City Of Detroit Taxes

The City of Detroit, Michigan, is a bustling metropolis with a rich history and a vibrant cultural scene. However, when it comes to taxes, it's essential to understand the complexities and intricacies involved. Detroit's tax system plays a crucial role in funding various city services and initiatives, making it a significant aspect of life for both residents and businesses. In this comprehensive guide, we will delve into the world of Detroit taxes, exploring the different types of taxes, their implications, and how they impact the city's economy and its citizens.

Understanding Detroit’s Tax Landscape

Detroit, like many other cities, relies on a combination of tax revenue streams to support its operations and development. These taxes contribute to the city’s overall fiscal health and are essential for maintaining infrastructure, providing public services, and driving economic growth.

Property Taxes: A Vital Revenue Source

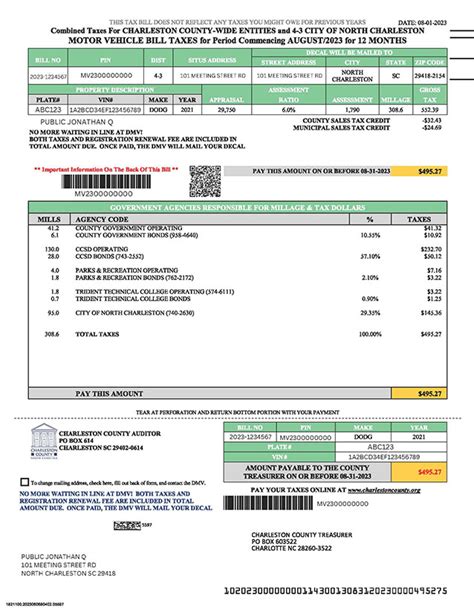

One of the primary tax revenue generators in Detroit is property taxes. These taxes are levied on both residential and commercial properties within the city limits. Property taxes contribute significantly to the city’s budget, as they are a stable and predictable source of income.

The property tax rate in Detroit is determined by the Detroit City Council and can vary depending on the assessed value of the property and the designated tax millage rate. Property owners receive an annual tax bill, which is due by a specified deadline. Failure to pay property taxes on time can result in penalties and, in some cases, tax liens on the property.

| Tax Year | Average Property Tax Rate | Median Property Value |

|---|---|---|

| 2022 | 1.76% | 70,000</td> </tr> <tr> <td>2021</td> <td>1.82%</td> <td>65,000 |

| 2020 | 1.89% | $60,000 |

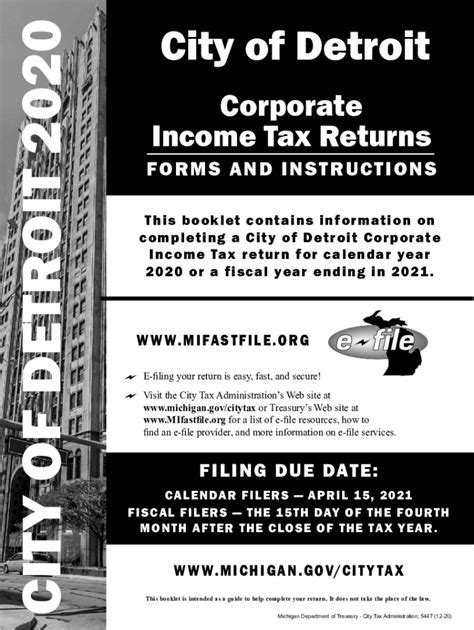

Income Taxes: A Shared Responsibility

Detroit also imposes an income tax on its residents and businesses. This tax is a progressive tax, meaning that higher incomes are taxed at a higher rate. The income tax revenue helps fund essential city services such as public safety, education, and infrastructure development.

For individuals, the income tax rate in Detroit is 2.4% for residents and 1.2% for non-residents. Businesses, on the other hand, are subject to a flat rate of 1.2%. The income tax is calculated based on the taxpayer’s gross income, and deductions and credits are available to reduce the taxable amount.

| Tax Category | Tax Rate |

|---|---|

| Resident Income Tax | 2.4% |

| Non-Resident Income Tax | 1.2% |

| Business Income Tax | 1.2% |

Sales and Use Taxes: Supporting City Services

Like many other cities, Detroit imposes a sales and use tax on goods and services purchased within its borders. This tax is typically included in the retail price and is collected by businesses, which then remit the tax to the city. The sales tax revenue is vital for funding various city services and initiatives.

