Indiana Tax Refund

Are you an Indiana resident awaiting your tax refund? The Indiana Department of Revenue manages the tax refund process, and understanding how it works can help you navigate the system efficiently. This guide will provide an in-depth look at the Indiana tax refund process, offering valuable insights and tips to ensure a smooth and timely refund.

Understanding the Indiana Tax Refund Process

The Indiana tax refund process begins with the timely filing of your state income tax return. The Indiana Department of Revenue processes these returns and calculates the amount you are owed or the amount you owe. This process is crucial as it determines whether you will receive a refund or need to make a payment.

The Department of Revenue has implemented an efficient system to process tax returns and issue refunds. They utilize advanced technology and a well-organized structure to ensure a swift and accurate process. Here's an overview of the key steps involved:

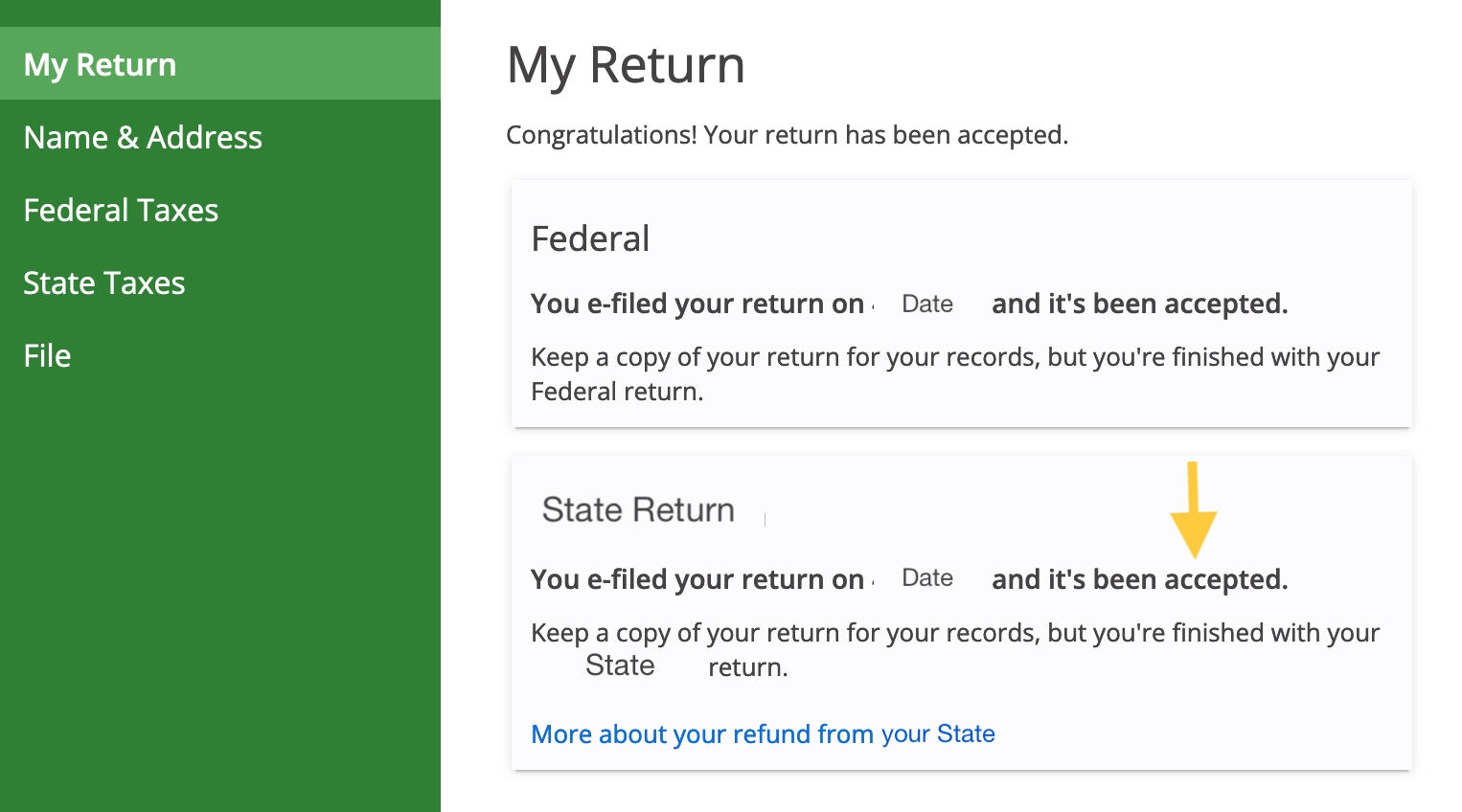

- Filing Your Return: You can file your tax return online or by mail. Online filing is the most convenient and fastest method, as it allows the Department to process your return more efficiently. When filing online, you can expect a faster refund compared to traditional mail methods.

