Local Business Tax

Local Business Tax, also known as Business Privilege Tax or Occupational Privilege Tax, is a crucial aspect of the tax landscape, especially for small businesses and entrepreneurs operating within specific jurisdictions. This tax, often overlooked by those new to the business world, plays a significant role in the economic dynamics of a region and can have a direct impact on the success and growth of local enterprises.

In this comprehensive guide, we will delve into the intricacies of Local Business Tax, exploring its purpose, variations across different regions, the registration process, potential exemptions, and strategies for effective management. By the end of this article, you should have a clear understanding of this essential tax and be equipped with the knowledge to navigate it successfully.

Understanding the Purpose of Local Business Tax

Local Business Tax is a revenue-generating mechanism designed to support the financial needs of local governments and municipalities. It is a form of tax levied on businesses operating within a specific jurisdiction, typically based on the privilege of doing business in that area. This tax contributes to the funding of essential public services, infrastructure development, and community initiatives.

The tax serves as a critical tool for local authorities to maintain and improve the quality of life for their residents. It helps cover the costs of maintaining public facilities, such as parks, libraries, and community centers, and also supports local law enforcement, fire protection, and other emergency services. Moreover, Local Business Tax can be a significant source of funding for economic development initiatives, encouraging entrepreneurship and fostering a thriving business environment.

Variations in Local Business Tax Structures

One of the intriguing aspects of Local Business Tax is its diversity across different regions. While the fundamental concept remains the same—taxing businesses for operating within a jurisdiction—the specifics can vary widely. These variations can include different tax rates, calculation methods, and exemptions, often tailored to the unique needs and circumstances of the locality.

Tax Rates and Assessment Methods

Tax rates for Local Business Tax can be flat or graduated, depending on the jurisdiction. A flat rate applies a consistent tax percentage to all businesses, regardless of their size or revenue. In contrast, a graduated rate structure imposes higher tax rates as the business’s revenue or size increases. These rates can be determined based on factors such as gross receipts, payroll, or even the number of employees.

Assessment methods also vary. Some jurisdictions use a simple formula based on a percentage of gross receipts, while others may consider more complex factors like business assets, profit margins, or industry-specific criteria. For instance, a municipality might offer a lower tax rate for businesses in certain sectors, such as agriculture or technology, to encourage growth in those areas.

| Jurisdiction | Tax Rate | Assessment Method |

|---|---|---|

| City of Evergreen | 2% of gross receipts | Flat rate based on revenue |

| Township of Prosper | Graduated: 1.5% for up to $1M revenue, 2% for $1M-$5M, 2.5% above $5M | Tiered based on revenue brackets |

| County of Meadowview | 1% of net profits | Based on profit margins |

Exemptions and Incentives

Local governments often offer exemptions or incentives to certain businesses to promote specific economic goals. These exemptions can be based on factors like industry, business size, or even the location of the business within the jurisdiction. For example, a municipality might exempt startups or small businesses from Local Business Tax for the first few years to encourage entrepreneurship.

Other incentives could include reduced tax rates for businesses operating in designated economic zones or for those that meet certain environmental or social responsibility criteria. These incentives not only attract businesses to the area but also promote sustainable and responsible business practices.

Navigating the Registration Process

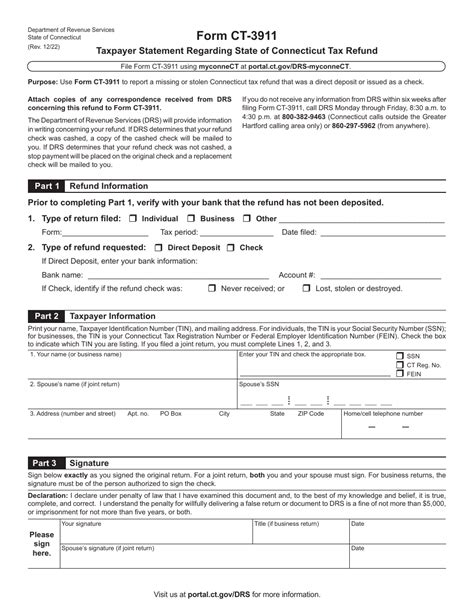

Registering for Local Business Tax is a critical step for any business operating within a jurisdiction. The registration process typically involves the following steps:

- Determining Tax Obligations: Research and understand the Local Business Tax requirements for your specific jurisdiction. This includes identifying the applicable tax rates, assessment methods, and any potential exemptions or incentives.

