Vehicle Tax Illinois Calculator

The state of Illinois, like many other states in the United States, imposes a vehicle tax on its residents who own and operate motor vehicles. This tax is an important source of revenue for the state and is used to fund various transportation projects and infrastructure improvements. Understanding the vehicle tax system in Illinois is crucial for vehicle owners to ensure compliance and to make informed decisions regarding their automotive expenses.

Understanding Vehicle Tax in Illinois

The vehicle tax in Illinois is calculated based on a variety of factors, including the type of vehicle, its age, and its value. The tax is imposed annually and is due when registering or renewing the registration of a vehicle. It is important to note that the vehicle tax is separate from the registration fee and any other associated costs.

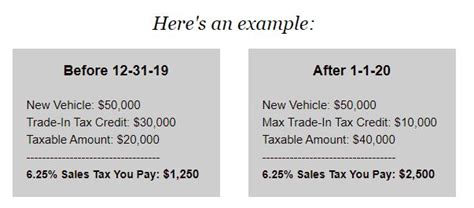

The state of Illinois employs a graduated tax system, which means that the tax rate increases as the value of the vehicle increases. This approach ensures that owners of more expensive vehicles contribute a higher proportion of tax. The tax is calculated based on a vehicle's base price, which includes the manufacturer's suggested retail price (MSRP) and any additional options or accessories. The base price is then adjusted based on the vehicle's age to arrive at the assessed value.

Vehicle Tax Rates and Calculations

Illinois uses a formula to determine the vehicle tax, which takes into account the assessed value of the vehicle and the applicable tax rate. The tax rate varies depending on the county in which the vehicle is registered. For instance, in Cook County, the tax rate is 0.8%, while in other counties, it can range from 0.5% to 0.6%. The tax rate is applied to the assessed value of the vehicle to calculate the total tax due.

To illustrate, consider a vehicle with a base price of $30,000 and a 5-year age adjustment. The assessed value of this vehicle would be calculated as follows:

| Base Price | $30,000 |

|---|---|

| Age Adjustment (5 years) | -$3,000 |

| Assessed Value | $27,000 |

Assuming this vehicle is registered in Cook County, the vehicle tax calculation would be as follows:

| Assessed Value | $27,000 |

|---|---|

| Tax Rate (Cook County) | 0.8% |

| Vehicle Tax | $216 |

Online Calculators and Resources

To assist vehicle owners in calculating their vehicle tax liability, the Illinois Department of Revenue provides an online Vehicle Tax Calculator. This user-friendly tool allows individuals to input their vehicle’s information, including make, model, year, and base price, to estimate the tax due. The calculator considers the applicable tax rate based on the county of registration and provides a clear breakdown of the calculation.

Additionally, the Illinois Department of Revenue website offers comprehensive resources and guidelines for vehicle owners. These resources include detailed explanations of the vehicle tax system, instructions for filing and paying the tax, and information on available exemptions and credits. The website also provides contact information for taxpayers to seek assistance or clarification on any tax-related matters.

The Importance of Accurate Calculations

Accurate calculation of vehicle tax is crucial for several reasons. Firstly, it ensures compliance with state laws and regulations, avoiding potential penalties for underpayment or non-payment of taxes. Secondly, precise calculations help vehicle owners budget for their automotive expenses effectively. Knowing the tax liability upfront allows individuals to plan their finances accordingly, especially when purchasing a new vehicle or registering a vehicle for the first time in Illinois.

Furthermore, accurate calculations are essential when considering the resale value of a vehicle. The vehicle tax is directly linked to the value of the vehicle, and an incorrect assessment can impact the overall cost of ownership and the potential resale price. It is advisable for vehicle owners to utilize the official online calculator and resources provided by the Illinois Department of Revenue to ensure the most accurate and up-to-date tax calculations.

Conclusion

Understanding and calculating vehicle tax in Illinois is a vital aspect of vehicle ownership in the state. The graduated tax system ensures fairness, with higher-value vehicles contributing more to the state’s revenue. By utilizing the official online resources and calculators, vehicle owners can navigate the vehicle tax system with ease and ensure compliance with state regulations. Additionally, staying informed about available tax credits and exemptions can further reduce the financial burden of vehicle ownership in Illinois.

How often do I need to pay the vehicle tax in Illinois?

+The vehicle tax in Illinois is an annual tax. It is due when registering or renewing the registration of your vehicle. You must pay the tax each year to maintain your vehicle’s registration and compliance with state laws.

Are there any exemptions or credits available for the vehicle tax in Illinois?

+Yes, Illinois offers various tax exemptions and credits. For example, disabled veterans, active-duty military personnel, and individuals with certain disabilities may be eligible for exemptions or reduced tax rates. Additionally, programs like the Clean Energy Community Grant Program provide incentives for the purchase of electric vehicles, reducing the vehicle tax liability. It is advisable to check the Illinois Department of Revenue website for the latest information on available exemptions and credits.

Can I register my vehicle without paying the vehicle tax in Illinois?

+No, you cannot register your vehicle without paying the applicable vehicle tax. The tax is a mandatory requirement for vehicle registration in Illinois. Failure to pay the tax can result in penalties, including the suspension of your vehicle registration and potential legal consequences.

What happens if I sell my vehicle before the annual tax is due in Illinois?

+If you sell your vehicle before the annual tax is due, you may be eligible for a refund of the unused portion of the tax. The process involves submitting a request for a refund to the Illinois Department of Revenue, providing documentation of the sale, and completing the necessary forms. It is important to note that the refund process can vary based on individual circumstances, and it is advisable to consult the official guidelines provided by the Department of Revenue for accurate information.