Oregon State Taxes

Oregon, known for its diverse landscapes and progressive policies, has a unique approach to state taxation. Understanding the intricacies of Oregon's tax system is crucial for residents, businesses, and anyone interested in the state's economic landscape. This comprehensive guide aims to delve into the specifics of Oregon state taxes, offering an in-depth analysis of the tax structures, rates, and implications.

The Foundation of Oregon’s Tax System

Oregon’s tax framework is built upon a foundation of fairness and simplicity, with a primary focus on individual and corporate income taxes. The state operates on the principle of “taxing the privilege of doing business in Oregon,” which means that businesses are a significant contributor to the state’s revenue.

Individual Income Tax

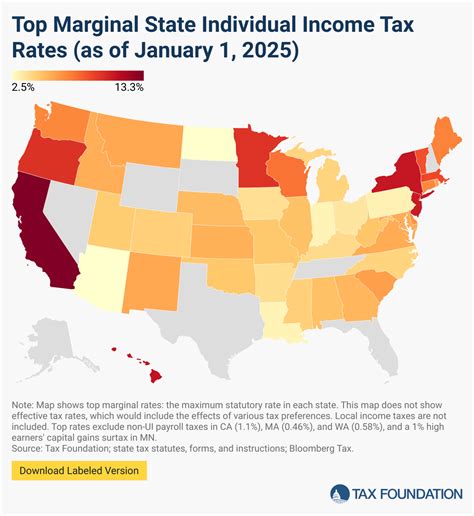

Oregon employs a progressive income tax system, which means that higher income earners pay a higher percentage of their income in taxes. The state’s income tax rates are divided into four tax brackets, ranging from 5% to 9.9%, depending on taxable income.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $4,000 | 5% |

| $4,001 - $8,000 | 6% |

| $8,001 - $10,000 | 7% |

| Over $10,000 | 9.9% |

It's worth noting that Oregon has a unique kicker law, which mandates that any revenue exceeding a certain threshold must be refunded to taxpayers. This law aims to prevent the state from collecting more taxes than it needs.

Corporate Income Tax

Corporations doing business in Oregon are subject to a flat corporate income tax rate of 6.6%. This rate applies to both C-corporations and S-corporations. The state also offers tax incentives for businesses that create jobs or invest in certain sectors, such as renewable energy.

In addition to income taxes, Oregon imposes various other taxes, including:

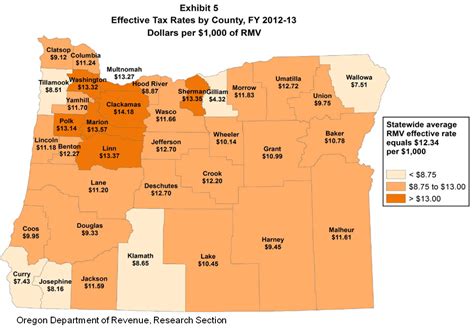

- Property Tax: Oregon's property tax system is primarily managed at the county level, with rates varying across the state. Property taxes fund local services such as schools, fire departments, and infrastructure.

- Sales and Use Tax: Oregon is one of the few states without a statewide sales tax. However, some local jurisdictions have implemented their own sales taxes, with rates ranging from 0% to 10%. The use of these funds is typically designated for specific projects or services.

- Excise Taxes: Excise taxes are levied on specific goods and services, such as fuel, tobacco, and alcohol. These taxes often serve a dual purpose: generating revenue and discouraging certain behaviors, like smoking.

Tax Benefits and Incentives

Oregon recognizes the importance of encouraging economic growth and supporting businesses. As such, the state offers a range of tax benefits and incentives to attract and retain businesses.

Research and Development Tax Credit

Businesses engaged in research and development activities can benefit from a tax credit of up to 24% of eligible research expenses. This credit aims to promote innovation and technological advancement within the state.

Enterprise Zone Tax Credits

Certain areas designated as “enterprise zones” offer businesses tax credits for hiring employees who live in those zones. This initiative aims to stimulate economic activity in underdeveloped regions.

Strategic Investment Program

The Strategic Investment Program provides tax credits to businesses that make significant investments in Oregon. These credits can be used to offset income taxes, making it more attractive for companies to expand their operations in the state.

Tax Administration and Compliance

The Department of Revenue (DOR) is responsible for administering and enforcing Oregon’s tax laws. The DOR provides resources and guidance to help taxpayers understand their obligations and ensure compliance.

Online Filing and Payment Options

Oregon offers convenient online filing and payment options for individual and business taxpayers. The state’s e-filing system, OR eFile, allows taxpayers to file their returns electronically and securely. Online payment options include credit cards, electronic checks, and direct withdrawal from a bank account.

Taxpayer Assistance and Appeals

The DOR provides assistance to taxpayers who have questions or need help with their tax obligations. Taxpayers can reach out to the DOR’s Customer Service Center for guidance on filing, payments, and other tax-related matters. In cases of disagreement with a tax assessment, taxpayers have the right to appeal through the DOR’s appeals process.

Impact on Oregon’s Economy

Oregon’s tax system plays a significant role in shaping the state’s economic landscape. The progressive income tax structure ensures that higher-income earners contribute a larger share, promoting economic fairness. The state’s focus on tax incentives for businesses has also contributed to a thriving business environment, attracting companies from various sectors.

Case Study: Tech Industry in Oregon

Oregon’s tech industry has benefited significantly from the state’s tax incentives. Companies like Intel, Nike, and Amazon have established a strong presence in the state, taking advantage of tax breaks for research and development and job creation. This has led to a thriving tech ecosystem, with a highly skilled workforce and innovative startups.

Future Outlook

As Oregon continues to evolve, its tax system is likely to adapt to meet the changing needs of the state. The state’s commitment to fairness and economic growth suggests that future tax policies will continue to strike a balance between generating revenue and encouraging investment.

Stay tuned for updates on Oregon's tax landscape, as the state's progressive approach to taxation remains a key factor in its economic success.

How does Oregon’s progressive income tax system work?

+Oregon’s progressive income tax system means that taxpayers pay a higher percentage of their income in taxes as their income increases. The state has four tax brackets, ranging from 5% to 9.9%, with higher rates applied to higher income levels.

What are the tax incentives for businesses in Oregon?

+Oregon offers a range of tax incentives for businesses, including tax credits for research and development, hiring employees from designated enterprise zones, and making significant investments in the state. These incentives aim to attract and retain businesses, fostering economic growth.

How can taxpayers in Oregon file and pay their taxes online?

+Oregon taxpayers can use the state’s e-filing system, OR eFile, to file their tax returns electronically. Online payment options include credit cards, electronic checks, and direct withdrawal from a bank account. These convenient options ensure a seamless tax-filing experience.