- Obtaining Necessary Licenses and Permits: Depending on your business activities and location, you may need to obtain additional licenses or permits. These could include sales tax permits, health department permits, or professional licenses. Ensure you have all the required documentation before proceeding.

- Completing Registration Forms: Most jurisdictions provide online platforms or physical forms for Local Business Tax registration. Carefully fill out all required fields, providing accurate information about your business, including its legal name, physical address, and contact details.

- Calculating and Remitting Tax Payments: Calculate your Local Business Tax liability based on the assessment method and tax rate applicable to your business. Make timely payments to avoid penalties and interest. Many jurisdictions offer online payment portals for convenience.

- Maintaining Records: Keep detailed records of your tax payments, receipts, and any correspondence with the taxing authority. These records can be crucial for audits or in case of disputes.

It's important to note that the registration process can vary depending on the jurisdiction and the nature of your business. Some localities may have specific requirements or deadlines, so staying informed and proactive is essential.

Strategies for Effective Management

Managing Local Business Tax effectively can significantly impact your business’s financial health and overall success. Here are some strategies to consider:

- Stay Informed: Keep abreast of any changes or updates to Local Business Tax laws and regulations in your jurisdiction. Subscribe to relevant newsletters, follow local government announcements, and consult with tax professionals to ensure you're aware of any new developments.

- Utilize Exemptions and Incentives: Research and understand the potential exemptions and incentives available to your business. If you meet the criteria, take advantage of these opportunities to reduce your tax burden and optimize your financial strategy.

- Consider Tax Planning: Work with a tax professional to develop a comprehensive tax planning strategy. This can involve structuring your business to optimize tax efficiency, exploring tax-deductible expenses, and leveraging any available tax credits or incentives.

- Maintain Accurate Records: Good record-keeping is essential for managing Local Business Tax effectively. Keep track of all income, expenses, and tax payments to ensure compliance and facilitate easy reference during tax audits or reviews.

- Seek Professional Guidance: If you're unsure about any aspect of Local Business Tax or need assistance with complex tax matters, consult a qualified tax advisor or accountant. They can provide expert guidance tailored to your specific business needs and circumstances.

Future Implications and Conclusion

Local Business Tax is an essential component of the tax landscape, especially for small businesses and local enterprises. Understanding its purpose, variations, and management strategies is crucial for businesses operating within specific jurisdictions. By staying informed, utilizing available exemptions and incentives, and seeking professional guidance when needed, businesses can effectively manage their Local Business Tax obligations and contribute to the economic vitality of their communities.

As the tax landscape continues to evolve, businesses must remain adaptable and proactive in their approach to tax management. With a clear understanding of Local Business Tax and its implications, businesses can navigate this complex terrain with confidence and contribute to the growth and prosperity of their localities.

What is the typical timeframe for Local Business Tax registration?

+The timeframe for Local Business Tax registration can vary depending on the jurisdiction. Some localities may require immediate registration upon starting business operations, while others might have specific deadlines or grace periods. It’s essential to research the requirements for your specific area to ensure timely compliance.

Can Local Business Tax be deducted from my federal or state tax returns?

+The deductibility of Local Business Tax from federal or state tax returns depends on the tax laws of your specific jurisdiction. In some cases, Local Business Tax may be deductible as a business expense, while in others, it may be considered a non-deductible local tax. Consulting with a tax professional can provide clarity on this matter.

Are there any penalties for late Local Business Tax payments or non-compliance?

+Yes, most jurisdictions impose penalties and interest for late payments or non-compliance with Local Business Tax obligations. The severity of these penalties can vary, and they may include fines, additional tax assessments, or even legal action. It’s crucial to make timely payments and maintain compliance to avoid these consequences.

How often do Local Business Tax rates change, and how are businesses notified of these changes?

+The frequency of Local Business Tax rate changes can vary, but they are typically reviewed and adjusted periodically by local governing bodies. Businesses are often notified of these changes through official announcements, local newspapers, or direct communication from the taxing authority. Staying informed about these updates is essential for accurate tax planning.