Car Sales Tax In Florida

When purchasing a vehicle in Florida, understanding the intricacies of sales tax is crucial. Florida's sales tax system, while straightforward, offers unique considerations for car buyers. This comprehensive guide delves into the specifics of car sales tax in the Sunshine State, exploring the rates, exemptions, and strategies to navigate this essential aspect of vehicle ownership.

Understanding Florida’s Sales Tax Structure

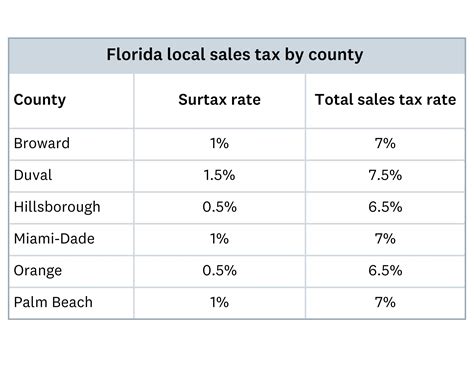

Florida imposes a sales tax on the purchase of motor vehicles, with the rate varying based on the location of the dealership and the specific county. The state sales tax rate stands at 6%, with an additional 1% to 2.5% levied by individual counties. This means that the total sales tax can range from 7% to 8.5% across the state.

For instance, in Miami-Dade County, the total sales tax is 8%, while in Hillsborough County, it is 7%. These county-specific surcharges are allocated for funding local projects and initiatives, showcasing the diverse nature of Florida's sales tax landscape.

Calculating Sales Tax for Vehicle Purchases

The sales tax for a vehicle purchase in Florida is calculated based on the purchase price of the car. Here’s a step-by-step breakdown of the process:

Step 1: Determine the Base Tax

Start by calculating the base tax, which is the state sales tax rate (6%) multiplied by the purchase price of the vehicle. For a car priced at 25,000, the base tax would be 1,500.

Step 2: Add County Surcharge

Next, add the applicable county surcharge. For instance, if the vehicle is purchased in Miami-Dade County, the surcharge is 2%, so an additional 500 would be added to the base tax, resulting in a total of 2,000.

Step 3: Consider Additional Fees and Exemptions

In some cases, additional fees or exemptions may apply. For example, Florida offers a disability exemption for certain qualified individuals. Additionally, lease pull-ahead programs or loyalty discounts can impact the final sales tax amount. It’s crucial to consult with a tax professional or dealership to understand these nuances.

Strategies for Minimizing Sales Tax

While sales tax is an inevitable part of vehicle ownership, there are strategies to minimize its impact:

1. Research County Tax Rates

Before finalizing a purchase, research the sales tax rates in different counties. Consider shopping in counties with lower tax rates, especially if you’re open to a broader search for your ideal vehicle.

2. Explore Online Sales

Online car-buying platforms offer an alternative to traditional dealerships. By purchasing a car online, you can often avoid certain fees and surcharges, making it a cost-effective option. However, be sure to research the reputation and reliability of online sellers.

3. Consider Leasing vs. Buying

Leasing a vehicle can provide tax advantages, as the sales tax is typically calculated based on the monthly payment rather than the full purchase price. This can result in significant savings, especially for high-value vehicles.

4. Utilize Exemptions and Discounts

Stay informed about available exemptions and discounts. For example, active-duty military personnel and veterans may qualify for reduced sales tax rates. Additionally, some dealerships offer loyalty discounts or incentives that can lower the overall sales tax burden.

The Role of Sales Tax in Vehicle Ownership

Sales tax plays a significant role in the vehicle ownership experience in Florida. Beyond the initial purchase, sales tax impacts various aspects of car ownership, including:

1. Vehicle Registration

When registering a vehicle, the sales tax paid during the purchase is often a consideration. In some cases, the sales tax may be used to satisfy a portion of the registration fee, simplifying the registration process.

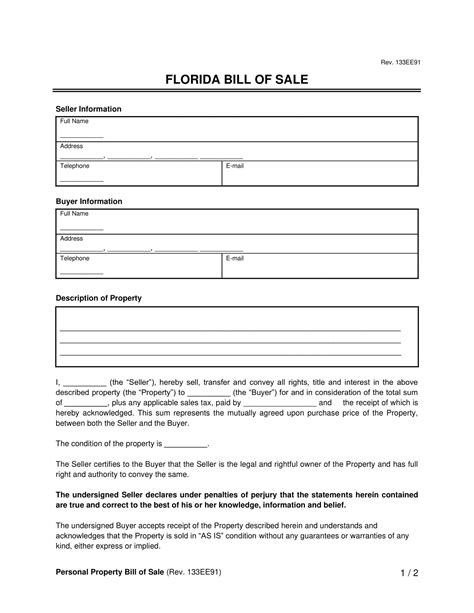

2. Title Transfer

When transferring the title of a vehicle, the sales tax paid is taken into account. This ensures that the appropriate taxes are applied and that the transfer process is compliant with state regulations.

3. Trade-In Values

When trading in a vehicle, the sales tax paid on the previous purchase can impact the trade-in value. Dealerships may offer incentives or discounts to offset the sales tax on the new vehicle, making trade-ins a strategic way to manage sales tax obligations.

| County | Sales Tax Rate |

|---|---|

| Miami-Dade | 8% |

| Hillsborough | 7% |

| Orange | 7% |

| Broward | 8% |

| Palm Beach | 8% |

Are there any exemptions for specific types of vehicles in Florida?

+

Yes, Florida offers exemptions for certain vehicles. For example, hybrid and electric vehicles are exempt from the state sales tax, providing an incentive for environmentally conscious consumers. Additionally, disabled individuals may qualify for exemptions based on their specific needs.

Can I negotiate the sales tax with the dealership?

+

While the sales tax rate is set by law, dealerships may offer incentives or discounts that effectively lower the sales tax burden. Negotiating with the dealership can lead to savings, especially when purchasing a vehicle during promotional periods.

How often do sales tax rates change in Florida?

+

Sales tax rates in Florida are relatively stable, with changes occurring infrequently. However, it’s essential to stay informed, as any changes can impact the overall cost of vehicle ownership. Consulting with tax professionals or monitoring local news sources can provide the latest updates.