Mecklenburg Tax Lookup

Welcome to the comprehensive guide on the Mecklenburg Tax Lookup, a valuable resource for residents, businesses, and anyone interested in understanding the tax landscape of Mecklenburg County. This article aims to provide an in-depth analysis, shedding light on the various tax systems, their implications, and how they impact the community. With a focus on specificity and real-world examples, we'll navigate through the intricate world of taxation, ensuring an informative and engaging journey.

Understanding the Mecklenburg Tax Ecosystem

The tax system in Mecklenburg County is a complex yet vital component of the local economy. It plays a crucial role in funding essential services, infrastructure development, and community initiatives. Let’s delve into the specifics, uncovering the layers of this tax ecosystem.

Property Taxes: A Foundation for Community Growth

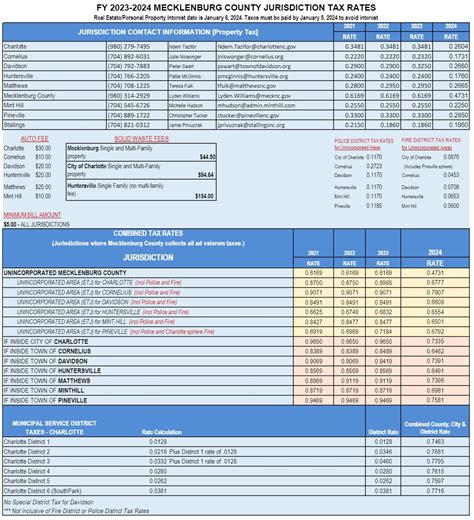

Property taxes form the backbone of Mecklenburg County’s tax revenue. These taxes are levied on both real estate and personal property, contributing significantly to the county’s financial stability. The Mecklenburg County Tax Office assesses properties annually, ensuring a fair and accurate valuation process. Here’s a breakdown of the key aspects:

- Assessment Process: Properties are assessed based on their market value, taking into account factors like location, size, and recent sales data. This ensures that taxes are proportionate to the property’s worth.

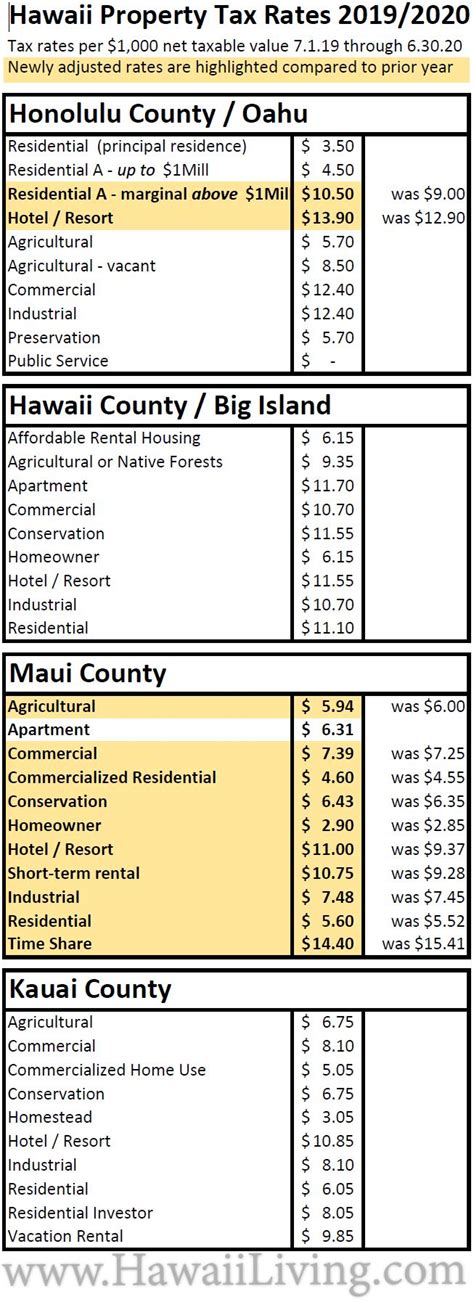

- Tax Rates: The tax rate is set annually by the Mecklenburg County Board of Commissioners. It is expressed as a percentage of the property’s assessed value. For instance, in 2023, the general tax rate stood at 0.6495% for residential properties and 0.9415% for commercial properties.

