Tax Collector San Francisco Ca

In the bustling city of San Francisco, California, the role of the Tax Collector is an integral part of the local government's financial operations. This position plays a vital role in ensuring the smooth administration and collection of various taxes, fees, and assessments, thereby contributing to the city's economic health and stability.

Understanding the Role: Tax Collector, San Francisco

The Tax Collector of San Francisco, CA, is responsible for managing a wide range of financial obligations, including but not limited to property taxes, business taxes, and utility user taxes. This position acts as the primary point of contact for taxpayers, providing assistance and guidance on tax-related matters. It is a critical role that ensures the city's revenue stream remains steady and reliable.

The Tax Collector's office is known for its efficiency and dedication to serving the diverse San Francisco community. They offer a range of services, from online tax payment options to in-person assistance, catering to the needs of all taxpayers.

Key Responsibilities and Services

- Property Tax Collection: The primary responsibility is to collect property taxes, ensuring timely and accurate assessments. The office provides resources to help property owners understand their tax obligations and offers payment plans for those facing financial difficulties.

- Business Tax Management: This role oversees the registration, reporting, and collection of business taxes. It ensures that all businesses operating within the city comply with tax regulations and provides support for new businesses to navigate the tax system.

- Utility User Tax: The Tax Collector is responsible for administering and collecting utility user taxes, which are levied on various utility services such as electricity, gas, and telecommunications. These taxes contribute significantly to the city's revenue.

- Online Services: The office has embraced digital transformation, offering online services for taxpayers. This includes online registration, payment portals, and access to tax records, making it more convenient for taxpayers to manage their obligations.

- Community Engagement: The Tax Collector's office actively engages with the community, hosting informational sessions and workshops to educate taxpayers about their rights and responsibilities. They also participate in local events to foster a positive relationship with the public.

Meet the Current Tax Collector

Currently, the position of Tax Collector in San Francisco is held by [Name], a seasoned professional with an extensive background in finance and public administration. [Name] has been instrumental in modernizing the tax collection process, implementing innovative solutions to enhance efficiency and transparency.

[Name]'s leadership has focused on improving taxpayer services, with a particular emphasis on digital accessibility. Under their tenure, the office has seen a significant increase in online tax payments, streamlining the process for both taxpayers and administrative staff.

Notable Achievements

- Launched an online tax assistance portal, providing taxpayers with a user-friendly platform to access information, calculate estimates, and make payments.

- Implemented a comprehensive tax exemption program for senior citizens and individuals with disabilities, reducing their tax burden and providing much-needed relief.

- Collaborated with local businesses to streamline tax registration processes, making it easier for new ventures to comply with tax regulations from the outset.

- Initiated an annual Taxpayer Appreciation Day, offering discounts and incentives to taxpayers who visit the office in person, fostering a positive relationship with the community.

Future Outlook and Innovations

Looking ahead, the Tax Collector's office in San Francisco aims to continue its innovative approach to tax collection. With a focus on technology and community engagement, the office plans to implement the following initiatives:

- Mobile App Development: Developing a mobile application to provide taxpayers with real-time access to their tax information, payment history, and upcoming deadlines.

- AI-Powered Assistance: Integrating artificial intelligence to enhance taxpayer support, offering personalized recommendations and answers to frequently asked questions.

- Community Outreach Programs: Expanding community outreach initiatives to reach underserved populations, ensuring that all taxpayers have access to the resources they need.

- Sustainable Practices: Implementing eco-friendly practices in the office, such as digital record-keeping and paperless transactions, to reduce the environmental impact of tax administration.

The Tax Collector's office in San Francisco is committed to maintaining a high standard of service, ensuring that taxpayers receive the support they need while also contributing to the city's financial stability and growth.

