Country Without Income Tax

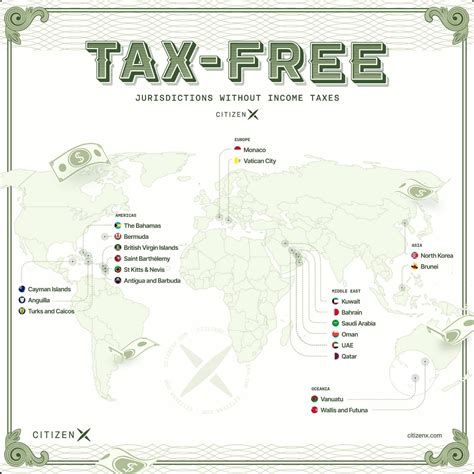

In a world where financial obligations are an inevitable part of life, the concept of a country without income tax may seem like a distant dream. However, it is not entirely a fantasy; there are places on Earth where individuals and businesses thrive without the burden of income tax. These nations have crafted unique economic models, offering an intriguing alternative to the traditional tax systems we are accustomed to. Let's embark on a journey to explore these tax-free territories, understanding their allure, their challenges, and the lessons they offer to the global economic landscape.

The Enigmatic Islands of the Caribbean

The Caribbean Sea is not just renowned for its crystal-clear waters and tropical breezes; it is also home to some of the world’s most intriguing tax havens. Countries like the Cayman Islands, the British Virgin Islands, and the Bahamas have long been associated with a zero-income tax policy. This unique economic strategy has attracted a diverse range of investors, businesses, and individuals seeking to minimize their tax liabilities.

The Cayman Islands: A Financial Hub

The Cayman Islands, a British Overseas Territory, has a population of just over 60,000 people. Despite its small size, it boasts one of the highest GDP per capita globally, largely due to its robust financial services industry. The absence of income tax has made the islands a preferred destination for hedge funds, investment companies, and high-net-worth individuals. The financial sector contributes significantly to the economy, employing a large portion of the population and generating substantial revenues.

| Economic Sector | Contribution to GDP |

|---|---|

| Financial Services | 50% |

| Tourism | 30% |

| Other Industries | 20% |

The Cayman Islands have a well-established legal and regulatory framework, ensuring a stable environment for financial activities. However, this tax-free status has also attracted scrutiny, with critics pointing to potential issues related to money laundering and tax evasion.

The British Virgin Islands: A Legal Paradise

Just north of the Cayman Islands lies another tax-free haven: the British Virgin Islands (BVI). The BVI has a robust corporate registration system, making it a popular jurisdiction for international businesses. With no income, capital gains, or corporate tax, the BVI has become a hub for offshore companies and financial institutions.

The economy is heavily reliant on financial services and tourism. The absence of income tax has made it an attractive destination for retirees and high-net-worth individuals seeking a relaxed lifestyle. The BVI has a well-developed infrastructure, including modern ports and an international airport, facilitating easy access to this tropical tax haven.

The Middle East: A Land of Oil and Tax-Free Benefits

While the Caribbean islands offer a unique tax-free experience, the Middle East presents a different model. Countries like Bahrain, the United Arab Emirates (UAE), and Qatar have adopted a no-income-tax policy, leveraging their abundant natural resources to sustain their economies.

Bahrain: A Pioneer in Tax-Free Policies

Bahrain, an island nation in the Persian Gulf, was one of the first countries in the region to abolish income tax. This move was a strategic decision to attract foreign investment and talent. The oil and gas sector remains a significant contributor to the economy, but Bahrain has also diversified into other industries, including finance, tourism, and manufacturing.

The absence of income tax has made Bahrain an attractive destination for expatriates, offering a high quality of life and a vibrant business environment. The government has invested heavily in infrastructure, education, and healthcare, ensuring a competitive business climate.

| Economic Sector | Contribution to GDP |

|---|---|

| Oil & Gas | 30% |

| Financial Services | 20% |

| Manufacturing | 15% |

| Tourism | 10% |

| Other Industries | 25% |

The UAE: A Tax-Free Haven in the Desert

The United Arab Emirates, with its iconic cities like Dubai and Abu Dhabi, has a unique approach to taxation. The country does not impose income tax on individuals, but it does have a corporate tax structure. This selective taxation policy has attracted businesses and individuals from around the world, contributing to the UAE’s rapid economic growth.

The UAE's economy is diverse, with sectors like real estate, tourism, finance, and trade thriving. The government has implemented various initiatives to promote economic development, including free trade zones and incentives for foreign investors. The absence of income tax has made the UAE an attractive hub for global businesses.

The Challenges and Considerations

While the concept of a country without income tax may seem appealing, it is not without its challenges. These nations often rely heavily on a few industries or sectors, making them vulnerable to economic downturns or changes in global markets. Additionally, the absence of income tax can lead to a lack of public revenue, potentially impacting social services and infrastructure development.

Furthermore, the reputation of tax havens has come under scrutiny in recent years, with international efforts to combat tax evasion and ensure transparency. Countries with zero-income-tax policies must navigate these challenges while maintaining their competitive edge in the global economic landscape.

Conclusion: The Future of Tax-Free Nations

The idea of a country without income tax is a fascinating aspect of global economics, offering a glimpse into alternative economic models. These nations have carved out their unique paths, leveraging their resources and strategic policies to create thriving economies. While they present intriguing opportunities, they also serve as a reminder of the complexities and considerations that come with tax-free policies.

As the world continues to evolve, these tax-free territories will likely adapt and innovate, finding new ways to sustain their economies and attract global attention. The journey of these nations is a testament to the diverse approaches nations can take to achieve economic prosperity, offering valuable lessons for the global community.

What are the potential drawbacks of living in a country without income tax?

+While the absence of income tax may be attractive, it can lead to limited public services and infrastructure development. Additionally, these countries may face scrutiny for their tax policies, potentially impacting their reputation and economic stability.

How do these countries generate revenue without income tax?

+These nations often rely on other sources of revenue, such as corporate taxes, tourism, or natural resources. They may also have well-developed financial sectors that contribute significantly to the economy.

Are there any countries with a low income tax rate that are worth considering?

+Yes, countries like Singapore and Hong Kong have relatively low income tax rates and are known for their business-friendly environments. These places offer a balance between tax obligations and economic opportunities.