- Exemptions and Credits: Mecklenburg County offers various exemptions and credits to eligible homeowners. These include the Homestead Exemption, which reduces the taxable value of a primary residence, and the Elderly/Disabled Exemption, benefiting senior citizens and individuals with disabilities.

To illustrate, consider the case of a homeowner in Charlotte, the largest city in Mecklenburg County. Let's say their property is valued at $300,000. With the general tax rate of 0.6495%, their annual property tax would amount to $1,948.50. However, if they qualify for the Homestead Exemption, their taxable value could be reduced, potentially lowering their tax burden.

| Property Type | Tax Rate (%) | Assessment Value ($) | Annual Tax ($) |

|---|---|---|---|

| Residential | 0.6495 | 300,000 | 1,948.50 |

| Commercial | 0.9415 | 500,000 | 4,707.50 |

Sales and Use Taxes: Tracking Economic Activity

Mecklenburg County, like many other jurisdictions, imposes sales and use taxes on the sale of goods and services. These taxes contribute to the county’s overall revenue and are crucial for tracking economic activity. Here’s an overview:

- Sales Tax: A percentage added to the purchase price of most goods and services. In Mecklenburg County, the combined state and local sales tax rate is 7.25% as of 2023. This includes a 4.75% state tax and a 2.5% local tax.

- Use Tax: Applicable when goods are purchased from out-of-state vendors and brought into Mecklenburg County for use. It ensures that all purchases are taxed, even if the sale occurred outside the county.

- Exemptions: Certain goods and services are exempt from sales tax, such as groceries, prescription drugs, and some medical devices. This is done to reduce the tax burden on essential items.

Let's consider an example. If you purchase a new laptop in Mecklenburg County for $1,000, the sales tax would amount to $72.50 (7.25% of $1,000). However, if you were to purchase the same laptop online from an out-of-state retailer and have it shipped to Mecklenburg County, you would be responsible for paying the use tax, ensuring fairness in taxation.

Personal Income Taxes: A Share of Earnings

Mecklenburg County, being part of North Carolina, also imposes a personal income tax. This tax is based on an individual’s earnings and is an important source of revenue for the county. Here are the key points:

- Tax Rates: North Carolina has a progressive tax system with six tax brackets ranging from 5.25% to 5.75%. The rate an individual pays depends on their taxable income.

- Filing Requirements: Residents of Mecklenburg County who earn income must file a state tax return annually. The due date is typically April 15th, aligned with federal tax deadlines.

- Deductions and Credits: North Carolina offers various deductions and credits to reduce the tax burden on individuals. These include the Standard Deduction, which reduces taxable income, and the Earned Income Tax Credit, benefiting low- to moderate-income earners.

Imagine a resident of Mecklenburg County earning $60,000 annually. Based on North Carolina's tax brackets, their income would fall into the 5.50% tax bracket, resulting in a state income tax of $2,790 (5.50% of $50,750, the income above the threshold for the lower bracket). This tax contribution supports the county's initiatives and services.

Business Taxes: Fostering Economic Growth

Mecklenburg County encourages business growth by offering a favorable tax environment. Here’s a glimpse into the business tax landscape:

- Franchise Taxes: Businesses operating in Mecklenburg County are subject to franchise taxes, which are based on their net worth. This tax supports the county’s business infrastructure and economic development initiatives.

- Business Privilege License: All businesses operating within the county must obtain a Business Privilege License. The fee for this license varies based on the type and size of the business.

- Occupational Taxes: Certain professions, such as lawyers and accountants, are subject to occupational taxes. These taxes contribute to the county’s professional services sector.