Frequently Asked Questions

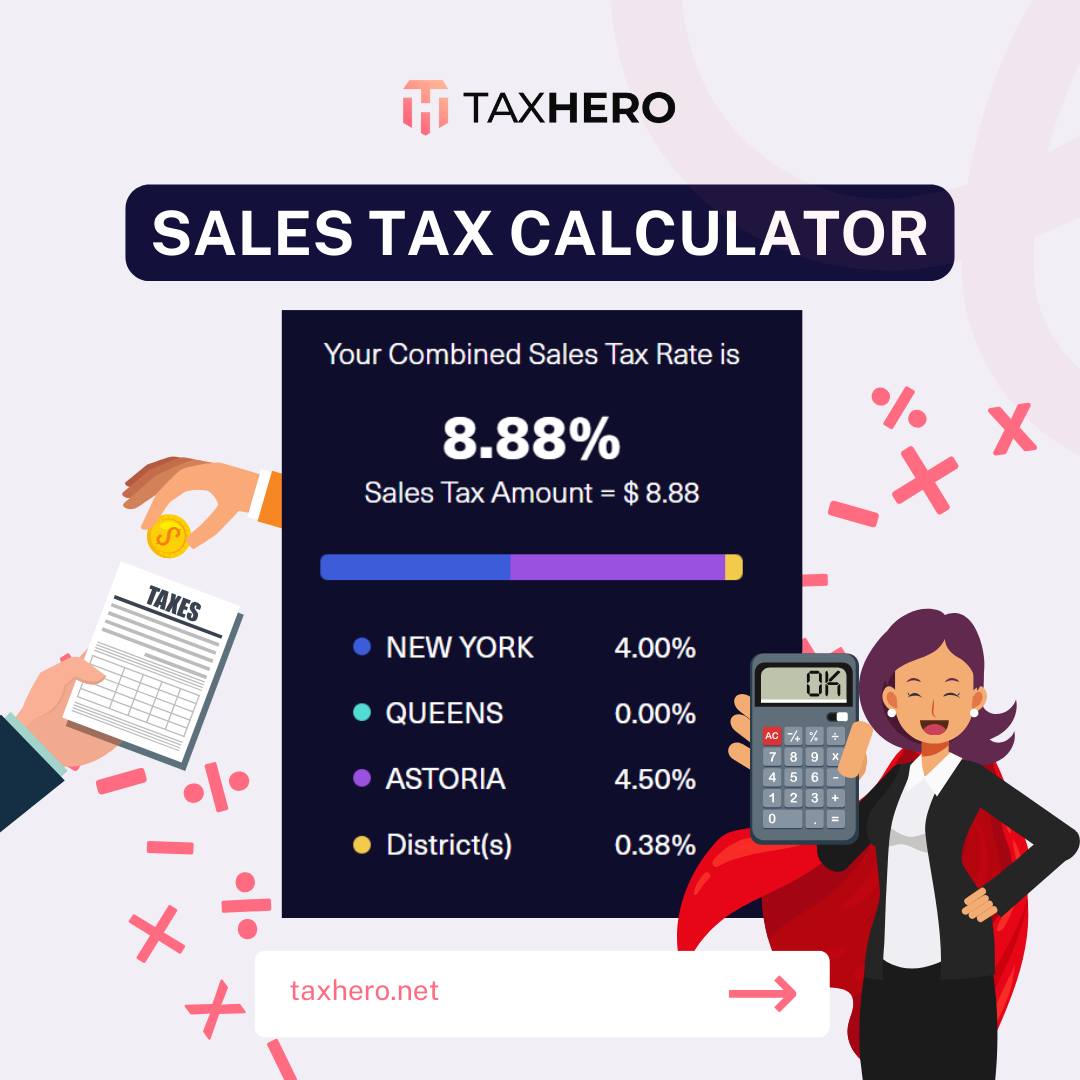

What are the tax rates in San Francisco for residents and businesses?

+The tax rates in San Francisco vary depending on the type of tax and the taxpayer's classification. For property taxes, the current rate is [current rate]%. Business taxes, on the other hand, are assessed based on gross receipts, with rates ranging from [lowest rate]% to [highest rate]% depending on the business type and revenue.

<div class="faq-item">

<div class="faq-question">

<h3>How can I make tax payments in San Francisco?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>San Francisco offers a variety of payment options for taxpayers. You can make payments online through the Tax Collector's website, by mail, in person at the Tax Collector's office, or even via phone. The office also accepts major credit cards for a nominal fee.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax relief programs available in San Francisco?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, San Francisco provides several tax relief programs to assist eligible taxpayers. These include the Senior Citizen Exemption, Disabled Veterans Exemption, and the Homeowner Assistance Program. Each program has specific eligibility criteria and offers varying levels of tax relief.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I fail to pay my taxes in San Francisco?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Failure to pay taxes in San Francisco can result in penalties and interest accrual. The Tax Collector's office will send notices and reminders, and if the taxes remain unpaid, they may initiate collection actions, including liens and potential legal proceedings.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I contact the Tax Collector's office in San Francisco for assistance?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>You can reach the Tax Collector's office in San Francisco by calling [phone number], sending an email to [email address], or visiting their website [website URL]. They also provide in-person assistance at their office located at [address], where you can speak with a tax representative.</p>

</div>

</div>

</div>