Broward County Taxes

Welcome to an in-depth exploration of Broward County Taxes, a complex yet crucial aspect of living in this vibrant community. Broward County, nestled in the southeastern region of Florida, boasts a rich tapestry of diverse neighborhoods, thriving businesses, and a vibrant cultural scene. As a resident or business owner here, understanding the local tax landscape is essential for making informed financial decisions and navigating the county's unique tax system.

In this comprehensive guide, we will delve into the intricacies of Broward County's tax structure, shedding light on its various components, rates, and the impact it has on residents and businesses alike. By the end of this article, you will have a comprehensive understanding of the tax obligations in Broward County, allowing you to plan your finances effectively and make the most of the resources available to you.

Unraveling the Broward County Tax System

Broward County’s tax system is a carefully crafted framework designed to support the county’s operations, infrastructure development, and public services. This system is composed of several key components, each playing a vital role in funding the county’s growth and sustainability.

Property Taxes: The Backbone of Broward County’s Revenue

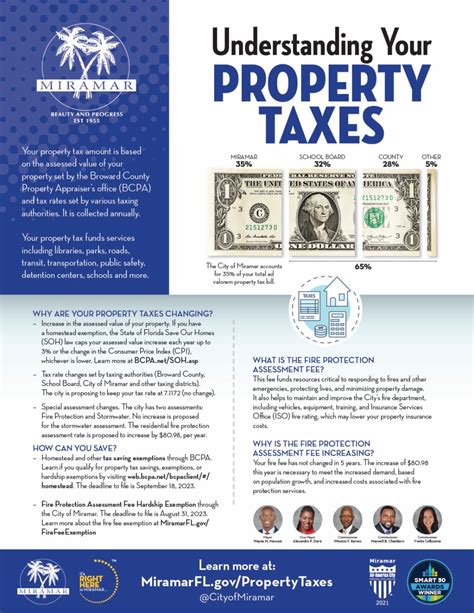

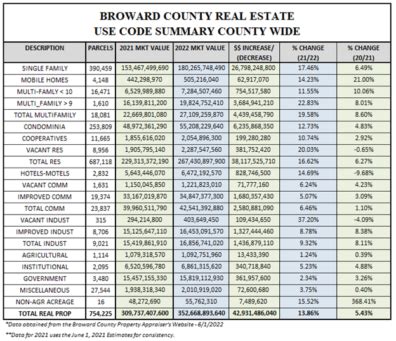

Property taxes form the cornerstone of Broward County’s tax revenue. These taxes are levied on real estate properties within the county, including residential homes, commercial buildings, and land. The property tax rate in Broward County is determined by a combination of factors, including the assessed value of the property, the tax rate set by the local government, and any applicable exemptions or discounts.

The property tax assessment process in Broward County is conducted annually. Assessed values are based on the property's fair market value, taking into account factors such as location, size, improvements, and overall condition. Property owners receive a Notice of Proposed Property Taxes, detailing the assessed value, the proposed tax amount, and any applicable exemptions or discounts. This notice serves as a crucial tool for property owners to understand their tax obligations and plan their finances accordingly.

To illustrate, let's consider a hypothetical scenario. Imagine a homeowner in Broward County, residing in a single-family home with an assessed value of $300,000. The local government has set a tax rate of 1.25% for residential properties. By applying this rate to the assessed value, we can calculate the property tax owed. In this case, the homeowner would be responsible for paying $3,750 in property taxes for the year.

| Property Type | Assessed Value | Tax Rate | Estimated Taxes |

|---|---|---|---|

| Residential Home | $300,000 | 1.25% | $3,750 |

| Commercial Building | $1,500,000 | 1.5% | $22,500 |

| Vacant Land | $50,000 | 1% | $500 |

This table provides a snapshot of the estimated taxes for different property types based on their assessed values and corresponding tax rates. It highlights the variation in tax obligations across different property categories, showcasing the impact of property value and tax rate on the overall tax burden.

