Status Of Louisiana Tax Return

As of the latest available information, the status of Louisiana tax returns is a topic of interest for many residents and businesses in the state. Understanding the current system, processes, and timelines for tax return processing and refunds is crucial for effective financial planning. This article aims to provide an in-depth analysis of the Louisiana tax return status, shedding light on the various aspects that impact taxpayers.

Understanding the Louisiana Tax System

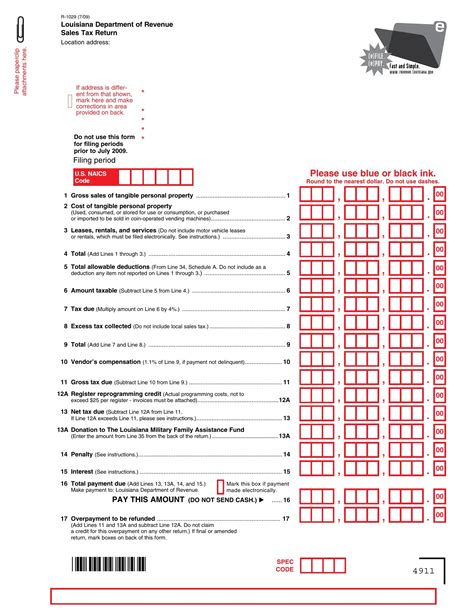

Louisiana’s tax system is administered by the Louisiana Department of Revenue (LDR), which is responsible for enforcing state tax laws, collecting taxes, and providing assistance to taxpayers. The state’s tax structure includes various types of taxes, such as income tax, sales and use tax, corporate tax, and more.

The income tax structure in Louisiana consists of four tax brackets ranging from 2% to 6%, depending on the taxpayer's income level. The sales and use tax is a consumption tax levied on the sale of goods and services, with rates varying across the state due to local taxes in addition to the state's base rate of 4.45%. Additionally, Louisiana imposes a corporate income tax on businesses operating within the state, with rates ranging from 4% to 8%.

Key Facts and Figures

According to the LDR’s latest reports, the department processed over 2.5 million individual income tax returns in the 2022 fiscal year, with a total revenue collection of approximately $10.2 billion. This included both state and local taxes. The average processing time for individual income tax returns was 14 days, while complex returns or those with errors could take up to 30 days or more.

In terms of refunds, the LDR issued over 1.8 million refunds totaling $1.2 billion in the same fiscal year. The average refund amount was around $650, with the majority of refunds being processed within 21 days of filing. However, it's worth noting that refund processing times can vary based on the complexity of the return and the method of filing.

| Tax Type | Tax Rate |

|---|---|

| Individual Income Tax | 2% - 6% (4 brackets) |

| Sales and Use Tax | 4.45% (base rate) + Local Taxes |

| Corporate Income Tax | 4% - 8% |

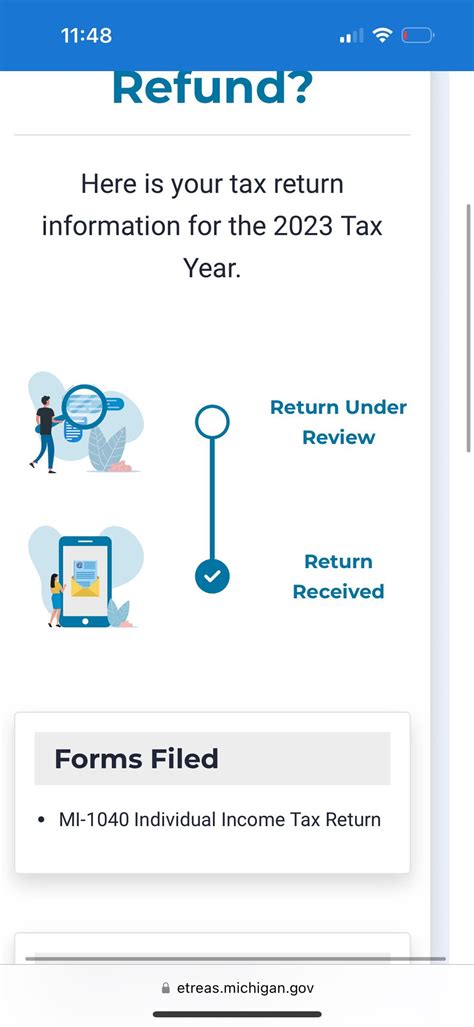

Checking Your Louisiana Tax Return Status

To check the status of your Louisiana tax return, you can utilize the LDR’s online services. The department provides a MyLDR Portal, which allows registered users to access their account information, view return status, and track refund progress.

Online Status Check

Here’s a step-by-step guide to checking your tax return status online:

- Visit the Louisiana Department of Revenue website at https://revenue.louisiana.gov.

- Navigate to the MyLDR Portal and click on "Login".

- If you already have an account, enter your username and password to log in. If not, you'll need to create an account by providing your personal details and setting up a secure login.

