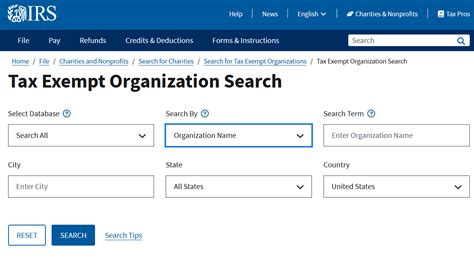

Search Irs Tax Exempt Organizations

Welcome to an in-depth exploration of the Internal Revenue Service's (*IRS*) tax-exempt organizations. This article will provide an expert overview of the various aspects related to tax exemption, from understanding the different types of exempt organizations to the processes involved in obtaining and maintaining tax-exempt status. By delving into real-world examples and industry insights, we aim to offer a comprehensive guide for anyone interested in navigating the complex world of tax-exempt organizations.

Understanding Tax-Exempt Organizations

Tax-exempt organizations play a crucial role in society, offering a range of services and contributing significantly to various sectors, including education, healthcare, research, and community development. The IRS, through its tax-exempt status, provides these organizations with certain privileges, primarily exemption from federal income taxes on their earnings and profits.

The concept of tax exemption is rooted in the belief that certain entities, due to their nature and the public good they provide, should be incentivized and supported by the government. This incentive takes the form of tax relief, allowing these organizations to direct more of their resources towards their core missions.

However, obtaining and maintaining tax-exempt status is a complex process, involving a thorough understanding of IRS regulations and guidelines. Let's delve into the key aspects of this process.

Types of Tax-Exempt Organizations

The IRS recognizes several types of tax-exempt organizations, each with its own unique characteristics and purposes. The most common categories include:

- 501(c)(3) Organizations: These are charitable organizations, such as public charities, private foundations, and religious organizations. They are dedicated to religious, charitable, scientific, literary, or educational purposes, and must operate exclusively for these exempt purposes to maintain their tax-exempt status.

- 501(c)(4) Organizations: Civic leagues, social welfare organizations, and local associations of employees are typically classified under this category. These organizations are focused on promoting social welfare and often engage in lobbying activities.

- 501(c)(6) Organizations: Business leagues, chambers of commerce, real estate boards, boards of trade, and professional football leagues fall under this category. Their primary purpose is to promote the common business interests of their members.

- 501(c)(7) Organizations: Social and recreational clubs are tax-exempt under this category. These organizations provide recreational opportunities and amenities to their members, who often share a common interest or affiliation.

- 501(c)(8) and 501(c)(10) Organizations: These categories include certain types of fraternal beneficiary societies and domestic fraternal societies, respectively. They are exempt from tax as long as they provide insurance benefits to their members and operate primarily for the benefit of their members.

Each type of tax-exempt organization has its own set of rules and regulations, and understanding these distinctions is crucial for any organization seeking tax-exempt status.

The Application Process

Obtaining tax-exempt status involves a detailed application process, which varies depending on the type of organization. The primary form used is the IRS Form 1023 or Form 1024, depending on the organization’s structure and purpose. This form requires extensive information about the organization’s activities, governance, and financial projections.

During the application process, the IRS scrutinizes the organization's activities to ensure they align with the purpose for which tax exemption is granted. This involves a thorough review of the organization's governing documents, such as its articles of incorporation and bylaws, to ensure they meet the legal requirements for tax exemption.

The IRS also examines the organization's planned activities to determine if they are exclusively charitable, educational, or religious in nature. If the organization engages in activities that are not in line with its stated purpose, it may be denied tax-exempt status or face revocation of its exemption.

Maintaining Tax-Exempt Status

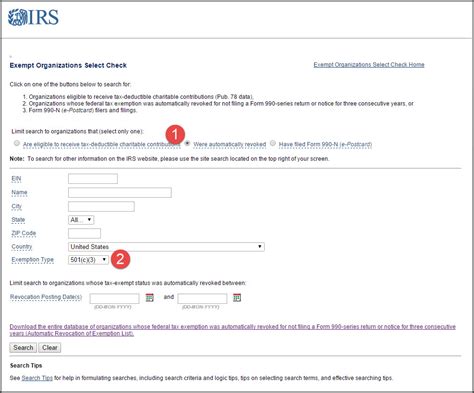

Once an organization has obtained tax-exempt status, maintaining it is an ongoing responsibility. The IRS requires exempt organizations to adhere to specific rules and regulations to retain their exemption. These include filing annual information returns (Form 990 series) and complying with lobbying and political campaign regulations.

