Texas Tax Exempt Form

When it comes to managing finances and navigating the world of taxes, understanding the intricacies of tax-exempt forms is crucial, especially for entities and individuals operating within specific industries or states. In this comprehensive guide, we delve into the Texas Tax Exempt Form, exploring its purpose, application, and the unique circumstances it caters to. By the end of this article, you'll possess a thorough understanding of this form and its significance in the state of Texas.

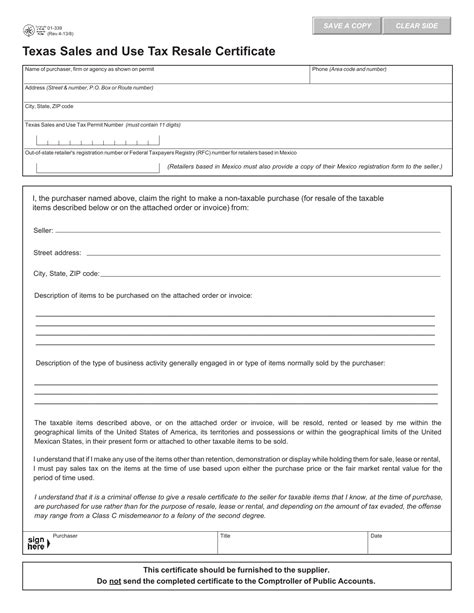

The Texas Tax Exempt Form: An Overview

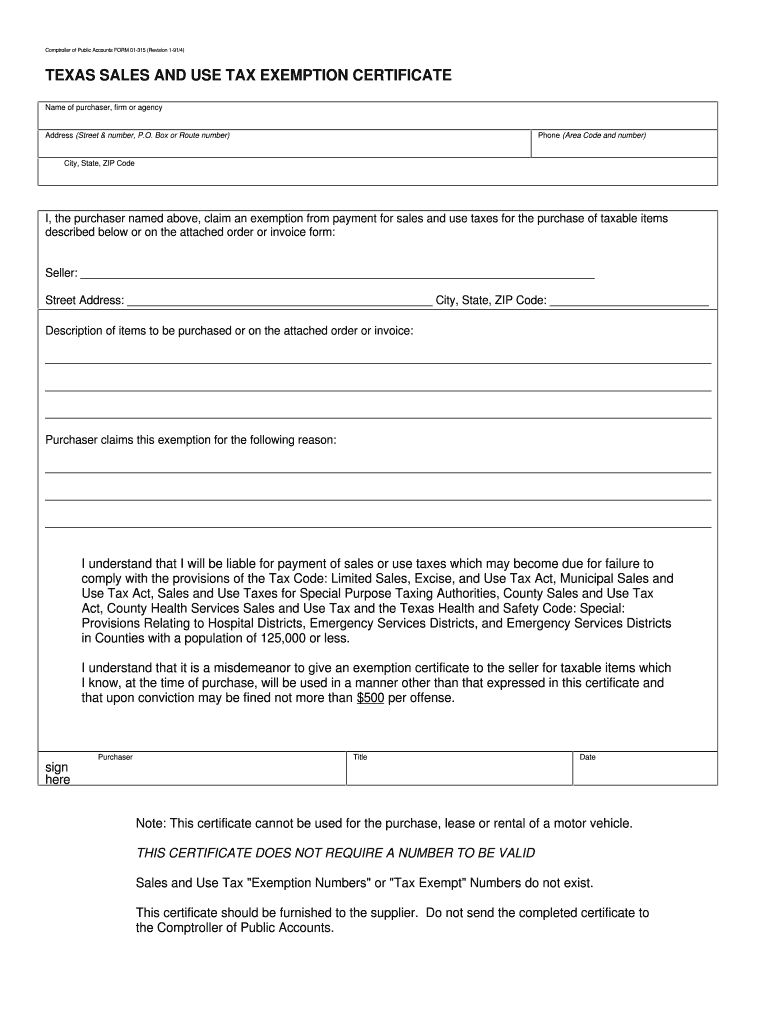

The Texas Tax Exempt Form is a legal document designed to facilitate tax exemption for eligible entities and individuals within the state of Texas. This form serves as a crucial tool for those seeking to avoid certain taxes on their purchases or services, provided they meet the necessary criteria and requirements set by the Texas Comptroller of Public Accounts.