- Once logged in, you'll find the "Account Information" section. Here, you can view your tax return status, including the processing stage, any issues or errors, and the estimated refund amount (if applicable).

- Additionally, the portal provides a "Refund Tracker" feature, which allows you to monitor the progress of your refund. It displays the date the refund was approved, the method of refund (direct deposit or check), and the expected delivery date.

Phone and Mail Options

If you prefer not to use the online portal, you can also check your tax return status by contacting the LDR’s Taxpayer Assistance Center via phone or mail.

The phone number for the Taxpayer Assistance Center is (855) 345-3297. Representatives are available Monday through Friday from 8 a.m. to 4:30 p.m. CST. When calling, have your Social Security Number and tax return information readily available to provide accurate assistance.

For inquiries via mail, you can send a letter to the following address:

Louisiana Department of Revenue

Taxpayer Assistance Center

PO Box 61000

Baton Rouge, LA 70896-9000

Include your name, address, Social Security Number, and a brief description of your inquiry in the letter.

Common Issues and Resolutions

While the LDR strives to process tax returns efficiently, there can be instances where returns are delayed or errors occur. Here are some common issues and their potential resolutions:

Delayed Refunds

If your refund is taking longer than expected, there could be a few reasons. The LDR may be reviewing your return for accuracy, or there might be an issue with your banking information (if you opted for direct deposit). In such cases, it’s advisable to:

- Check the MyLDR Portal for any updates or messages regarding your refund.

- Review your tax return for errors or omissions, and amend it if necessary.

- Contact the Taxpayer Assistance Center for further assistance and to inquire about the specific reason for the delay.

Return Processing Errors

Sometimes, tax returns can be flagged for errors or discrepancies. This could be due to incorrect information, missing forms, or other issues. If your return is selected for further review, the LDR will send a notice explaining the issue. To resolve this:

- Review the notice carefully and identify the specific error or request.

- Provide the necessary documentation or correct the error as requested.

- If you disagree with the error or have additional information, you can respond to the notice by providing supporting evidence.

Louisiana Tax Return Timeline

Understanding the timeline for Louisiana tax return processing and refunds can help taxpayers plan their finances effectively. Here’s an overview of the typical timeline:

Filing and Processing

The filing season for Louisiana income tax returns typically begins in January and runs through April 15th (or the next business day if the 15th falls on a weekend or holiday). Returns can be filed electronically or by mail.

The LDR aims to process returns within 14 days for electronic filings and 21 days for paper returns. However, this timeline can vary based on the complexity of the return and the volume of filings received.

Refunds

Refunds are typically issued within 21 days of filing for most taxpayers. However, it’s important to note that refunds can take longer if there are errors, additional reviews, or if the refund amount is significant.

The LDR offers a Direct Deposit option for refunds, which is the fastest way to receive your refund. You can also choose to receive your refund by check, which may take additional time for processing and delivery.

Future Outlook and Potential Changes

The Louisiana tax system is subject to ongoing review and potential changes to align with economic trends and taxpayer needs. Here are some potential future developments:

Tax Rate Adjustments

The state’s tax rates, especially for income tax, may be adjusted periodically to balance the state’s budget and economic growth objectives. While income tax rates have remained stable in recent years, there is always a possibility of changes in the future.

Digital Transformation

The LDR is continuously improving its digital services and online platforms to enhance the taxpayer experience. Future developments may include further enhancements to the MyLDR Portal, additional online filing options, and improved refund tracking features.

Tax Law Updates

Louisiana’s tax laws are subject to legislative changes and updates. These changes could impact various aspects of taxation, including eligibility for tax credits, deductions, and exemptions. Staying informed about these updates is crucial for taxpayers to ensure compliance and take advantage of any new benefits.

Conclusion

Understanding the status of your Louisiana tax return is essential for effective financial planning and ensuring compliance with state tax laws. By utilizing the LDR’s online services, taxpayers can efficiently track their return status and refunds. Additionally, being aware of common issues and potential future changes allows taxpayers to proactively manage their tax obligations and take advantage of any available benefits.

How can I check the status of my Louisiana tax return if I don’t have access to the internet?

+If you don’t have internet access, you can check your tax return status by calling the Louisiana Department of Revenue’s Taxpayer Assistance Center at (855) 345-3297. Representatives are available Monday through Friday from 8 a.m. to 4:30 p.m. CST. Have your Social Security Number and tax return information ready when calling.

What should I do if I receive a notice about an error on my tax return?

+If you receive a notice about an error on your tax return, it’s important to review the notice carefully and identify the specific issue. You may need to provide additional documentation or correct the error as requested. If you disagree with the error or have additional information, you can respond to the notice by providing supporting evidence.

Are there any tax credits or deductions available in Louisiana?

+Yes, Louisiana offers various tax credits and deductions to promote economic growth and support specific industries. These include tax credits for film and digital media production, historic rehabilitation, and research and development. It’s advisable to consult with a tax professional or refer to the Louisiana Department of Revenue’s website for a comprehensive list of available credits and deductions.