Minnesota State Tax Refund

The Minnesota State Tax Refund is a topic of interest for many residents and businesses in the North Star State. Understanding the tax refund process, eligibility criteria, and timelines is crucial for individuals and entities looking to maximize their financial returns. In this comprehensive guide, we will delve into the intricacies of the Minnesota State Tax Refund, offering expert insights and practical information to help you navigate the process with ease.

Understanding the Minnesota State Tax Refund

The Minnesota State Tax Refund is a refund of overpaid state taxes to eligible taxpayers. It is an essential aspect of the state’s tax system, ensuring that taxpayers receive their fair share of deductions and credits. The refund process is designed to provide financial relief and support to individuals and businesses, promoting economic stability and growth.

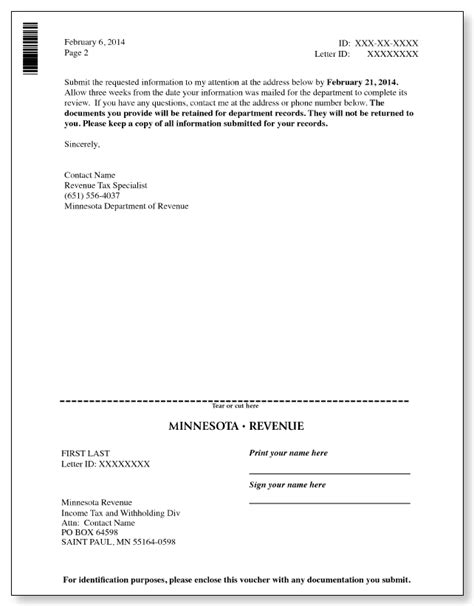

The Minnesota Department of Revenue plays a pivotal role in managing the tax refund process. They are responsible for administering state tax laws, collecting taxes, and processing refund claims. Their dedication to transparency and efficiency ensures that taxpayers receive their refunds promptly and accurately.

Eligibility and Criteria

Not everyone is eligible for a Minnesota State Tax Refund. The eligibility criteria are determined by various factors, including income level, residency status, and tax filing status. Understanding these criteria is crucial to determining if you qualify for a refund.

Income level is a significant factor in determining eligibility. Taxpayers with low to moderate incomes are often eligible for larger refunds, as they may qualify for specific deductions and credits designed to support lower-income households. These deductions and credits can significantly reduce the tax burden, resulting in substantial refunds.

Residency status is another crucial aspect. To be eligible for a Minnesota State Tax Refund, individuals must be residents of the state. Non-residents who work or own property in Minnesota may also be eligible for refunds, depending on their specific circumstances.

Additionally, tax filing status influences eligibility. Married couples, single individuals, and heads of households may have different refund amounts based on their filing status and the deductions and credits available to them.

Tax Refund Calculation and Process

Calculating the exact amount of your Minnesota State Tax Refund can be complex, as it involves various factors and tax laws. However, the basic principle is straightforward: your refund is the difference between the total taxes you paid and the amount you actually owe based on your income, deductions, and credits.

The process begins with filing your state tax return accurately and on time. The Department of Revenue provides comprehensive guidelines and resources to assist taxpayers in completing their returns. It is essential to gather all relevant tax documents, including W-2 forms, 1099 forms, and receipts for deductions and credits.

Once you have filed your return, the Department of Revenue reviews and processes it. They verify the accuracy of the information and calculate your refund amount. If there are any discrepancies or errors, they may contact you for further clarification or documentation.

The processing time for tax refunds can vary depending on the complexity of your return and the volume of refund claims received by the Department of Revenue. Typically, refunds are issued within a few weeks to a couple of months. However, it is essential to plan accordingly and be aware of any potential delays, especially during peak tax seasons.

