Wealthsimple Tax

In the ever-evolving landscape of financial technology, a new breed of investment platforms has emerged, offering accessible and innovative ways to manage personal finances. One such platform that has gained significant attention is Wealthsimple Tax, a Canadian-based fintech company that aims to revolutionize the way individuals approach their taxes and investments. This article will delve into the world of Wealthsimple Tax, exploring its features, impact, and potential for shaping the future of financial management.

The Rise of Wealthsimple Tax: A Game-Changer in Financial Services

Wealthsimple Tax, a subsidiary of the renowned Wealthsimple financial services company, was launched with a bold mission: to simplify the complex world of taxes and make it more accessible to everyday investors. Founded in 2014, Wealthsimple has established itself as a leading online investment platform, catering to a wide range of investors with its user-friendly interface and diverse investment options. With the introduction of Wealthsimple Tax, the company took a step further, aiming to disrupt the traditional tax preparation process and empower individuals to take control of their financial well-being.

The concept behind Wealthsimple Tax is straightforward yet revolutionary. The platform leverages advanced technology and algorithms to streamline the tax filing process, making it faster, more accurate, and significantly less daunting for users. By integrating with various financial institutions and employing machine learning techniques, Wealthsimple Tax automatically retrieves and organizes financial data, such as investment gains, interest income, and deductions, into a comprehensive tax return.

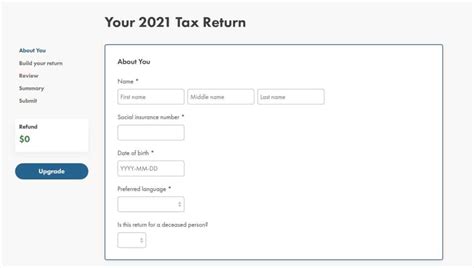

One of the key advantages of Wealthsimple Tax is its accessibility. Unlike traditional tax preparation services that often require in-person appointments or complex software installations, Wealthsimple Tax operates entirely online. Users can conveniently access the platform through their web browsers or mobile apps, making tax filing a seamless and convenient process. Additionally, the platform's intuitive design and user-friendly interface ensure that even those with limited financial knowledge can navigate through the tax preparation process with ease.

Features and Benefits of Wealthsimple Tax

Wealthsimple Tax offers a range of features and benefits that set it apart from traditional tax preparation methods. Let’s explore some of its key attributes:

Automated Data Aggregation

One of the most significant advantages of Wealthsimple Tax is its ability to automate the data aggregation process. The platform seamlessly connects with users’ financial institutions, such as banks, brokerage accounts, and investment platforms, to retrieve relevant financial information. This automated process eliminates the tedious task of manually entering financial data, reducing the risk of errors and saving users valuable time.

For instance, imagine a user with multiple investment accounts across different platforms. Wealthsimple Tax can consolidate all their investment data into a single, organized view, making it easier to track gains, losses, and overall portfolio performance. This feature not only simplifies the tax preparation process but also provides users with a holistic overview of their financial health.

Intuitive Tax Return Filing

Wealthsimple Tax’s intuitive interface guides users through the tax return filing process step by step. The platform utilizes plain language and clear explanations to ensure that users understand each section and can provide accurate information. By eliminating complex tax jargon, Wealthsimple Tax empowers individuals to take an active role in their tax preparation, fostering financial literacy and confidence.

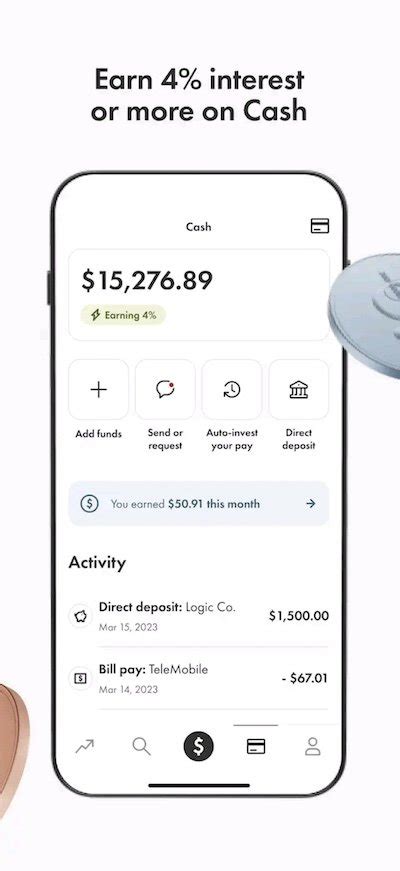

Furthermore, the platform offers real-time calculations and estimates, allowing users to see the potential impact of their choices on their tax liability. This transparency enables users to make informed decisions and optimize their tax strategies, potentially leading to significant savings.

