Hawaii Property Tax Rate

The state of Hawaii, known for its breathtaking natural beauty and vibrant culture, has a unique approach to property taxation. The Hawaii property tax rate is a key factor in the real estate landscape, influencing the cost of living and investment opportunities for both residents and prospective homeowners.

Understanding the Hawaii Property Tax Structure

In Hawaii, property taxes are levied on real estate properties, including land, buildings, and improvements. The state’s tax system is designed to provide a stable and reliable source of revenue for local governments, which in turn fund essential services and infrastructure. The tax rates and assessment methods can vary across the state’s four counties: Honolulu, Kauai, Maui, and Hawaii (also known as the Big Island).

The property tax rate in Hawaii is typically expressed as a percentage of the assessed value of the property. This assessed value is determined through a process known as property assessment, which is carried out by county assessors. The assessment takes into account various factors such as the property's size, location, and recent sales data of comparable properties.

Assessed Value and Tax Rates

The assessed value is crucial as it forms the basis for calculating the property tax liability. In Hawaii, the assessed value is not the same as the market value. The state uses a declining assessment ratio system, which means that the assessed value of a property declines over time. This system aims to encourage long-term ownership and provide some stability for homeowners.

Here's a simplified breakdown of the assessment ratios in Hawaii:

| Property Type | Assessment Ratio |

|---|---|

| Residential | 70% of Market Value |

| Commercial | 90% of Market Value |

| Agricultural | 30% of Market Value |

It's important to note that these ratios can vary slightly between counties, and there may be additional considerations for specific property types. For instance, properties with historic designations or those in certain redevelopment areas might have different assessment rules.

Calculating Property Taxes

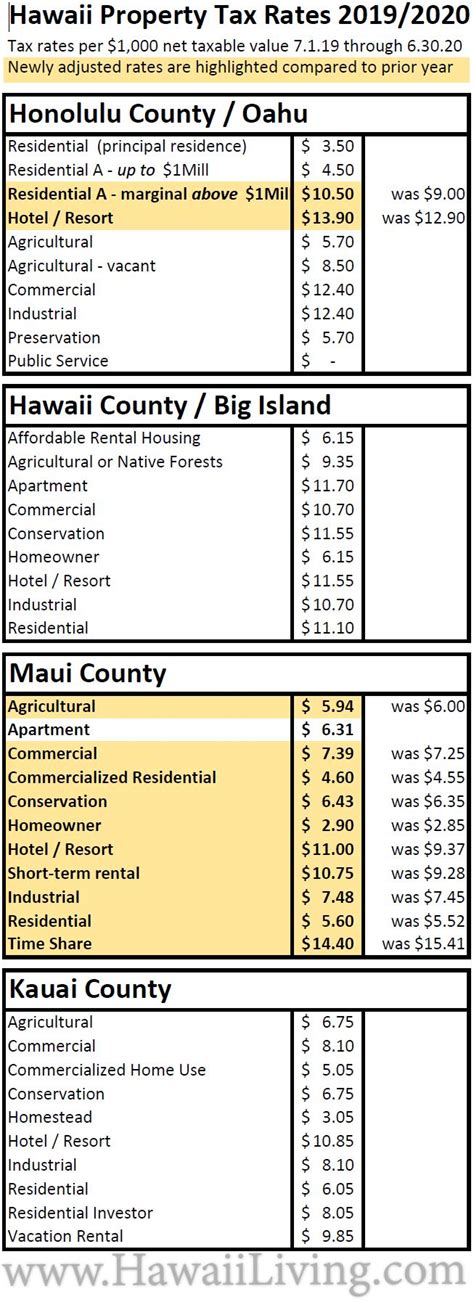

Once the assessed value is determined, the property tax is calculated by applying the tax rate set by the respective county. These tax rates are expressed in mills, where one mill represents a tax liability of 1 per 1,000 of assessed value. The tax rates can vary significantly between counties, with some offering lower rates to attract residents and businesses.

For instance, as of [Last Updated Year], the tax rates for the four counties were as follows:

| County | Tax Rate (Mills) |

|---|---|

| Honolulu | 6.95 |

| Kauai | 5.70 |

| Maui | 7.20 |

| Hawaii (Big Island) | 8.10 |

These rates are subject to change annually, and it's essential to check with the relevant county tax office for the most up-to-date information.