It's important to note that Broward County offers various exemptions and discounts to eligible property owners. These include homestead exemptions for primary residences, which reduce the taxable value of the property, as well as other exemptions for veterans, seniors, and those with disabilities. Understanding these exemptions can significantly impact a property owner's tax liability, making it essential to stay informed about the available benefits.

Sales and Use Taxes: Funding Essential Services

In addition to property taxes, Broward County generates revenue through sales and use taxes. These taxes are applied to the sale of goods and services within the county, as well as the use of certain items and materials. The sales tax rate in Broward County is currently set at 6%, which is combined with the state sales tax rate of 6%, resulting in a total sales tax rate of 7.5% for most transactions.

Sales and use taxes play a crucial role in funding essential services such as public safety, education, transportation, and infrastructure development. These taxes are collected by businesses at the point of sale and remitted to the county and state governments. The revenue generated from these taxes is then allocated to various departments and agencies, ensuring the smooth operation of public services and the overall well-being of the community.

To illustrate the impact of sales and use taxes, let's consider a hypothetical scenario. Imagine a resident of Broward County purchasing a new television for $1,000. With a total sales tax rate of 7.5%, the resident would pay an additional $75 in taxes on top of the purchase price. This tax revenue contributes to funding local schools, maintaining roads and highways, and supporting law enforcement and emergency services.

It's important to note that certain items are exempt from sales tax in Broward County, such as groceries, prescription drugs, and certain medical devices. Additionally, there are specific rules and regulations regarding the collection and remittance of sales and use taxes for businesses. Understanding these exemptions and compliance requirements is essential for businesses operating in Broward County to ensure they are fulfilling their tax obligations accurately.

Other Taxes and Fees: Supporting County Operations

Beyond property and sales taxes, Broward County levies various other taxes and fees to support specific operations and initiatives. These additional taxes and fees contribute to funding a range of services and programs that enhance the quality of life for residents and businesses alike.

One such tax is the tourist development tax, also known as the "bed tax." This tax is imposed on the rental of hotel rooms, condominiums, and other short-term accommodations within Broward County. The revenue generated from this tax is primarily used to promote tourism, develop and maintain tourist attractions, and support the county's vibrant hospitality industry. The tourist development tax rate varies depending on the type of accommodation and can be as high as 6% in some cases.

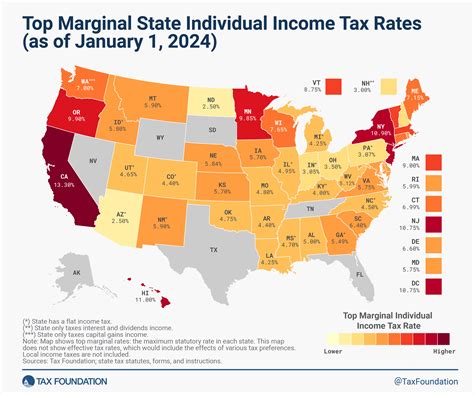

Another notable tax is the county surtax, which is added to the state's income tax. The county surtax rate is currently set at 0.25%, and it applies to all taxable income earned within Broward County. This additional tax revenue is utilized to support county-wide initiatives, including infrastructure projects, public safety enhancements, and economic development programs.

Additionally, Broward County imposes fees for specific services and permits. These fees cover the costs associated with providing various administrative, regulatory, and licensing services. For instance, there are fees for building permits, business licenses, vehicle registration, and other governmental services. These fees are essential for covering the operational expenses of county departments and agencies, ensuring efficient and effective service delivery.

It's important for residents and businesses to be aware of these additional taxes and fees, as they contribute to the overall financial health and sustainability of Broward County. By understanding the purpose and impact of these taxes, individuals and businesses can appreciate the value they bring to the community and the services they support.

Navigating the Tax Landscape: Tips and Resources

Understanding and managing your tax obligations in Broward County can be a complex task, but there are resources and strategies available to simplify the process and ensure compliance.