- Processing Your Return: Once your return is received, the Department of Revenue reviews it for accuracy and completeness. This step ensures that all necessary information is provided and that the calculations are correct. If any discrepancies are found, you may be contacted for additional information.

- Refund Processing: If you are due a refund, the Department of Revenue will initiate the refund process. They utilize electronic funds transfer (EFT) to deposit refunds directly into your bank account. This method is not only faster but also more secure than traditional paper checks.

- Refund Status Tracking: The Department of Revenue offers an online tool to track the status of your refund. You can access this tool using your e-file number or your Social Security number. This allows you to stay informed about the progress of your refund and receive real-time updates.

Key Factors Affecting Refund Timelines

Several factors can influence the timeline of your Indiana tax refund. While the Department of Revenue strives to process refunds promptly, certain situations may cause delays. Understanding these factors can help manage your expectations and ensure a smooth process.

- Filing Method: As mentioned earlier, online filing is the fastest way to receive your refund. If you choose to file by mail, the processing time may be longer due to the manual handling of paper returns.

- Accuracy and Completeness: The Department of Revenue carefully reviews each tax return to ensure accuracy. If your return contains errors or missing information, it may be delayed for further review. Providing accurate and complete information can help expedite the process.

- Identity Verification: In some cases, the Department of Revenue may require additional identity verification to protect against fraud. This step is necessary to ensure that refunds are issued to the rightful taxpayers. While it may cause a slight delay, it is an essential security measure.

- Refund Amount: The size of your refund can also impact the processing time. Larger refunds may require additional review to ensure accuracy. While this may cause a slight delay, it helps maintain the integrity of the refund process.

Maximizing Your Indiana Tax Refund

Maximizing your Indiana tax refund involves more than just accurate filing. It requires a strategic approach to ensure you receive all the deductions and credits you are entitled to. Here are some tips to help you make the most of your tax refund:

- Claim All Eligible Deductions: Indiana offers various deductions that can reduce your taxable income. These include deductions for charitable contributions, medical expenses, and certain business expenses. Make sure to claim all applicable deductions to minimize your tax liability.

- Take Advantage of Tax Credits: Indiana provides several tax credits to eligible taxpayers. These credits can significantly reduce your tax liability or even result in a refund. Some common credits include the Child and Dependent Care Credit, the Earned Income Tax Credit, and the Low Income Housing Credit. Research and understand the criteria for these credits to determine your eligibility.

- File Your Return Early: Filing your tax return early can give you a head start on the refund process. It allows the Department of Revenue to process your return more promptly, especially during the busy tax season. Additionally, filing early can help reduce the risk of fraud and identity theft.

- Consider Direct Deposit: Opting for direct deposit is the fastest and most secure way to receive your refund. It eliminates the risk of lost or stolen checks and ensures a quicker turnaround. You can provide your bank account details when filing your return to receive your refund directly into your account.

Common Misconceptions About Indiana Tax Refunds

There are several misconceptions surrounding Indiana tax refunds that can lead to confusion and misinformation. It’s important to separate fact from fiction to ensure a smooth and accurate process. Here are some common misconceptions clarified:

- Refunds Are Guaranteed: While most taxpayers are eligible for a refund, it is not guaranteed. Your refund amount depends on various factors, including your income, deductions, and credits. It's essential to understand that a refund is a result of overpayment of taxes, and not everyone will receive one.

- Refunds Are Issued on a First-Come, First-Served Basis: The Department of Revenue processes refunds based on the complexity of the return and the accuracy of the information provided. They prioritize returns with no errors or discrepancies to ensure a swift process. While early filers may receive their refunds sooner, it doesn't guarantee a faster refund for everyone.

- All Refunds Are Issued Within a Certain Timeframe: The Department of Revenue aims to process refunds as quickly as possible, but the timeline can vary. The complexity of your return, the method of filing, and the accuracy of your information can all impact the processing time. It's important to be patient and allow the Department to thoroughly review your return.

Indiana Tax Refund Resources and Support

Navigating the tax refund process can be challenging, especially if you encounter issues or have specific questions. Fortunately, the Indiana Department of Revenue provides various resources and support options to assist taxpayers. Here’s an overview of the resources available to you:

- Online Tools: The Department of Revenue offers an array of online tools to help you navigate the tax refund process. These tools include a refund status tracker, tax return calculators, and a comprehensive FAQ section. These resources provide instant access to information and can help answer common queries.

