Tax Refund Calendar 2025

Welcome to the comprehensive guide on the 2025 Tax Refund Calendar, a crucial tool for taxpayers to navigate the upcoming tax season efficiently. This article aims to provide an in-depth analysis of the key dates, deadlines, and strategies to ensure a smooth tax refund process. By understanding the timeline and leveraging the right resources, taxpayers can optimize their financial planning and make the most of their tax refunds.

Understanding the 2025 Tax Season

The 2025 tax season is an important event on the financial calendar, offering taxpayers an opportunity to review their financial status and claim any eligible deductions or credits. The Internal Revenue Service (IRS) sets specific deadlines for various tax-related activities, and being aware of these dates is crucial for timely and accurate tax filing.

The tax season typically begins with the opening of the tax filing period, allowing taxpayers to start submitting their returns. This period, which varies annually, is a crucial window for taxpayers to gather their financial documents, calculate their taxable income, and determine their refund or payment obligations.

For the 2025 tax year, the IRS has set a series of key dates and deadlines that taxpayers must adhere to. These dates not only impact the tax filing process but also influence financial planning, investment strategies, and budgeting decisions.

Key Dates and Deadlines for 2025 Tax Refunds

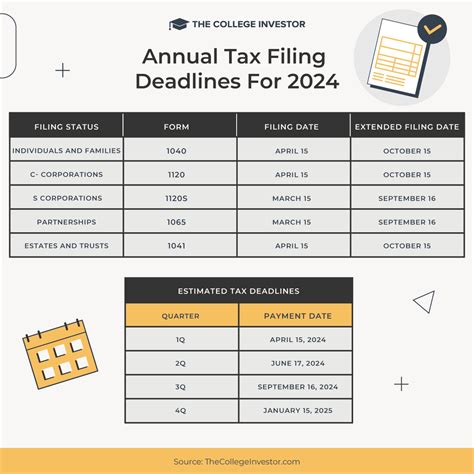

Understanding the critical dates for the 2025 tax season is essential for effective tax planning. Here’s a breakdown of the key milestones:

- Opening of Tax Filing Season (Late January): The IRS officially opens the tax filing season, allowing taxpayers to start submitting their returns. This date often falls in the last week of January or the first week of February.

- Extended Tax Filing Deadline (April 15th): Taxpayers have until April 15th to file their tax returns for the previous year. This deadline is a crucial one, as missing it may result in penalties and interest charges.

