Is Ein Same As Tax Id Number

In the world of business and finance, understanding the nuances of identification numbers is crucial for compliance and effective record-keeping. One common question that arises is whether the EIN is the same as a Tax ID number. While these terms are often used interchangeably, there are some important distinctions to be made. Let's delve into the specifics to provide a comprehensive understanding.

Understanding the EIN

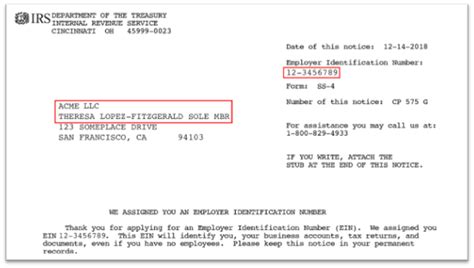

The Employer Identification Number (EIN), also known as the Federal Employer Identification Number (FEIN) or simply Federal Tax ID Number, is a unique nine-digit identifier assigned to businesses by the Internal Revenue Service (IRS) in the United States. It serves as a crucial identification tool for various purposes, including tax administration and compliance.

An EIN is typically required when a business engages in activities such as hiring employees, opening a bank account, or applying for licenses and permits. It allows the IRS to track a business's tax filings and payments, ensuring that all necessary taxes are accounted for.

How to Obtain an EIN

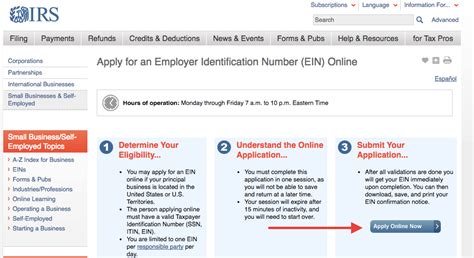

Obtaining an EIN is a straightforward process. Businesses can apply for one online through the IRS website or by submitting Form SS-4, Application for Employer Identification Number. The online application is usually processed within minutes, while the form may take a few days to process.

Format and Structure

An EIN follows a specific format: two digits, a hyphen, and then seven more digits (XX-XXXXXXX). The first two digits are assigned based on the type of entity, with 00 reserved for agencies and instrumentalities of the United States, 01 to 99 for corporations, 10 to 39 for partnerships, and 40 to 69 for sole proprietorships. The remaining seven digits are unique to each business.

| Entity Type | EIN Prefix |

|---|---|

| Corporations | 01-99 |

| Partnerships | 10-39 |

| Sole Proprietorships | 40-69 |

Use Cases

- Tax Filings: EINs are used on tax forms to identify the business entity.

- Banking: Banks often require an EIN for business accounts.

- Legal Compliance: Certain licenses and permits may mandate an EIN.

- Employment: Businesses need an EIN when hiring employees.

Exploring Tax ID Numbers

A Tax ID Number, or Tax Identification Number, is a broader term that encompasses various identification numbers used for tax purposes. While the EIN is a specific type of Tax ID, there are other Tax IDs that serve different functions.

Individual Taxpayer Identification Number (ITIN)

The Individual Taxpayer Identification Number (ITIN) is a nine-digit number issued by the IRS to individuals who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security Number (SSN). This includes non-resident aliens, foreign nationals, and their dependents.

