File Amended Tax Return

When it comes to managing our finances, mistakes can happen, and sometimes, we might find ourselves needing to make adjustments to our tax returns. Amending a tax return is a process that allows individuals and businesses to correct errors or make changes to previously filed tax documents. It's an essential step to ensure accuracy and compliance with tax regulations. In this comprehensive guide, we will delve into the world of amended tax returns, covering everything from the reasons behind amendments to the step-by-step process and potential consequences. So, whether you're a business owner, an individual taxpayer, or simply curious about the intricacies of tax law, read on to discover the ins and outs of filing an amended tax return.

Understanding the Need for Amended Tax Returns

Amending a tax return is not a decision to be taken lightly, but rather a necessary step in certain circumstances. There are several reasons why individuals and businesses might find themselves in need of an amended return. Some common scenarios include:

- Mathematical Errors: Simple mistakes in calculations can occur, leading to incorrect tax liabilities. Whether it's a missed digit or a misinterpreted formula, these errors can result in overpaid or underpaid taxes.

- Forgotten Income or Deductions: In the rush to meet filing deadlines, it's possible to overlook certain income sources or eligible deductions. Amending the return allows taxpayers to claim their rightful deductions or report previously unreported income.

- Change in Filing Status: Life events such as marriage, divorce, or the birth of a child can impact your tax filing status. If you realize you've filed using the wrong status, an amended return is necessary to rectify the situation.

- Additional Tax Forms: Sometimes, a taxpayer might discover that they need to include additional tax forms or schedules to accurately report their income or claim specific credits or deductions.

- IRS Correspondence: If the Internal Revenue Service (IRS) contacts you regarding errors or discrepancies in your tax return, they may provide guidance on the need for an amended return.

It's crucial to address these situations promptly to avoid potential penalties and ensure compliance with tax laws. By understanding the reasons behind the need for an amended return, taxpayers can take proactive steps to correct their tax filings.

The Step-by-Step Process of Amending a Tax Return

Filing an amended tax return may seem daunting, but with careful preparation and attention to detail, it can be a straightforward process. Here’s a comprehensive guide to help you navigate the steps involved:

1. Gather Necessary Documents

Before you begin, collect all the relevant documents and information you’ll need. This includes your original tax return, any supporting documents related to the changes you’re making, and any correspondence from the IRS if applicable. Ensure you have accurate records of your income, deductions, and credits.

2. Determine the Type of Amendment

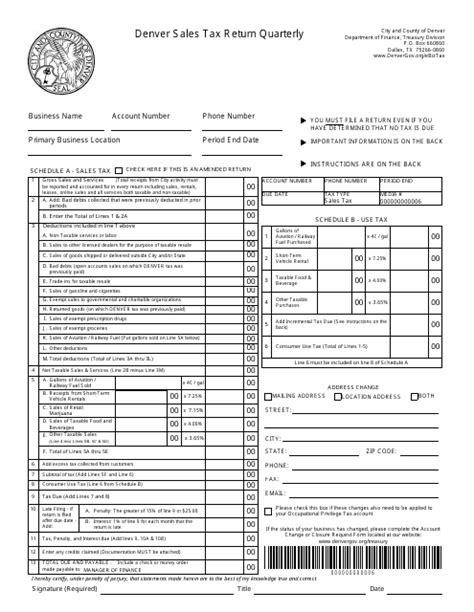

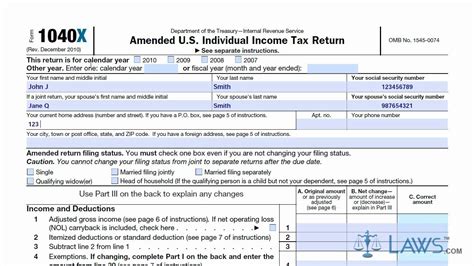

Amended returns can be categorized into three types: Form 1040-X, Form 1065-X, and Form 1120-X. The type you choose depends on your tax filing status and the complexity of the changes you’re making. Form 1040-X is for individual taxpayers, Form 1065-X is for partnerships, and Form 1120-X is for corporations.

3. Complete the Appropriate Form

Each form has specific instructions and requires detailed information about the changes you’re making. Carefully review the instructions and complete the form accurately. Ensure you include all necessary schedules and supporting documentation.