The Form 990 series provides the IRS and the public with information about the organization's finances, governance, and activities. It ensures transparency and accountability, allowing stakeholders to understand how the organization is utilizing its resources and achieving its exempt purposes.

Additionally, tax-exempt organizations must be cautious about engaging in activities that could jeopardize their exempt status. This includes political activities, which are generally prohibited for 501(c)(3) organizations, and certain types of business activities that could indicate the organization is operating more like a for-profit entity.

| Form Type | Organization Type |

|---|---|

| Form 990 | Small organizations with gross receipts less than $200,000 and assets under $500,000 |

| Form 990-EZ | Organizations with gross receipts between $200,000 and $500,000 and assets under $2.5 million |

| Form 990-PF | Private foundations |

| Form 990-N (e-Postcard) | Small organizations with gross receipts under $50,000 |

Real-World Examples and Case Studies

Let’s explore some real-world examples of tax-exempt organizations and their impact on society.

The Red Cross

The American Red Cross is a well-known 501©(3) organization dedicated to humanitarian aid. It provides emergency assistance, disaster relief, and blood donation services. The tax-exempt status allows the Red Cross to operate efficiently, ensuring that more funds are directed towards its life-saving missions rather than being tied up in taxes.

The National Football League (NFL)

Surprisingly, the NFL, despite its massive revenue, operates as a 501©(6) tax-exempt organization. This status exempts it from federal income taxes, allowing it to funnel more resources into promoting the sport and supporting its teams and players. However, this arrangement has faced scrutiny, leading to debates about the appropriateness of tax exemption for such a lucrative industry.

The Sierra Club

The Sierra Club is an environmental organization focused on conservation and environmental advocacy. As a 501©(4) organization, it can engage in lobbying activities to further its mission. The tax-exempt status ensures that the organization can effectively advocate for environmental policies without being hindered by tax obligations.

Industry Insights and Future Implications

The world of tax-exempt organizations is constantly evolving, influenced by changes in societal needs, government policies, and economic landscapes. Let’s delve into some key industry insights and future implications.

The Rise of Social Enterprise

There has been a growing trend of social enterprises, which blend traditional business models with social impact missions. These organizations often navigate the complex landscape of tax-exempt status to maximize their social impact while maintaining financial sustainability. The IRS is adapting its guidelines to accommodate these innovative models, recognizing the potential for social good.

Increased Scrutiny and Transparency

With the rise of high-profile scandals involving tax-exempt organizations, the IRS and the public have become increasingly vigilant about ensuring transparency and accountability. Organizations are now under greater scrutiny to demonstrate their commitment to their stated purposes and to avoid any activities that could jeopardize their exempt status.

Technology’s Role in Tax-Exempt Organizations

Technology is transforming the way tax-exempt organizations operate, offering tools for improved efficiency, fundraising, and impact measurement. From online donation platforms to data analytics for program evaluation, technology is helping these organizations optimize their operations and better serve their communities.

As we conclude this comprehensive exploration of IRS tax-exempt organizations, we hope to have provided valuable insights into this complex yet vital aspect of the nonprofit sector. Remember, understanding the intricacies of tax exemption is crucial for any organization aiming to make a positive impact on society.

What is the primary benefit of tax-exempt status for organizations?

+Tax-exempt status provides organizations with exemption from federal income taxes on their earnings, allowing them to direct more resources towards their core missions and societal impact.

How often do tax-exempt organizations need to file information returns?

+Tax-exempt organizations are generally required to file annual information returns (Form 990 series) to provide transparency about their finances, governance, and activities.

Can tax-exempt organizations engage in political activities?

+Political activities are generally prohibited for 501©(3) organizations, but 501©(4) organizations can engage in limited lobbying activities to further their social welfare missions.