Illinois Property Tax Rate

The Illinois property tax system is a complex and essential component of the state's revenue structure, playing a pivotal role in funding vital public services and infrastructure. Property taxes in Illinois are levied on real estate properties, including homes, businesses, and other tangible assets. The tax rate varies significantly across the state, influenced by a multitude of factors, including the assessed value of the property, local tax rates, and the distribution of tax revenue among various government entities.

Understanding the Illinois property tax rate is crucial for homeowners, businesses, and prospective property investors. It provides insights into the financial obligations associated with property ownership and the impact on personal or business finances. This comprehensive guide aims to delve into the intricacies of the Illinois property tax rate, offering a detailed analysis of the system, its variations, and its implications.

The Structure of Illinois Property Taxes

The property tax system in Illinois is a local tax, meaning it is administered and collected by local government units, primarily counties and municipalities. These local governments use property taxes as a primary source of revenue to fund essential services such as education, public safety, transportation, and infrastructure development. The state of Illinois itself does not impose a property tax but relies on the revenue generated by local property taxes to support various state-level initiatives and programs.

The structure of Illinois property taxes is characterized by a combination of assessment methods, tax rates, and distribution mechanisms. The property tax calculation involves three main components: the property's assessed value, the equalization factor (a state-determined multiplier), and the local tax rate. Each of these components contributes to the final property tax bill that property owners are required to pay.

Property Assessment

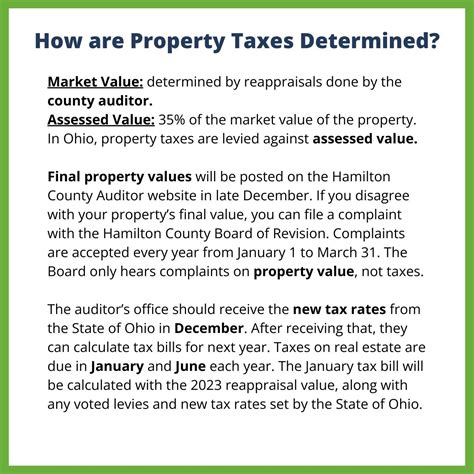

Property assessment is the process of determining the value of a property for tax purposes. In Illinois, property assessment is conducted by county assessors, who are responsible for evaluating the market value of properties within their jurisdiction. The assessed value is typically based on the property’s fair market value, which is the price it would likely sell for in an open and competitive market.

County assessors assess properties at least once every four years, but they can perform reassessments more frequently if property values fluctuate significantly. This assessment cycle ensures that property values remain current and that the tax burden is distributed fairly among property owners.

| Assessment Cycle | County |

|---|---|

| Quadrennial (every 4 years) | Cook County |

| Triennial (every 3 years) | Most other Illinois counties |

Equalization Factor

To ensure that property taxes are assessed fairly across the state, the Illinois Department of Revenue calculates an equalization factor for each county. This factor is applied to the assessed value of properties to adjust for any disparities in assessment practices between counties. The equalization factor aims to ensure that properties with similar values are taxed at the same rate, regardless of their location within the state.

The equalization factor is based on a variety of factors, including sales ratios, assessment levels, and other market data. It is typically expressed as a percentage and is applied uniformly to all properties within a county.

Local Tax Rates

Local tax rates are set by the various taxing districts within a county, such as school districts, fire protection districts, park districts, and municipalities. These taxing districts have the authority to determine their own tax rates based on their revenue needs and the assessed value of properties within their jurisdiction. As a result, property tax rates can vary significantly from one taxing district to another, even within the same county.

Taxing districts use property taxes to fund a wide range of services and initiatives, including public education, emergency services, road maintenance, and cultural programs. The local tax rate is expressed as a percentage of the equalized assessed value of a property and is often referred to as the "tax rate levy."

Calculating Illinois Property Taxes

The calculation of Illinois property taxes involves a straightforward process that combines the assessed value, equalization factor, and local tax rate. Here’s a step-by-step breakdown of how it works:

- Assessed Value Determination: The county assessor determines the fair market value of the property and assesses it accordingly. This value is subject to change based on market conditions and reassessment cycles.

