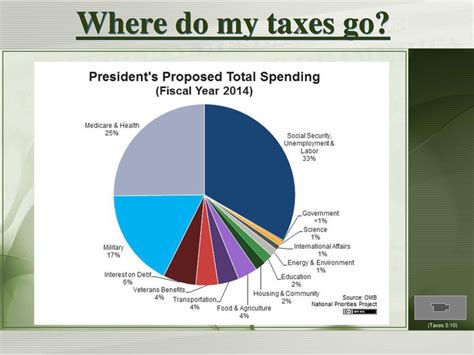

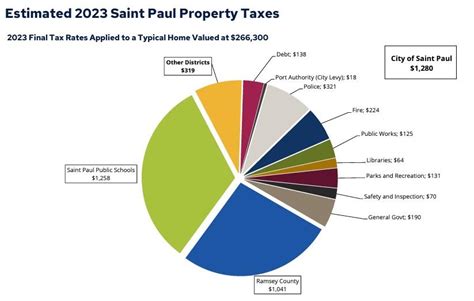

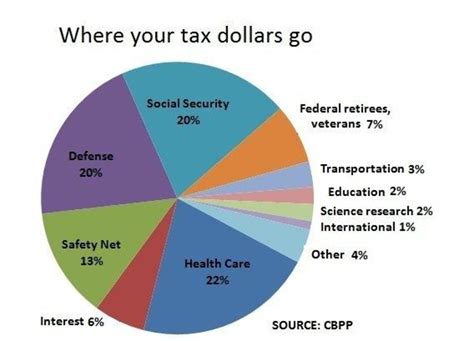

Where Do My Taxes Go

Have you ever wondered where your hard-earned money goes once you've filed your taxes? It's only natural to be curious about how the government allocates the revenue it collects from its citizens. In this comprehensive guide, we will delve into the various sectors and programs that benefit from your tax contributions, shedding light on the impact your taxes have on society and the economy.

Taxes are an essential component of any functioning society, as they provide the government with the resources needed to fund public services and infrastructure. From education and healthcare to national defense and social welfare programs, tax revenue plays a crucial role in shaping the well-being and prosperity of a nation. By understanding where your taxes go, you can gain insight into the government's priorities and the allocation of public funds.

Education: Nurturing the Future

One of the largest recipients of tax revenue is the education sector. Taxes fund public schools, colleges, and universities, ensuring that every child has access to quality education. The investment in education not only shapes the future workforce but also contributes to a more informed and engaged citizenry.

For instance, in the United States, the Department of Education's budget is primarily funded through tax dollars. This budget supports initiatives such as the Federal Pell Grant program, which provides financial aid to low-income students pursuing higher education. Additionally, taxes contribute to the funding of special education programs, ensuring that students with disabilities receive the support they need to thrive academically.

Key Statistics on Education Funding

- In 2022, the U.S. federal government spent approximately 78.5 billion</strong> on education-related programs, with a significant portion coming from tax revenue.</li> <li>The <strong>average spending per public school student</strong> in the U.S. is around <strong>12,800 annually, according to the National Center for Education Statistics.

- Tax-funded education grants and scholarships have helped millions of students pursue their academic goals, opening doors to countless opportunities.

Healthcare: Ensuring Well-Being

Taxes also play a vital role in funding healthcare systems, ensuring that citizens have access to essential medical services. Whether it’s maintaining public hospitals, supporting research, or providing insurance coverage, tax revenue is instrumental in promoting public health.

Consider the impact of taxes on healthcare in the United Kingdom. The National Health Service (NHS), one of the world's largest publicly funded healthcare systems, relies heavily on tax contributions. Taxes help cover the cost of healthcare for all UK residents, including primary care, hospital treatments, and prescription medications. This system ensures that individuals receive necessary medical care without facing financial hardship.

| Healthcare Funding Source | Percentage of Total Funding |

|---|---|

| Tax Revenue | 77% |

| National Insurance Contributions | 21% |

| Other Sources | 2% |

The Impact of Taxes on Global Health Initiatives

Tax-funded organizations like the World Health Organization (WHO) play a critical role in addressing global health crises. Through tax contributions, governments can allocate resources to combat pandemics, provide emergency healthcare in crisis zones, and support initiatives to eradicate diseases worldwide.

National Defense and Security: Protecting Sovereignty

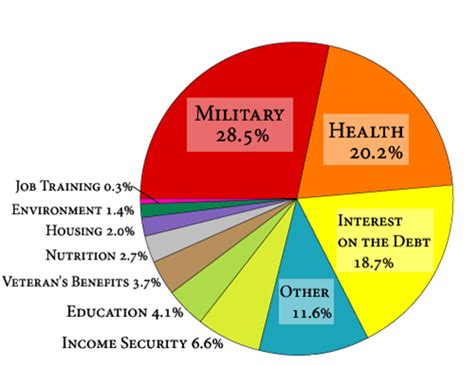

Tax revenue is vital for maintaining a strong national defense and ensuring the security of a country’s citizens. It funds military operations, intelligence agencies, and border control, among other security measures.

In the United States, the Department of Defense (DoD) is one of the largest recipients of tax dollars. The DoD's budget covers a wide range of expenses, including the salaries and benefits of military personnel, the development and procurement of advanced weaponry, and the maintenance of military bases both domestically and abroad.

Defense Spending: A Global Perspective

According to the Stockholm International Peace Research Institute (SIPRI), global military spending reached $2.1 trillion in 2022. Taxes play a significant role in funding defense budgets worldwide, with the U.S. accounting for 38% of this expenditure.