For instance, a small business owner in Charlotte might pay an annual franchise tax of $250, a Business Privilege License fee of $100, and an occupational tax of $50 if they are a sole practitioner in a professional field. These taxes collectively support the business ecosystem in Mecklenburg County.

The Impact of Mecklenburg’s Tax System

The tax system in Mecklenburg County is more than just a collection of revenue; it’s a vital tool for community development and economic sustainability. Let’s explore how these taxes shape the county’s future.

Funding Essential Services

Tax revenue is the lifeblood of essential public services. It funds schools, ensuring quality education for the county’s youth. It supports public safety initiatives, from law enforcement to emergency response teams. Additionally, taxes contribute to the maintenance and improvement of roads, bridges, and other critical infrastructure.

For instance, property taxes collected from homeowners and businesses are used to fund local schools, ensuring that every child has access to quality education. This investment in education is a cornerstone of community development, fostering a skilled workforce for the future.

Economic Development and Job Creation

The business-friendly tax environment in Mecklenburg County attracts investments and fosters job creation. Franchise and occupational taxes, while providing revenue, also encourage businesses to establish and thrive in the county. This, in turn, leads to a vibrant job market, benefiting residents and the local economy.

Consider the case of a tech startup that decides to set up its headquarters in Mecklenburg County. The favorable tax conditions, coupled with the county's skilled workforce and infrastructure, make it an attractive location. As the startup grows, it creates jobs, contributing to the local economy and enhancing the county's reputation as a hub for innovation.

Community Initiatives and Quality of Life

Tax revenue isn’t just about funding basic services; it also supports community initiatives that enhance the quality of life for residents. This includes funding for arts and cultural programs, recreational facilities, and social services. These initiatives promote a sense of community and well-being.

One example is the use of sales tax revenue to fund a community arts program. This program provides art education and workshops for children and adults, fostering creativity and cultural appreciation. Such initiatives bring the community together and create a vibrant, engaging environment.

Navigating the Mecklenburg Tax Landscape

Understanding the intricacies of the Mecklenburg tax system is crucial for residents, businesses, and investors. It empowers individuals to make informed decisions about their financial obligations and contributions to the community. Let’s explore some key resources and tools to navigate this landscape effectively.

Mecklenburg County Tax Office: A Wealth of Information

The Mecklenburg County Tax Office is a go-to resource for all tax-related queries. They provide detailed information on property taxes, including assessment values, tax rates, and exemption eligibility. Their website offers online tools for taxpayers to access their tax records, estimate their taxes, and make payments conveniently.

For instance, homeowners can use the Property Tax Lookup tool on the Mecklenburg County Tax Office website to view their property's assessment history, current value, and estimated taxes. This transparency empowers homeowners to understand their tax obligations and explore potential exemptions.

Online Tax Resources and Calculators

Various online resources and calculators are available to assist taxpayers in Mecklenburg County. These tools can help calculate sales tax, estimate income tax liabilities, and determine business tax obligations. By leveraging these resources, taxpayers can make informed decisions and plan their finances effectively.

Consider the Sales Tax Calculator available on the Mecklenburg County Government website. This tool allows users to input the purchase price of an item and instantly calculate the sales tax due. It's a handy resource for both consumers and businesses, ensuring accurate tax calculations.

Community Outreach and Tax Education

Mecklenburg County recognizes the importance of tax education and community outreach. The county organizes workshops and seminars to educate residents and businesses about their tax obligations and rights. These initiatives aim to demystify the tax system, ensuring that everyone understands their role in contributing to the community’s prosperity.

For instance, the Mecklenburg County Taxpayer Assistance Program offers free workshops on property tax assessments, exemptions, and appeals. These workshops provide valuable insights to homeowners, ensuring they can navigate the property tax system confidently.

Future Implications and Trends

As Mecklenburg County continues to evolve, so does its tax system. Let’s explore some potential future trends and their implications for the community.