The current sales tax rate in Detroit is 6%, which includes both the state and local sales tax. This tax applies to a wide range of goods and services, including clothing, electronics, groceries (excluding food items for home consumption), and entertainment tickets. Certain items, such as prescription medications and educational materials, are exempt from sales tax.

The Impact of Detroit’s Taxes

The tax system in Detroit plays a critical role in shaping the city’s economic landscape and influencing the lives of its residents.

Economic Development and Growth

Tax revenue generated by Detroit’s various taxes is a driving force behind economic development initiatives. The city utilizes tax revenue to attract businesses, create job opportunities, and stimulate economic growth. Investments in infrastructure, such as road improvements and public transportation, are made possible through tax revenue, enhancing the city’s overall appeal to businesses and investors.

Funding Essential City Services

One of the primary purposes of Detroit’s tax system is to fund essential city services. These services include public safety, such as police and fire departments, as well as critical infrastructure maintenance and development. Additionally, tax revenue supports public education, ensuring that Detroit’s youth have access to quality schools and resources.

Tax Incentives and Business Attraction

Detroit recognizes the importance of attracting and retaining businesses within its borders. As such, the city offers various tax incentives and programs to encourage economic growth. These incentives can take the form of tax credits, abatements, or exemptions, making Detroit an attractive location for businesses looking to expand or relocate.

For example, the Renaissance Zone Program provides significant tax incentives to businesses and individuals who invest in designated areas within the city. These zones aim to stimulate economic activity and revitalize underdeveloped neighborhoods. By offering reduced or eliminated taxes on certain income sources, Detroit can encourage businesses to invest in the city’s future.

Navigating Detroit’s Tax System

Understanding and complying with Detroit’s tax regulations is crucial for both individuals and businesses. Here are some key considerations and resources to help navigate the city’s tax landscape.

Tax Payment and Compliance

Ensuring timely tax payments is essential to avoid penalties and maintain a good standing with the city. Detroit provides online platforms and resources to facilitate tax payment, making it convenient for taxpayers to fulfill their obligations.

For property taxes, homeowners can access their tax bills and make payments online through the Detroit Tax Portal. Similarly, businesses and individuals can use the online platform to remit income taxes and sales taxes. Staying up to date with tax payment deadlines is vital to avoid late fees and potential legal consequences.

Tax Assistance and Resources

The City of Detroit offers various resources and assistance programs to help taxpayers navigate the tax system. The Detroit Taxpayer Assistance Center provides guidance and support to individuals and businesses with tax-related inquiries or challenges.

Additionally, the city’s website offers a wealth of information and resources, including tax forms, guidelines, and frequently asked questions. Taxpayers can find detailed explanations of tax rates, due dates, and any applicable exemptions or deductions. This transparency and accessibility ensure that residents and businesses have the tools they need to comply with Detroit’s tax regulations.

Conclusion: Detroit’s Tax System in Perspective

Detroit’s tax system is a complex and multifaceted structure that plays a pivotal role in the city’s economic and social fabric. While taxes may be a necessary burden, they are essential for funding the services and infrastructure that make Detroit a desirable place to live and do business.

By understanding the various taxes, their rates, and their implications, individuals and businesses can make informed decisions and contribute to the city’s growth and development. As Detroit continues to evolve and thrive, its tax system will remain a critical component of its success and resilience.

How can I estimate my property taxes in Detroit?

+Estimating your property taxes in Detroit involves considering factors such as your property’s assessed value and the current tax rate. You can calculate an estimate by multiplying your property’s assessed value by the tax rate. Keep in mind that tax rates may change annually, so it’s essential to stay updated with the latest information.

Are there any tax exemptions or deductions available in Detroit?

+Yes, Detroit offers various tax exemptions and deductions to eligible taxpayers. These include homestead exemptions for primary residences, senior citizen and veteran discounts, and exemptions for certain types of property, such as agricultural land. It’s advisable to consult with a tax professional or refer to the Detroit Tax Department’s website for specific details.

What happens if I fail to pay my taxes in Detroit?

+Failure to pay taxes in Detroit can result in penalties, interest charges, and potential legal consequences. The city may issue tax liens on properties with delinquent taxes, which can affect your credit rating and future financial opportunities. It’s crucial to stay on top of your tax obligations to avoid these issues.