Polk County Florida Tax Collector

Welcome to the comprehensive guide to the Polk County, Florida Tax Collector's office, a vital institution for residents and property owners in this vibrant region. In this article, we will delve deep into the functions, services, and significance of the Polk County Tax Collector, shedding light on its role in the local community and the broader economic landscape.

The Polk County Tax Collector: An Essential Public Service

The Polk County Tax Collector’s office is an indispensable entity, responsible for the efficient collection and management of various taxes and fees within the county. This institution plays a pivotal role in ensuring the smooth functioning of local government and the overall prosperity of the community. Let’s explore its key functions and the impact it has on the lives of Polk County residents.

Tax Collection and Assessment

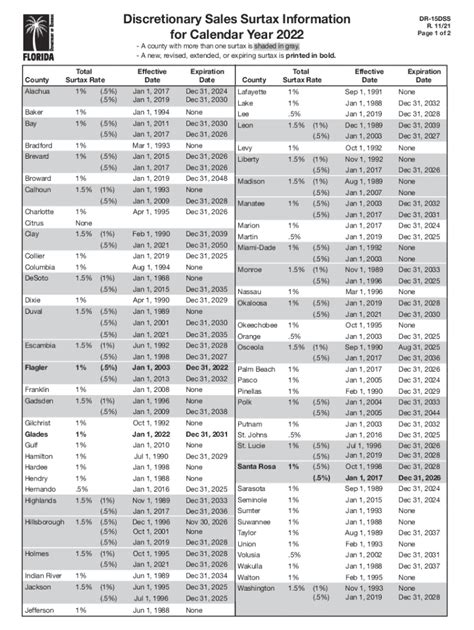

At the heart of the Tax Collector’s mission is the collection of taxes. This includes property taxes, one of the most significant sources of revenue for local governments. The office assesses the value of properties within the county, ensuring that owners pay their fair share based on the assessed value. This process is crucial for maintaining the financial stability of Polk County and funding essential public services like schools, infrastructure, and public safety.

| Tax Type | Collection Period |

|---|---|

| Property Taxes | November to April (two installments) |

| Vehicle Registration Fees | Annual Renewal |

| Business Taxes | Based on Business Type and Renewal Dates |

The Tax Collector's office employs a team of experts who are well-versed in tax laws and regulations. They provide valuable assistance to taxpayers, ensuring they understand their obligations and are aware of any changes in tax policies. This proactive approach helps maintain a positive relationship between the government and taxpayers, fostering a sense of community engagement and trust.

Vehicle Registration and Titling

For vehicle owners in Polk County, the Tax Collector’s office is the go-to destination for registration and titling services. Whether it’s registering a new vehicle, renewing an existing registration, or transferring a title, the office efficiently handles these tasks. This service is critical for maintaining road safety and compliance with state laws. The Tax Collector’s office also facilitates the payment of various fees associated with vehicle ownership, ensuring a seamless experience for vehicle owners.

Business Taxes and Permits

The Tax Collector’s office is responsible for collecting business taxes, ensuring that businesses operating within Polk County contribute to the local economy and comply with tax regulations. This includes the collection of occupational licenses, sales taxes, and other business-related fees. By effectively managing these taxes, the office supports the growth and sustainability of local businesses, fostering an environment conducive to economic prosperity.

Efficient Online Services

Recognizing the digital age, the Polk County Tax Collector’s office has embraced technology to enhance its services. The official website offers a user-friendly interface, allowing taxpayers to access a wide range of services online. From tax payment to vehicle registration renewal, the online platform provides convenience and efficiency, saving time and resources for both taxpayers and the office. This digital transformation has significantly improved the overall taxpayer experience, making it more accessible and user-friendly.

Community Outreach and Education

Beyond its core functions, the Tax Collector’s office actively engages with the community through educational initiatives and outreach programs. They organize workshops and seminars to educate taxpayers about their rights and responsibilities, demystifying the tax process and fostering a culture of compliance. By building strong community ties, the office ensures that taxpayers understand the importance of their contributions and the impact it has on the local community.

Impact on Local Economy and Community

The work of the Polk County Tax Collector extends far beyond tax collection. It is a critical component of the local economy, providing the financial foundation for essential public services. The taxes collected fund schools, maintain infrastructure, support public safety, and drive economic development initiatives. By efficiently managing tax revenues, the Tax Collector’s office contributes to the overall well-being and prosperity of Polk County residents.

Promoting Economic Growth

A well-functioning tax system attracts businesses and investors, fostering economic growth. The Tax Collector’s office, by ensuring fair and efficient tax collection, creates an environment conducive to business expansion and investment. This, in turn, generates more revenue for the county, leading to improved public services and a higher quality of life for residents.

Community Development and Support

The Tax Collector’s office actively supports community development initiatives. Through partnerships with local organizations and charities, the office contributes to various causes, including education, healthcare, and social welfare programs. This commitment to community support reinforces the office’s role as a trusted public servant, dedicated to the overall welfare of Polk County residents.

Conclusion: A Vital Pillar of Polk County’s Success

In conclusion, the Polk County Tax Collector’s office is a vital institution, playing a pivotal role in the economic and social fabric of the county. Its efficient tax collection, transparent processes, and community engagement efforts contribute to the overall success and prosperity of Polk County. As a trusted public service, the Tax Collector’s office continues to serve as a pillar of strength, supporting the growth and well-being of the community it serves.

What are the office hours of the Polk County Tax Collector’s office?

+The office is open Monday to Friday from 8:00 AM to 5:00 PM. However, it’s always best to check their website or contact them directly for any updates or special holiday hours.

How can I pay my property taxes in Polk County?

+You can pay your property taxes online through the Tax Collector’s official website. Alternatively, you can visit the office in person or mail your payment. Ensure you have the correct tax bill and follow the payment instructions provided.

What happens if I miss the tax payment deadline?

+Missing the tax payment deadline may result in penalties and interest charges. It’s important to pay your taxes on time to avoid additional costs. If you face financial difficulties, consider contacting the Tax Collector’s office to discuss potential payment plans or assistance programs.

Can I renew my vehicle registration online?

+Yes, you can renew your vehicle registration online through the Tax Collector’s website. This convenient service allows you to complete the renewal process from the comfort of your home. Ensure you have the necessary information, such as your vehicle’s details and registration number.