Az State Sales Tax

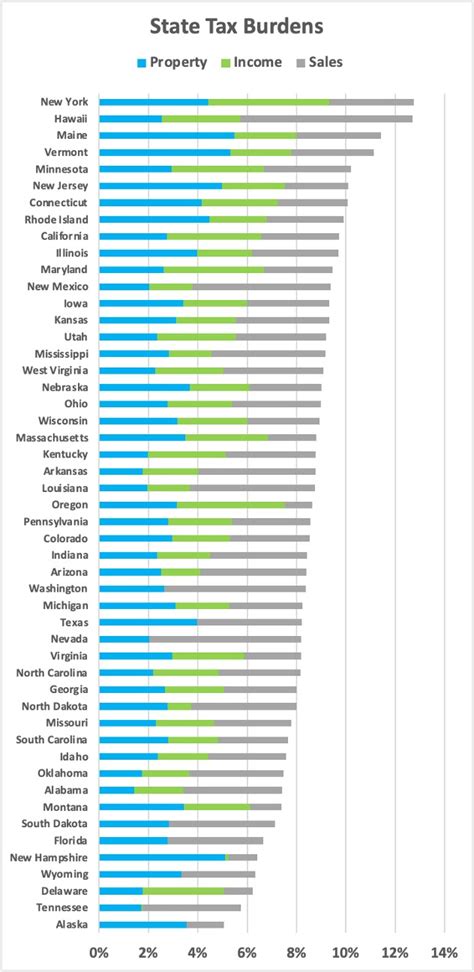

In the United States, sales tax is a vital component of state revenue systems, with each state having the authority to establish its own sales tax laws and rates. Arizona, often referred to as the Grand Canyon State, has a unique sales tax structure that impacts businesses and consumers alike. This article delves into the intricacies of Arizona's state sales tax, providing an in-depth analysis of its rates, exemptions, collection, and distribution processes.

Understanding Arizona’s State Sales Tax

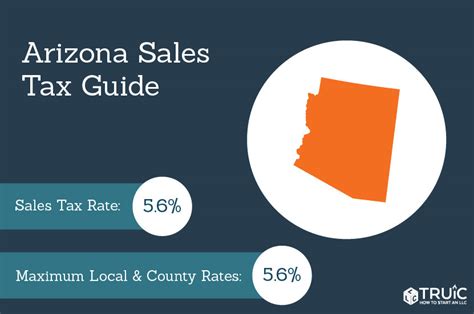

Arizona imposes a state sales tax on the sale of tangible personal property, certain digitally provided products, and some services. The primary purpose of this tax is to generate revenue for state and local governments, which is then allocated for essential public services and infrastructure development. As of [current year], Arizona’s state sales tax rate stands at 5.6%, making it a significant contributor to the state’s overall fiscal health.

However, it's important to note that sales tax in Arizona is not a uniform rate across the state. In addition to the state sales tax, counties, cities, and special districts may impose additional transaction privilege taxes (TPTs), leading to varying total sales tax rates depending on the location of the sale. These local taxes can range from 0% to 5.7%, resulting in a combined sales tax rate that can reach up to 11.3% in certain areas.

The sales tax in Arizona is administered by the Arizona Department of Revenue (ADOR), which is responsible for the collection and distribution of sales tax revenue. The ADOR ensures compliance with sales tax laws and provides resources and guidance to businesses and taxpayers to facilitate accurate reporting and payment of taxes.

Sales Tax Exemptions and Special Considerations

While Arizona’s state sales tax applies to a broad range of goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of. Some notable exemptions include:

- Food items for home consumption.

- Prescription and non-prescription medications.

- Residential rent and lease payments.

- Sales to certain tax-exempt organizations, such as schools and churches.

- Sales of manufacturing machinery and equipment.

- Aircraft sales and leases.

- Certain agricultural sales and purchases.

Additionally, Arizona offers a sales tax holiday during specific periods, typically around back-to-school season. During these designated days, certain categories of items, such as clothing, shoes, and school supplies, are exempt from sales tax, providing a financial relief to families and encouraging consumer spending.