- Equalization Factor Application: The Illinois Department of Revenue's equalization factor is applied to the assessed value to adjust for any assessment disparities between counties. This step ensures a uniform tax base across the state.

- Local Tax Rate Application: The taxing districts within the county set their own tax rates based on their budgetary needs. These rates are then applied to the equalized assessed value of the property to determine the property tax liability.

- Property Tax Calculation: The property tax is calculated by multiplying the equalized assessed value by the cumulative tax rate levy of all taxing districts in which the property is located. This results in the total property tax bill that the property owner is required to pay.

It's important to note that the cumulative tax rate levy can vary significantly between properties, even within the same county, due to the varying tax rates set by different taxing districts. This can lead to substantial differences in property tax bills for properties with similar assessed values.

Example Calculation

Let’s consider an example to illustrate the property tax calculation process in Illinois. Suppose we have a residential property in Cook County with an assessed value of $200,000. The equalization factor for Cook County is 90%, and the cumulative tax rate levy of the taxing districts in which the property is located is 6.5%.

- Assessed Value: $200,000

- Equalization Factor: 90%

- Cumulative Tax Rate Levy: 6.5%

The property tax calculation would proceed as follows:

- Equalized Assessed Value: $200,000 x 90% = $180,000

- Property Tax: $180,000 x 6.5% = $11,700

In this example, the property owner would be required to pay an annual property tax of $11,700.

Variations in Illinois Property Tax Rates

One of the notable characteristics of the Illinois property tax system is the significant variation in tax rates across the state. This variation is primarily driven by the diverse needs and revenue requirements of local taxing districts. While some districts may have lower tax rates due to efficient budgeting and management, others may have higher rates to support more extensive public services or address specific infrastructure needs.

Factors Influencing Property Tax Rates

Several factors contribute to the variations in property tax rates within Illinois. These factors include:

- Taxing District Needs: The primary factor influencing property tax rates is the budgetary requirements of local taxing districts. Districts with higher expenses, such as those with extensive school systems or advanced infrastructure projects, may need to set higher tax rates to meet their financial obligations.

- Property Value Distribution: The distribution of property values within a taxing district can also impact tax rates. If a district has a higher concentration of valuable properties, it may be able to generate sufficient revenue with lower tax rates. Conversely, districts with lower-valued properties may need to set higher rates to achieve the same level of revenue.

- Service Levels: The level of public services provided by a taxing district can significantly affect its tax rate. Districts offering more comprehensive services, such as extensive public transportation networks or advanced public safety measures, may require higher tax rates to fund these initiatives.

- Local Governance: The governance structure and decision-making processes within a taxing district can influence tax rates. Districts with more efficient governance and management practices may be able to control costs and set lower tax rates, while those with less efficient practices may need to increase rates to cover their expenses.

- Economic Conditions: The economic climate of a region can impact property tax rates. In areas with strong economic growth and rising property values, taxing districts may be able to generate sufficient revenue with lower tax rates. Conversely, districts in economically depressed areas may need to set higher rates to maintain their revenue levels.