Stay Informed: Accessing Tax Information and Resources

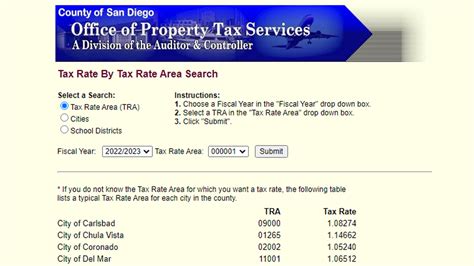

The first step in navigating the tax landscape is staying informed about the latest tax rates, regulations, and deadlines. Broward County provides a wealth of resources to help residents and businesses understand their tax obligations. The Broward County Property Appraiser’s Office offers detailed information on property tax assessments, exemption eligibility, and payment options. Additionally, the Broward County Tax Collector’s Office provides resources on sales and use taxes, including registration requirements for businesses and tax rate information.

By visiting these official websites and exploring the available resources, individuals and businesses can access valuable information tailored to their specific tax needs. These resources often include user-friendly guides, instructional videos, and FAQs, making it easier to understand complex tax concepts and navigate the tax system effectively.

For instance, the Broward County Property Appraiser's Office website provides an online property tax estimator tool. This tool allows property owners to input their property's details and receive an estimated tax amount based on the current tax rate and any applicable exemptions. This estimator is a valuable resource for budgeting and financial planning, enabling property owners to anticipate their tax obligations accurately.

Additionally, the Broward County Tax Collector's Office website offers a comprehensive guide on sales and use taxes. This guide provides clear explanations of the tax rates, exemptions, and registration requirements for businesses. It also includes practical examples and case studies, helping businesses understand their tax responsibilities and ensuring compliance with the latest regulations.

Staying informed about tax-related updates and changes is crucial. Both the Property Appraiser's Office and the Tax Collector's Office provide newsletters and email alerts, keeping residents and businesses up-to-date on important tax-related announcements, deadline reminders, and any changes to tax laws or regulations. Subscribing to these newsletters ensures that individuals and businesses remain aware of any adjustments that may impact their tax obligations.

Seek Professional Guidance: Tax Consultants and Advisors

While staying informed is essential, seeking professional guidance can provide valuable expertise and support in navigating the complexities of Broward County’s tax system. Tax consultants and advisors are well-versed in the local tax laws, regulations, and best practices, making them an invaluable resource for individuals and businesses alike.

Tax consultants can offer personalized advice and assistance based on your specific tax situation. Whether you're a homeowner, a business owner, or an investor, they can provide tailored guidance on tax planning, tax optimization strategies, and compliance with tax regulations. They can help you identify applicable tax benefits, exemptions, and deductions, ensuring you take full advantage of the available tax incentives.

For businesses, tax advisors can offer strategic tax planning services, helping to minimize tax liabilities and maximize tax efficiency. They can assist with business structure planning, tax filing requirements, and compliance with local, state, and federal tax laws. By working with a tax advisor, businesses can ensure they are meeting their tax obligations while also optimizing their tax position.

Additionally, tax consultants can provide valuable assistance in resolving tax-related issues and disputes. If you find yourself facing a tax audit or facing penalties for non-compliance, a tax consultant can guide you through the process, representing your interests and ensuring a fair resolution. They can also help with tax appeal processes, negotiating with tax authorities to achieve a favorable outcome.

When seeking a tax consultant or advisor, it's important to choose a professional with expertise in Broward County's tax system. Look for consultants who have a strong track record of success and positive client reviews. Consider their specialization in property taxes, sales taxes, or business taxes, depending on your specific needs. A good tax consultant will not only provide accurate and timely advice but also offer ongoing support and guidance throughout the year.

Utilize Online Tools and Software: Simplifying Tax Management

In today’s digital age, a plethora of online tools and software solutions are available to simplify tax management and streamline the tax filing process. These tools offer convenience, accuracy, and efficiency, making it easier for individuals and businesses to stay on top of their tax obligations.

