Pay Santa Clara County Property Tax

Welcome to our comprehensive guide on understanding and managing your Santa Clara County property tax obligations. As a property owner in this vibrant region, it's crucial to stay informed about the tax landscape to ensure compliance and take advantage of available resources. This article will delve into the specifics of Santa Clara County's property tax system, offering valuable insights and practical steps to navigate the process smoothly.

Unraveling the Santa Clara County Property Tax Landscape

Santa Clara County, nestled in the heart of Silicon Valley, boasts a dynamic real estate market and a thriving economy. The county’s property tax system plays a pivotal role in funding essential services, from education and public safety to infrastructure development. Understanding this system is key to being a responsible homeowner or property investor.

Assessments and Tax Rates: A Comprehensive Overview

The Santa Clara County Assessor’s Office is responsible for evaluating properties annually. This assessment process determines the taxable value of your property, which forms the basis for your property tax bill. The county operates on a fiscal year from July 1st to June 30th, with assessments typically mailed out in March. Here’s a breakdown of the key components:

| Assessment Type | Description |

|---|---|

| Regular Annual Value (RAV) | The primary assessment method, where the property's value is determined based on market conditions. |

| Proposition 13 Value | For properties purchased before 1975, this value is set at the purchase price plus a maximum annual increase of 2%. |

| Proposition 8 Value | In cases of natural disasters, this value may be used to reduce the tax burden for affected properties. |

Once your property's assessed value is determined, it's subjected to a tax rate that's calculated as follows:

Tax Rate = General Tax Rate + Special Tax Rate + Voter-Approved Bond Rate

The General Tax Rate, as mandated by the California Constitution, is currently set at 1%. The Special Tax Rate covers various district-specific services, such as water or fire protection, while the Voter-Approved Bond Rate finances bonds passed by the county's voters. The total tax rate can vary across the county due to these district-specific factors.

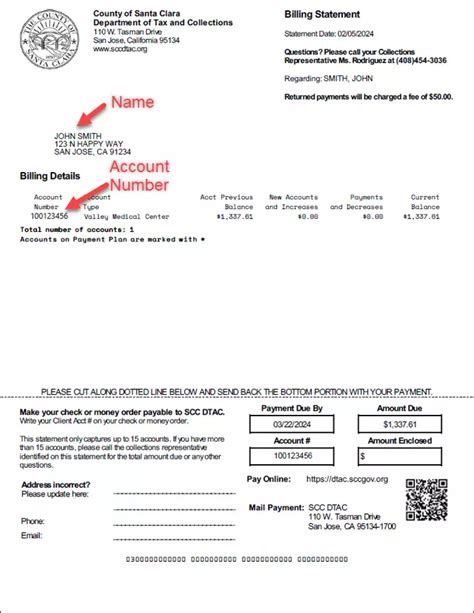

Understanding Your Property Tax Bill

Your property tax bill, typically issued in late August, provides a detailed breakdown of the taxes owed. It includes the assessed value of your property, the applicable tax rates, and any applicable exemptions or credits. Here’s a step-by-step guide to reading your bill:

- Assessed Value: This is the value of your property as determined by the Assessor's Office.

- Tax Rates: This section breaks down the various tax rates applied to your property.

- Exemptions and Credits: Look for any applicable reductions, such as the Homeowner's Exemption or Veteran's Exemption.

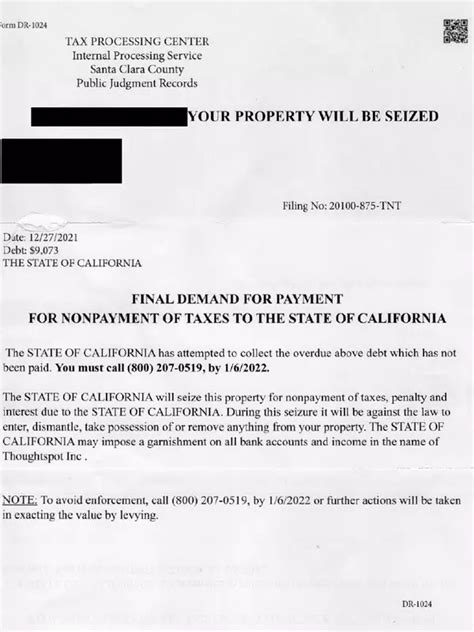

- Payment Due Date: Note the deadline for paying your taxes to avoid penalties.

