Wage After Taxes California

Welcome to an in-depth exploration of wages after taxes in California, a state known for its vibrant economy and diverse workforce. As an expert in personal finance and tax matters, I aim to provide a comprehensive guide to understanding the real wages individuals take home in this golden state. In this article, we'll delve into the complexities of the California tax system, uncover the factors influencing take-home pay, and offer practical insights to help individuals maximize their earnings.

Understanding the California Tax Landscape

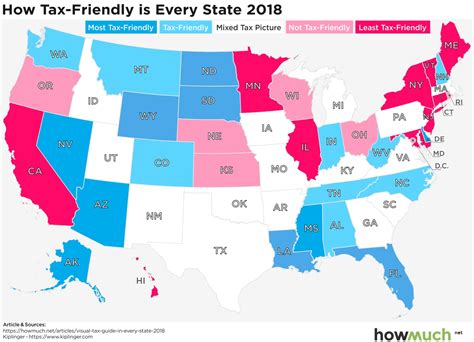

California, the most populous state in the US, boasts a robust economy with a diverse range of industries, from technology and entertainment to agriculture and manufacturing. This economic diversity translates to a wide variety of wage structures and tax obligations.

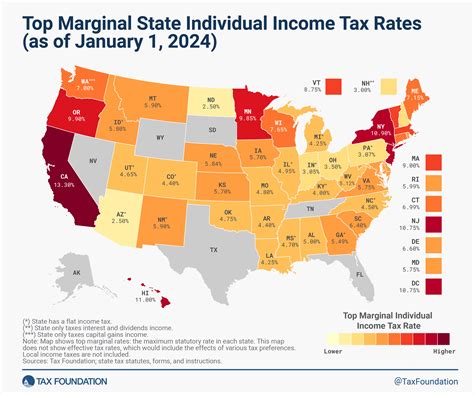

The Golden State's tax system is a combination of federal, state, and local taxes. At the federal level, income taxes are levied based on a progressive tax structure, meaning higher incomes are taxed at higher rates. California, too, has its own progressive income tax system, with rates ranging from 1% to 12.3% depending on taxable income.

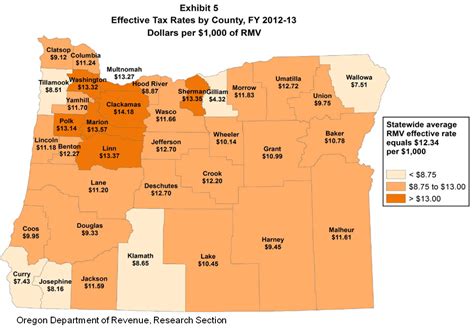

In addition to state income tax, California residents also pay local taxes, which can vary significantly depending on the county and city. These local taxes often include sales taxes, property taxes, and various other levies. For instance, the city of Los Angeles has a sales tax rate of 9.5%, while San Francisco has a rate of 8.5%, showcasing the variations across the state.

California’s Unique Tax Features

California’s tax system is notable for several unique features. One is the Alternative Minimum Tax (AMT), which is a parallel tax system designed to ensure that high-income earners pay at least a minimum amount of tax. This tax can significantly impact take-home pay for certain individuals, especially those with substantial deductions or tax credits.

Additionally, California is one of the few states with a state-level estate tax. This tax is imposed on the transfer of a deceased person's estate, over a certain threshold, to their heirs. While the federal government has an estate tax threshold of $12.06 million for 2022, California's threshold is much lower at $5.625 million, making estate planning a critical consideration for many Californians.

Factors Influencing Take-Home Pay

Understanding the gross income is just the first step in calculating take-home pay. Several factors influence the amount of money an individual takes home, and these can vary significantly based on personal circumstances and the specific nature of their employment.

Deductions and Tax Credits

Deductions and tax credits are crucial elements in reducing taxable income and, consequently, the amount of tax owed. Deductions reduce the amount of income that is taxable, while tax credits directly reduce the amount of tax owed. For instance, the Standard Deduction, which is a set amount that reduces taxable income, is a common deduction for many individuals. In California, the state allows a deduction for personal exemptions, which further reduces taxable income.