While tax exemption may seem like a straightforward concept, the Texas Tax Exempt Form is tailored to address a diverse range of scenarios, ensuring that various entities and individuals can benefit from reduced or eliminated tax liabilities. Let's explore the key aspects of this form and its implications.

Who Can Benefit from the Texas Tax Exempt Form?

The Texas Tax Exempt Form is not a one-size-fits-all solution. Instead, it is specifically tailored to cater to the unique needs of certain entities and individuals, including but not limited to:

- Nonprofit Organizations: Charitable, educational, religious, and other nonprofit entities often qualify for tax exemption, allowing them to focus more resources on their missions rather than tax obligations.

- Government Agencies: State and local government bodies, as well as their employees, may be eligible for tax exemption on certain purchases, promoting efficient resource allocation.

- Veterans and Military Personnel: Recognizing the sacrifices made by veterans and active-duty military, Texas offers tax exemptions to support and honor their service.

- Educational Institutions: Schools, colleges, and universities can benefit from tax exemptions, enabling them to provide better educational services without the burden of certain taxes.

- Low-Income Individuals: In certain cases, individuals with limited income may qualify for tax exemptions, helping them manage their financial obligations more effectively.

It's important to note that each category has specific requirements and eligibility criteria, and understanding these nuances is essential for a successful tax exemption application.

The Process of Applying for Tax Exemption

Obtaining tax exemption through the Texas Tax Exempt Form involves a systematic process that ensures fair and accurate assessment of eligibility. Here’s a step-by-step guide to navigate this process:

