Tax Attorney Philadelphia Pa

Navigating the complex world of tax law is a challenging endeavor, especially when it involves a bustling metropolis like Philadelphia. For individuals and businesses alike, seeking the expertise of a Tax Attorney can be a crucial step towards ensuring compliance, minimizing liabilities, and safeguarding their financial interests. In the City of Brotherly Love, where tax regulations can be as intricate as the city's rich history, understanding the role of a Tax Attorney and how to find the right one is essential.

Understanding the Role of a Tax Attorney in Philadelphia

A Tax Attorney is a legal professional specializing in matters related to taxation. In Philadelphia, a city known for its diverse economy and complex tax landscape, the role of a Tax Attorney extends far beyond simple tax return preparation. These legal experts play a pivotal role in guiding individuals and businesses through the labyrinth of federal, state, and local tax laws, ensuring they meet their obligations while optimizing their financial strategies.

The scope of a Tax Attorney's work in Philadelphia is diverse. They can assist with a wide array of tax-related issues, including but not limited to:

- Compliance and Planning: Ensuring clients adhere to all relevant tax laws and regulations, and devising strategies to minimize tax liabilities.

- Audit Representation: Acting as a client's advocate during tax audits, ensuring fair treatment and a favorable outcome.

- Tax Dispute Resolution: Negotiating with tax authorities to resolve disputes and potential penalties.

- Estate and Business Tax Planning: Providing guidance on tax-efficient estate planning and business structures.

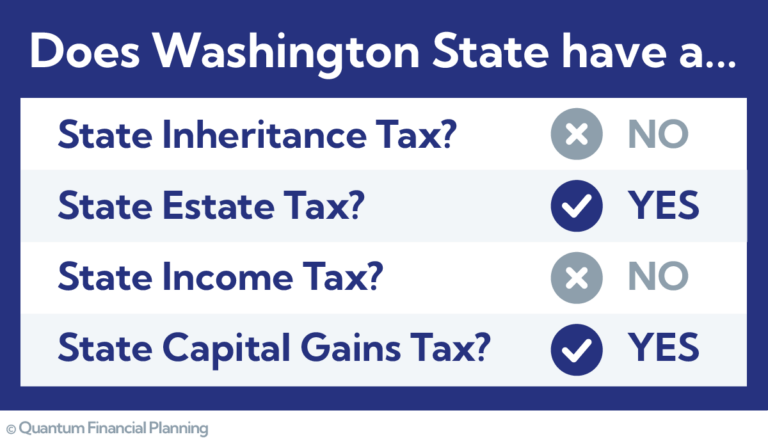

- International Tax Matters: Assisting clients with cross-border tax issues, ensuring compliance with global tax regulations.

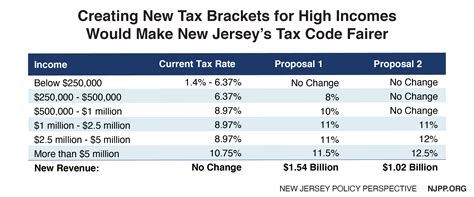

The importance of a Tax Attorney's role in Philadelphia cannot be overstated, especially given the city's unique tax environment. Philadelphia levies a Wage Tax, one of the highest in the nation, and has a complex system of Business Privilege Taxes and Net Profits Taxes for businesses operating within city limits. Additionally, Pennsylvania has its own set of state taxes, and the interplay between federal, state, and local taxes can be intricate and challenging to navigate.

Finding the Right Tax Attorney in Philadelphia

With the multitude of tax professionals in Philadelphia, finding the right Tax Attorney can be a daunting task. However, by following a systematic approach and considering key factors, individuals and businesses can ensure they find a legal expert who best suits their needs.

Research and Expertise

Begin by conducting thorough research. Look for Tax Attorneys who have extensive experience in Philadelphia’s tax landscape. Consider their specialization. Do they focus on individual tax matters, business taxes, or both? Check their background, educational qualifications, and professional affiliations. Membership in organizations like the American Bar Association (ABA) Section of Taxation or the Pennsylvania Bar Association can be indicative of a higher level of expertise and professionalism.

Client Reviews and Testimonials

Word-of-mouth recommendations can be invaluable. Seek referrals from trusted sources, such as colleagues, friends, or other professionals. Check online reviews and testimonials to gauge the attorney’s reputation and client satisfaction. Be cautious of attorneys with a high volume of negative reviews, especially if they pertain to communication issues or a lack of expertise.

Communication and Compatibility

Tax matters can be highly sensitive and complex. It’s crucial to find an attorney who communicates effectively and in a manner that you understand. Schedule a consultation to discuss your specific tax issues. Pay attention to how the attorney listens, explains concepts, and provides solutions. A good Tax Attorney should make you feel comfortable and confident in their ability to handle your case.

Fees and Payment Structures

Tax Attorneys in Philadelphia may charge by the hour, by the project, or offer a flat rate for certain services. Discuss fee structures upfront and ensure you understand all associated costs. Be wary of significantly lower fees, as they may indicate a lack of experience or expertise. A comprehensive fee agreement should outline all expected costs, including potential additional fees for unexpected complications.

Specialized Services

Depending on your specific needs, you may require a Tax Attorney who specializes in a particular area. For instance, if you’re facing a complex IRS audit or have significant international tax issues, you may need an attorney with specialized knowledge in these areas. Conversely, if you’re a small business owner, you might benefit from an attorney who understands the unique tax challenges faced by startups and small businesses in Philadelphia.

The Future of Tax Law in Philadelphia

As the tax landscape in Philadelphia and beyond continues to evolve, the role of Tax Attorneys becomes increasingly vital. With the advent of new tax laws and regulations, such as the Tax Cuts and Jobs Act and its impact on individual and business taxes, Tax Attorneys will play a critical role in helping clients navigate these changes. Additionally, as Philadelphia continues to attract businesses and individuals, the demand for Tax Attorneys who can provide specialized services and strategic tax planning will likely grow.

Furthermore, the rise of digital technologies and the increasing complexity of global tax regulations mean Tax Attorneys must stay abreast of the latest developments and utilize innovative tools to provide efficient and effective services. This includes leveraging technology for tax compliance, planning, and dispute resolution, as well as staying informed about international tax treaties and their implications for Philadelphia-based businesses and individuals.

In conclusion, the role of a Tax Attorney in Philadelphia is multifaceted and essential. From ensuring compliance to offering strategic tax planning, these legal experts provide invaluable services to individuals and businesses navigating the complex tax landscape. As the city continues to thrive economically, the demand for skilled Tax Attorneys will only increase, making this an exciting and critical field for legal professionals and those seeking their expertise.

What is the role of a Tax Attorney in Philadelphia?

+A Tax Attorney in Philadelphia specializes in guiding individuals and businesses through complex tax laws and regulations, ensuring compliance, minimizing liabilities, and providing strategic tax planning. They represent clients during tax audits, negotiate with tax authorities, and assist with various tax-related matters, including estate and business tax planning.

How do I find the right Tax Attorney in Philadelphia?

+Finding the right Tax Attorney involves research, checking client reviews, ensuring effective communication, understanding fee structures, and considering specialized services. Look for attorneys with expertise in Philadelphia’s unique tax landscape, strong professional affiliations, and a track record of successful cases.

What are the key considerations when choosing a Tax Attorney in Philadelphia?

+Key considerations include the attorney’s expertise in Philadelphia’s tax laws, their specialization (individual or business taxes), communication skills, fee structure, and whether they offer specialized services relevant to your specific tax needs.