Sales Tax Collection and Remittance

For businesses operating in Arizona, sales tax collection and remittance is a critical aspect of their financial obligations. Here’s an overview of the process:

Registering for a Sales Tax Permit

Any business making taxable sales in Arizona must obtain a Transaction Privilege Tax (TPT) License from the ADOR. This license is unique to each business location and is required for collecting and remitting sales tax. The application process involves providing detailed information about the business, its ownership, and the nature of its activities.

Calculating Sales Tax

Businesses are responsible for calculating the applicable sales tax rate for each transaction based on the location of the sale. This involves considering both the state sales tax rate and any additional local TPT rates. Accurate calculation ensures compliance with tax laws and prevents potential penalties for underpayment.

Collecting Sales Tax

Sales tax is typically collected at the point of sale, with businesses adding the tax to the retail price of taxable goods or services. It’s important for businesses to clearly communicate the tax amount to customers to maintain transparency and avoid confusion.

Remitting Sales Tax

The frequency of sales tax remittance to the ADOR depends on the business’s tax liability. Businesses with higher tax liabilities may be required to remit taxes monthly, while those with lower liabilities may remit taxes quarterly or semi-annually. The ADOR provides online tools and resources to facilitate accurate and timely tax payments.

Filing Sales Tax Returns

In addition to remitting sales tax, businesses must also file sales tax returns with the ADOR. These returns provide a detailed account of the sales tax collected and are due on the same schedule as tax payments. Accurate and timely filing of sales tax returns is crucial to avoid penalties and maintain a positive relationship with the ADOR.

Distribution of Sales Tax Revenue

The revenue generated from Arizona’s state sales tax is distributed to various state and local entities, supporting a range of public services and infrastructure projects. Here’s an overview of how sales tax revenue is allocated:

| Recipient | Percentage of Revenue |

|---|---|

| State General Fund | 50% |

| County Governments | 21.67% |

| Cities and Towns | 18.33% |

| School Districts | 10% |

The State General Fund, which receives the largest share of sales tax revenue, supports a wide range of state-level services, including education, healthcare, public safety, and transportation infrastructure. County governments, cities, and towns use their allocated funds for local services, such as law enforcement, fire protection, and road maintenance.

School districts, which are allocated 10% of sales tax revenue, use these funds to support public education, including teacher salaries, school supplies, and facility maintenance.

Frequently Asked Questions

What is the current state sales tax rate in Arizona?

+As of [current year], the state sales tax rate in Arizona is 5.6%. However, this rate may vary depending on local taxes, resulting in a combined sales tax rate of up to 11.3% in certain areas.

Are there any sales tax exemptions in Arizona?

+Yes, Arizona offers sales tax exemptions for certain items and transactions. This includes food for home consumption, prescription medications, residential rent, sales to tax-exempt organizations, and more. It’s important to consult the Arizona Department of Revenue for a comprehensive list of exemptions.

How often do businesses need to remit sales tax in Arizona?

+The frequency of sales tax remittance depends on a business’s tax liability. Businesses with higher tax liabilities may be required to remit taxes monthly, while those with lower liabilities may remit taxes quarterly or semi-annually. The Arizona Department of Revenue provides guidelines and resources for businesses to determine their remittance schedule.

How is sales tax revenue distributed in Arizona?

+Sales tax revenue in Arizona is distributed to various state and local entities. The State General Fund receives 50% of the revenue, while county governments, cities, towns, and school districts receive 21.67%, 18.33%, and 10% respectively. This distribution supports a range of public services and infrastructure projects.

What happens if a business fails to collect or remit sales tax in Arizona?

+Failure to collect or remit sales tax in Arizona can result in penalties and interest charges. The Arizona Department of Revenue may impose penalties for non-compliance, which can vary based on the severity and duration of the violation. It’s crucial for businesses to understand their sales tax obligations and seek guidance if needed.