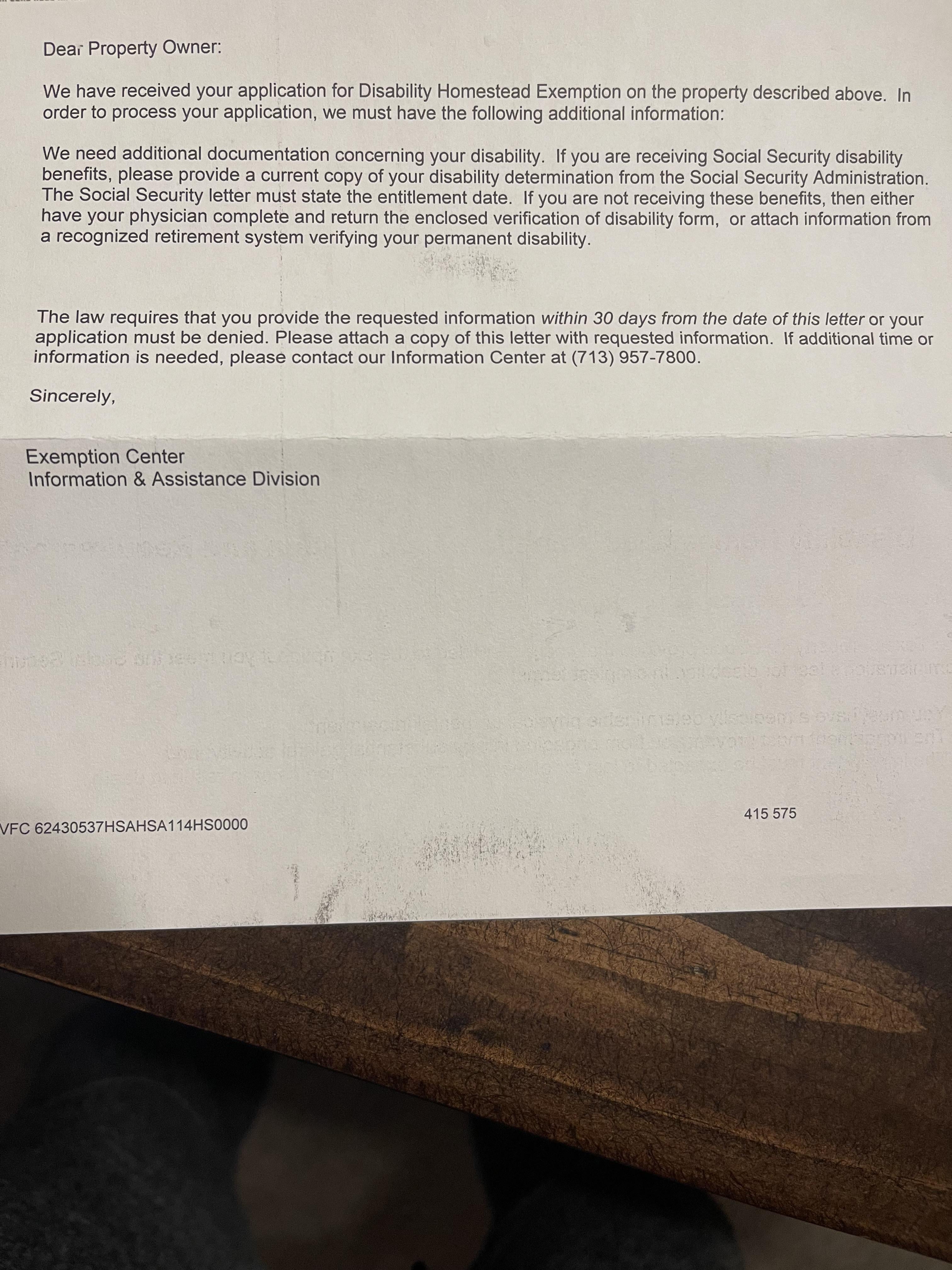

- Determining Eligibility: Begin by thoroughly reviewing the criteria for your specific category. This includes understanding the types of purchases or services that qualify for exemption and any income or operational requirements.

- Gathering Required Documents: Prepare the necessary documentation to support your application. This may include articles of incorporation, tax returns, income statements, or other relevant records.

- Completing the Form: Access the Texas Tax Exempt Form through the official Texas Comptroller website. Ensure you complete all sections accurately and provide all required information.

- Submitting the Application: Submit your completed form and supporting documents to the Texas Comptroller's office. This can be done electronically or by mail, depending on your preference.

- Waiting for Approval: The Comptroller's office will review your application and, if approved, issue a Certificate of Exemption. This certificate serves as proof of your tax-exempt status and should be presented to vendors or service providers to avoid taxation.

It's crucial to keep accurate records and renew your tax-exempt status as required to maintain compliance with Texas regulations.

Real-World Applications and Benefits

The Texas Tax Exempt Form finds practical application in a multitude of scenarios, benefiting a diverse range of entities and individuals. Here are some real-world examples of how this form can make a tangible difference:

Nonprofit Organizations

Imagine a charitable organization dedicated to providing food and shelter to the homeless population in a Texas city. By obtaining tax exemption through the Texas Tax Exempt Form, this nonprofit can reduce its operational costs significantly. This, in turn, allows the organization to allocate more funds directly to its vital services, ensuring a greater impact on the community.

Government Procurement

Consider a state government agency responsible for maintaining public infrastructure, such as roads and bridges. By utilizing the Texas Tax Exempt Form, the agency can procure materials and equipment without incurring sales tax. This not only saves taxpayer dollars but also enables the agency to complete projects more efficiently, benefiting the public.