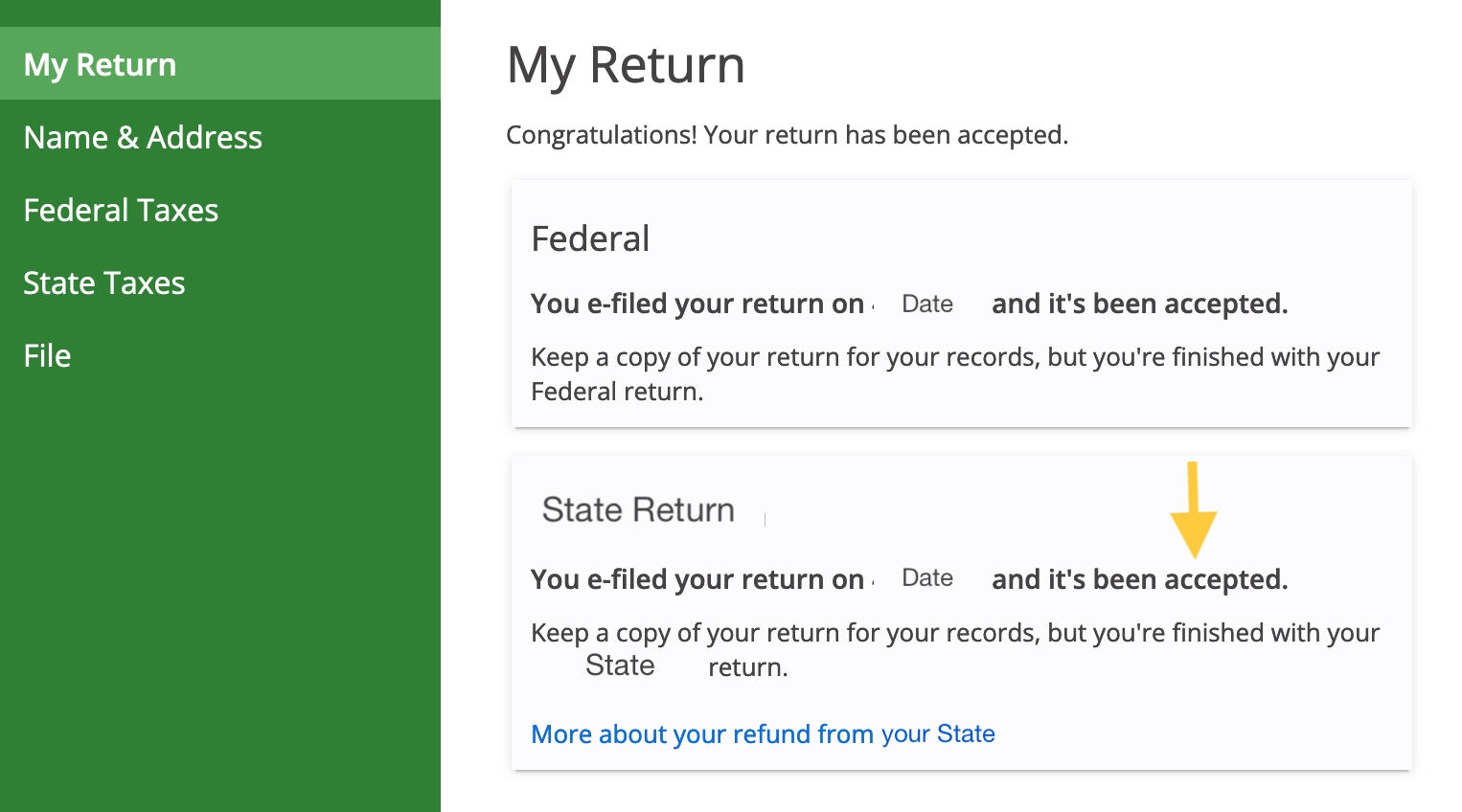

- Refund Processing Timeline: The IRS aims to process tax refunds within 21 days of receiving a complete and accurate return. However, factors like e-filing, direct deposit, and tax law changes can impact this timeline.

- Early Refund Receipt (Within 3 Weeks): Taxpayers who file early and choose direct deposit can expect to receive their refunds within 3 weeks of the IRS accepting their return. This quick turnaround is an advantage of electronic filing.

- Amended Return Deadline (October 15th): If a taxpayer needs to make corrections to their tax return, they have until October 15th to file an amended return for the previous tax year. This date ensures taxpayers have sufficient time to address any issues.

By familiarizing themselves with these dates, taxpayers can plan their financial activities, investment strategies, and budgeting accordingly. It's important to note that while these dates provide a general guideline, individual circumstances may warrant further research and professional advice.

| Date | Event |

|---|---|

| Late January | Opening of Tax Filing Season |

| April 15th | Extended Tax Filing Deadline |

| 21 Days after Filing | Tax Refund Processing Timeline |

| 3 Weeks after E-filing | Early Refund Receipt (with Direct Deposit) |

| October 15th | Amended Return Deadline |

Maximizing Your Tax Refund: Strategies and Tips

Maximizing your tax refund is an art, and with the right strategies, taxpayers can optimize their financial gains. Here are some expert tips to consider:

- File Early: Submitting your tax return early in the tax season can be advantageous. Not only does it reduce the risk of errors, but it also ensures a faster refund process. The IRS processes returns on a first-come, first-served basis, so early filers often receive their refunds sooner.

