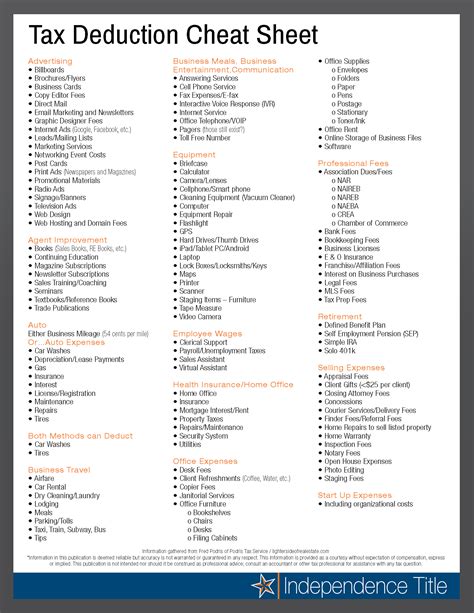

Real Estate Agent Tax Deductions

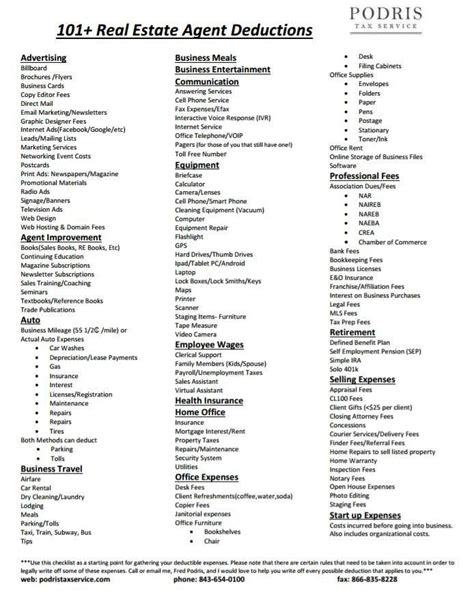

As a real estate agent, understanding the tax deductions available to you is crucial for maximizing your financial benefits and minimizing your tax liability. The real estate industry offers a unique set of opportunities for tax deductions, and being well-informed can significantly impact your bottom line. This comprehensive guide will delve into the various tax deductions real estate agents can claim, providing you with the knowledge to optimize your financial strategy.

Maximizing Deductions: A Strategic Approach

Real estate agents, like other professionals, are entitled to a range of tax deductions. These deductions not only help offset income but also serve as a strategic tool for managing your financial portfolio. By understanding and utilizing these deductions effectively, you can enhance your financial stability and long-term growth prospects.

Business Expenses: The Foundation of Deductions

Business expenses form the backbone of real estate agent tax deductions. These are costs directly related to your real estate business and are crucial for maintaining your professional operations. From marketing materials to client entertainment, these expenses can be significant and warrant careful consideration for optimal tax savings.

Some key business expenses to consider include:

- Office Space and Equipment: Whether you have a dedicated home office or rent an external office space, the associated costs are deductible. This includes rent, utilities, and furniture.

- Marketing and Advertising: Real estate marketing is an essential expense. From online listings to print advertisements, these costs can be substantial and should be claimed as deductions.

- Client Entertainment and Gifts: Building relationships with clients often involves social events and gifts. These expenses are deductible, provided they are directly related to client engagement and business development.

- Vehicle and Travel Costs: As a real estate agent, travel is often necessary for property showings and client meetings. You can claim deductions for vehicle expenses, including fuel, maintenance, and mileage.

- Professional Fees and Subscriptions: Membership fees for real estate associations, subscriptions to industry publications, and professional development courses are all deductible expenses.

| Business Expense | Description |

|---|---|

| Office Rent | Monthly rent for dedicated office space. |

| Marketing Budget | Annual allocation for advertising and promotional activities. |

| Vehicle Maintenance | Expenses for vehicle upkeep and repairs. |

| Professional Development | Fees for industry conferences and educational programs. |

Home Office Deductions: Maximizing Space Efficiency

If you operate a home-based real estate business, you may be eligible for home office deductions. This deduction allows you to claim a portion of your home expenses, such as mortgage interest, property taxes, and utilities, based on the percentage of your home used exclusively for business purposes.

To qualify for home office deductions, the IRS requires that your home office space be used regularly and exclusively for business. This means that the space should be specifically allocated for business activities and not serve any other purpose.

Calculating home office deductions can be complex, as it involves determining the percentage of your home used for business. This is typically based on the square footage of your home office relative to the total square footage of your home. The IRS provides guidelines and calculators to assist with this calculation.

Additionally, it's important to note that home office deductions may impact your eligibility for certain tax credits and benefits. Consult with a tax professional to ensure you're optimizing your deductions while remaining compliant with tax regulations.