Taxes also contribute to funding intelligence agencies, such as the Central Intelligence Agency (CIA) in the U.S. These agencies play a crucial role in gathering intelligence to protect national security interests and prevent potential threats.

Social Welfare: Supporting Vulnerable Populations

Tax revenue is essential for funding social welfare programs aimed at supporting vulnerable populations, such as the elderly, the disabled, and low-income families. These programs provide financial assistance, healthcare coverage, and social services to ensure the well-being of those in need.

For example, in Canada, the Canada Child Benefit program is funded through tax revenue. This initiative provides monthly payments to eligible families to help cover the costs of raising children. The program aims to reduce child poverty and ensure that every child has the opportunity to thrive.

Social Welfare Programs: A Lifeline for Many

- The Supplemental Nutrition Assistance Program (SNAP) in the U.S. provides food assistance to low-income households, helping to combat food insecurity.

- Tax-funded housing programs, such as the Section 8 Housing Choice Voucher in the U.S., assist low-income families in securing affordable housing options.

- In many countries, taxes contribute to pension funds, ensuring a stable income for retired individuals.

Infrastructure Development: Building for the Future

Taxes are a primary source of funding for infrastructure projects, which are vital for economic growth and development. These projects include the construction and maintenance of roads, bridges, public transportation systems, and utility networks.

Take the case of Singapore, where taxes contribute significantly to the country's renowned infrastructure. The government's focus on tax-funded infrastructure development has transformed Singapore into a global hub for transportation and trade. The efficient road network, mass transit systems, and world-class airports have not only improved the quality of life for residents but have also attracted businesses and investors, boosting the economy.

Infrastructure Spending: A Catalyst for Economic Growth

Investing tax revenue in infrastructure has proven to be a wise decision for many nations. Well-developed infrastructure attracts businesses, creates jobs, and enhances a country’s competitiveness on the global stage.

Environmental Conservation: Preserving Our Planet

Taxes play a crucial role in funding environmental conservation efforts, which are essential for preserving our planet’s health and combating climate change. Tax revenue supports initiatives such as renewable energy development, pollution control, and the protection of natural habitats.

Consider the example of Norway, which has implemented a carbon tax to reduce greenhouse gas emissions. The revenue generated from this tax is invested in sustainable energy projects, research, and the development of carbon capture and storage technologies. Norway's commitment to using tax revenue for environmental initiatives has positioned the country as a leader in sustainable practices.

Environmental Programs Funded by Taxes

- The Clean Water Act in the U.S. regulates the discharge of pollutants into water bodies, and its enforcement is funded by tax dollars.

- Tax-funded wildlife conservation programs, such as the Endangered Species Act, protect vulnerable species and their habitats.

- In many countries, taxes contribute to renewable energy subsidies, encouraging the adoption of clean energy sources.

Research and Development: Driving Innovation

Tax revenue is often allocated to research and development (R&D) initiatives, fostering innovation and technological advancements. These investments drive economic growth, create new industries, and improve the overall quality of life.

The National Science Foundation (NSF) in the U.S. is a prime example of a tax-funded organization that supports basic research and education in all non-medical fields of science and engineering. The NSF's grants and fellowships have funded groundbreaking research, leading to discoveries and innovations that have shaped various industries, from computing to biotechnology.

The Impact of Tax-Funded R&D

Tax-funded research has led to countless advancements, including the development of life-saving medical treatments, sustainable energy solutions, and cutting-edge technologies. These investments not only benefit the present but also shape the future by fostering a culture of innovation and discovery.

In Conclusion: The Impact of Your Taxes

Your tax contributions have a profound impact on society, shaping the quality of life for millions of people. From education and healthcare to national defense and environmental conservation, taxes are the lifeblood of public services and infrastructure. Understanding where your taxes go can foster a deeper appreciation for the role you play in the collective well-being of your community and nation.

Key Takeaways

- Tax revenue funds a wide range of essential services, from education and healthcare to national security and infrastructure development.

- Tax-funded programs support vulnerable populations, ensuring social welfare and equality.

- Investments in research and development, driven by tax dollars, shape the future through innovation.

- The allocation of tax revenue reflects a nation’s priorities and its commitment to the well-being of its citizens.

How much of my taxes go to education and why is it important?

+A significant portion of tax revenue is allocated to education because it is a foundational pillar for a nation’s progress. Investing in education ensures a skilled and knowledgeable workforce, fosters innovation, and promotes social mobility. It’s a long-term investment in the future, as educated citizens contribute to economic growth and a more stable society.

What role do taxes play in maintaining a strong healthcare system?

+Taxes are crucial for funding healthcare systems, ensuring access to medical services for all citizens. They support the operation of public hospitals, the training of healthcare professionals, and the development of medical research. A well-funded healthcare system contributes to a healthier population and a more productive workforce.

How do taxes contribute to national defense and security?

+Tax revenue funds military operations, intelligence agencies, and border control, all of which are essential for protecting a nation’s citizens and interests. It ensures the country is well-prepared to respond to potential threats, both domestically and internationally, maintaining peace and stability.

What are some examples of social welfare programs funded by taxes?

+Taxes fund a wide range of social welfare programs, including unemployment benefits, pension plans, housing assistance, and financial aid for low-income families. These programs provide a safety net for vulnerable populations, ensuring their basic needs are met and promoting social equality.