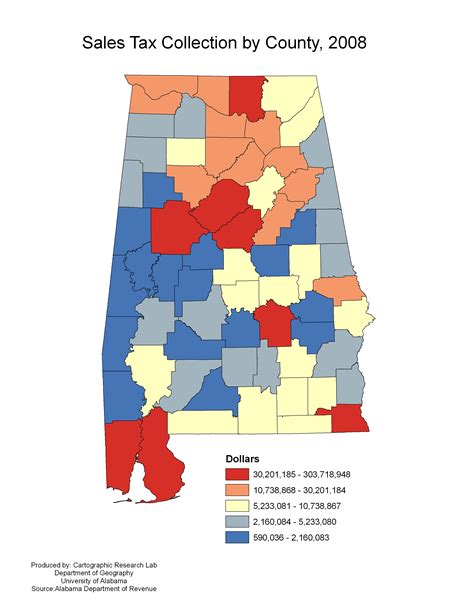

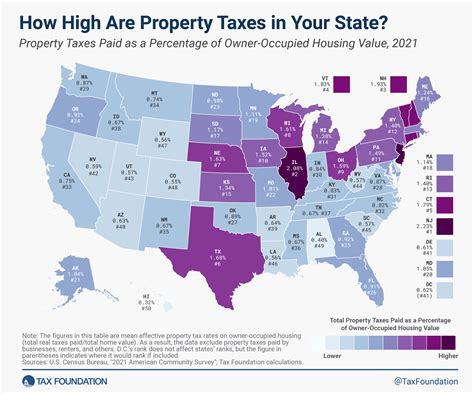

Tax Rate Variations Across Illinois

The variations in property tax rates across Illinois are evident when comparing different counties and taxing districts. Here are a few examples to illustrate the range of tax rates:

- Cook County: Cook County, which includes the city of Chicago, has one of the highest property tax rates in the state. The cumulative tax rate levy for Cook County ranges from approximately 4% to 6%, depending on the specific taxing districts within the county.

- DuPage County: DuPage County, a suburban county bordering Cook County, has a slightly lower tax rate. The cumulative tax rate levy in DuPage County typically falls between 3% and 5%.

- Rock Island County: Rock Island County, located in western Illinois, has a more moderate tax rate. The cumulative tax rate levy in Rock Island County is approximately 2.5% to 4%.

- McHenry County: McHenry County, a suburban county north of Chicago, has a tax rate that is relatively lower compared to other counties in the region. The cumulative tax rate levy in McHenry County is around 2% to 3.5%.

These examples highlight the wide range of property tax rates across Illinois, with rates varying based on the specific needs and circumstances of each taxing district.

Impact of Property Tax Rates on Property Owners

The variations in Illinois property tax rates have a direct impact on the financial obligations of property owners. Higher tax rates can result in substantial increases in property tax bills, particularly for properties with high assessed values. Conversely, lower tax rates can provide relief to property owners, making homeownership and business operations more affordable.

Financial Considerations

When purchasing a property in Illinois, it is crucial to consider the potential impact of property taxes on the overall cost of ownership. Property taxes are a recurring expense that must be factored into the financial planning of homeowners and businesses. Here are some key financial considerations related to property tax rates:

- Annual Tax Burden: Property owners should be aware of the annual tax burden associated with their property. Higher tax rates can significantly increase the annual property tax bill, impacting the overall cost of ownership. It is essential to research and understand the tax rates in the area where the property is located.

- Tax Increases: Property tax rates can fluctuate over time, and taxing districts may increase rates to meet changing budgetary needs. Property owners should stay informed about potential tax rate changes and their impact on their financial obligations.

- Property Value Appreciation: As property values increase, the assessed value for tax purposes may also rise. This can lead to higher property tax bills, even if the tax rate remains constant. Property owners should be prepared for potential increases in their tax liability as their property values appreciate.

- Tax Relief Programs: Illinois offers various tax relief programs and exemptions to eligible property owners. These programs can provide significant savings on property tax bills, particularly for low-income homeowners, senior citizens, and individuals with disabilities. Understanding the availability and requirements of these programs can help property owners reduce their tax burden.

Property Tax Appeals

Property owners who believe their property has been over-assessed or feel that the tax rate is unfair have the right to appeal their property tax assessment. The process for appealing property taxes varies by county, but generally involves submitting an appeal to the county board of review or a similar administrative body. Here’s an overview of the property tax appeal process in Illinois:

- Obtain Assessment Information: Property owners should obtain a copy of their property assessment from the county assessor's office. This document will provide details about the assessed value, any exemptions applied, and the basis for the assessment.

- Review Assessment Accuracy: Carefully review the assessment information to ensure that it accurately reflects the current condition and value of the property. Look for any errors in the description, such as incorrect square footage, outdated improvements, or misclassified property features.

- Gather Supporting Evidence: Collect evidence to support your case for a lower assessment. This may include recent sales of similar properties in the area, appraisals, or other relevant documentation that demonstrates the property's true market value.