Vehicle and Travel Expenses: Navigating the Open Road

Real estate agents often rely on their vehicles for property showings, client meetings, and site inspections. These travel expenses can accumulate quickly and are a significant aspect of your business costs.

When claiming vehicle and travel expenses, there are two primary methods to consider:

- Standard Mileage Rate: The IRS provides a standard mileage rate, which is a set amount per mile driven for business purposes. This rate covers vehicle depreciation, maintenance, and fuel costs. To use this method, you must keep a log of your business miles and multiply them by the standard mileage rate for the tax year.

- Actual Expense Method: With this method, you calculate the actual costs associated with your vehicle, such as fuel, maintenance, insurance, and registration. This method requires more detailed record-keeping but can be advantageous if your vehicle expenses exceed the standard mileage rate.

It's essential to maintain accurate records of your vehicle usage, including the dates, destinations, and business purposes of each trip. This documentation is crucial for substantiating your deductions during tax audits.

Client Entertainment and Gifts: Building Relationships

Building and maintaining client relationships is an integral part of the real estate business. The IRS allows deductions for client entertainment and gifts, provided they meet certain criteria.

To qualify as a deductible expense, client entertainment must be directly related to your business and have a legitimate business purpose. This includes activities such as client appreciation events, team-building outings, and business meals. It's important to note that entertainment expenses are subject to certain limitations and restrictions, so it's advisable to consult with a tax professional for guidance.

When it comes to client gifts, the IRS allows deductions for gifts with a value of up to $25 per person per year. These gifts must be business-related and not excessive. Examples include holiday gifts, client appreciation tokens, or promotional items with your business logo.

It's crucial to keep detailed records of client entertainment and gift expenses, including dates, locations, attendees, and business purposes. These records are essential for supporting your deductions and demonstrating their legitimacy.

Professional Development and Education: Investing in Your Future

Investing in your professional development is not only beneficial for your career growth but also provides tax advantages. The IRS allows deductions for educational expenses that maintain or improve your skills in your current profession.

This includes costs associated with:

- Real estate licensing and continuing education courses

- Industry conferences and seminars

- Professional association membership fees

- Books, publications, and online resources for professional development

It's important to note that expenses for education that qualifies you for a new profession or substantially expands your current profession may not be deductible. Consult with a tax professional to ensure you're claiming the correct deductions.

Tax Strategy: Optimizing Your Deductions

Maximizing your tax deductions as a real estate agent requires a strategic approach. Here are some key considerations to optimize your tax strategy:

- Keep Detailed Records: Maintain meticulous records of all business expenses, including receipts, logs, and documentation. This practice ensures you have the necessary evidence to support your deductions during tax audits.

- Consult a Tax Professional: Real estate tax laws can be complex, and seeking advice from a qualified tax professional can provide valuable insights and ensure compliance with the latest regulations.

- Explore Tax Software: Utilizing tax preparation software can simplify the process of tracking and claiming deductions. These tools often provide guidance and suggestions based on your specific circumstances.

- Stay Informed: Keep abreast of changes in tax laws and regulations that may impact your deductions. The IRS and tax agencies regularly update guidelines, so staying informed ensures you're taking advantage of the most current deductions.

Conclusion: Empowering Your Financial Future

Understanding and maximizing your tax deductions as a real estate agent is a powerful tool for financial empowerment. By strategically claiming eligible deductions, you can significantly reduce your tax liability and optimize your financial resources. Remember, accurate record-keeping, professional guidance, and staying informed are key to a successful tax strategy.

As you navigate the complex world of real estate and tax regulations, this guide aims to provide a comprehensive roadmap to help you make the most of your financial opportunities. With a strategic approach to tax deductions, you can enhance your financial stability and continue to thrive in your real estate career.

How do I calculate my home office deductions accurately?

+To calculate your home office deductions accurately, you’ll need to determine the percentage of your home used exclusively for business purposes. This is typically based on the square footage of your home office relative to the total square footage of your home. The IRS provides guidelines and calculators to assist with this calculation. It’s essential to maintain accurate records of your home office expenses, including rent, utilities, and other related costs.

What are the limitations for client entertainment expenses?

+Client entertainment expenses must be directly related to your business and have a legitimate business purpose. They are subject to certain limitations and restrictions. For example, the costs of entertainment must be reasonable and not extravagant. Additionally, you can only deduct 50% of the total cost of meals, even if they are directly related to business. It’s advisable to consult with a tax professional to navigate these limitations effectively.

Can I deduct the cost of my cell phone as a business expense?

+Yes, you can deduct a portion of your cell phone expenses as a business expense if you use your phone for business purposes. To do this, you’ll need to determine the percentage of your phone usage dedicated to business calls and text messages. You can then deduct that percentage of your total cell phone expenses, including monthly fees and any additional charges. Keep records of your business-related phone usage to support your deductions.