Marginal Tax Vs Effective Tax

In the realm of personal finance and taxation, understanding the difference between marginal tax rates and effective tax rates is crucial for making informed financial decisions. These concepts play a significant role in determining how your income is taxed and can impact your overall financial planning. Let's delve into the intricacies of marginal and effective tax rates and explore their implications.

Marginal Tax Rates: Understanding the Brackets

Marginal tax rates are the tax rates applied to each additional dollar of income you earn. They are determined by the tax brackets set by the government for different income levels. Here’s how it works:

- Progressive Tax System: Most countries, including the United States, follow a progressive tax system. This means that as your income increases, you move into higher tax brackets, resulting in a higher marginal tax rate.

- Each tax bracket has a specific range of income and a corresponding tax rate. For instance, in the US, the 2023 tax brackets for single filers start with a 10% rate for incomes up to $10,275, progressing to 12%, 22%, 24%, 32%, 35%, and finally, 37% for incomes above $540,900.

- When your income exceeds the upper limit of a bracket, you move into the next bracket, and only the amount above that limit is taxed at the higher rate. This concept is known as "bracket creep."

Let's illustrate this with an example. Suppose you're a single filer with an annual income of $60,000. Your marginal tax rate would be calculated as follows:

| Income Range | Tax Rate | Income in Range | Tax Amount |

|---|---|---|---|

| $0 - $10,275 | 10% | $10,275 | $1,027.50 |

| $10,276 - $41,775 | 12% | $30,425 | $3,651 |

| $41,776 - $89,075 | 22% | $18,225 | $4,009.50 |

| Total Taxable Income | $60,000 | $8,688 |

In this case, your marginal tax rate would be 22% because you fall within the $41,776 to $89,075 income range. However, it's important to note that only the amount above $41,775 is taxed at 22%, while the income below that threshold is taxed at lower rates.

Effective Tax Rate: The Real Picture

While marginal tax rates give you an idea of how much tax you’ll pay on your next dollar earned, the effective tax rate provides a more comprehensive view of your overall tax burden. It’s the actual percentage of your total income that goes towards paying taxes.

To calculate your effective tax rate, you divide the total amount of taxes you pay by your total taxable income. Using the previous example, your effective tax rate would be:

Effective Tax Rate = Total Taxes Paid / Total Taxable Income

Effective Tax Rate = $8,688 / $60,000

Effective Tax Rate ≈ 14.48%

So, in this scenario, you would pay approximately 14.48% of your income in taxes. This effective tax rate takes into account all the tax deductions, credits, and adjustments you're eligible for, providing a more accurate representation of your tax liability.

Implications and Planning

Understanding the difference between marginal and effective tax rates is essential for several reasons:

- Tax Planning: Knowing your marginal tax rate can help you make strategic decisions to minimize your tax burden. For instance, you might consider tax-efficient investment strategies or take advantage of deductions and credits to reduce your taxable income.

- Income Strategies: If you're close to the upper limit of a tax bracket, you may want to explore ways to structure your income to avoid bracket creep. This could involve adjusting your income sources or timing certain transactions.

- Retirement Planning: Effective tax rates are crucial when considering retirement savings options. Different retirement accounts have varying tax treatments, and understanding how your contributions and withdrawals are taxed can impact your overall financial strategy.