- Claim All Eligible Deductions and Credits: Review your financial records thoroughly to identify all eligible deductions and credits. From standard deductions to tax credits for education, childcare, or energy-efficient home improvements, claiming these can significantly reduce your taxable income and increase your refund.

- Utilize Tax Software or Professional Services: Investing in tax software or seeking professional tax preparation services can be beneficial. These tools and experts can help identify deductions and credits you may have overlooked, ensuring a more accurate and potentially larger refund.

- Direct Deposit for Faster Refunds: Choosing direct deposit as your refund method can expedite the refund process. It eliminates the wait time for a paper check and ensures a quicker receipt of your refund.

- Stay Informed about Tax Law Changes: Tax laws evolve annually, and keeping up-to-date with these changes is crucial. Understanding new tax credits, deductions, or incentives can help you optimize your tax strategy and increase your refund potential.

By implementing these strategies and staying informed about tax regulations, taxpayers can maximize their tax refunds and make the most of their financial situation. It's a matter of being proactive, thorough, and well-informed about the tax landscape.

Navigating the 2025 Tax Season: A Comprehensive Guide

As the 2025 tax season approaches, it’s crucial to have a comprehensive understanding of the tax landscape. This section aims to provide an in-depth guide, covering essential aspects such as tax preparation, common pitfalls to avoid, and strategies to ensure a smooth and successful tax filing experience.

Tax Preparation: A Step-by-Step Guide

Effective tax preparation is the cornerstone of a successful tax filing journey. Here’s a step-by-step guide to help you navigate the process:

- Gather Your Documents: Start by collecting all necessary documents, including W-2 forms, 1099 forms, receipts for deductions, and any other relevant financial records. Ensure you have a complete and organized set of information to streamline the preparation process.

- Choose Your Filing Method: Decide whether you'll file your taxes electronically (e-file) or opt for a traditional paper return. E-filing is generally faster and more secure, offering quicker refunds and reduced errors. However, for complex tax situations, seeking professional assistance may be advisable.

- Review Your Taxable Income: Calculate your taxable income, taking into account various deductions and credits. This step is crucial to ensure you're not overpaying or underpaying your taxes. Utilize tax software or professional services to ensure accuracy.

- Claim Eligible Deductions and Credits: Identify and claim all applicable deductions and credits. From standard deductions to itemized deductions, tax credits for education, childcare, or energy-efficient improvements, these can significantly reduce your taxable income and increase your refund.

- Review and Double-Check Your Return: Before submitting your tax return, thoroughly review it for accuracy. Check all calculations, ensure all forms and schedules are complete, and verify your personal information. A thorough review can help identify and rectify errors before submission.

- Submit Your Return: Once you're confident your return is accurate and complete, submit it to the IRS. If you're e-filing, ensure you have a reliable internet connection and follow the instructions carefully. For paper returns, ensure they're mailed promptly and consider using certified mail for tracking purposes.

By following this step-by-step guide, taxpayers can ensure a well-organized and accurate tax preparation process. It's a systematic approach that can help minimize errors, reduce stress, and increase the chances of a successful and timely tax filing.

Common Pitfalls to Avoid

Navigating the tax landscape is not without its challenges. Here are some common pitfalls to steer clear of during the 2025 tax season:

- Missing Key Deductions or Credits: One of the most common mistakes is overlooking eligible deductions or credits. From standard deductions to itemized deductions, education credits, or energy-efficient home improvements, failing to claim these can result in overpaying your taxes. Ensure you thoroughly review your financial records and consult tax experts or software to identify all applicable deductions and credits.

- Filing Inaccurate or Incomplete Returns: Another pitfall is submitting returns with errors or missing information. This can lead to delays in processing, additional inquiries from the IRS, or even penalties. Take the time to review your return thoroughly, ensuring all calculations are accurate and all necessary forms and schedules are included. Consider using tax software or professional services to minimize errors.