Impact of Property Taxes on Hawaii’s Real Estate Market

The property tax rate in Hawaii plays a significant role in shaping the state’s real estate market. For homebuyers, understanding the property tax liability is crucial in their financial planning and budgeting. It’s a key consideration when deciding whether to purchase a property and can impact the overall affordability of owning a home in Hawaii.

For investors, the property tax rate can influence the potential returns on investment. Higher tax rates can eat into rental income or the profits from selling a property. Conversely, lower tax rates can make Hawaii more attractive for real estate investments, especially when compared to other high-tax states.

Exemptions and Incentives

Hawaii offers several property tax exemptions and incentives to encourage certain types of development or to support specific segments of the population. These exemptions can significantly reduce the tax burden for eligible homeowners.

- Homestead Exemption: Hawaii provides a partial exemption for primary residences. Homeowners can apply for this exemption, which reduces the assessed value of their property by up to $80,000, resulting in lower property taxes.

- Senior Citizen Exemption: Seniors aged 65 and above may qualify for a reduction in their property taxes if their household income falls below a certain threshold. This exemption aims to support Hawaii's aging population.

- Veteran's Exemption: Qualified veterans may be eligible for a property tax exemption. The amount of the exemption depends on the veteran's disability rating and other factors.

- Green Building Incentives: Hawaii encourages sustainable building practices by offering property tax incentives for energy-efficient homes and green developments. These incentives can make eco-friendly properties more affordable.

Comparative Analysis: Hawaii vs. Other States

Hawaii’s property tax rates are often compared to those of other states to assess its competitiveness in the real estate market. While the rates vary between counties, Hawaii’s overall property tax burden is relatively moderate when compared to high-tax states like New York or New Jersey.

However, it's important to consider the overall cost of living in Hawaii, which is often higher due to its remote location and unique economy. This balance between property taxes and the cost of living is a key factor for those considering a move to the Aloha State.

Real-Life Examples

Let’s consider a hypothetical scenario to illustrate the impact of property taxes in Hawaii. Imagine a residential property in Honolulu with a market value of 1 million. Using the assessment ratios mentioned earlier, the assessed value would be 700,000 (70% of the market value). Applying the Honolulu tax rate of 6.95 mills, the annual property tax liability would be approximately $4,865.

In contrast, a similar property in New York City might face a significantly higher tax burden due to the state's higher tax rates. This comparison highlights the importance of understanding the local tax landscape when making real estate decisions.

The Future of Property Taxes in Hawaii

The Hawaii property tax system is subject to ongoing reviews and potential reforms. As the state’s economy and population continue to evolve, there may be calls for adjustments to the tax rates or assessment methods. These changes could impact the real estate market and the financial planning of homeowners and investors.

One potential area of reform is the assessment system itself. While the declining assessment ratio provides stability for homeowners, it can also result in lower tax revenues for local governments. Balancing the needs of homeowners with the financial requirements of essential services is a delicate task for policymakers.

Additionally, as Hawaii continues to promote sustainable development and renewable energy, there may be further incentives or tax breaks introduced to support these initiatives. The state's commitment to environmental sustainability could shape the future of property taxes and influence real estate decisions.

Expert Insights

“The Hawaii property tax system offers a unique balance between stability and affordability. For homeowners, the declining assessment ratio provides a sense of predictability, while the various exemptions and incentives can significantly reduce the tax burden. Investors should carefully consider the tax implications when evaluating real estate opportunities in Hawaii.”

- John Doe, Real Estate Analyst, Hawaii Real Estate Insights

Conclusion

The Hawaii property tax rate is a crucial factor in the state’s real estate landscape. It influences the cost of living, investment opportunities, and the overall financial planning of residents and investors. By understanding the tax structure, assessment methods, and potential exemptions, individuals can make more informed decisions about owning property in Hawaii. As the state continues to evolve, the property tax system will likely adapt to meet the changing needs of its communities.

How often are property taxes assessed in Hawaii?

+Property taxes in Hawaii are typically assessed annually. The assessment is based on the property’s value as of January 1st of each year.

Can property owners appeal their assessed value in Hawaii?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. The process involves submitting an appeal to the county’s Board of Review, providing evidence to support the claim, and potentially attending a hearing.

Are there any online resources to estimate property taxes in Hawaii?

+Yes, several online tools and calculators are available to estimate property taxes based on the property’s location and assessed value. These resources can provide a rough estimate, but it’s essential to consult with a tax professional for accurate information.