Tax credits, on the other hand, provide a direct reduction in the amount of tax owed. The Child Tax Credit, for example, provides a credit of up to $2,000 per qualifying child under the age of 17. This credit can significantly reduce the tax liability for families with children. Similarly, the Earned Income Tax Credit (EITC) is a refundable tax credit for low- to moderate-income working individuals and families. This credit can provide a substantial boost to take-home pay for eligible workers.

Withholding and Tax Estimates

The amount of tax withheld from a paycheck is another critical factor in determining take-home pay. Withholding too much can result in a large tax refund, but it also means an individual is effectively providing the government with an interest-free loan throughout the year. Conversely, withholding too little can lead to penalties and interest charges if an individual owes money at the end of the year.

For individuals with complex financial situations or high incomes, it may be beneficial to make estimated tax payments throughout the year. These payments ensure that enough tax is paid to cover both federal and state tax liabilities. Failure to pay enough tax can result in underpayment penalties, which can significantly reduce the net income.

Taxable Benefits and Perks

Certain benefits and perks provided by employers are taxable and can impact take-home pay. For instance, the value of a company car, housing allowances, and certain types of stock options are all considered taxable income. Even some non-cash benefits, such as the use of a company gym or the provision of meals, can have tax implications.

| Benefit | Taxable Status |

|---|---|

| Company Car | Taxable, based on private use |

| Housing Allowance | Taxable |

| Stock Options | Taxable upon exercise or vesting |

| Company Gym | Generally not taxable |

| Meals | Taxable unless qualified as a working condition fringe benefit |

Maximizing Your Take-Home Pay

Understanding the intricacies of the tax system is the first step towards maximizing your take-home pay. Here are some strategies to consider:

Review Your Withholding

Ensure that the amount of tax withheld from your paycheck aligns with your expected tax liability. The IRS Withholding Calculator can be a useful tool to estimate your tax liability and adjust your withholding accordingly. This can help prevent underpayment penalties and ensure you receive a reasonable refund or owe a manageable amount at tax time.

Utilize Deductions and Credits

Maximizing deductions and tax credits can significantly reduce your taxable income and increase your take-home pay. This includes claiming all eligible deductions, such as the standard deduction or itemized deductions for expenses like mortgage interest and charitable contributions. Additionally, be sure to take advantage of any tax credits for which you qualify, such as the Child Tax Credit or the EITC.

Consider Tax-Advantaged Accounts

Participating in tax-advantaged accounts, such as a 401(k) or an Individual Retirement Account (IRA), can reduce your taxable income in the year the contributions are made. This can lower your tax bill and increase your take-home pay, especially if you’re in a higher tax bracket.

Strategic Tax Planning

For individuals with complex financial situations or high incomes, strategic tax planning can be crucial. This may involve working with a tax professional to structure income and expenses in a way that minimizes tax liability. It can also include making use of tax-advantaged strategies, such as charitable giving or tax-loss harvesting, to further reduce taxable income.

Conclusion

Understanding the impact of taxes on your wages is a critical aspect of financial planning. California’s diverse tax landscape presents unique challenges and opportunities, making it essential for individuals to stay informed and proactive in managing their finances. By understanding the factors that influence take-home pay and implementing strategies to maximize earnings, Californians can ensure they’re making the most of their hard-earned wages.

How do I calculate my take-home pay in California?

+

Calculating take-home pay involves subtracting federal, state, and local taxes, as well as any deductions or withholdings, from your gross income. This can be a complex process due to the variety of taxes and deductions, so using a take-home pay calculator or consulting a tax professional can be beneficial.

What is the average income tax rate in California?

+

The average income tax rate in California depends on an individual’s taxable income. The state’s progressive tax system means that higher incomes are taxed at higher rates. For instance, an individual earning 50,000 may have an effective tax rate of around 6-7%, while someone earning 200,000 may have a rate closer to 10-12%.

Are there any tax breaks or incentives for specific industries in California?

+

Yes, California offers a variety of tax incentives and credits to encourage economic growth and development. These incentives can vary by industry and location. For instance, the state offers tax credits for film and television production, as well as incentives for clean energy and technology companies.