It's crucial to review your bill carefully to ensure accuracy and take advantage of any eligible exemptions or credits.

Payment Options: Convenience and Flexibility

Santa Clara County offers a range of convenient payment methods to suit your preferences:

- Online Payment: The most convenient option, allowing you to pay securely using your credit/debit card or e-check. You can also set up automatic payments for a seamless experience.

- Phone Payment: Call the Treasurer-Tax Collector's Office to make a payment over the phone using your credit/debit card.

- Mail-in Payment: Send your payment by mail, ensuring it reaches the designated address before the due date.

- In-Person Payment: Visit one of the county's designated payment locations to make a payment in person.

Regardless of the payment method, ensure you have your Assessor's Parcel Number (APN) and the Property Tax Account Number handy for accurate processing.

Resources and Assistance: Navigating the System

The Santa Clara County Treasurer-Tax Collector’s Office provides a wealth of resources to assist property owners:

- Property Tax Bill Explanation: A detailed guide to understanding your property tax bill, available on the county's website.

- Payment Plans: If you're facing financial difficulties, the county offers payment plans to help manage your tax obligations.

- Exemptions and Credits: Explore the various exemptions and credits you may be eligible for, such as the Homeowner's Exemption or Senior Citizen's Exemption.

- Assistance Programs: The county provides resources for low-income homeowners and disabled veterans to help with property tax payments.

Conclusion: Empowering Property Owners

Understanding and managing your Santa Clara County property tax obligations is an essential aspect of responsible property ownership. By staying informed about the assessment process, tax rates, and available resources, you can navigate the system confidently and ensure timely payments. Remember, the county’s Treasurer-Tax Collector’s Office is your ally, offering a range of tools and assistance to make the process as smooth as possible.

FAQ

What is the deadline for paying my Santa Clara County property taxes?

+

The deadline for paying your Santa Clara County property taxes without incurring penalties is typically November 1st. However, it’s essential to check your specific bill for the exact due date, as it may vary slightly from year to year.

Can I pay my property taxes in installments?

+

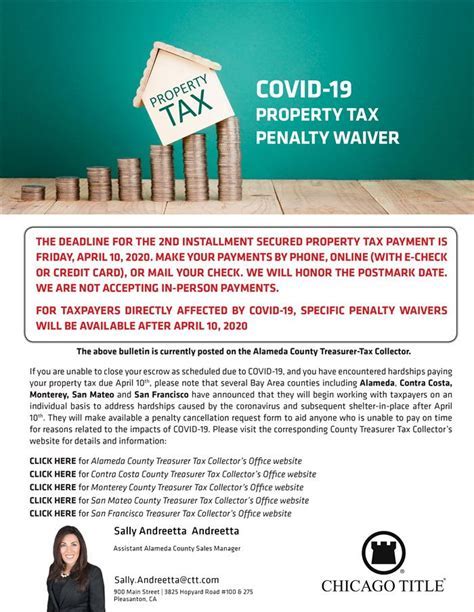

Yes, Santa Clara County offers a convenient installment payment plan. You can choose to pay your taxes in two installments, with the first due by December 10th and the second by April 10th of the following year. This plan helps spread out the financial burden and ensures timely payments.

Are there any exemptions or credits I might be eligible for?

+

Absolutely! Santa Clara County offers a range of exemptions and credits to reduce your property tax burden. These include the Homeowner’s Exemption, Senior Citizen’s Exemption, Disabled Veteran’s Exemption, and more. It’s worth exploring these options to see if you qualify.