Maximizing Your Minnesota State Tax Refund

Maximizing your Minnesota State Tax Refund requires a strategic approach and an understanding of the available deductions and credits. Here are some key strategies to consider:

Deductions and Credits

Minnesota offers various deductions and credits to reduce your tax liability and increase your refund. These include:

- Standard Deduction: A basic deduction that reduces your taxable income. The amount varies based on filing status.

- Personal Exemptions: A deduction for each dependent you claim on your tax return.

- Itemized Deductions: Includes expenses such as medical costs, charitable donations, and state and local taxes.

- Credit for Property Tax Paid: A credit available to homeowners and renters, reducing the tax burden on property owners.

- Working Family Credit: A refundable credit for low- to moderate-income working families, providing significant financial relief.

- Education Credits: Credits available for higher education expenses, helping families afford college tuition.

It is essential to explore all available deductions and credits relevant to your situation to maximize your refund.

Tax Planning Strategies

Effective tax planning can help you optimize your tax situation and increase your refund. Here are some strategies to consider:

- Maximize Retirement Contributions: Contributions to retirement accounts, such as 401(k)s and IRAs, can reduce your taxable income and increase your refund.

- Charitable Donations: Donating to qualified charities can provide a tax benefit, especially if you itemize your deductions.

- Home Ownership: Owning a home can provide tax benefits through deductions for mortgage interest and property taxes.

- Education Savings: Saving for education expenses through dedicated savings accounts can offer tax advantages.

- Healthcare Costs: Keeping track of healthcare expenses, including insurance premiums and out-of-pocket costs, can lead to significant deductions.

Consulting with a tax professional or utilizing tax preparation software can help you navigate these strategies and ensure you are taking full advantage of the available benefits.

The Future of Minnesota State Tax Refunds

The Minnesota State Tax Refund system is continuously evolving to meet the needs of its residents and businesses. The state government and the Department of Revenue are dedicated to improving the tax refund process, ensuring fairness, and providing economic support.

One significant development is the increasing focus on digital tax filing and refund processing. The Department of Revenue is investing in modern technology to streamline the process, making it more efficient and secure. Online filing and refund tracking systems are becoming more user-friendly, allowing taxpayers to manage their refunds with ease.

Additionally, the state is exploring ways to simplify the tax code and make it more accessible to taxpayers. Efforts are being made to reduce complexity and provide clearer guidelines, ensuring that taxpayers can understand and navigate the tax system with confidence.

Looking ahead, the future of Minnesota State Tax Refunds is promising. The state is committed to supporting its residents and businesses through a fair and efficient tax system. With ongoing improvements and a focus on taxpayer satisfaction, the process will continue to evolve, providing financial relief and stability to Minnesotans.

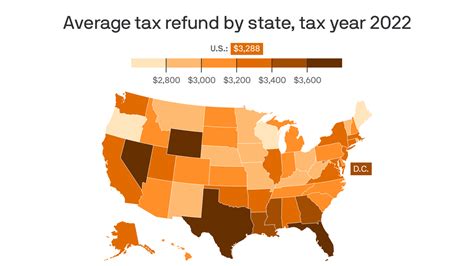

| Tax Year | Total Refunds Issued | Average Refund Amount |

|---|---|---|

| 2021 | $2.5 billion | $700 |

| 2020 | $2.3 billion | $650 |

| 2019 | $2.2 billion | $620 |

When can I expect my Minnesota State Tax Refund?

+The processing time for tax refunds can vary, but typically, refunds are issued within 4 to 6 weeks after filing. However, during peak tax seasons, it may take longer. The Department of Revenue provides online tools to track the status of your refund.

How do I check the status of my Minnesota State Tax Refund?

+You can check the status of your refund online through the Department of Revenue’s website. Simply enter your personal information, and you will receive an update on the processing of your refund.

What if I have a question or need assistance with my Minnesota State Tax Refund?

+The Department of Revenue offers comprehensive resources and support. You can visit their website, call their helpline, or schedule an appointment with a tax specialist for personalized assistance.