Can I Deduct Property Taxes

When it comes to managing your finances, especially during tax season, understanding the deductions you're eligible for can make a significant difference in your overall tax liability. One common question many homeowners have is whether they can deduct property taxes from their taxable income. In this comprehensive guide, we will delve into the intricacies of property tax deductions, exploring the relevant laws, potential benefits, and real-world examples to help you navigate this complex yet rewarding aspect of homeownership.

Understanding Property Tax Deductions

Property tax deductions are an essential part of the tax code, offering homeowners an opportunity to reduce their taxable income by accounting for the taxes they pay on their properties. These deductions are governed by a set of regulations and guidelines that ensure fairness and compliance with the Internal Revenue Service (IRS) standards. Let’s explore the key aspects of property tax deductions and how they can impact your financial planning.

What Are Property Taxes?

Property taxes are a crucial source of revenue for local governments and are typically levied on real estate properties, including residential homes, commercial buildings, and land. These taxes are calculated based on the assessed value of the property and are used to fund various public services such as schools, infrastructure, and emergency services. As a homeowner, you are responsible for paying these taxes, which can vary significantly depending on your location and the value of your property.

The Impact of Property Taxes on Homeowners

For homeowners, property taxes can represent a significant portion of their annual expenses. These taxes are typically paid in installments, either directly to the local government or through an escrow account managed by your mortgage lender. The amount you pay in property taxes can influence your monthly mortgage payments and overall financial planning. Therefore, understanding how to navigate these taxes, including potential deductions, is essential for effective financial management.

The Role of Property Tax Deductions

Property tax deductions are a powerful tool in your tax planning arsenal. By deducting the property taxes you’ve paid throughout the year, you can reduce your taxable income, which, in turn, can lead to a lower tax liability. This deduction is particularly beneficial for homeowners who itemize their deductions on their tax returns, as it allows them to offset a portion of their income with the taxes they’ve paid. The more you’ve paid in property taxes, the greater the potential deduction, resulting in significant tax savings.

Eligibility and Regulations

While the idea of property tax deductions is enticing, it’s essential to understand the eligibility criteria and regulations surrounding these deductions to ensure you’re compliant with the law and maximize your savings.

Who Qualifies for Property Tax Deductions?

Property tax deductions are available to a wide range of homeowners, including those who own their homes outright and those with mortgages. However, there are certain criteria you must meet to qualify for these deductions. First and foremost, you must own the property for which you’re claiming the deduction. Additionally, you must be responsible for paying the property taxes, whether you pay them directly or through an escrow account. Rental property owners can also benefit from property tax deductions, provided they meet specific criteria and correctly report their income and expenses.

Real-World Examples of Property Tax Deductions

To better understand how property tax deductions work in practice, let’s consider a few real-world examples. Imagine a homeowner, Jane, who owns a house in a suburban area. Her property is assessed at 500,000, and the local government levies a property tax rate of 1.5%. This means Jane pays 7,500 in property taxes annually. If she itemizes her deductions on her tax return, she can deduct this entire amount from her taxable income, resulting in substantial tax savings.

Now, let's consider a different scenario with John, a homeowner who recently purchased his first home. John's property is assessed at $300,000, and he pays $4,500 in property taxes annually. By deducting these taxes, John can reduce his taxable income, which can lead to a lower tax bracket and potentially thousands of dollars in savings over time.

Regulations and Limitations

While property tax deductions offer significant benefits, there are certain regulations and limitations you should be aware of. One critical limitation is the SALT deduction cap, which stands for State and Local Taxes. This cap limits the amount of state and local taxes, including property taxes, that you can deduct on your federal tax return. As of the most recent tax year, the SALT deduction cap is set at 10,000 for individuals and married couples filing jointly. This means that if your property taxes exceed this amount, you can only deduct up to 10,000 on your federal return.

Maximizing Your Property Tax Deductions

Now that we’ve covered the basics of property tax deductions, let’s explore some strategies to maximize your savings and make the most of this valuable tax benefit.

