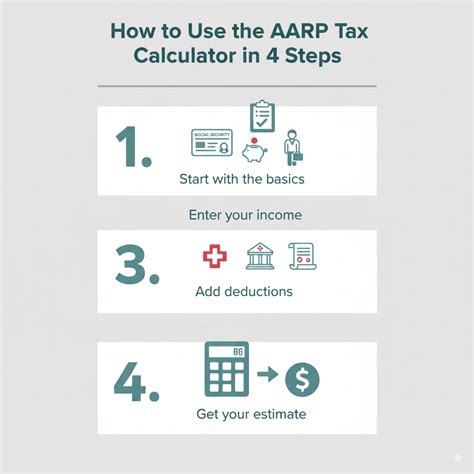

The Dallas County Property Tax Lookup system is designed to provide convenient and accessible information to property owners and interested parties. This online platform allows users to search for property tax details quickly and efficiently. Here’s a step-by-step guide to navigating the Dallas County Property Tax Lookup:

Step 1: Access the Property Tax Lookup Portal

To begin your search, visit the official Dallas County Property Tax Lookup website. The portal is user-friendly and can be accessed through a web browser on any device with an internet connection.

The homepage of the website typically features a search bar where you can enter the property address, owner's name, or parcel number. Alternatively, you can navigate through the available options and filters to refine your search.

| Search Options | Description |

|---|---|

| Address Search | Enter the property address, including the street number, street name, and city. |

| Owner Name Search | Search by the name of the property owner or partial name. |

| Parcel Number Search | Enter the unique parcel number assigned to the property. |

Step 2: Refine Your Search

Once you’ve entered your search criteria, the system will display a list of matching properties. If there are multiple results, you can refine your search further using additional filters.

Filters may include options such as property type (residential, commercial, vacant land), tax year, and appraisal district. By selecting the relevant filters, you can narrow down the results to find the specific property you're interested in.

Step 3: View Property Details

After refining your search, select the property you wish to explore. The system will provide detailed information about the property, including the following:

- Property Address: The complete address of the property, including the street, city, and zip code.

- Owner Information: Details about the current owner, including their name and contact information (if available).

- Appraised Value: The assessed value of the property for the current tax year, determined by the DCAD.

- Taxable Value: The value used for calculating property taxes, which may differ from the appraised value due to exemptions or special valuations.

- Tax Rates: The tax rates applied to the property, including rates for the county, school district, and other taxing entities.

- Tax Amount: The total amount of property taxes due for the current tax year, calculated based on the taxable value and tax rates.

- Tax Due Dates: Information on when property taxes are due and any applicable deadlines.

- Payment Options: Details on how to pay property taxes, including online payment portals, mailing addresses, and payment plans (if available).

Step 4: Explore Additional Resources

The Dallas County Property Tax Lookup portal often provides additional resources and tools to assist property owners and taxpayers. These may include:

- Tax Protest Information: Guidance and resources for property owners who wish to file a protest against their appraised value.

- Exemption Details: Information on available property tax exemptions, such as homestead exemptions, and the application process.

- Tax Rate Comparison: Tools to compare tax rates across different areas within Dallas County, helping taxpayers understand variations in tax burdens.

- Contact Information: Direct contact details for the Dallas Central Appraisal District and other relevant departments for inquiries and assistance.

Key Considerations for Property Owners

As a property owner in Dallas County, there are several key considerations to keep in mind when it comes to property taxes:

Stay Informed

Regularly review your property tax information and stay updated on any changes to tax rates, appraisal values, and due dates. This helps you budget effectively and avoid any unexpected surprises.

Understand Exemptions

Dallas County offers various property tax exemptions, such as the Homestead Exemption and Senior Citizen Exemptions. Research and understand the eligibility criteria for these exemptions, as they can significantly reduce your property tax burden.

Timely Payment

Ensure you pay your property taxes on time to avoid penalties and interest. Explore the available payment options and consider setting up automatic payments or reminders to stay on track.

Appraisal Review

If you disagree with the appraised value of your property, you have the right to file a protest. Review the appraisal carefully and consider seeking professional assistance if needed. The Dallas Central Appraisal District provides guidelines and resources for the protest process.

Seek Professional Advice

For complex property tax matters or if you require further guidance, consider consulting a tax professional or accountant. They can provide personalized advice and ensure you’re taking advantage of all available benefits and exemptions.

Future Implications and Trends

The Dallas County Property Tax system is continually evolving to meet the needs of a growing and diverse population. Here are some key trends and future implications to consider:

Technological Advancements

The Dallas County Property Tax Lookup system is expected to embrace technological advancements, improving user experience and accessibility. This may include enhanced search functionalities, mobile-friendly interfaces, and integration with other online government services.

Data Accuracy and Transparency

As property data becomes more accessible, the focus on data accuracy and transparency will intensify. Efforts will be made to ensure that property tax information is consistently updated and easily verifiable, promoting trust and confidence among taxpayers.

Community Engagement

Dallas County may explore initiatives to engage with property owners and taxpayers through community outreach programs. These efforts could include educational workshops, online forums, and collaborative platforms to address concerns and provide support.

Efficient Tax Collection

The county may implement measures to streamline the tax collection process, such as electronic filing and payment options, to reduce administrative costs and improve efficiency.

Tax Rate Stability

Maintaining stable tax rates is a priority for Dallas County. Efforts will likely be made to balance the need for revenue with the impact on taxpayers, ensuring a fair and sustainable tax structure.

Conclusion

The Dallas County Property Tax Lookup system serves as a vital resource for property owners and taxpayers, providing transparency and accessibility in the property tax process. By understanding the system, property owners can make informed decisions, manage their tax obligations, and contribute to the growth and development of their community.

As the system continues to evolve, Dallas County aims to strike a balance between efficient tax collection and taxpayer convenience, ensuring a fair and equitable approach to property taxation.

How often are property taxes assessed in Dallas County?

+

Property taxes in Dallas County are typically assessed annually. The appraisal process occurs once a year, and property owners receive notices of their appraised value for the upcoming tax year.

Can I protest my property’s appraised value?

+

Yes, property owners have the right to protest their appraised value if they believe it is inaccurate or excessive. The Dallas Central Appraisal District provides guidelines and timelines for filing protests.

What happens if I don’t pay my property taxes on time?

+

Failure to pay property taxes on time can result in penalties, interest charges, and, in extreme cases, a tax lien on your property. It’s crucial to stay informed about due dates and payment options to avoid these consequences.

Are there any property tax exemptions available in Dallas County?

+

Yes, Dallas County offers various property tax exemptions, including the Homestead Exemption, which reduces the taxable value of a property for homeowners. Other exemptions are available for seniors, veterans, and certain organizations. Check with the Dallas Central Appraisal District for eligibility criteria.

How can I stay updated on changes to property tax rates and due dates?

+

Stay informed by regularly checking the official Dallas County Property Tax Lookup website and subscribing to any available newsletters or alerts. Additionally, follow local news and attend community meetings to stay aware of any changes or updates.