Halifax County Tax Office Nc

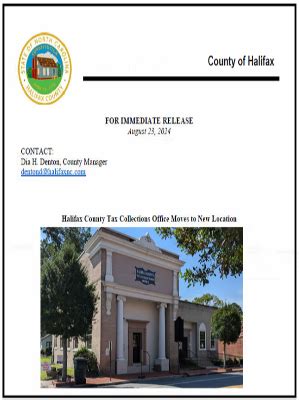

Welcome to the Halifax County Tax Office in North Carolina, a vital hub for residents and property owners in this region. The office plays a crucial role in managing and collecting taxes, which are essential for funding various public services and infrastructure projects. In this article, we will delve into the functions, services, and impact of the Halifax County Tax Office, offering an insightful guide for anyone interested in understanding the county's tax system.

The Role and Functions of the Halifax County Tax Office

The Halifax County Tax Office is responsible for the administration and collection of property taxes, one of the primary sources of revenue for local governments in the United States. These taxes are levied on real estate properties, including homes, businesses, and vacant land, within the county boundaries.

The office ensures that all taxable properties are accurately assessed and fairly valued. This process involves a comprehensive evaluation of each property's characteristics, such as size, location, improvements, and recent sales data, to determine its taxable value. The assessed value is then used to calculate the property tax bill for each owner.

Halifax County's tax system is designed to be progressive and equitable. The tax rates are set by the county commissioners, taking into consideration the needs of the community and the cost of providing essential services. These services include education, public safety, healthcare, road maintenance, and other vital public amenities.

Key Functions of the Halifax County Tax Office

- Property Assessment: The office conducts regular assessments to ensure property values are up-to-date and accurate. This process involves field inspections, data collection, and the application of assessment methodologies.

- Tax Collection: The primary responsibility of the tax office is to collect property taxes from residents and businesses. This includes issuing tax bills, managing payment plans, and enforcing collection processes for delinquent accounts.

- Tax Relief Programs: Halifax County offers various tax relief programs to support eligible homeowners. These programs include the Homestead Exemption, which reduces the taxable value of a primary residence, and the Elderly or Disabled Citizen Property Tax Deferral, which allows certain individuals to defer their property taxes.

- Appeals Process: Property owners who believe their assessment is incorrect can file an appeal with the tax office. The office provides a fair and transparent process for hearing these appeals, ensuring that property owners have a voice in the assessment process.

- Community Engagement: The Halifax County Tax Office actively engages with the community to promote transparency and understanding of the tax system. This includes hosting public meetings, providing educational resources, and offering assistance to taxpayers who may have questions or concerns.

Services Offered by the Halifax County Tax Office

The Halifax County Tax Office provides a range of services to assist taxpayers in understanding and fulfilling their tax obligations. These services are designed to be accessible and user-friendly, ensuring that taxpayers can navigate the complex world of property taxation with ease.

Online Services

The tax office offers a comprehensive online platform that allows taxpayers to access a wealth of information and services. Some of the key online features include:

- Property Search: Taxpayers can search for property records, view assessment details, and access historical data for any property in the county.

- Tax Bill Payment: Online payment options make it convenient for taxpayers to settle their property tax bills securely and efficiently.

- Appeal Filing: The online system provides a simple and streamlined process for submitting appeals against property assessments.

- Tax Estimate Calculator: This tool allows prospective property buyers or renters to estimate their potential tax liability based on the property’s location and value.

- News and Updates: The online portal serves as a hub for the latest tax-related news, announcements, and important dates, keeping taxpayers informed.

In-Person Services

For those who prefer personal interaction, the Halifax County Tax Office provides in-person services at its physical location. Taxpayers can visit the office to:

- Obtain Tax Information: Speak with tax professionals to clarify doubts, understand tax assessments, or discuss payment options.

- File Appeals: Taxpayers can submit their appeals in person, ensuring they receive guidance and support throughout the process.

- Review Property Records: Access physical records, maps, and assessment documents for a detailed understanding of their property’s tax status.

- Pay Taxes: While online payment is convenient, some taxpayers may prefer to make payments in person, and the office accommodates this preference.

Performance and Impact

The Halifax County Tax Office’s performance is critical to the county’s financial health and stability. By efficiently collecting property taxes, the office ensures that the county can meet its financial obligations and provide essential services to residents.

The office's success is measured by its ability to collect taxes in a timely manner and at an acceptable rate. In recent years, Halifax County has achieved a high collection rate, indicating the effectiveness of its tax administration processes.

| Fiscal Year | Collection Rate |

|---|---|

| 2022 | 95.2% |

| 2021 | 94.7% |

| 2020 | 93.8% |

The Halifax County Tax Office's impact extends beyond tax collection. By implementing fair and progressive tax policies, the office ensures that the tax burden is distributed equitably among residents. This fosters a sense of community and supports the county's overall economic health.

Future Implications and Opportunities

As Halifax County continues to grow and develop, the role of the Tax Office will evolve to meet the changing needs of the community. Here are some potential future implications and opportunities:

Technological Advancements

The tax office can leverage emerging technologies to enhance its operations. This could include the use of artificial intelligence for more accurate and efficient property assessments, as well as blockchain technology for secure and transparent tax record-keeping.

Community Outreach

Continuing to engage with the community will be vital for the tax office. By hosting educational workshops, town hall meetings, and tax clinics, the office can ensure that taxpayers, especially those who may be new to the county, understand their rights and responsibilities.

Tax Policy Review

As the county’s demographics and economic landscape change, the tax office should periodically review and update tax policies to ensure they remain fair and effective. This includes considering the impact of tax relief programs and adjusting tax rates to meet the county’s financial goals.

Collaborative Partnerships

Collaborating with other county departments and local businesses can create opportunities for the tax office to streamline processes and improve efficiency. For instance, working with the county’s planning department could lead to more accurate property assessments, benefiting both departments and taxpayers.

FAQs

What is the deadline for paying property taxes in Halifax County, NC?

+

The deadline for paying property taxes in Halifax County is typically January 5th of each year. However, it’s advisable to check the official Halifax County Tax Office website for any updates or changes to this deadline.

How can I dispute my property assessment if I believe it is inaccurate?

+

If you disagree with your property assessment, you can file an appeal with the Halifax County Tax Office. The office provides a clear and transparent process for appealing assessments. You’ll need to provide evidence supporting your claim, such as recent sales data or professional appraisals. It’s recommended to review the office’s guidelines for appealing assessments before submitting your appeal.

Are there any tax relief programs available for senior citizens or disabled individuals in Halifax County?

+

Yes, Halifax County offers several tax relief programs for eligible senior citizens and disabled individuals. These programs include the Homestead Exemption, which reduces the taxable value of a primary residence, and the Elderly or Disabled Citizen Property Tax Deferral, which allows certain individuals to defer their property taxes. To learn more about these programs and determine your eligibility, you can visit the Halifax County Tax Office website or contact the office directly.

Can I pay my property taxes online, and what payment methods does the Halifax County Tax Office accept?

+

Yes, you can pay your property taxes online through the Halifax County Tax Office’s official website. The office accepts various payment methods, including credit cards, debit cards, and electronic checks (e-checks). However, it’s important to note that there may be convenience fees associated with certain payment methods. To ensure a smooth payment process, it’s advisable to review the accepted payment methods and any associated fees on the tax office’s website.