Itemize Your Deductions

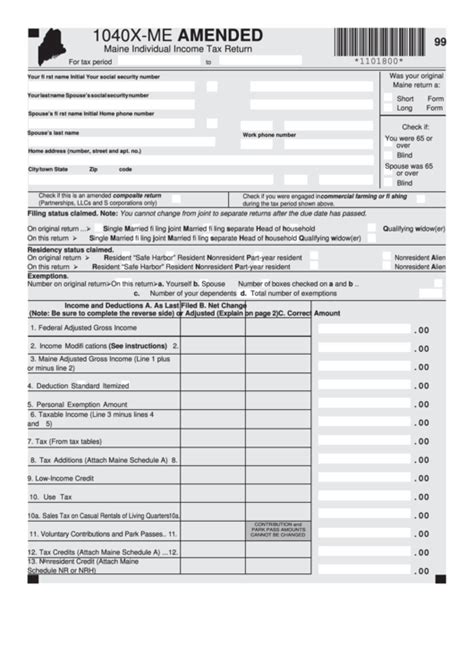

To take advantage of property tax deductions, you must itemize your deductions on your tax return. This means you’ll need to complete Schedule A of Form 1040, which allows you to list all your eligible deductions, including property taxes. Itemizing your deductions can be more beneficial than taking the standard deduction, especially if your property taxes are substantial. However, it’s essential to weigh the benefits of itemizing against the time and effort required to accurately track and report your deductions.

Keep Accurate Records

Accurate record-keeping is crucial when claiming property tax deductions. You’ll need to keep track of your property tax payments throughout the year, including any receipts, statements, or records from your local government or mortgage lender. These records will serve as evidence of your payments and are essential for supporting your tax return. Additionally, keep records of any property tax adjustments or changes, as these can impact the amount you’re eligible to deduct.

Consider Tax-Efficient Strategies

To maximize your property tax deductions, consider implementing tax-efficient strategies. For example, if you’re planning to make improvements to your property, timing these improvements strategically can impact your tax liability. By completing improvements before the end of the tax year, you may be able to deduct a larger portion of the costs, including any associated property taxes. Additionally, if you’re considering purchasing a new property, researching the property tax rates in different areas can help you make an informed decision and potentially save on taxes.

The Future of Property Tax Deductions

As tax laws and regulations evolve, it’s essential to stay informed about potential changes that may impact your property tax deductions. While the current tax code offers valuable benefits for homeowners, future reforms could introduce new limitations or opportunities. Stay tuned to tax news and consult with tax professionals to ensure you’re aware of any changes that may affect your financial planning.

Potential Reforms and Their Impact

In recent years, there have been discussions and proposals for tax reforms that could impact property tax deductions. Some of these proposals aim to simplify the tax code by limiting or eliminating certain deductions, including property taxes. While the outcome of these proposals remains uncertain, it’s crucial to stay vigilant and plan your financial strategy accordingly. By staying informed and adapting to potential changes, you can ensure you’re making the most of your property tax deductions in the present and future tax years.

Long-Term Planning and Investment

Property tax deductions are just one aspect of your overall financial planning. To maximize your savings and build wealth, consider integrating your tax strategy with long-term investment plans. Consult with financial advisors and tax professionals to develop a comprehensive plan that aligns with your goals. By combining tax-efficient strategies with smart investment choices, you can work towards achieving financial freedom and security.

FAQs

Can I deduct property taxes if I rent out my property part-time?

+Yes, you can deduct property taxes on rental properties, but it’s important to accurately report your income and expenses. Ensure you understand the rules for rental properties and consult a tax professional if needed.

What if my property taxes are paid through an escrow account?

+If your property taxes are paid through an escrow account, you can still deduct them. The taxes are considered paid when they are withdrawn from your escrow account, even if you don’t pay them directly.

Are there any limitations on the amount of property taxes I can deduct?

+Yes, there are limitations. As mentioned, the SALT deduction cap limits the amount of state and local taxes, including property taxes, that you can deduct. As of the latest tax year, this cap is set at $10,000.

Property tax deductions are a valuable tool for homeowners looking to reduce their taxable income and maximize their tax savings. By understanding the regulations, eligibility criteria, and strategies for maximizing deductions, you can make informed financial decisions and plan for a more secure future. Stay informed, consult professionals, and make the most of the tax benefits available to you.