4. Calculate the Adjustments

Calculate the adjustments you need to make to your tax return. This includes correcting any errors, claiming additional deductions or credits, or adjusting your income. Be sure to use the correct tax rates and applicable laws for the year in question.

5. Attach Supporting Documents

Attach all relevant supporting documents to your amended return. This may include W-2 forms, 1099 forms, receipts for deductions, and any other documentation that validates the changes you’re making.

6. Sign and Date the Form

Once you’ve completed the form and gathered all the necessary documentation, sign and date it. Ensure that all required signatures are present and that the form is properly filled out.

7. File the Amended Return

Submit your amended return to the IRS using the appropriate method. You can file electronically or mail the physical forms, depending on your preference and the complexity of your amendment.

8. Await Processing and Response

After filing, the IRS will process your amended return. Depending on the complexity of your case, it may take several weeks or months for a response. Keep track of the processing timeline and any updates from the IRS.

By following these steps, you can effectively navigate the process of amending a tax return. Remember, accuracy and attention to detail are crucial to ensure a smooth and successful amendment.

Potential Consequences and Considerations

While amending a tax return is often necessary to correct errors, it’s important to be aware of the potential consequences and considerations that may arise. Here are some key points to keep in mind:

1. Penalties and Interest

If you underpaid your taxes due to an error or omission on your original return, you may be subject to penalties and interest. The IRS calculates these based on the amount of tax due and the length of time it was underpaid. It’s crucial to address any underpayments promptly to minimize these additional costs.

2. Audits and Scrutiny

Filing an amended return may trigger additional scrutiny from the IRS. While the agency strives to process amendments accurately, it’s important to be prepared for the possibility of an audit. Ensure you have all supporting documentation ready and be transparent in your dealings with the IRS.

3. Timeframe for Amendments

The IRS allows taxpayers to file amended returns within a certain timeframe. Generally, you have three years from the original filing date or two years from the date the tax was paid, whichever is later. However, it’s essential to act promptly to avoid missing any deadlines.

4. Impact on Future Returns

Amending a tax return can have implications for future filings. It’s important to carefully review your future returns to ensure accuracy and consistency. Keep in mind that any changes made in an amended return may impact your tax liabilities for subsequent years.

5. Professional Assistance

If you’re unsure about the process or have complex tax situations, it may be beneficial to seek professional assistance. Tax professionals, such as accountants or enrolled agents, can provide guidance and ensure that your amended return is accurate and compliant with tax laws.

6. Keep Records

Maintain thorough records of your amended return and any correspondence with the IRS. This documentation will be valuable if you need to reference your tax history in the future or if you face any audits or inquiries.

By being aware of these potential consequences and considerations, you can approach the process of amending a tax return with confidence and ensure compliance with tax regulations.

Conclusion: Empowering Taxpayers with Knowledge

Amending a tax return is a crucial step in maintaining financial integrity and compliance with tax laws. By understanding the reasons behind the need for amendments, following the step-by-step process, and considering the potential consequences, taxpayers can navigate this process with confidence. Remember, accuracy and transparency are key when dealing with tax matters. Whether it’s correcting errors, claiming missed deductions, or addressing life changes, filing an amended return ensures that your tax obligations are met accurately and fairly.

As you embark on the journey of amending your tax return, stay informed, seek professional guidance when needed, and maintain a proactive approach to your financial affairs. With the right knowledge and attention to detail, you can successfully navigate the complexities of tax law and ensure a smooth and compliant financial journey.

Can I amend my tax return electronically?

+Yes, you can amend your tax return electronically using specific software or online platforms approved by the IRS. However, not all types of amendments can be filed electronically, so it’s important to check the IRS guidelines for eligibility.

How long does it take for the IRS to process an amended return?

+The processing time for an amended return can vary depending on the complexity of the amendment and the workload of the IRS. Typically, it can take several weeks to several months. It’s advisable to check the IRS website for the latest processing times and updates.

Are there any situations where I shouldn’t amend my tax return?

+In certain cases, amending a tax return may not be necessary or advisable. For example, if you’ve already received a refund for the tax year in question and the amendment would result in a reduced refund or additional tax owed, it might be best to consult a tax professional to weigh the benefits and potential drawbacks.

What happens if I file an amended return and discover another error later on?

+If you file an amended return and subsequently discover another error, you can file a second amended return to correct the additional mistake. It’s important to address all errors accurately and in a timely manner to avoid potential penalties.