- File an Appeal: Submit a formal appeal to the appropriate authority, typically the county board of review. The appeal should clearly state the reasons why you believe the assessment is incorrect and provide supporting evidence to substantiate your claim.

- Hearing and Decision: The county board of review will review your appeal and may schedule a hearing where you can present your case. If your appeal is successful, the assessed value of your property may be adjusted, resulting in a lower property tax bill.

It's important to note that the property tax appeal process can be complex and time-consuming. Property owners may benefit from seeking professional assistance or consulting with tax experts to ensure a successful appeal.

Future Outlook and Implications

The Illinois property tax system is likely to continue evolving in response to changing economic conditions, demographic shifts, and public policy priorities. As the state and local governments navigate budgetary challenges and strive to provide essential services, property taxes will remain a critical revenue source. Here are some key implications and potential future developments related to the Illinois property tax rate:

Economic Impact

The property tax system in Illinois has a significant impact on the state’s economy. Property taxes contribute to the funding of public services, infrastructure development, and local government operations. They play a crucial role in supporting economic growth, job creation, and the overall prosperity of the state.

As the economy fluctuates, property values may rise or fall, impacting the assessed value of properties for tax purposes. This, in turn, can affect the revenue generated by property taxes and the financial stability of local governments. Effective management of property tax rates and assessment practices is essential to ensure a balanced approach that supports economic growth while meeting the financial needs of local communities.

Policy Considerations

The Illinois property tax system is subject to ongoing policy discussions and reforms. State and local governments continually evaluate the fairness and efficiency of the system, seeking ways to improve revenue generation, reduce administrative burdens, and address equity concerns. Here are some key policy considerations related to the Illinois property tax rate:

- Assessment Reform: There is an ongoing debate about the frequency and accuracy of property assessments. Some advocate for more frequent assessments to better reflect changing property values, while others argue for reforms to ensure assessments are fair and consistent across the state.

- Equalization Factor Review: The equalization factor, applied to adjust for assessment disparities between counties, is a critical component of the property tax system. Regular reviews and adjustments to the equalization factor are necessary to ensure it accurately reflects the market conditions and assessment practices in each county.

- Tax Rate Limits: Some proposals suggest implementing tax rate limits to prevent excessive taxation and provide relief to property owners. While tax rate limits can offer protection against sudden increases, they may also limit the ability of local governments to raise revenue, potentially impacting the quality and availability of public services.

- Tax Relief and Exemptions: Illinois offers various tax relief programs and exemptions, but there is an ongoing discussion about expanding these initiatives to provide greater support to low-income homeowners, senior citizens, and other vulnerable groups. Expanding tax relief measures can help alleviate the financial burden on certain segments of the population, promoting social equity and stability.

Technology and Data Analytics

Advancements in technology and data analytics offer opportunities to enhance the efficiency and accuracy of the Illinois property tax system. Here are some potential developments in this area:

- Automated Assessment Systems: Implementing automated assessment systems can streamline the property assessment process, reducing administrative burdens and potential errors. These systems can leverage advanced data analytics and machine learning to improve the accuracy and consistency of assessments.

- Data-Driven Decision Making: Utilizing data analytics can enable more informed decision-making by local taxing districts. By analyzing property value trends, market data, and economic indicators, districts can set tax rates that are better aligned with their revenue needs and the financial capacity of property owners.

- Online Tax Assessment and Appeal Platforms: Developing user-friendly online platforms for property tax assessment and appeal processes can improve transparency, efficiency, and accessibility. These platforms can provide property owners with easy access to assessment information, enable online appeals, and facilitate timely communication with taxing authorities.

Conclusion

The Illinois property tax rate is a dynamic and essential component of the state’s revenue structure, playing a critical role in funding public services and infrastructure. Understanding the property tax system, its variations, and its implications is crucial for property owners, businesses, and prospective investors. By comprehending the factors influencing tax rates and staying informed about policy developments, property owners can make informed decisions and effectively manage their financial obligations.

As the Illinois property tax system