- Taxpayer Assistance Centers: If you prefer in-person assistance, the Department of Revenue operates Taxpayer Assistance Centers across the state. These centers provide personalized support and guidance to taxpayers. You can schedule an appointment to discuss your specific situation and receive expert advice.

- Phone Support: For phone-based assistance, the Department of Revenue operates a dedicated taxpayer support line. Trained professionals are available to answer your questions and provide guidance. This option is ideal for those who prefer a more direct and personalized approach.

- Email Support: If you have a specific query or issue, you can reach out to the Department of Revenue via email. Their support team will respond to your inquiry and provide the necessary assistance. Email support is convenient for those who prefer written communication.

Indiana Tax Refund Timeline

Understanding the timeline for your Indiana tax refund is crucial to managing your expectations. While the Department of Revenue aims to process refunds promptly, the exact timeframe can vary depending on several factors. Here’s an overview of the typical tax refund timeline in Indiana:

| Filing Method | Processing Time |

|---|---|

| Online Filing | Typically, refunds are issued within 4-6 weeks from the date of filing. However, it's important to note that this timeline can be affected by the accuracy and complexity of your return. |

| Paper Filing | Paper returns generally take longer to process. The Department of Revenue estimates a processing time of 8-12 weeks from the date of filing. Again, this timeline can vary based on the complexity and accuracy of your return. |

It's important to keep in mind that these timelines are estimates and can change based on various factors. The Department of Revenue works diligently to process refunds as quickly as possible, but unexpected delays may occur. If you have concerns about the status of your refund, you can utilize the online refund status tracker or reach out to the Department for further assistance.

Future Implications and Changes to the Indiana Tax Refund Process

As technology advances and tax laws evolve, the Indiana tax refund process is likely to undergo changes in the future. The Department of Revenue is committed to improving efficiency and security, and several initiatives are underway to enhance the refund process. Here are some potential future implications and changes to keep an eye on:

- Enhanced Security Measures: With the increasing threat of identity theft and fraud, the Department of Revenue is investing in advanced security technologies. This includes implementing stronger authentication methods, encrypting sensitive data, and utilizing biometric identification for added security. These measures will help protect taxpayers' personal information and ensure the integrity of the refund process.

- Mobile App Integration: To cater to the growing number of mobile users, the Department of Revenue is exploring the development of a dedicated mobile app. This app would allow taxpayers to track their refund status, receive real-time updates, and access important tax information on the go. It would provide a more convenient and accessible way to manage their tax refund process.

- Simplified Tax Forms and Processes: The Department of Revenue is constantly working to simplify tax forms and processes to make them more user-friendly. They aim to reduce complexity and streamline the filing process, making it easier for taxpayers to understand and complete their tax returns accurately. This initiative will not only benefit taxpayers but also reduce the time and resources required for processing.

- Expanded Online Services: The Department of Revenue recognizes the importance of online services and is committed to expanding its online presence. They plan to introduce additional online tools and resources to assist taxpayers throughout the year. This may include interactive tax calculators, educational resources, and an enhanced online filing system with improved features and functionalities.

It's important to stay informed about these potential changes and keep an eye on official announcements from the Indiana Department of Revenue. By staying updated, you can ensure a smoother and more efficient tax refund process in the future.

How do I check the status of my Indiana tax refund?

+

You can check the status of your Indiana tax refund by visiting the Indiana Department of Revenue’s website and using their online refund status tracker. You will need to provide your e-file number or Social Security number to access your refund information.

What if I haven’t received my refund after the estimated timeframe?

+

If you haven’t received your refund after the estimated timeframe, it’s recommended to contact the Indiana Department of Revenue. They can assist you in tracking your refund and provide further guidance. You can reach them through their taxpayer support line or visit one of their Taxpayer Assistance Centers.

Can I receive my refund as a paper check instead of direct deposit?

+

Yes, you have the option to receive your Indiana tax refund as a paper check. When filing your return, you can choose to have your refund issued as a check and provide your mailing address. However, it’s important to note that direct deposit is the faster and more secure method of receiving your refund.

Are there any deductions or credits specific to Indiana that I should be aware of?

+

Yes, Indiana offers several deductions and credits that can reduce your taxable income or increase your refund. Some examples include the Hoosier Tax Credit, the Property Tax Deduction, and the Education Expense Credit. It’s important to research and understand these deductions and credits to maximize your refund.