Tax Filing Online Quick Book

With the increasing digitalization of financial processes, tax filing has become more accessible and convenient for individuals and businesses alike. Quick Book, a popular accounting software, has revolutionized the way taxes are handled, offering a user-friendly online platform for efficient tax management. In this comprehensive guide, we delve into the world of online tax filing with Quick Book, exploring its features, benefits, and best practices to ensure a smooth and successful tax season.

The Evolution of Tax Filing: Quick Book’s Role

The traditional method of tax filing involved piles of paperwork, complicated forms, and lengthy calculations. However, the digital era has brought about a significant transformation, making tax filing a more streamlined and accessible process. Quick Book, with its innovative accounting solutions, has been at the forefront of this revolution, providing a comprehensive online platform for tax management.

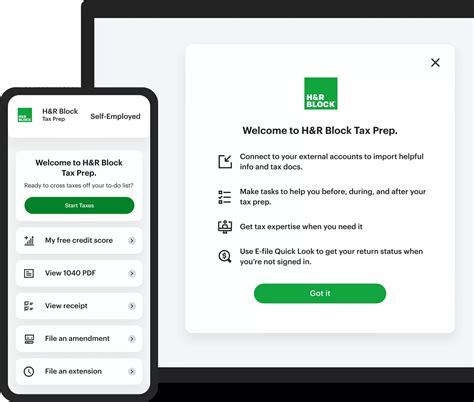

Quick Book's online tax filing service has gained popularity among small businesses, freelancers, and individuals for its ease of use and efficient features. The platform offers a user-friendly interface, allowing users to navigate through the tax filing process with minimal hassle. From income tracking to expense management and tax deduction calculations, Quick Book simplifies the entire journey, ensuring accuracy and reducing the risk of errors.

Key Features of Quick Book’s Online Tax Filing

Quick Book’s online tax filing platform boasts an array of features designed to enhance the user experience and streamline the tax filing process. Some of the notable features include:

- Income Tracking: The platform offers robust income tracking tools, allowing users to categorize and record their income sources effortlessly. Whether it's sales revenue, consulting fees, or rental income, Quick Book ensures that every income stream is accurately accounted for.

- Expense Management: Managing expenses is crucial for tax purposes, and Quick Book excels in this area. Users can easily track and categorize expenses, ensuring that they are optimized for tax deductions. The platform's expense management tools provide a clear overview of business costs, making it easier to identify areas for potential savings.

- Tax Deduction Calculations: Quick Book's advanced algorithms automate the process of calculating tax deductions. The platform considers various factors, including business expenses, personal deductions, and tax credits, to provide users with an accurate estimate of their tax liabilities. This feature saves time and effort, ensuring that users receive the maximum deductions they are entitled to.

- Real-Time Reporting: Quick Book's real-time reporting capabilities provide users with up-to-date financial insights. With instant access to financial reports, users can monitor their tax liabilities, identify potential issues, and make informed decisions to optimize their tax positions.

- Integration with Banking Services: One of the standout features of Quick Book's online tax filing platform is its seamless integration with banking services. Users can connect their bank accounts directly to the platform, allowing for automatic transaction synchronization. This feature eliminates the need for manual data entry, reducing the risk of errors and saving valuable time.

| Feature | Description |

|---|---|

| Income Tracking | Comprehensive income tracking tools for accurate record-keeping. |

| Expense Management | Efficient expense tracking and categorization for optimized tax deductions. |

| Tax Deduction Calculations | Automated tax deduction calculations based on business and personal expenses. |

| Real-Time Reporting | Instant access to financial reports for up-to-date tax insights. |

| Banking Integration | Seamless integration with banking services for automatic transaction synchronization. |

Maximizing the Benefits of Online Tax Filing with Quick Book

Quick Book’s online tax filing platform offers a range of advantages, making it a preferred choice for many taxpayers. By leveraging its features effectively, users can optimize their tax positions, streamline their financial processes, and save valuable time and resources.

