Does Louisiana Have State Tax

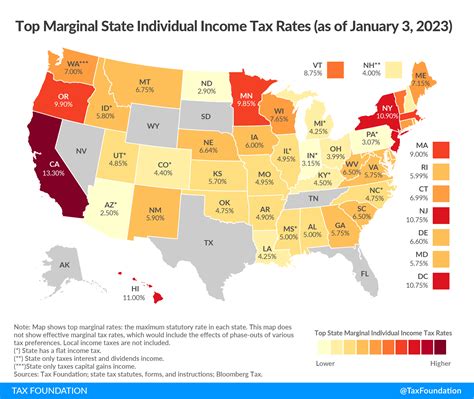

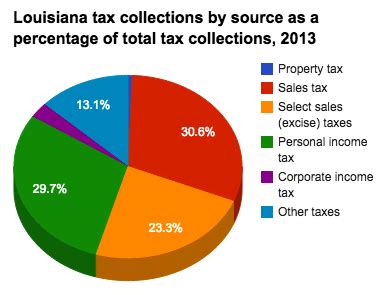

When it comes to taxation, each state in the United States has its own unique set of rules and regulations. Louisiana, the 18th state admitted to the Union, is no exception. The state of Louisiana imposes a variety of taxes, including income tax, sales and use tax, and various excise taxes. Understanding the tax landscape in Louisiana is crucial for both residents and businesses operating within the state.

Louisiana’s Income Tax Structure

Louisiana operates a progressive income tax system, which means that taxpayers are subjected to varying tax rates based on their income levels. The state’s income tax brackets range from 2% to 6%, with higher earners falling into the higher tax brackets. For the tax year 2022, Louisiana has five income tax brackets, each with its own tax rate. These brackets are adjusted annually to account for inflation.

| Income Bracket | Tax Rate |

|---|---|

| $0 - $12,500 | 2% |

| $12,501 - $50,000 | 4% |

| $50,001 - $125,000 | 5% |

| $125,001 - $250,000 | 5.25% |

| Over $250,000 | 6% |

Louisiana offers several tax credits and deductions to help alleviate the tax burden on its residents. These include credits for the elderly, disabled individuals, and those with dependent children. Additionally, the state allows deductions for medical expenses, charitable contributions, and certain business-related expenses.

Income Tax for Businesses

Louisiana imposes a corporate income tax on businesses operating within the state. The tax rate for corporations is set at 6%, which is applicable to net income derived from Louisiana sources. This includes income from the sale of goods, services, or property within the state. Sole proprietors and partnerships, on the other hand, are taxed at the individual income tax rates mentioned earlier.

Sales and Use Tax in Louisiana

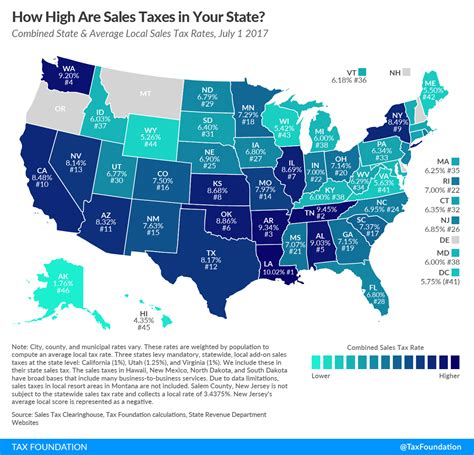

Louisiana levies a sales and use tax on the sale, lease, or rental of tangible personal property, as well as on certain services. The state’s general sales tax rate is 4.45%, but this can vary depending on the locality, with some parishes and municipalities imposing additional taxes. These additional taxes, known as local sales taxes, can increase the overall tax rate significantly.

For example, in the city of New Orleans, the total sales tax rate stands at 9.45%, which includes the state's base rate of 4.45% and a local tax rate of 5%.

Exemptions and Special Taxes

Louisiana provides exemptions for certain items and services from sales tax. These include groceries, prescription drugs, and residential utility services. Additionally, the state imposes special taxes on specific items such as alcoholic beverages, tobacco products, and soft drinks.

Other Taxes and Fees in Louisiana

Louisiana’s tax landscape extends beyond income and sales taxes. The state imposes various other taxes and fees, including:

- Franchise Taxes: Corporations doing business in Louisiana are required to pay an annual franchise tax based on their capital stock and surplus.

- Motor Vehicle Taxes: Taxes are levied on the purchase, lease, or transfer of motor vehicles, as well as on the annual registration of vehicles.

- Severance Taxes: These taxes are imposed on the extraction of natural resources, such as oil and gas, from Louisiana's lands and waters.

- Inheritance and Estate Taxes: Louisiana imposes taxes on the transfer of property upon death, with rates varying based on the relationship between the decedent and the beneficiary.

Property Taxes

Property taxes in Louisiana are assessed and collected at the local level, primarily by parishes and municipalities. These taxes are based on the assessed value of real property and are used to fund local services and infrastructure. The property tax rates can vary significantly depending on the location within the state.

Tax Incentives and Programs

Louisiana offers various tax incentives and programs to attract businesses and promote economic development. These incentives can take the form of tax credits, exemptions, or reduced tax rates for specific industries or types of investments. For instance, the state provides tax credits for film and digital media production, as well as for research and development activities.

Tax Filing and Payment

Individuals and businesses in Louisiana are required to file their tax returns and make payments by specific deadlines. The Louisiana Department of Revenue provides online filing options and offers resources to help taxpayers understand their obligations and navigate the tax system. Late filing and payment penalties may apply, so it is important for taxpayers to stay informed and comply with the state’s tax regulations.

Conclusion

Louisiana’s tax system encompasses a range of taxes, from income and sales taxes to various excise taxes and fees. Understanding these taxes is crucial for individuals and businesses operating within the state. By being aware of the tax landscape, taxpayers can ensure compliance with Louisiana’s regulations and take advantage of any available tax incentives or credits.

Stay Informed, Stay Compliant

Tax laws and regulations can change over time, so it is essential for taxpayers to stay updated on any modifications or new tax policies. The Louisiana Department of Revenue provides regular updates and resources to help taxpayers stay informed. By staying compliant with Louisiana’s tax system, individuals and businesses can contribute to the state’s revenue and support the local economy.

What is the deadline for filing income taxes in Louisiana?

+The deadline for filing Louisiana income tax returns typically aligns with the federal tax deadline, which is usually April 15th of each year. However, it is essential to check for any changes or extensions, as these deadlines may vary depending on the year.

Are there any tax incentives for renewable energy projects in Louisiana?

+Yes, Louisiana offers tax incentives for renewable energy projects, including solar, wind, and biomass energy systems. These incentives aim to encourage the adoption of clean energy technologies and reduce carbon emissions.

How does Louisiana’s tax system impact small businesses?

+Louisiana provides tax incentives and programs specifically designed to support small businesses. These initiatives can include reduced tax rates, tax credits for job creation, and streamlined tax filing processes, making it easier for small businesses to thrive within the state.