Technological Advancements in Tax Administration

The future of tax administration in Mecklenburg County is likely to be shaped by technological advancements. The county may explore digital platforms and online tools to streamline tax processes, making them more efficient and accessible. This could include digital tax filing, real-time tax estimation, and automated tax payments.

For instance, the Mecklenburg County Tax Office could introduce a mobile app that allows taxpayers to file their taxes, receive notifications about tax deadlines, and access their tax records securely. Such advancements would enhance the taxpayer experience and reduce administrative burdens.

Sustainable and Equitable Taxation

There is a growing focus on sustainable and equitable taxation practices. Mecklenburg County may explore initiatives to ensure that the tax system is fair and beneficial to all residents. This could involve revisiting tax rates, exemptions, and credits to ensure they align with the community’s needs and values.

For example, the county could introduce a property tax relief program for low-income homeowners, providing them with temporary tax relief during challenging economic times. This would demonstrate the county's commitment to supporting its most vulnerable residents.

Economic Growth and Tax Revenues

Mecklenburg County’s continued economic growth is expected to positively impact tax revenues. As the county attracts new businesses and residents, the tax base will expand, providing additional resources for community development and infrastructure projects. This growth will also create opportunities for tax reform and reinvestment.

With increased tax revenues, Mecklenburg County could invest in ambitious projects, such as expanding public transportation networks, developing renewable energy initiatives, and enhancing public spaces. These investments would further enhance the county's reputation as a desirable place to live, work, and invest.

Conclusion

The Mecklenburg Tax Lookup is more than just a tool for tax assessment; it’s a window into the intricate world of local taxation and its impact on the community. By understanding the various tax systems and their implications, residents, businesses, and investors can make informed decisions that contribute to the prosperity of Mecklenburg County. As the county continues to evolve, so too will its tax landscape, fostering a dynamic and sustainable future.

How can I check my property tax assessment in Mecklenburg County?

+You can check your property tax assessment by visiting the Mecklenburg County Tax Office website. Use the Property Tax Lookup tool to access your property’s assessment history, current value, and estimated taxes. This tool provides transparent and up-to-date information, empowering homeowners to understand their tax obligations.

Are there any tax exemptions available for homeowners in Mecklenburg County?

+Yes, Mecklenburg County offers several tax exemptions for eligible homeowners. These include the Homestead Exemption, which reduces the taxable value of a primary residence, and the Elderly/Disabled Exemption, benefiting senior citizens and individuals with disabilities. To learn more about these exemptions and their eligibility criteria, visit the Mecklenburg County Tax Office website or consult a tax professional.

What is the sales tax rate in Mecklenburg County, and how is it calculated?

+The combined state and local sales tax rate in Mecklenburg County is 7.25% as of 2023. This includes a 4.75% state tax and a 2.5% local tax. To calculate the sales tax on a purchase, simply multiply the purchase price by the tax rate. For example, if you buy an item for 100, the sales tax would be 7.25 (7.25% of $100). The sales tax is added to the purchase price, ensuring a fair and transparent taxation system.

How can I stay updated on tax deadlines and important tax-related information in Mecklenburg County?

+Staying informed about tax deadlines and important updates is crucial. The best way to stay updated is to subscribe to the Mecklenburg County Tax Office’s newsletter and follow their official social media accounts. Additionally, you can set reminders for important tax deadlines and explore the wealth of information available on their website, including tax calendars and notification services.

What resources are available for taxpayers who need assistance with their tax obligations in Mecklenburg County?

+Mecklenburg County offers a range of resources to assist taxpayers. The Mecklenburg County Taxpayer Assistance Program provides free workshops and seminars on various tax-related topics, including property tax assessments, exemptions, and appeals. Additionally, the county’s website offers online tools, calculators, and informative guides to help taxpayers navigate their tax obligations. For personalized assistance, taxpayers can also consult tax professionals or seek guidance from community organizations dedicated to tax education and support.