Accuracy and Efficiency

One of the key benefits of using Quick Book for online tax filing is the accuracy and efficiency it brings to the table. The platform’s automated features, such as income tracking, expense management, and tax deduction calculations, minimize the risk of errors that are common in manual tax filing. By eliminating human error, users can rest assured that their tax returns are accurate, reducing the chances of audits and penalties.

Time and Cost Savings

Quick Book’s online tax filing platform is designed to save users both time and money. The user-friendly interface and automated processes streamline the tax filing journey, allowing users to complete their tax obligations quickly and efficiently. Additionally, by reducing the need for manual data entry and calculations, users can allocate their time and resources to other critical aspects of their business or personal finances.

Real-Time Financial Insights

Quick Book’s real-time reporting capabilities provide users with instant access to financial insights. This feature is particularly valuable for tax planning and decision-making. By monitoring their financial performance and tax liabilities in real-time, users can identify areas for improvement, optimize their tax strategies, and make informed choices to maximize their tax benefits.

Data Security and Privacy

Security and privacy are paramount when it comes to financial data. Quick Book understands the importance of safeguarding sensitive information, and its online tax filing platform employs robust security measures to protect user data. With encryption protocols, two-factor authentication, and regular security audits, users can have peace of mind knowing that their financial information is secure.

Future Implications and Industry Insights

As the world continues to embrace digital transformation, the role of online tax filing platforms like Quick Book is set to expand. With increasing technological advancements, we can expect further enhancements in the features and capabilities of these platforms. Here are some future implications and industry insights to consider:

Artificial Intelligence Integration

The integration of artificial intelligence (AI) is expected to revolutionize the tax filing process. AI algorithms can analyze vast amounts of data, identify patterns, and provide personalized tax recommendations. Quick Book, being at the forefront of accounting technology, is likely to incorporate AI-powered features, enhancing the accuracy and efficiency of tax management.

Cloud-Based Collaboration

The shift towards cloud-based collaboration is gaining momentum in the accounting industry. Quick Book, recognizing the benefits of cloud technology, is likely to enhance its online tax filing platform with cloud-based features. This would enable seamless collaboration between users, tax professionals, and accountants, facilitating efficient tax planning and compliance.

Data-Driven Tax Strategies

With the availability of real-time financial data and advanced analytics, taxpayers can leverage data-driven tax strategies. Quick Book’s online tax filing platform can provide users with insights and recommendations based on their financial performance, helping them optimize their tax positions and make strategic financial decisions.

Regulatory Compliance and Updates

Staying up-to-date with the latest tax regulations and compliance requirements is crucial for accurate tax filing. Quick Book’s online platform is designed to keep users informed about tax law changes and updates. By providing timely notifications and guidance, users can ensure that their tax filings are compliant with the latest regulations.

User Experience Enhancements

As technology advances, Quick Book is expected to continue refining its user experience. This includes improvements in the platform’s usability, adding new features, and enhancing existing ones. By listening to user feedback and incorporating innovative solutions, Quick Book aims to provide an exceptional tax filing experience that meets the evolving needs of its users.

How does Quick Book’s online tax filing platform compare to traditional tax filing methods?

+

Quick Book’s online tax filing platform offers several advantages over traditional methods. It provides a user-friendly interface, automated features for accuracy and efficiency, real-time financial insights, and seamless data synchronization. These benefits make the tax filing process faster, more convenient, and less prone to errors compared to manual filing.

Is Quick Book’s online tax filing platform suitable for small businesses and individuals?

+

Absolutely! Quick Book’s online tax filing platform is designed to cater to the needs of small businesses, freelancers, and individuals. Its user-friendly nature, coupled with its robust features, makes it an ideal choice for those looking for a simplified and efficient tax filing experience.

What are the key benefits of using Quick Book’s online tax filing platform?

+

Quick Book’s online tax filing platform offers a range of benefits, including accuracy, efficiency, time and cost savings, real-time financial insights, and data security. By leveraging these features, users can streamline their tax management, optimize their tax positions, and make informed financial decisions.