For property tax management, several online platforms provide convenient tools for tracking assessments, calculating estimated taxes, and managing payment schedules. These platforms often integrate with local tax databases, ensuring accurate and up-to-date information. They can also send automated reminders for tax deadlines, helping property owners stay organized and avoid late fees.

When it comes to sales and use taxes, specialized software solutions are available to streamline the tax collection and filing process for businesses. These software tools automate the calculation of sales tax based on the applicable rates and exemptions, ensuring accurate tax reporting. They also generate detailed sales tax reports, making it easier for businesses to reconcile their tax obligations and prepare for tax audits.

Additionally, online tax filing platforms offer a user-friendly interface for individuals and businesses to file their tax returns electronically. These platforms guide users through the filing process, providing clear instructions and helping to ensure accurate and complete submissions. Some platforms even offer real-time support and tax tips, making the tax filing experience less daunting and more efficient.

It's important to choose reputable and reliable online tools and software for tax management. Look for platforms that have a strong track record of security and data protection, ensuring the confidentiality and integrity of your tax information. Seek recommendations from trusted sources or consult with tax professionals who can guide you towards the most suitable tools for your specific needs.

Future Outlook: Broward County’s Tax Evolution

As Broward County continues to thrive and evolve, its tax system is also expected to undergo changes and adaptations to meet the growing needs of the community. The county’s leadership and policymakers are actively engaged in evaluating and improving the tax structure to ensure its sustainability and effectiveness.

Potential Tax Reform and Modernization

In recent years, there has been growing discussion and consideration of potential tax reform initiatives in Broward County. These reforms aim to address various concerns, such as tax fairness, economic development, and infrastructure funding. One area of focus is the property tax system, with proposals to adjust tax rates, revise assessment methods, and introduce new exemptions to better align with the changing needs of residents and businesses.

Additionally, there is an ongoing discussion about exploring alternative revenue sources to diversify the county's tax base. This could involve the introduction of new taxes or fees targeted at specific industries or activities. For instance, there have been proposals to implement a local carbon tax to support environmental initiatives and promote sustainability.

Modernizing the tax system is also a key focus, with efforts directed towards streamlining tax processes, improving efficiency, and enhancing transparency. This includes leveraging technology to digitize tax records, automate tax calculations, and provide better online services for taxpayers. By embracing digital transformation, Broward County aims to make tax management more accessible and user-friendly for residents and businesses.

Impact on Residents and Businesses

The potential tax reforms and modernization efforts in Broward County are expected to have both positive and challenging implications for residents and businesses. On the positive side, reforms could lead to a more equitable distribution of tax burdens, providing relief to certain segments of the population. For instance, adjustments to property tax rates or the introduction of new exemptions could benefit homeowners, especially those on fixed incomes.

However, there may also be challenges and uncertainties associated with tax reform. Changes in tax rates or the introduction of new taxes could impact the financial planning and budgeting of residents and businesses. It is essential for taxpayers to stay informed about proposed reforms and engage in discussions with local policymakers to ensure their voices are heard and their interests are considered.

Businesses, in particular, may need to adapt their financial strategies and tax planning approaches in response to tax reforms. They should stay updated on any changes to tax regulations, seek professional guidance, and explore opportunities to optimize their tax positions within the new framework. By proactively addressing these changes, businesses can ensure compliance and maintain their competitiveness in the local market.

Conclusion

Broward County’s tax system is a complex yet vital component of the local economy and community. By understanding the various taxes and fees that comprise this system, residents and businesses can make informed decisions, plan their finances effectively, and contribute to the county’s growth and development.

From property taxes to sales and use taxes, each component plays a unique role in funding essential services, supporting infrastructure, and promoting economic prosperity. By staying informed, seeking professional guidance, and utilizing modern tools and resources, individuals and businesses can navigate the tax landscape with confidence and ensure compliance with the county's tax regulations.

As Broward County