- Choosing the Wrong Filing Status: Selecting the incorrect filing status can impact your taxable income and potentially lead to overpaying your taxes. Understand the different filing statuses (single, married filing jointly, married filing separately, head of household, etc.) and choose the one that best aligns with your personal situation. Consult tax experts or guides to ensure you're selecting the most advantageous status.

- Not Keeping Up with Tax Law Changes: Tax laws evolve annually, and failing to stay informed can lead to missed opportunities or errors. Keep abreast of any new tax credits, deductions, or incentives introduced by the IRS. Understanding these changes can help you optimize your tax strategy and ensure compliance with the latest regulations.

Avoiding these common pitfalls is essential to a successful tax filing journey. It requires diligence, attention to detail, and a commitment to staying informed about the ever-changing tax landscape.

The Future of Tax Refunds: A Look Ahead

As we look to the future of tax refunds, several trends and advancements are shaping the landscape. Here’s a glimpse into what taxpayers can expect in the coming years:

- Enhanced Tax Software and Technology: The tax preparation industry is witnessing rapid technological advancements. Tax software is becoming increasingly sophisticated, offering improved accuracy, ease of use, and integration with financial platforms. Expect to see more advanced features, artificial intelligence-driven tools, and streamlined processes, making tax filing more efficient and user-friendly.

- Increased Focus on Data Security: With the rise of cyber threats, data security is a top priority for tax professionals and taxpayers alike. Expect to see heightened security measures, encryption technologies, and multi-factor authentication to protect sensitive financial information. Tax professionals and software providers will continue to invest in robust security protocols to safeguard taxpayer data.

- Expanding Use of Digital Payments: The shift towards digital payments is gaining momentum, and this trend is expected to continue. Taxpayers can anticipate increased options for electronic refunds, including direct deposit, prepaid cards, and mobile wallets. This transition not only expedites refund processes but also reduces the risk of fraud and errors associated with paper checks.

- Integration of Blockchain Technology: Blockchain, the technology behind cryptocurrencies, is poised to revolutionize tax processes. Its potential to enhance security, streamline transactions, and improve data accuracy is being explored by tax authorities and financial institutions. Expect to see pilot programs and experiments incorporating blockchain technology into tax refund processes, offering increased transparency and efficiency.

- Continued Evolution of Tax Laws: Tax laws are in a constant state of evolution, and taxpayers can expect ongoing changes and updates. From new tax credits and deductions to shifts in tax rates and regulations, staying informed is crucial. Taxpayers should anticipate annual updates and research relevant changes to ensure compliance and maximize their tax benefits.

The future of tax refunds is exciting, with advancements in technology, security, and efficiency promising a smoother and more secure tax filing experience. Taxpayers can look forward to these innovations, which aim to simplify processes, enhance security, and optimize financial outcomes.

When is the earliest I can file my 2025 tax return and expect a refund?

+The IRS typically opens the tax filing season in late January or early February. To receive your refund as early as possible, consider filing your return as soon as the IRS opens the filing season. However, ensure you have all necessary documents and your return is accurate to avoid delays.

What is the average wait time for receiving a tax refund in 2025?

+The IRS aims to process tax refunds within 21 days of receiving a complete and accurate return. However, various factors, including the filing method, payment method, and tax law changes, can impact this timeline. On average, taxpayers can expect to receive their refunds within 3 weeks of filing.

Can I check the status of my 2025 tax refund online?

+Absolutely! The IRS provides an online tool called “Where’s My Refund” that allows taxpayers to track the status of their refund. You’ll need your Social Security Number, filing status, and the exact amount of your expected refund to access this tool.

Are there any special considerations for taxpayers with complex financial situations or multiple streams of income?

+Yes, taxpayers with complex financial situations, multiple streams of income, or significant deductions should consider seeking professional tax advice. A tax professional can help navigate the complexities, ensure compliance, and maximize tax benefits. They can also assist with strategies to optimize your tax refund.