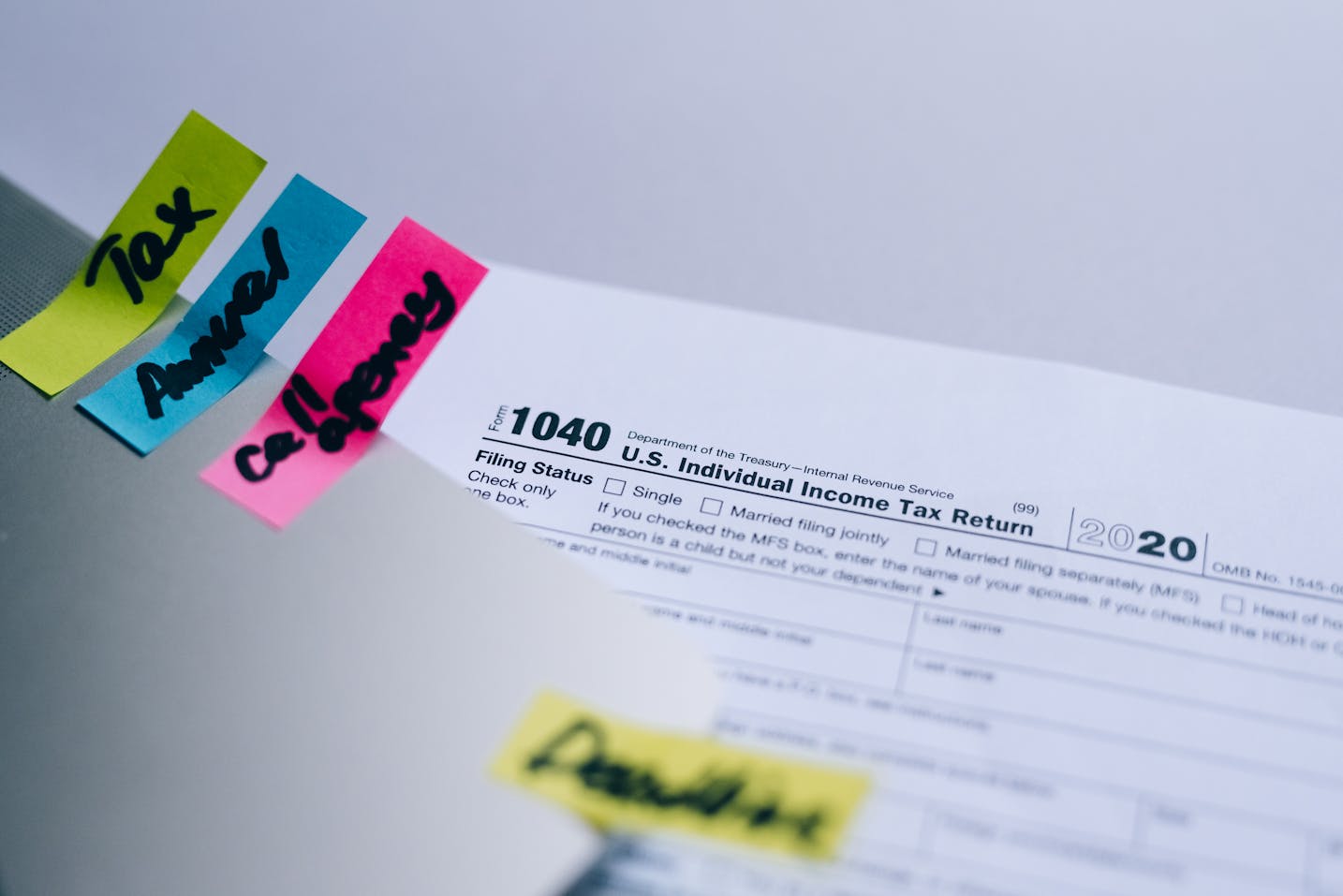

An ITIN is used for tax reporting purposes and does not authorize an individual to work in the United States. It is typically required when filing tax returns, such as the U.S. Individual Income Tax Return (Form 1040) or other tax forms.

Social Security Number (SSN)

The Social Security Number (SSN) is a nine-digit number issued to U.S. citizens, permanent residents, and temporary (working) residents under section 205©(2) of the Social Security Act, codified as 42 U.S.C. § 405©(2). It is administered by the Social Security Administration (SSA) and is used for a wide range of purposes, including identifying individuals for tax purposes.

While the SSN is not specifically a Tax ID, it is often used as a de facto Tax ID for individuals. When an individual has a SSN, it is typically used for tax filings and reporting, making it a crucial identifier for tax purposes.

Other Tax IDs

In addition to the EIN, ITIN, and SSN, there are other Tax IDs that serve specific purposes. For instance, certain government agencies and entities may have their own Tax IDs for administrative and compliance purposes.

The Difference Between EIN and Tax ID

While the terms “EIN” and “Tax ID” are often used interchangeably, especially in the context of business identification, it’s important to recognize that they are not entirely synonymous. The distinction lies in the scope and purpose of each identifier.

The EIN is specifically designed for businesses and is used for various administrative and tax-related purposes. It is a unique identifier that allows the IRS to track a business's tax obligations and filings. On the other hand, the term "Tax ID" encompasses a broader range of identification numbers used for tax purposes, including those assigned to individuals.

Key Differences

- Scope: EINs are for businesses, while Tax IDs can be for individuals or businesses.

- Purpose: EINs focus on tax administration for businesses, while Tax IDs serve various tax-related functions.

- Assignment: EINs are assigned by the IRS, while Tax IDs may be issued by different entities, including the IRS, SSA, or other government agencies.

Why the Confusion?

The confusion between EIN and Tax ID often arises due to the overlapping use of these terms in business and tax contexts. In many cases, businesses refer to their EIN as their “Tax ID” or “Federal Tax ID,” further contributing to the ambiguity.

Additionally, when individuals engage in business activities, they may need to obtain an EIN, which can blur the lines between personal and business identification. This can lead to situations where individuals use their SSN for business purposes, adding to the complexity.

Clarity for Compliance

Understanding the differences between EIN and Tax ID is crucial for businesses and individuals alike. Misunderstanding or misusing these identifiers can lead to compliance issues and potential legal consequences.

Businesses should ensure they obtain the correct identifier for their specific needs and use it accurately in all relevant documentation. Similarly, individuals engaged in business activities should be aware of the distinction and obtain the necessary identifiers to comply with tax regulations.

Conclusion: A Clear Understanding

In summary, while the terms “EIN” and “Tax ID” are often used interchangeably, they represent distinct identification systems with specific purposes. The EIN is a critical tool for businesses to navigate tax administration and compliance, while Tax IDs encompass a broader range of identifiers used for various tax-related functions, including those assigned to individuals.

By understanding these distinctions, businesses and individuals can ensure accurate and compliant use of these identifiers, contributing to a more efficient and effective tax system.

Can I use my SSN as my business’s Tax ID?

+No, you should not use your SSN as your business’s Tax ID. An EIN is the appropriate identifier for businesses. Using your SSN for business purposes can lead to confusion and potential legal issues.

Do all businesses need an EIN?

+Not all businesses require an EIN. Sole proprietorships with no employees and no need for a business bank account may not need one. However, it’s always recommended to consult with a tax advisor to ensure compliance.

Can I apply for an EIN if I’m not a U.S. citizen?

+Yes, non-U.S. citizens can apply for an EIN if they are operating a business in the United States. The application process is the same, and the EIN serves the same purpose for foreign businesses as it does for domestic ones.