Tax Rate In Swiss

Welcome to a comprehensive exploration of the tax system in Switzerland, a country renowned for its unique economic and financial landscape. In this article, we will delve into the intricacies of the Swiss tax structure, offering a detailed analysis of its rates, implications, and global significance.

Understanding the Swiss Tax System

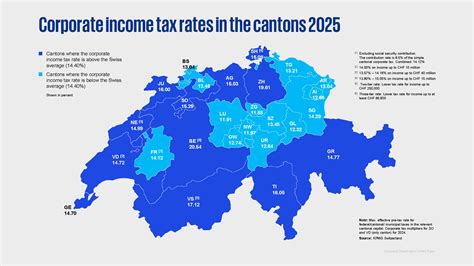

Switzerland boasts a federal state structure, comprising 26 cantons, each with its own unique tax regulations. This decentralized approach to taxation results in a diverse and complex system, making it crucial to understand the specifics of each canton when discussing Swiss tax rates.

Federal, Cantonal, and Municipal Taxes

The Swiss tax system operates on three levels: federal, cantonal, and municipal. Each level has its own set of taxes and rates, contributing to the overall complexity of the system.

- Federal Taxes: These taxes are uniform across the country and include income tax, value-added tax (VAT), and various indirect taxes.

- Cantonal Taxes: Each canton imposes its own income tax, property tax, and corporate tax rates, leading to significant variations across the country.

- Municipal Taxes: Municipalities also levy taxes, often as a percentage of the cantonal taxes, further adding to the diversity of tax rates.

Progressive Tax Rates

Switzerland employs a progressive tax system for income tax, meaning the tax rate increases as income rises. This approach ensures that higher-income individuals contribute a larger portion of their income to the tax system.

| Income Bracket (CHF) | Marginal Tax Rate (%) |

|---|---|

| Up to 120,000 | 6.5 - 13.0 |

| 120,001 - 240,000 | 13.0 - 20.5 |

| 240,001 - 360,000 | 20.5 - 25.0 |

| Over 360,000 | 25.0 - 40.0 |

Note: The above tax rates are indicative and may vary based on the canton and personal circumstances.

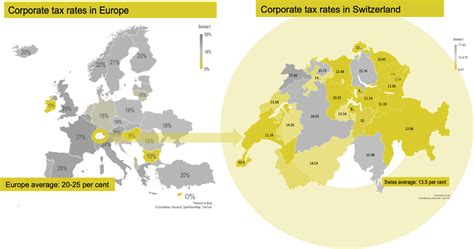

Corporate Tax Rates

Switzerland is often perceived as a tax haven due to its historically low corporate tax rates. However, recent reforms have aimed to increase corporate tax contributions, especially after the country was faced with international pressure to meet OECD standards.

The effective corporate tax rate in Switzerland varies widely, with an average effective tax rate of approximately 15-20% across cantons. This rate can be significantly lower for certain types of companies, particularly holding companies, which can benefit from special tax regimes.

Value-Added Tax (VAT)

Switzerland imposes a standard VAT rate of 7.7%, one of the lowest in Europe. This rate applies to most goods and services, with certain exceptions like financial services and some agricultural products.

Additionally, there is a reduced VAT rate of 2.5% for essential goods like groceries, and a zero-rate for exported goods and services.

The Impact of Swiss Tax Rates

The unique tax landscape of Switzerland has had a profound impact on its economic development and global reputation.

Attracting Foreign Investment

Low corporate tax rates, combined with a stable political and economic environment, have made Switzerland an attractive destination for foreign businesses. The country’s reputation as a tax haven, while changing, has historically played a significant role in its economic success.

Financial Privacy and Banking

Switzerland’s banking sector has long benefited from strict privacy laws and a tradition of financial secrecy. While the country has made efforts to enhance transparency and comply with international standards, it still maintains a high level of discretion, making it an appealing hub for global wealth management.

Global Economic Influence

Switzerland’s tax system has contributed to its status as a global financial center. The country’s role in international finance, coupled with its stable economy and robust financial institutions, has made it a key player in global economic affairs.

Conclusion: A Complex, Yet Attractive Tax System

The Swiss tax system, with its cantonal variations and progressive rates, presents a complex picture. However, its ability to attract foreign investment and maintain a robust economy cannot be understated. While the country continues to adapt to international tax standards, its unique tax structure remains a defining feature of its economic landscape.

What is the average income tax rate in Switzerland?

+The average income tax rate in Switzerland varies depending on the canton and personal circumstances. Generally, it ranges from 15% to 35%, with higher rates applicable to higher income brackets.

Are there any tax incentives for businesses in Switzerland?

+Yes, Switzerland offers various tax incentives to attract businesses, including reduced tax rates for holding companies and patent boxes. These incentives can significantly lower the effective tax rate for eligible companies.

How does Switzerland’s tax system compare to other European countries?

+Switzerland’s tax system is unique compared to other European countries due to its cantonal variations and historically low corporate tax rates. However, recent reforms have brought it more in line with European standards, while still maintaining its attractiveness for businesses.