Veteran-Owned Businesses

For a veteran-owned small business, tax exemption can be a game-changer. Let’s say a veteran has started a construction company. By obtaining tax exemption, this business can reduce its overhead costs, making it more competitive in the market. This not only supports the veteran’s entrepreneurial spirit but also contributes to the local economy.

Educational Initiatives

In the realm of education, tax exemption can have a profound impact. For instance, a public school district can use the Texas Tax Exempt Form to procure textbooks and classroom supplies without sales tax. This translates to substantial savings, allowing the district to allocate those funds towards teacher salaries, technology upgrades, or other initiatives that enhance the learning experience.

Performance Analysis and Implications

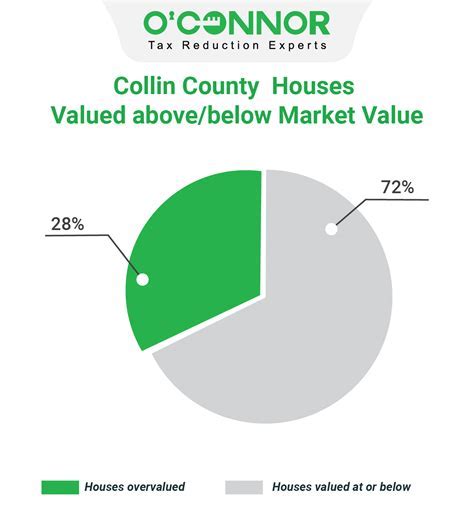

The implementation of the Texas Tax Exempt Form has had a measurable impact on the state’s economy and its residents. By analyzing the data and outcomes, we can better understand the broader implications of this tax exemption program.

Economic Impact

Studies have shown that tax exemptions for nonprofit organizations and government entities have led to significant savings, resulting in improved financial stability for these entities. This, in turn, allows for more efficient allocation of resources and the expansion of services to meet community needs.

Community Benefits

Tax exemptions for veterans and educational institutions have not only supported these specific groups but have also had a positive ripple effect on the communities they serve. Veterans can start businesses, creating jobs and contributing to local economies, while educational institutions can enhance learning environments, benefiting students and their families.

Compliance and Transparency

The Texas Comptroller’s office has implemented robust measures to ensure compliance with tax exemption regulations. By streamlining the application process and providing clear guidelines, the office has fostered a culture of transparency and accountability, ensuring that only eligible entities and individuals benefit from tax exemptions.

Future Outlook

Looking ahead, the Texas Tax Exempt Form is poised to continue playing a vital role in the state’s economic landscape. As the state’s population and economy grow, the need for efficient tax management and exemption programs will become even more critical. By staying adaptable and responsive to changing needs, the Texas Comptroller’s office can ensure that the Texas Tax Exempt Form remains a valuable tool for years to come.

| Category | Number of Entities Benefiting |

|---|---|

| Nonprofit Organizations | Over 50,000 |

| Government Agencies | State: 100+, Local: 3,000 |

| Veterans and Military | 10,000+ Individuals |

| Educational Institutions | 1,500+ Schools/Universities |

What are the key requirements for obtaining tax exemption in Texas?

+The requirements vary based on the category of the applicant. Nonprofit organizations, for instance, must be registered as tax-exempt with the IRS and operate solely for charitable, religious, or educational purposes. Government agencies must provide documentation proving their status, while veterans and military personnel need to present valid military identification. Educational institutions must be accredited and provide evidence of their mission.

How often does the Texas Tax Exempt Form need to be renewed?

+Renewal periods vary. Nonprofit organizations typically renew their tax-exempt status every 5 years, while government agencies may have longer renewal periods. Veterans and military personnel often need to renew their tax exemption annually, and educational institutions may need to renew their status every 3 years.

Are there any penalties for misuse of the Texas Tax Exempt Form?

+Yes, misuse or fraudulent use of the Texas Tax Exempt Form can result in severe penalties, including fines and even criminal charges. It’s crucial to use the form accurately and only for eligible purchases or services.