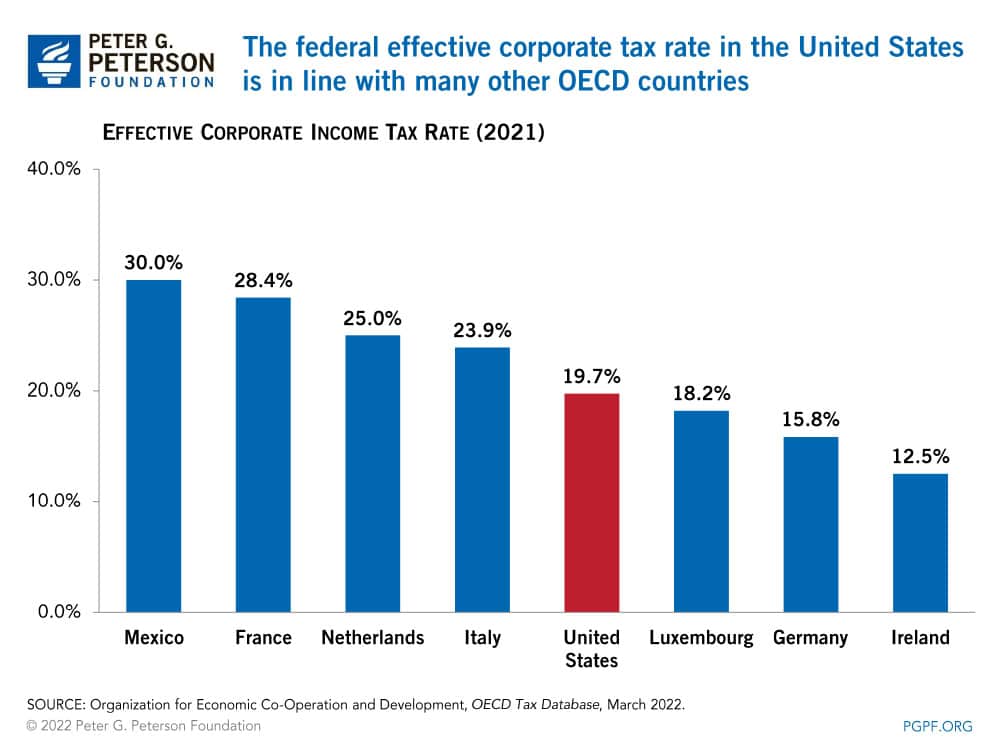

- Business Decisions: For business owners, understanding tax rates is vital for financial planning and decision-making. It can influence choices related to business structure, investment strategies, and employee compensation.

Maximizing Tax Benefits

To optimize your tax situation, consider the following strategies:

- Tax-Efficient Investing: Explore investment options that offer tax advantages, such as tax-free municipal bonds or retirement accounts like 401(k)s and IRAs.

- Tax Deductions and Credits: Take advantage of deductions and credits for which you're eligible. These can significantly reduce your taxable income and, consequently, your effective tax rate.

- Income Splitting: If you're married, consider income splitting strategies to ensure that you and your spouse are in similar tax brackets, optimizing your overall tax liability.

Real-World Example: Tax Strategies

Let’s consider a real-life scenario where understanding tax rates can make a significant difference. Imagine a high-income earner, John, who wants to maximize his tax savings. He has the option to invest in a tax-free municipal bond yielding 4% or a taxable corporate bond yielding 6%.

If John falls into the highest tax bracket of 37%, the taxable corporate bond would result in a return of only 3.78% after taxes (6% - 37% tax). In contrast, the tax-free municipal bond would provide him with the full 4% return, making it a more attractive option.

This example highlights how tax considerations can impact investment decisions and overall financial planning.

Conclusion: Navigating the Tax Landscape

Marginal and effective tax rates are two crucial concepts in the world of personal finance and taxation. By understanding these rates and their implications, you can make more informed decisions to optimize your financial well-being. Whether it’s strategic tax planning, income structuring, or investment choices, knowledge of tax rates is a powerful tool in your financial arsenal.

Stay tuned for more insights and expert advice on navigating the complex world of taxes and personal finance.

What is the difference between marginal and effective tax rates?

+Marginal tax rates refer to the tax rate applied to each additional dollar of income, while effective tax rates represent the actual percentage of your total income that goes towards taxes. Marginal rates determine how much tax you’ll pay on your next dollar earned, while effective rates provide a comprehensive view of your overall tax burden.

How do tax brackets work?

+Tax brackets are income ranges with corresponding tax rates. As your income increases, you move into higher brackets, resulting in a higher marginal tax rate. Only the income above the upper limit of a bracket is taxed at the higher rate, a concept known as “bracket creep.”

Why is it important to understand marginal and effective tax rates?

+Understanding these rates helps in strategic tax planning, income structuring, and investment decisions. It allows you to minimize your tax burden, optimize your financial strategies, and make informed choices regarding tax-efficient investments and deductions.