Tax Optimization Strategies

Wealthsimple Tax goes beyond basic tax filing by offering personalized tax optimization strategies. The platform analyzes users’ financial data and provides tailored recommendations to minimize their tax burden. These strategies may include suggestions for tax-efficient investments, maximizing deductions, or taking advantage of tax credits and incentives.

For example, Wealthsimple Tax might suggest that a user contribute to a tax-free savings account (TFSA) to maximize their after-tax returns or recommend strategies for harvesting tax losses to offset capital gains. By offering these insights, the platform not only assists users in meeting their tax obligations but also helps them make smarter financial decisions.

| Feature | Description |

|---|---|

| Real-Time Portfolio Tracking | Wealthsimple Tax provides users with real-time updates on their investment portfolios, allowing them to monitor gains and losses throughout the year. |

| Tax Loss Harvesting | The platform identifies opportunities for tax loss harvesting, helping users offset capital gains and reduce their tax liability. |

| Automated RRSP Contributions | Wealthsimple Tax assists users in maximizing their Registered Retirement Savings Plan (RRSP) contributions by automating the process and providing contribution room estimates. |

Impact and Future Implications

The introduction of Wealthsimple Tax has had a notable impact on the financial services industry and the way individuals approach their taxes. By simplifying the tax filing process and providing accessible tax optimization strategies, the platform has empowered a new generation of investors to take control of their financial future.

One of the key implications of Wealthsimple Tax's success is the potential shift towards a more digital and automated financial ecosystem. As more individuals embrace online platforms for their investment and tax needs, traditional financial institutions may be pressured to adapt and offer similar digital solutions. This could lead to increased competition and innovation within the industry, ultimately benefiting consumers with improved services and enhanced financial literacy.

Moreover, Wealthsimple Tax's focus on tax optimization strategies has the potential to influence investment decisions and market trends. By providing users with insights and recommendations, the platform encourages investors to make more tax-efficient choices. This could lead to a shift towards tax-friendly investment products and a broader understanding of the impact of taxes on investment returns.

Looking ahead, Wealthsimple Tax's future prospects are promising. As the platform continues to refine its algorithms and expand its user base, it is well-positioned to become a leading player in the digital financial services space. With potential partnerships and collaborations, Wealthsimple Tax could further enhance its capabilities, offering an even more comprehensive suite of financial management tools.

Conclusion: A Bright Future for Wealthsimple Tax

Wealthsimple Tax has emerged as a game-changer in the financial services industry, revolutionizing the way individuals approach their taxes and investments. By leveraging technology and a user-centric approach, the platform has simplified the complex world of taxes, making it accessible and empowering for everyday investors.

With its automated data aggregation, intuitive filing process, and tax optimization strategies, Wealthsimple Tax has set a new standard for tax preparation. The platform's impact extends beyond individual users, influencing the industry as a whole and shaping the future of financial management. As Wealthsimple Tax continues to grow and innovate, it is poised to play a significant role in shaping the digital financial landscape, offering a brighter and more accessible future for investors.

Is Wealthsimple Tax suitable for all types of investors?

+Wealthsimple Tax is designed to cater to a wide range of investors, from those with basic tax needs to more advanced investors with complex financial portfolios. The platform’s intuitive interface and personalized recommendations make it accessible to beginners, while its advanced features and tax optimization strategies benefit experienced investors as well.

How secure is my financial information on Wealthsimple Tax?

+Wealthsimple Tax prioritizes data security and employs robust encryption protocols to protect users’ financial information. The platform adheres to strict industry standards and regulations, ensuring that user data remains confidential and secure throughout the tax preparation process.

Can Wealthsimple Tax help me with tax planning beyond the filing process?

+Absolutely! Wealthsimple Tax provides ongoing tax planning support throughout the year. The platform offers real-time updates on users’ investment portfolios, helping them stay informed about their financial health and potential tax implications. Additionally, the platform’s tax optimization strategies and personalized recommendations enable users to make informed decisions to minimize their tax liability.

What happens if I encounter issues during the tax filing process on Wealthsimple Tax?

+Wealthsimple Tax offers dedicated customer support to assist users with any technical or tax-related queries. The platform provides a comprehensive help center with step-by-step guides and resources, and users can also reach out to the support team via email or live chat for personalized assistance.