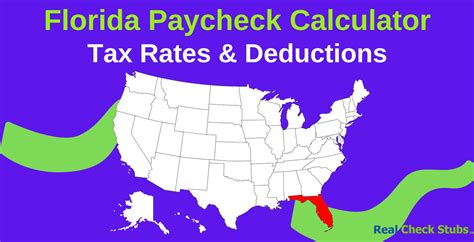

Florida Paycheck Tax Calculator

The Florida Paycheck Tax Calculator is a valuable tool for individuals and businesses alike, providing an easy and efficient way to estimate and manage tax obligations in the Sunshine State. With a unique tax landscape, Florida offers a business-friendly environment, and understanding the tax structure is crucial for financial planning and compliance. This article delves into the intricacies of the Florida paycheck tax system, offering a comprehensive guide to help users navigate this essential aspect of financial management.

Understanding Florida’s Tax Landscape

Florida boasts a distinctive tax system, known for its lack of personal income tax, which sets it apart from many other states. This feature makes it an attractive destination for businesses and individuals, offering potential tax savings. However, it’s essential to note that the state makes up for this with various other taxes, including sales tax, property tax, and corporate income tax.

For businesses operating in Florida, the tax structure can be complex, especially when it comes to payroll taxes. These taxes include federal and state-level obligations, such as Social Security, Medicare, federal unemployment tax (FUTA), and state unemployment tax (SUTA). Additionally, there are local taxes that may apply, depending on the specific jurisdiction within the state.

Key Tax Components

The following are the primary tax components that businesses need to consider when calculating payroll taxes in Florida:

- Social Security Tax: A federal tax of 6.2% on employee wages up to an annual limit, currently 147,000.</li> <li><strong>Medicare Tax:</strong> A federal tax of 1.45% on all employee wages, with no annual limit. Employers are required to match this contribution.</li> <li><strong>Federal Unemployment Tax (FUTA):</strong> A federal tax of 6% on the first 7,000 of employee wages, with potential credits reducing the effective rate.

- State Unemployment Tax (SUTA): Florida’s SUTA rate varies depending on the industry and the employer’s unemployment claims history. The base rate is 2.7%, but it can be reduced or increased based on the employer’s experience.

- Local Taxes: While Florida doesn’t have a state income tax, some counties and municipalities may impose local income taxes or surcharges. These vary widely and should be researched for specific locations.

How the Florida Paycheck Tax Calculator Works

The Florida Paycheck Tax Calculator is designed to simplify the process of calculating payroll taxes for businesses operating in the state. It takes into account the various tax components mentioned above, as well as the specific circumstances of the business and its employees.

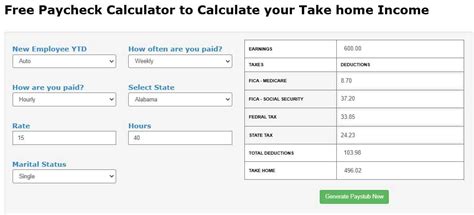

Step-by-Step Process

- Employee Information: The calculator begins by collecting essential details about the employee, including their annual salary, wage type (hourly or salaried), and any additional income or deductions.

- Tax Rate Determination: Based on the employee’s salary and the business’s location within Florida, the calculator determines the applicable tax rates for Social Security, Medicare, FUTA, and SUTA.

- Calculating Tax Withholdings: Using the determined tax rates and the employee’s salary information, the calculator computes the amount of tax to be withheld from each paycheck. This includes federal, state, and local taxes, if applicable.

- Employer Contributions: The calculator also provides an estimate of the employer’s contribution towards taxes, such as the employer’s share of Social Security and Medicare taxes, as well as any state unemployment taxes.

- Yearly Tax Summary: The final step of the calculation process provides a comprehensive summary of the employee’s total tax liability for the year, along with a breakdown of the taxes paid and the employer’s contributions.

Benefits of Using the Calculator

The Florida Paycheck Tax Calculator offers several advantages, making it an indispensable tool for businesses:

- Accuracy: The calculator ensures precise tax calculations, reducing the risk of errors that could lead to compliance issues or financial penalties.

- Time-Efficiency: By automating the tax calculation process, businesses can save significant time, allowing them to focus on core operations rather than tedious manual calculations.

- Compliance: With accurate tax calculations, businesses can ensure they are meeting their tax obligations, avoiding potential audits and penalties.

- Employee Communication: The calculator can provide a clear breakdown of tax withholdings, helping businesses communicate effectively with their employees about their paychecks.

Real-World Application and Scenarios

Let’s explore a hypothetical scenario to understand how the Florida Paycheck Tax Calculator can be applied in practice.

Scenario: Small Business in Miami

Imagine a small business, Sunshine Solutions, located in Miami, Florida. They have recently hired a new employee, Emily, who will be paid an annual salary of $50,000. Using the Florida Paycheck Tax Calculator, Sunshine Solutions can estimate Emily’s tax obligations and their own employer contributions.

| Tax Type | Tax Rate | Employee Contribution | Employer Contribution |

|---|---|---|---|

| Social Security | 6.2% | $3,100 | $3,100 |

| Medicare | 1.45% | $725 | $725 |

| FUTA | 6% (reduced to 0.6% due to credits) | $300 | N/A |

| SUTA | 2.7% | $1,350 | $1,350 |

| Local Taxes (Miami) | 1.5% | $750 | N/A |

| Total Tax Liability | $6,225 | $5,475 |

Future Implications and Updates

The tax landscape in Florida, like in any other state, is subject to change. It’s crucial for businesses to stay updated with any tax law modifications to ensure accurate calculations and compliance. The Florida Paycheck Tax Calculator will need to be regularly updated to reflect these changes, ensuring its continued accuracy and relevance.

Additionally, as the state's economy evolves, the tax structure may adapt to meet new challenges and opportunities. For instance, changes in the unemployment rate could affect SUTA rates, and shifts in the local economy could impact local tax rates. Staying informed about these changes is essential for businesses to plan their financial strategies effectively.

Potential Future Developments

- Digital Integration: The calculator could be integrated into accounting software or payroll systems, streamlining the tax calculation process further.

- Real-Time Updates: Implementing a system that automatically pulls the latest tax rates and regulations, ensuring businesses always have the most current information.

- Expanded Features: Adding more advanced features, such as the ability to handle complex compensation structures or provide more detailed reports, could enhance the calculator’s utility.

Conclusion

The Florida Paycheck Tax Calculator is a powerful tool that simplifies the complex task of payroll tax calculations for businesses operating in Florida. By offering accurate and efficient tax estimates, it empowers businesses to make informed financial decisions, ensuring compliance and financial health. As the tax landscape evolves, this calculator will continue to play a crucial role in helping businesses navigate the unique tax environment of the Sunshine State.

How often should businesses update their payroll tax calculations in Florida?

+Businesses should review and update their payroll tax calculations at least annually to account for any changes in tax rates or regulations. However, it’s also important to stay vigilant and monitor for any mid-year changes, especially if there are significant economic shifts or legislative updates.

What happens if a business fails to comply with payroll tax obligations in Florida?

+Non-compliance with payroll tax obligations can result in significant penalties and interest charges. It may also lead to audits and legal repercussions. Therefore, it’s crucial for businesses to prioritize accurate tax calculations and timely filings to avoid these consequences.

Are there any special considerations for businesses with remote workers in multiple Florida counties or cities?

+Yes, businesses with remote workers in multiple locations within Florida need to consider the varying local tax rates and regulations. It’s important to accurately calculate and withhold the correct taxes for each worker’s specific location to ensure compliance and avoid penalties.